Hackers from Anonymous or China are suspected of attacking the New York Stock Exchange

Recently, we wrote about the causes of large-scale technological failures on stock exchanges. In early July 2015, a serious accident occurred on the New York Stock Exchange (NYSE), as a result of which trading was stopped for several hours. Representatives of the trading platform explained what happened with an error in the electronic system of the exchange. The media said they were involved in the failure of hackers from Anonymous or China.

What happened on july 8

At 11:32 pm on July 8, trading on the NYSE was stopped due to "internal technical problems" that are not the result of a "computer malfunction." At 15:10 it was announced the resumption of trading and the "normal functioning of all systems."

')

NYSE President Thomas Fairley (Thomas Farley) said in a conversation with CNBC journalists:

I can not say exactly what caused the accident. But we found out what worked wrong, and fixed the problem. We have no evidence that problems were triggered by external influences.

Representatives of the US Presidential Administration also monitored the situation and stated that the failure was purely technical in nature and was not caused by intruders intruding into the work of stock exchange systems.

Conspiracy theories

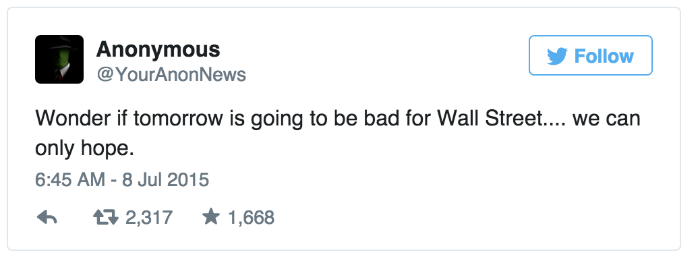

Despite assurances from the authorities and the management of the exchange, journalists questioned the veracity of the version of the internal failure. The reason for this was a suspicious tweet, published in the microblogging hacker group Anonymous (@ YourAnonNews ):

I wonder if something bad will happen for Wall Street tomorrow ... you can only hope for it.

The tweet was posted about 12 hours before the announcement of technical problems in the NYSE twitter account.

McAfee antivirus creator John McAfee in his column for the British edition of IBTimes said that the reason for the stock exchange failure could be hacker actions “like Anonymous”. Allegedly, McAfee studied the hacker dialogues in the shadow part of the Internet (dark web), in which they congratulated each other on "successful work on Wall Street."

McAfee believes that the crash was triggered by a DDoS attack on the NYSE network, but researchers at the F-Secure security company believe that a similar attack would not succeed, and the failure occurred within the system. Arbor Networks, which monitors DDoS attacks around the world, also did not notice any unusual spikes in traffic.

Anonymous has already promised to "erase the NYSE from the Internet," but these threats did not end there. Including this fact feeds another version, according to which hackers from China attacked the American stock exchange.

Journalists have suggested that the reason for the possible attack could be widespread press coverage of the crisis in the Middle Kingdom. Ostensibly, it was because of this that the sites of the Wall Street Journal and Zero Hedge were attacked.

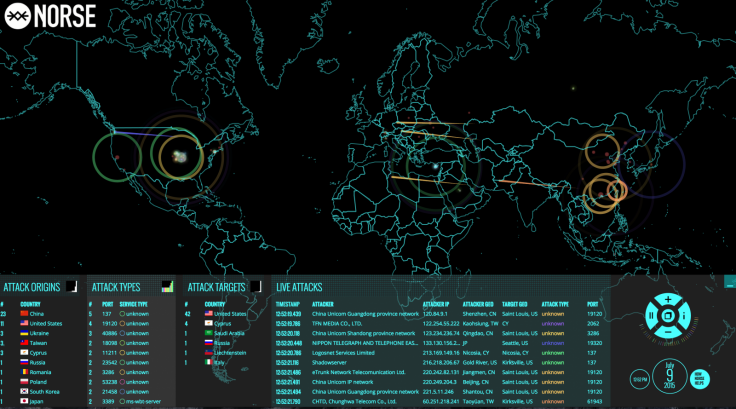

Interactive map of hacker attacks , created by NorseCorp, also showed attacks in the direction from China to the United States.

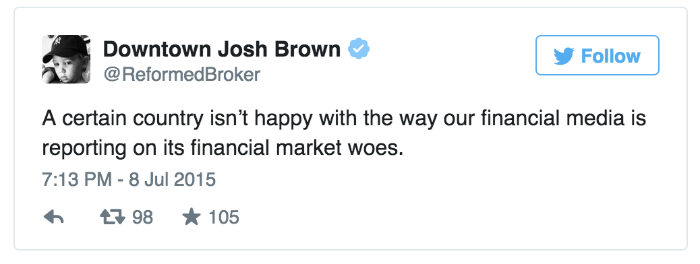

However, this does not mean that it was the stock exchange that was attacked - every day there are many attacks by Chinese hackers on certain resources in the United States. Nevertheless, former broker Josh Brown during the NYSE crash noted that “some countries are clearly not happy with the way our media covers the stock market”:

Everything could be much simpler.

Despite the existence of conspiracy theories, many observers agree that internal system malfunctions really caused the failure. The creator of the analytical company Nanex (we published a cycle of materials about it), Eric Hunsader (Eric Hunsader) told Fortune that he considered the cause of the accident to be an error in updating the trading system.

The weak point of this version is the time of failure - the exchange would hardly have begun to “roll up updates” in the midst of a trading session. Sean Sullivan from F-Secure remarked on this that the non-critical system could also be updated, but the failure in which, however, led to large-scale consequences. According to him, the human factor played a role here.

Failures periodically occur not only on American exchanges, but also on trading floors in other countries, for example, on the Moscow Exchange. Errors often lead not to stop trading, but, for example, to incorrect display of trade data or incorrect calculation of the collateral to hold a position (an error can even lead to premature closing of the transaction)

In order to minimize possible damage, brokerage companies are developing various systems to protect customers. We will talk about how similar protection is implemented in the ITinvest MatriX trading system in one of the following posts (you can briefly read about it here ).

Source: https://habr.com/ru/post/263203/

All Articles