Palantir, PayPal Mafia, special services, world government

“The best way to get rid of a dragon is to have your own”

On Habré there is not a single mention of Palantir, in the Russian Wikipedia there is no article about this project, Mithgol is silent - something goes wrong. Or so.

')

Meanwhile, Palantir has become the second largest private company in Silicon Valley with an estimate of $ 20,000,000 (losing to Uber). Among other merits of Palantir, the disclosure of major Chinese intelligence operations Ghostnet and Shadow Network .

We have to collect information about Palantirʻe bit by bit. And such a fat crumb hides in Peter Til's book “From Zero to One” (although there are many hints and information between the lines in this book, as well as in the legendary course and its translation into Habré , thanks to zag2art ).

I hope, thanks to this article and comments habrachiteli, the situation with respect to Palantir ʻa will be a little clearer.

(There is a multi-billion dollar market associated with analytics and information security, but we don’t know anything about it.)

Palantir’s consultants include Condoleezza Rice and former CIA director George Tenet, who once said about this company: “I wish we had such a powerful tool until September 11th.” General David Petraeus, the head of the CIA in the recent past, told Forbes that Palantir is “the best mousetrap for those times when such a mousetrap is needed.”

In the book From Zero to One, the word Palantir is used 9 times, and almost every time there is useful information next to it. I will give a few quotes.

[ Forbes article ]

Alex Karp, who owns 10% of Palantir, has repeatedly stated that the company plans to remain private for many years.

Karp is convinced that government organizations involved in surveillance must be controlled. Created by Palantir software keeps a history of actions - all the information about how it was used by special services and law enforcement agencies. According to the businessman, in the future there will be independent experts who will check such magazines and look for violations of the rights of ordinary people in them. It is possible that for these even the whole organization will appear.

The society will create a supervisory body to monitor state agencies. If this does not happen, either we lose all our rights, or the terrorist attacks will continue indefinitely.

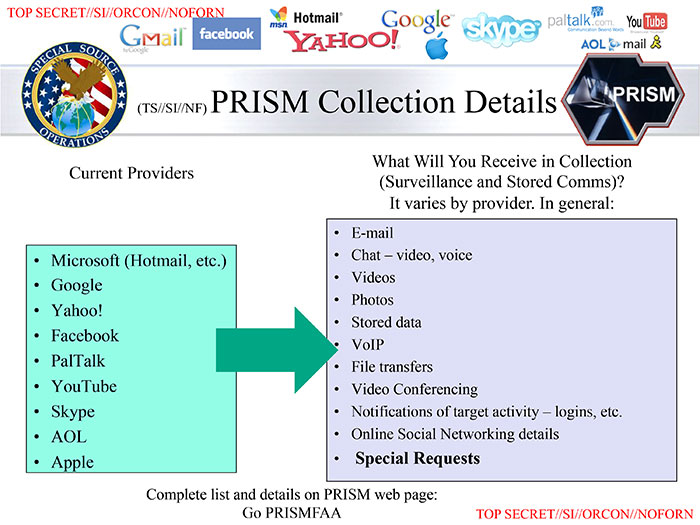

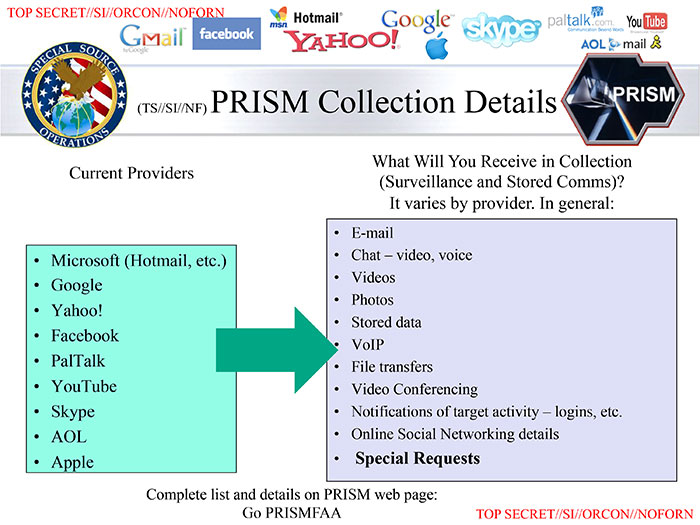

Palantir was involved in the PRISM scandal ( an article in Computerra about PRISM).

In 2011, it was reported that Palantir was involved in the program to counter the project WikiLeaks. Activists of their hacker organization Anonymous found out that Palantir experts suggested using cyber attacks and misinformation to counteract unwanted journalists. Subsequently, Karp apologized for the role of his company in this situation.

To confirm his concept of combining AI and human intelligence, Thiel gives an example:

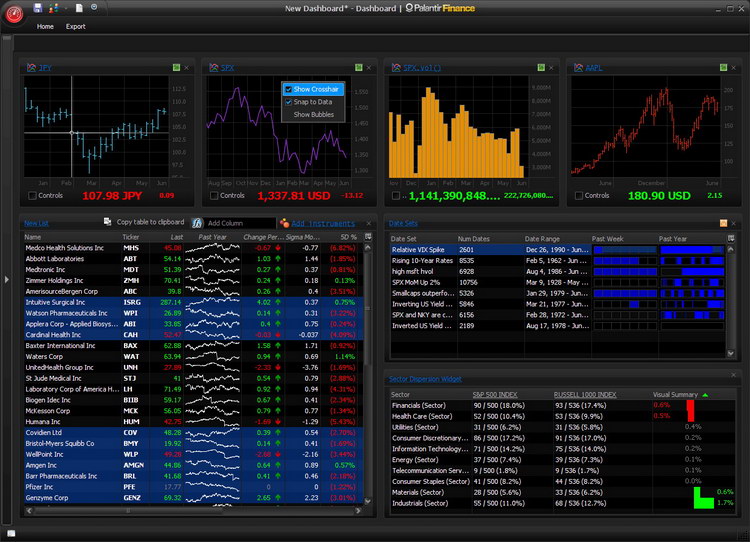

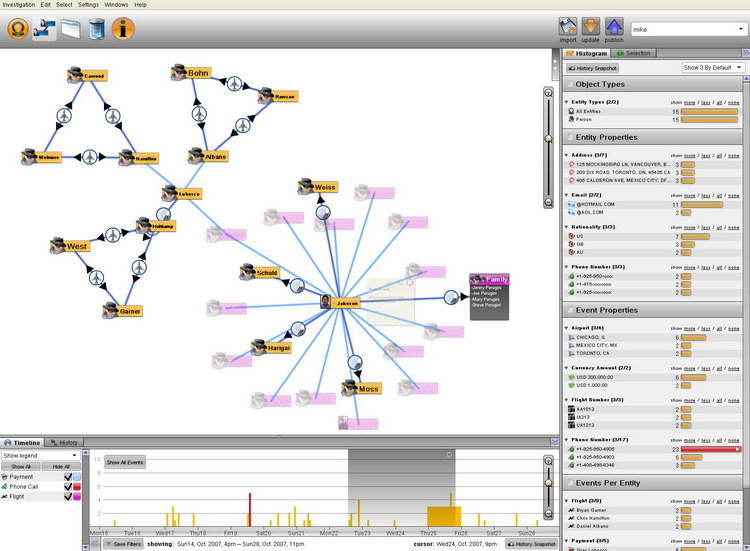

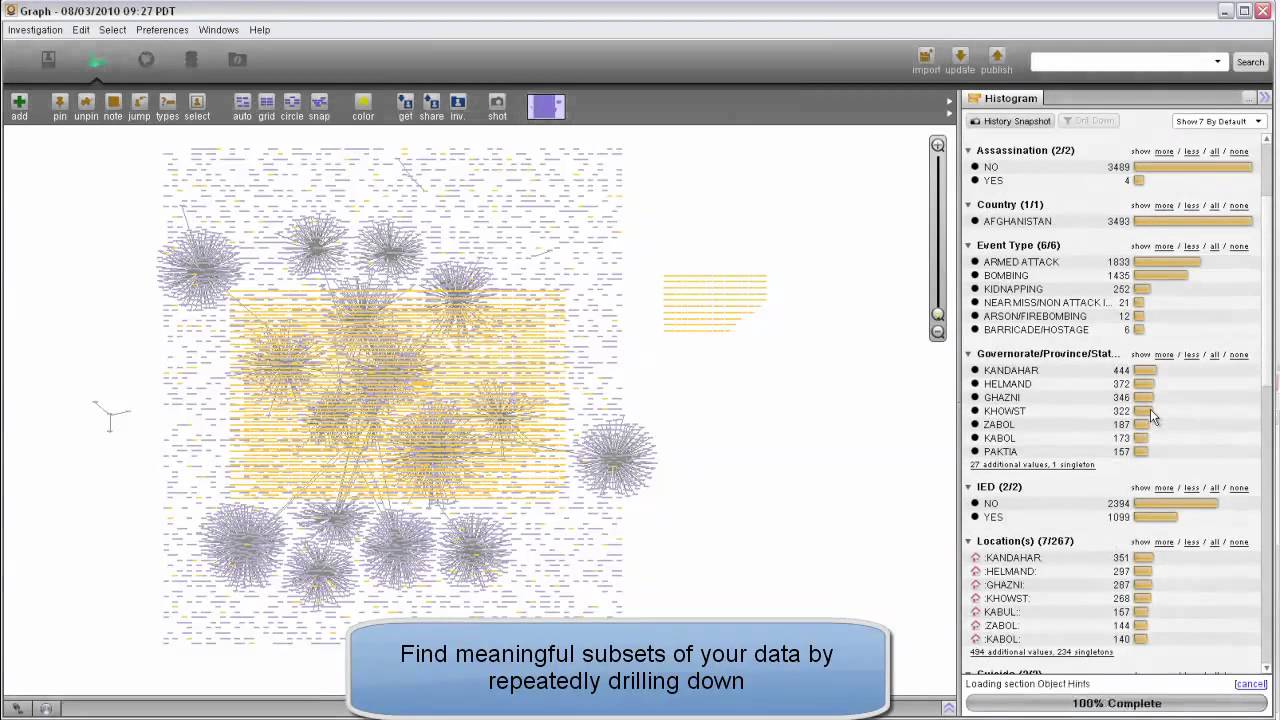

Interface

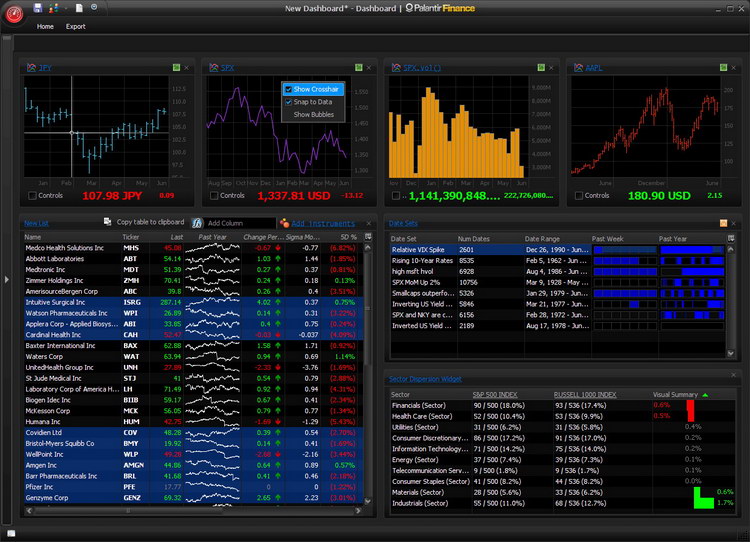

Palantir software application example in the financial field

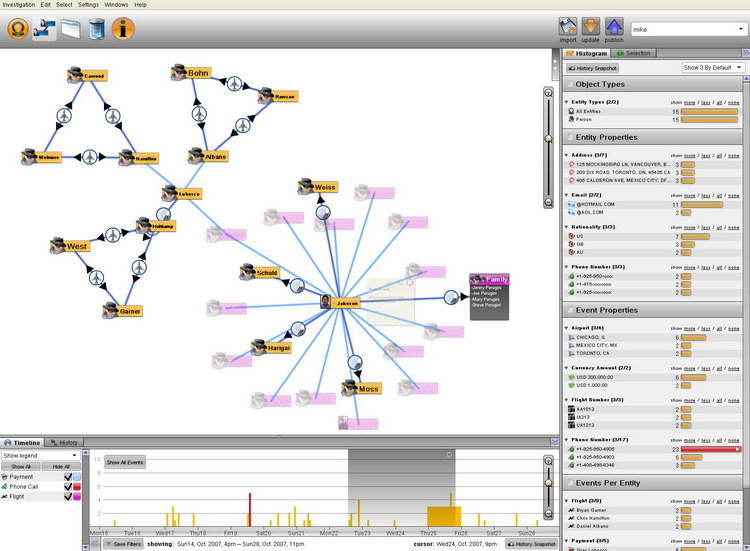

And this is how Palantir helps to track connections between people. To heighten convenience, all contacts of thevictim of the object of investigation are immediately displayed.

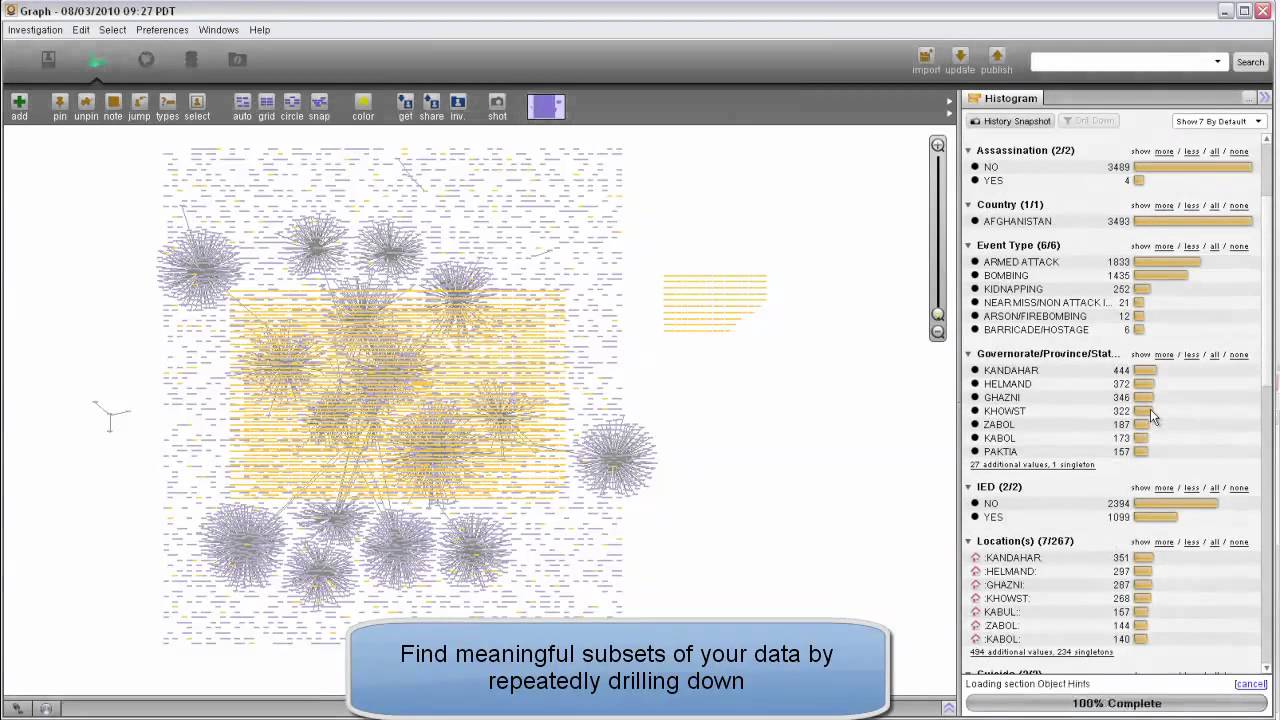

Palantir Cyber: Uncovering malicious behavior at petabyte scale

How Palantir Helps Prevent Cyber Attacks

PS

Pps

Read the book.

Twice.

On Habré there is not a single mention of Palantir, in the Russian Wikipedia there is no article about this project, Mithgol is silent - something goes wrong. Or so.

')

Meanwhile, Palantir has become the second largest private company in Silicon Valley with an estimate of $ 20,000,000 (losing to Uber). Among other merits of Palantir, the disclosure of major Chinese intelligence operations Ghostnet and Shadow Network .

Journalist : - Wikipedia says that you are a member of the management committee of the Bilderberg club. Is this true, and if so, what are you doing there? Organize secret world domination?

Peter Thiel : - This is true, although everything is not so secret or secret that I cannot tell you. The bottom line is that there is a good dialogue between the various political, financial, media and business leaders of America and Western Europe. There is no conspiracy. And this is a problem of our society. No secret plan. Our leaders do not have a secret plan how to solve all our problems. Perhaps secret plans are bad, but much more outrageous, in my opinion, the lack of a plan in principle.

We have to collect information about Palantirʻe bit by bit. And such a fat crumb hides in Peter Til's book “From Zero to One” (although there are many hints and information between the lines in this book, as well as in the legendary course and its translation into Habré , thanks to zag2art ).

Peter Thiel: The goal that I set for myself while reading the Stanford course on start-ups and entrepreneurship was to convey all the knowledge about the business that I acquired over the past 15 years in Silicon Valley as an investor and entrepreneur, to put them together. With the book is the same.

I hope, thanks to this article and comments habrachiteli, the situation with respect to Palantir ʻa will be a little clearer.

(There is a multi-billion dollar market associated with analytics and information security, but we don’t know anything about it.)

Palantir’s consultants include Condoleezza Rice and former CIA director George Tenet, who once said about this company: “I wish we had such a powerful tool until September 11th.” General David Petraeus, the head of the CIA in the recent past, told Forbes that Palantir is “the best mousetrap for those times when such a mousetrap is needed.”

In the book From Zero to One, the word Palantir is used 9 times, and almost every time there is useful information next to it. I will give a few quotes.

Peter Thiel Palantir Company - our second most profitable investment after Facebook - in turn, allowed us to earn more than other companies in total (net of Facebook, of course). This imbalance in profitable profits is quite natural: the same picture is observed in our other funds. The main secret of venture capital is that, if successful, the most successful of the fund's investments brings him no less, and often more, income than all other investments combined. From this follow two very strange rules for venture capitalists. Rule number one: you should only invest in companies that have enough potential to repay you the amount comparable to the capital of your fund. This rule frightens many, as it excludes the vast majority of potential candidates for investment, including quite successful companies, which, however, can only rely on a more modest profit. From here follows rule number two: since the first rule puts you in a rather rigid framework, no other rules should be followed.

[ Forbes article ]

Beyond professionalism

Peter Thiel: The first team I created in Silicon Valley was nicknamed “PayPal Mafia” because of the fact that many of my former colleagues subsequently helped each other by launching successful technology firms and investing in them. In 2002, we sold eBay to PayPal for $ 1.5 billion. Since then, Elon Musk founded SpaceX and co-founded Tesla Motors, Reed Hoffman co-founded LinkedIn, Steve Chan, Chad Hurley and Jod Karim jointly founded YouTube, Jeremy Stoppelman and Russell Simmons launched Yelp, David Sachs co-founded Yammer, and I co-founded Palantir. Today, the seven companies mentioned are estimated at about $ 1 billion each. The small joys that PayPal office has provided to employees have never attracted much attention from the press, but our team still works perfectly well, both together and separately. Our corporate culture has been strong enough to take root far beyond the PayPal office. We did not collect our mafia, arranging a resume or recruiting the most talented employees.

Alex Karp, who owns 10% of Palantir, has repeatedly stated that the company plans to remain private for many years.

Karp is convinced that government organizations involved in surveillance must be controlled. Created by Palantir software keeps a history of actions - all the information about how it was used by special services and law enforcement agencies. According to the businessman, in the future there will be independent experts who will check such magazines and look for violations of the rights of ordinary people in them. It is possible that for these even the whole organization will appear.

The society will create a supervisory body to monitor state agencies. If this does not happen, either we lose all our rights, or the terrorist attacks will continue indefinitely.

Peter Thiel: Comprehensive sales go best if you don't have individual sales managers in the state. Palantir, a data-processing company that I co-founded with my fellow student in law, Alex Karp, does not have a single professional whose only task is to sell its products. But Alex, the general director of the company, spends 25 days a month on the road, meeting current and potential clients. The average cost of a Palantir transaction ranges from $ 1 million to $ 100 million, and when it comes to these numbers, buyers want to talk to the CEO, not the vice president of sales.

Palantir was involved in the PRISM scandal ( an article in Computerra about PRISM).

In 2011, it was reported that Palantir was involved in the program to counter the project WikiLeaks. Activists of their hacker organization Anonymous found out that Palantir experts suggested using cyber attacks and misinformation to counteract unwanted journalists. Subsequently, Karp apologized for the role of his company in this situation.

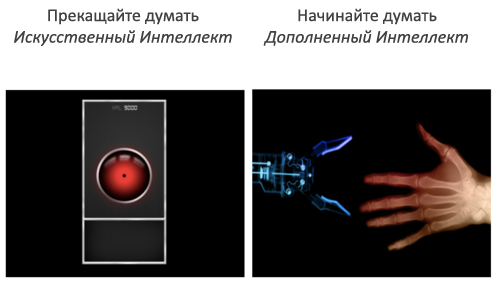

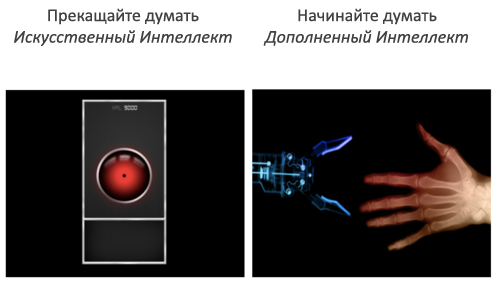

To confirm his concept of combining AI and human intelligence, Thiel gives an example:

Peter Thiel: The complementarity of a person and a computer is not only a global fact. It is also the way to build a successful business. I realized this from my own experience with PayPal. In the mid-2000s, our company, having survived the collapse of the dot-com bubble, grew rapidly, but we were disturbed by one serious problem: due to credit card fraud, we lost more than $ 10 million monthly. Making hundreds and even thousands of translations per minute, we could not physically track each one of them - no team of controllers could work at a similar speed.

We did what any team of engineers would do in our place: we tried to find an automated solution. To begin with, Max gathered a group of highly professional mathematicians who conducted a thorough analysis of all fraudulent transactions. Then, after studying the results of their work, we wrote a program that can automatically recognize and cancel dummy transactions in real time.

Nevertheless, it soon became clear that this decision could not work on its own: within an hour or two, the crooks, realizing what was happening, changed their tactics. We dealt with an enemy who knew how to quickly adapt to the situation — our software was not able to adapt after them. Changing the tricks, fraudsters easily tracked our automatic tracking algorithm around their fingers — but, as it turned out, our human analysts were not so easily deceived. Max and his engineers rewrote the program using a hybrid approach: the computer noted the most suspicious transactions in the user interface with a high-quality design, and the people-operators had already made the final decision whether it was fraudulent or not. We called this hybrid system "Igor" - in honor of the Internet swindler from Russia, who boasted that we could never cope with it.

Thanks to her, in the first quarter of 2002 we made a profit for the first time in the quarter (and even a year earlier our losses amounted to $ 29.3 million for the quarter!). The FBI asked us for permission to use Igor to solve financial crimes. And Max reluctantly boasted that he had become “Sherlock Holmes of the electronic underworld” - and this was true.

This is how the symbiosis of humans and machines allowed PayPal to remain on the market, which, in turn, opened up the opportunity for hundreds of thousands of small traders to accept the payments they need in order for their online business to flourish. None of this would have happened if a solution had not been invented, the basis of which was the cooperation of man and computer — even if most people did not know or even heard of anything similar. I continued to think about it after we sold PayPal in 2002: if a person and a computer, working together, are able to achieve much more than each of them separately, then what a big business can be created on the basis of such cooperation!

The following year, I shared with Alex Karp, my former Stanford classmate, a plan for a new startup. I wanted to use the PayPal security method that people and computers work together to

search for terrorist networks and financial scams. We already knew that the FBI was interested in such a tool, and in 2004 we founded Palantir, a software company that allows you to extract as much information from disparate data sources. Today we hope that the company's sales for 2014 will exceed $ 1 billion, and Forbes calls our software “killer program” because, according to rumors, it was with his help that the location of Osama bin Laden was established.

We cannot tell you anything about that operation, but personally I am sure that neither intelligence officers nor computers alone can ensure our security today. The two largest US intelligence organizations use diametrically opposed methods: the CIA is headed by spies who prefer the services of living people, while the NSA is led by generals who rely more on computers. CIA analysts have to wade through incredible streams of information in which it’s damn difficult to identify a real threat.

NSA's computers are capable of processing huge data arrays, but, like all machines, they are not able to independently determine whether an individual is planning a terrorist act. Palantir aims to balance both of these drawbacks. Our programs analyze information provided by government agencies - for example, telephone conversations of radical religious leaders of Yemen or bank accounts related to the activities of terrorist cells - and mark the most suspicious data, passing them on for examination by professional analysts.

In addition to searching for terrorists, using programs created by Palantir, analysts were able to:

- predict where in the Afghan insurgents plan to launch explosions;

- bring high-ranking insiders trading in internal business information to justice;

- destroy the world's largest distribution network for child pornography;

- to help the Disease Control and Prevention Center in the prevention of foodborne disease outbreaks;

- help the state and private banks to save hundreds of millions of dollars annually by more effectively identifying attempts at financial fraud.

All this became possible thanks to modern software, but even more important role was played by people - analysts, prosecutors, scientists and financiers. Without their active participation, the programs would have been absolutely useless.

Interface

Palantir software application example in the financial field

And this is how Palantir helps to track connections between people. To heighten convenience, all contacts of the

Video channel Palantir

Palantir Cyber: Uncovering malicious behavior at petabyte scale

How Palantir Helps Prevent Cyber Attacks

another selection of videotapes on IB from the channel Palantir

Palantir in the Anti-Money Laundering Space

Prepare, Detect, Respond, And Harden: Palantir Cyber In Action

Uncovering a Bot Net: Exploring Router Data using Palantir

Finding a Mole: Cyber Counter Intelligence - Part I

Uncovering Cyberfraud at a Large Financial Institution

"The Architect of the Matrix"

Palantir Night Live - Vint Cerf

Prepare, Detect, Respond, And Harden: Palantir Cyber In Action

Uncovering a Bot Net: Exploring Router Data using Palantir

Finding a Mole: Cyber Counter Intelligence - Part I

Uncovering Cyberfraud at a Large Financial Institution

"The Architect of the Matrix"

Palantir Night Live - Vint Cerf

PS

Peter Thiel: Time is your most valuable resource, and it’s foolish to spend it on working with people who don’t see any long-term shared future for themselves. If the result of the time spent at work did not become stable friendly relations with colleagues, it means that you have illiterately invested your time - even from a purely financial point of view.

From the very beginning, I was striving to ensure that relations between employees at PayPal were not formal, so that we would become a closely knit team. I thought that companionship would not only bring us satisfaction and contribute to efficient work, but also help to build more successful careers outside of PayPal. Therefore, we tried to hire people who will work together with sincere pleasure. Of course, we expected that they would be talented, but what was more important was that they genuinely strive to work with us. This is how the PayPal mafia was formed.

Pps

Read the book.

Twice.

Source: https://habr.com/ru/post/262837/

All Articles