How are converged infrastructure and online trading connected: New Juniper project

In the spring of 2015, Juniper Networks presented its view on the further development of the concept of converged infrastructure - a server on the switch.

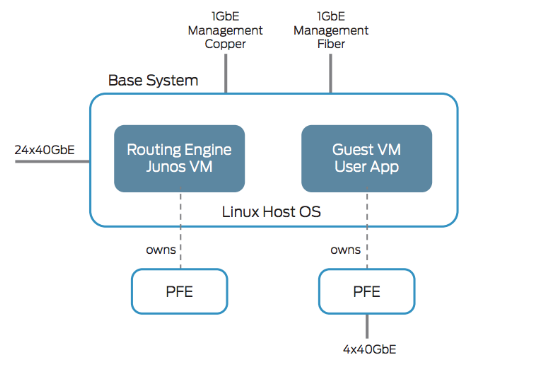

Andrew Bach, chief architect of the team involved in financial services at Juniper, told Data Center Knowledge that the new 40G Ethernet switch QFX5100-AA uses an Intel Xeon E3-1125C v2 processor and a Broadcom Trident II chip.

')

In addition, it can use an additional QFX-PFA packet flow accelerator package, based on Altera multi-100G FPGA - it allows developers to write applications that can be run directly on the switch. For programming, the development environment from Maxeler Technologies is used (Bach calls it very similar to Java).

Switch software architecture (description in English here )

Unlike many other Juniper products, which are designed for a wide range of customers in different markets, the new switch is designed for environments that have specific requirements for performance, speed and scalability. The financial market is not the only such segment, but one of the most obvious.

CME Group's Executive Infrastructure Director (the Chicago Stock Exchange is included - you can get access to trading on this site through ITinvest) Ryan Ivy told a reporter for the Network World journalist why the new Juniper switch is in the financial market.

One of the reasons for its use is the obvious fact of the need to increase throughput. The number of electronic trading systems is constantly growing, and the volume of the orders they generate, which need to be processed, is increasing. Ivy said that in 2010, the CME network processed 2.6 million orders per day, and in 2015 this number increased to 30-40 million per day. The problem is that each such message generates several signals at once, which also need to be transmitted over the network.

Another important factor is the reduction of profits from transactions. If earlier many HFT-companies and private traders on the Chicago Stock Exchange could count on earnings and 10 cents from the transaction, now profits are in the course of a tenth of a cent. It turns out that in order to preserve the level of income, merchants need to make many times more such unprofitable transactions or earn a lot from each transaction (which is often more difficult).

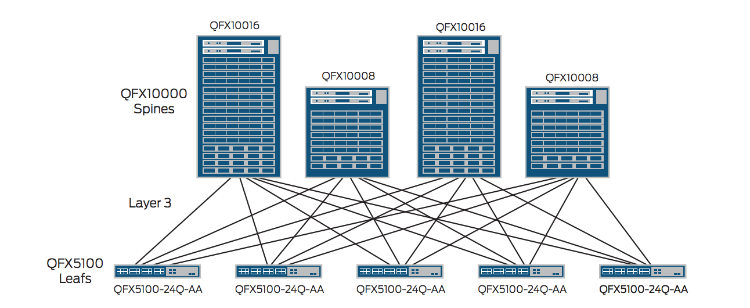

Ivi says CME will use new switches to change the way inbound and outbound messages are handled. Instead of “chasing” everything through the core of the trading system, processing of many things can be brought to the network’s border and traffic can be distributed from this point. This will significantly reduce traffic within the network.

In addition, it will allow to simplify the infrastructure - now all the technical “stuffing” of the Chicago Stock Exchange has been duplicated many times, which makes supporting the system quite a difficult task. Switches like QFX5100-AA will allow to maintain fault tolerance without the need to place racks with servers wherever possible. Thus, a more converged infrastructure will be implemented.

Interest in creating applications for FPGA is growing, and vendors are trying to meet this trend. New servers for Microsoft cloud services support FPGA , and Intel has developed a hybrid server chip that combines a Xeon E5 processor with an FPGA .

According to Bach, in the near future, whole new classes of applications will be created specifically for the “servers on the switch”, in addition, many existing software products will also “move” there. In the financial industry, for example, you can significantly speed up the processing of financial information flows, if you transfer it as close as possible to network equipment (which is what CME does).

Source: https://habr.com/ru/post/261961/

All Articles