Review and assessment of the prospects for the development of the global and Russian IT markets

Earlier, in our blog on Habré, we wrote about why the Moscow Exchange is primarily an IT company . As befits an IT company, we constantly monitor new trends in the IT market, make analytics and make forecasts.

We present a fresh analytical review of the IT market, prepared jointly with the RVC Foundation and IDC.

In this review

')

The first part of the review is devoted to a review of the global information technology (IT) market. Particular attention is paid to describing the future market development factors, such as the spread of cloud computing, the exponential increase in data, and the use of mobile devices and social networking technologies in the corporate environment. The evolution of the role of the director of information technology is considered separately.

The second part of the review contains an overview of the Russian IT market, including a detailed description of market segments and their development trends. Separately highlights the main provisions of the state policy in the field of IT and gives a rating of sectors of the economy in terms of the cost of IT. It also provides a description and a list of the main players in the Russian market.

The review contains a forecast of the development of the global and Russian IT market by major categories for the period 2014-2018.

The present study was prepared by IDC in collaboration with the Moscow Exchange Innovation and Investment Market and the Russian Venture Company.

Overview of the global information technology market

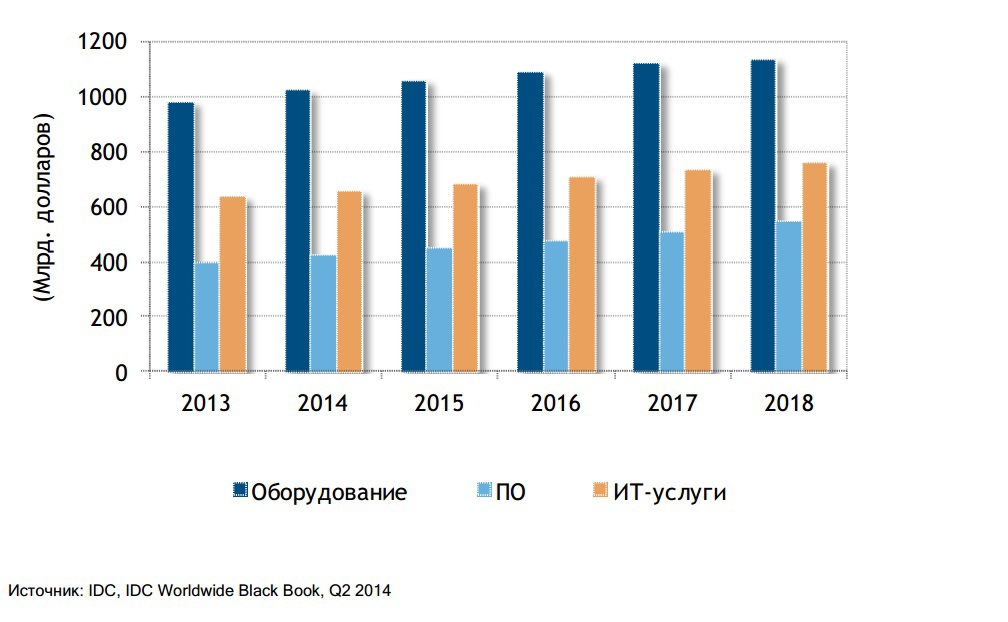

To date, the cumulative amount of the global IT market exceeds two trillion US dollars.

The largest segment of the market in terms of expenditure is equipment. The explosive growth of information volumes stimulates the demand for servers and data storage systems. The ubiquity of data centers and cloud solutions provides a steady demand for various types of network equipment. The personal computer market is gradually shrinking, while the mobile device market is growing steadily. Deliveries of printing and copying equipment are relatively stable, and sales of monitors are steadily declining.

The demand for IT services is provided by the growing diversity and complexity of the corporate IT systems used, which require large installation, integration, training and maintenance costs. IT outsourcing, that is, the transfer of third-party organizations to support and maintain IT infrastructure, is one of the promising areas in this market.

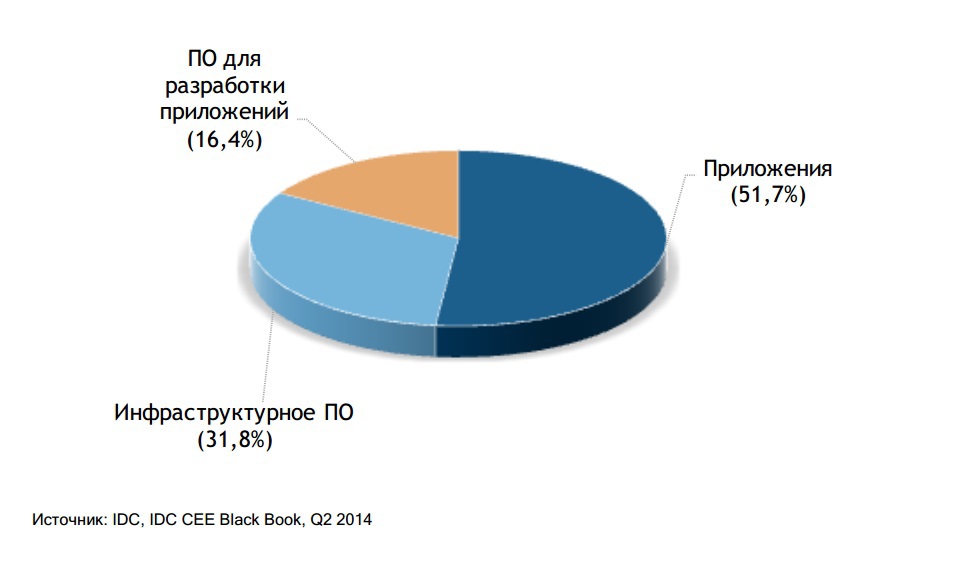

The most dynamic segment of the global IT market is software, whose annual growth in the past few years has exceeded 6%. Over half of the total volume of the segment is formed by various categories of applications, the rest falls on system software and development tools. The category of applications for organizing collaboration, especially solutions for corporate social networks and file sharing, is developing most rapidly: their volume increases by more than 20% annually. The category of database management and analytics solutions is also dynamically developing with an annual growth of more than 8%. Permanently strong demand remains for solutions for managing enterprise resources and customer relations, as well as security solutions.

Among the strategic directions of IT development, a special place is occupied by cloud technologies, big data analytics, integration of mobile devices and social networking technologies into the corporate environment. The combination of these technologies and processes of IDC unites the collective term “Third Platform”, the development of which in the next few years will lead to the transformation of business models in most industries.

Scientific and technological trends and the fastest growing segments in the global IT market

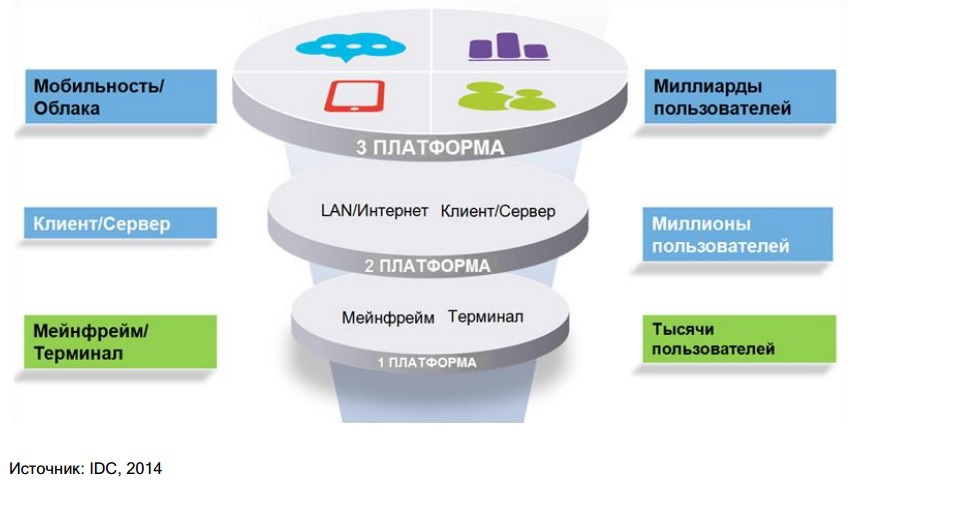

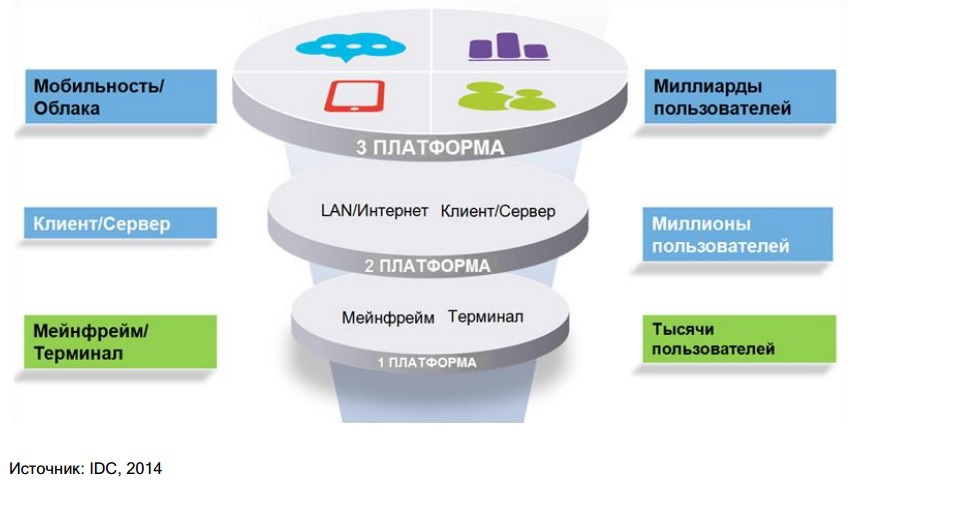

Stages of development of the IT industry IDC is in the form of three platforms. The first platform was built on the basis of mainframes and terminals, on which thousands of applications and users worked. The second platform is based on traditional personal computers, the Internet, client-server architecture and hundreds of thousands of applications. The third platform is characterized by a rapidly growing number

mobile devices that are constantly connected to the Internet, combined with the extensive use of social networks and a developed cloud infrastructure used to solve complex analytical tasks.

Applications, content and services based on technologies of the Third Platform are available to billions of users. Cloud computing, big data, mobile and social technologies stimulate mutual development. Indeed, users of a growing number of mobile devices are producing more and more content that is conveniently stored in the clouds. Due to the growth of mobile devices, user activity in social networks is increasing. The content they accumulate becomes an important source for analyzing and extracting valuable information using big data technologies.

Three platforms in the evolution of the IT market

A typical example of a solution based on the technologies of the Third Platform is the use of an application from a mobile device to gain access to corporate or social media information, analyze this data in real time and align activities depending on the information received. At the same time, both the application and the data can be located in different clouds, private or public.

As noted, the concept of the Third Platform is based on four elements: big data, mobile devices, cloud services and social technologies.

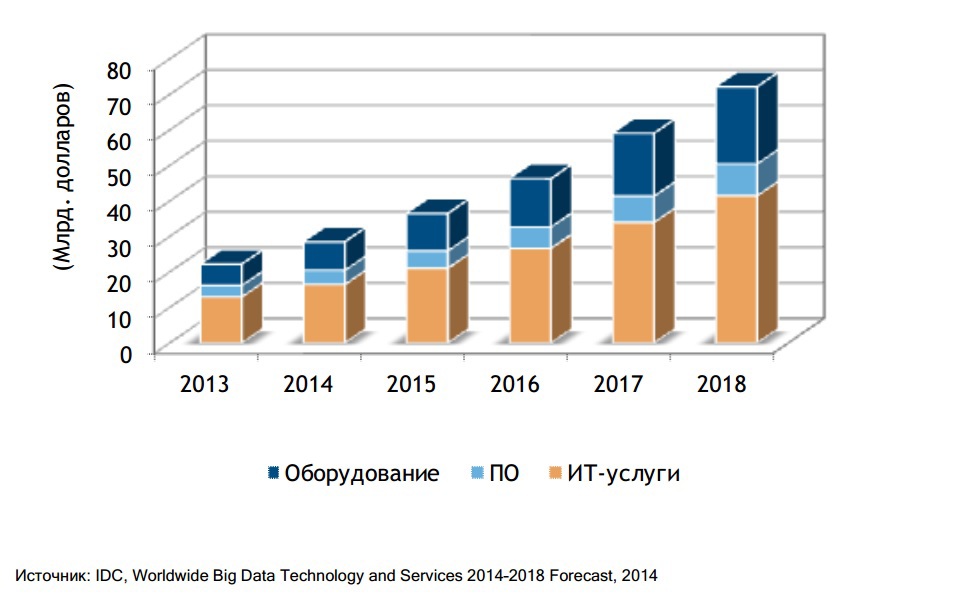

Big data means new generation technologies and architectures for cost-effective extraction of value from large-format multi-format data through their rapid capture, processing and analysis. Big data technology has three distinguishing features: speed, variability, and volume. The volume is expressed in the fact that huge amounts of data are analyzed in tens of terabytes. The speed indicates that the capture and data processing is performed in near real-time mode, or that the organization accumulates data at high speed. Variability suggests that data is collected from one or more sources in different formats.

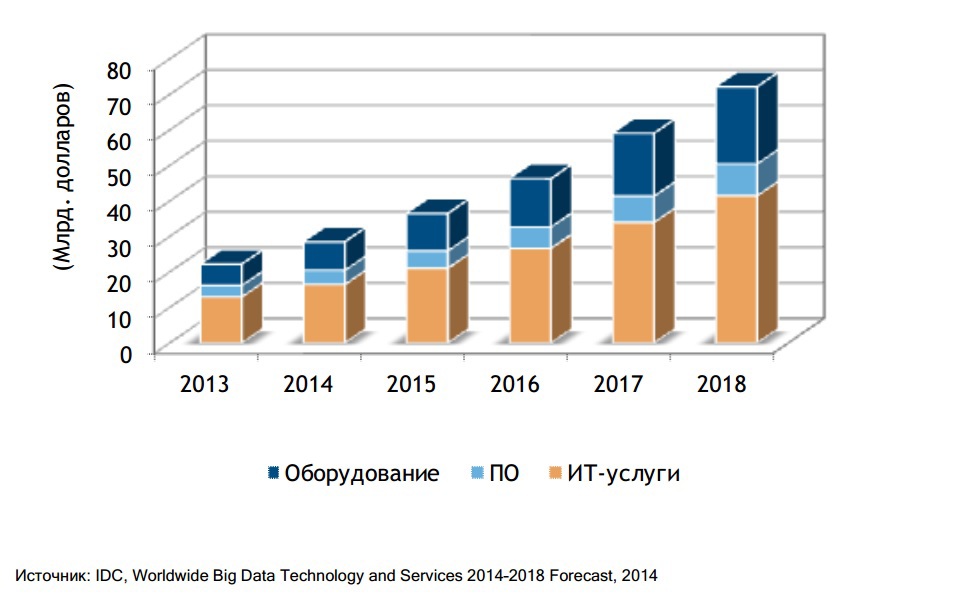

The cost of big data technology in the world

Cloud solutions underlie the Third Platform, since they provide remote access to information resources, including through a variety of mobile devices. Cloud services provide savings due to standardization of equipment, virtualization, new principles of joint consumption of software applications, as well as a new form of payment for the resources that the customer actually consumes.

According to IDC research, the cost of public cloud (operational) services in the world in 2016 will approach $ 100 billion. The cost of public cloud services in the period 2013–2018 will grow five times faster than the total cost of IT.

Today, 16 of the top 100 software developers already receive over half of their income from the cloud delivery model. The third platform, therefore, is not only a technological revolution, but also a consumer revolution, as a result of which new business models emerge.

The cost of public cloud services in the world

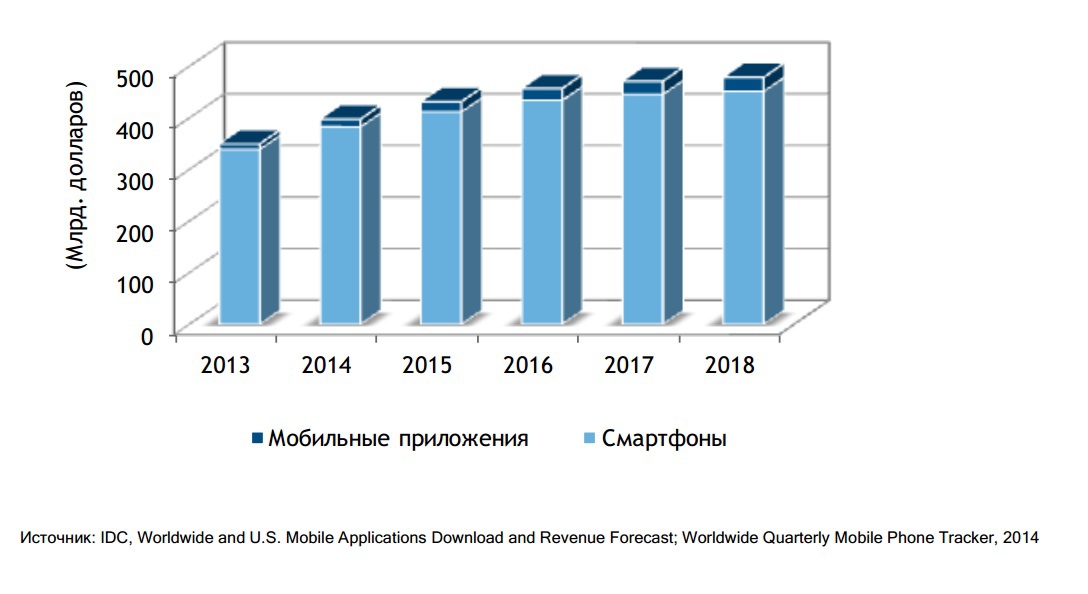

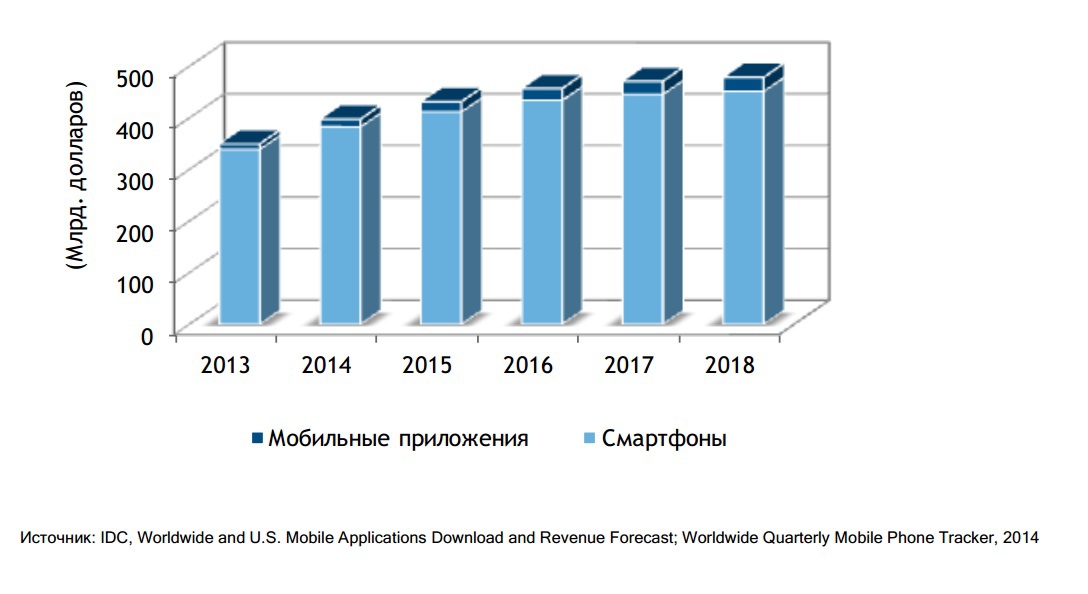

The proliferation of mobile devices and the organization of mobile access is another crucial element of the Third Platform. The double-digit annual growth rate of mobile device sales is driving companies to more actively implement the concept of using their own employee devices (BYOD) by deploying customized solutions to securely and effectively integrate personal mobile devices into the corporate IT environment. Mobile applications are the link between the device and the user. Most business applications today have a mobile version or represent a mobile application development environment. Application development for home users has a strong impact on the growth of the entire mobile application market.

The cost of mobile technology in the world

Social networks are becoming a standard tool to attract customers and promote products. By 2017, 80% of Fortune 500 companies are expected to have active online communities of their consumers. Such communities will become critical components of marketing strategies and customer engagement campaigns. With the help of social networks, companies receive the most valuable user information - user opinions about the brand, suggestions for product improvements, and pointing out shortcomings - for more effective planning of future developments. IDC highlights several factors that contribute to the rapid development of solutions based on the Third Platform:

It is expected that the development of solutions based on the technologies of the Third Platform will be the main driving force of the global IT market during this decade and will provide, according to IDC estimates, more than 75% of future growth.

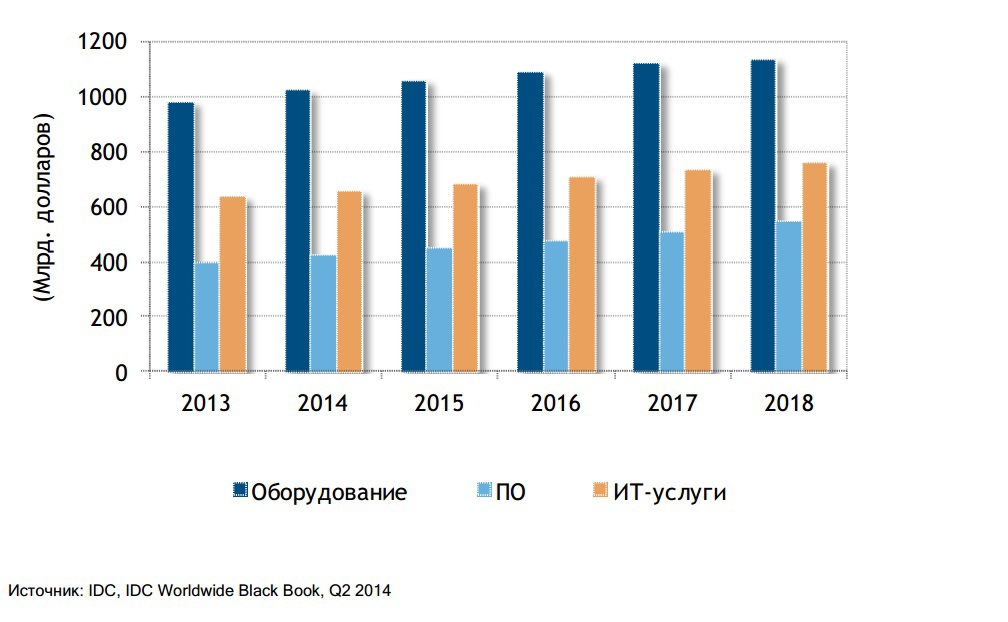

IT Costs Worldwide

Technology convergence

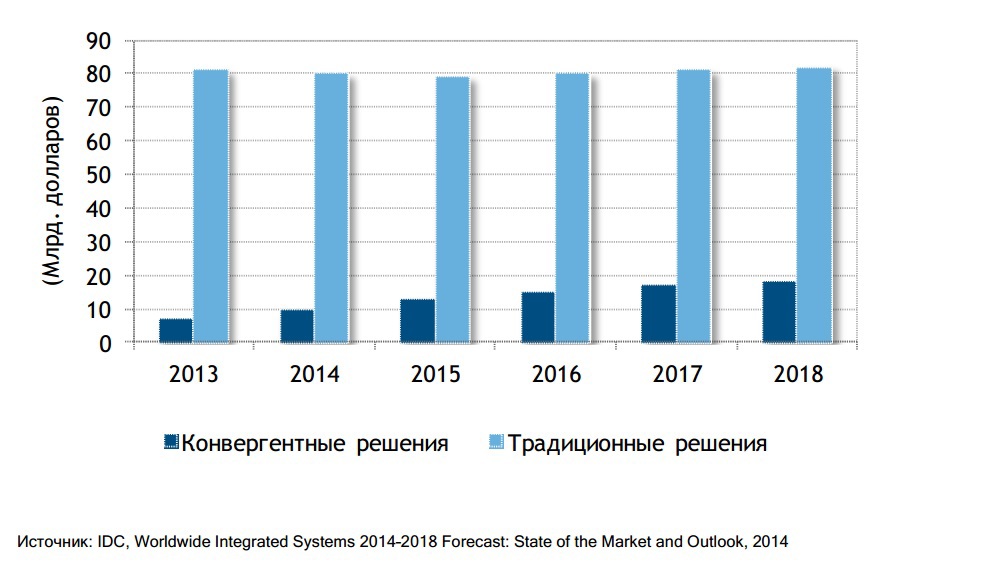

The following limiting factors are characteristic of modern IT infrastructure: the area of the premises, high energy consumption, the need for individual connection and configuration, the need for highly qualified service personnel. Any new technology must be built into the existing infrastructure, which requires additional integration tasks. Converged infrastructure solutions — capacious, cost-effective, flexible and energy-efficient, all-in-one systems — are based on state-of-the-art equipment and allow you to comprehensively cope with the problems associated with the aforementioned limiting factors.

Converged infrastructure solutions available today on the market combine computing devices, storage systems, network equipment, software for virtualization and infrastructure management on a preconfigured platform from a single vendor. A number of companies, including HP, IBM, EMC and Oracle, offer similar solutions that allow the user to choose the configuration that best meets their needs and at the same time is the most cost-effective.

A traditional computing center is a combination of servers, storage systems, network equipment from various vendors that have built up the IT infrastructure over the years. Such a heterogeneous environment emerged as a result of automating individual business processes using the best niche solutions.

As a rule, in such computing centers it is difficult to organize a centralized management of the entire infrastructure, since each of its individual elements has an individual control system. The bottleneck in the functioning of such computer centers is the diagnosis and troubleshooting.

The concept of converged infrastructure offers data centers an all-in-one solution for the entire infrastructure. Buying a set of infrastructure equipment from one supplier eliminates many problems with integration and compatibility, and also allows you to better organize infrastructure management, since software is specifically designed for this particular equipment, and maintenance is performed by the same supplier.

At present, the implementation of converged infrastructure systems is moving from the pilot operation stage to wider use. This contributes to significant advantages in terms of downtime, cost savings, increased productivity of IT staff and more efficient use of IT resources in general.

According to IDC estimates, the aggregate market for network equipment, servers and external storage systems will grow at an average annual rate of 0.1% over the next five years, while the supply of converged network equipment systems, servers and external storage systems will be 19.6%.

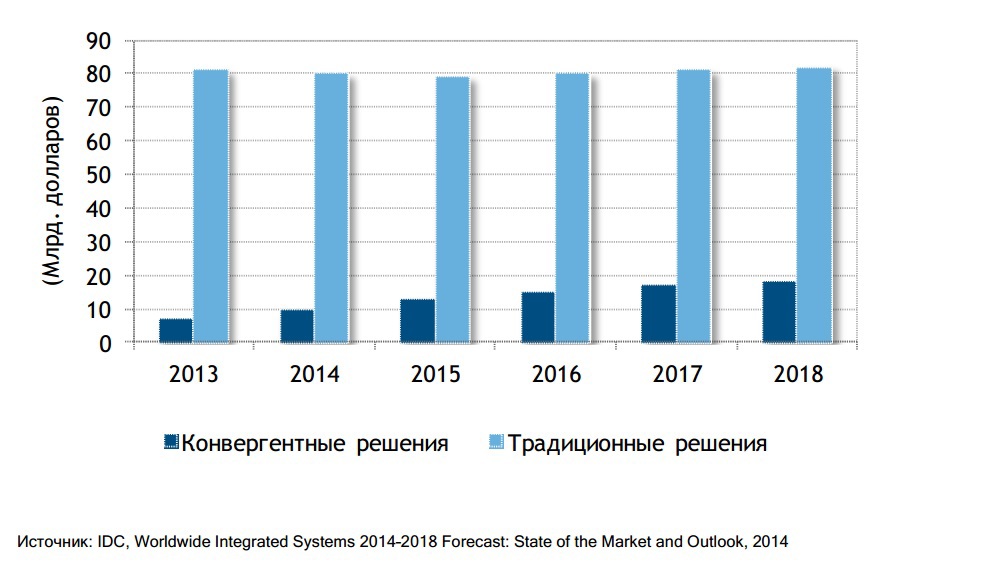

Investments in traditional and convergent solutions (network equipment, servers and external storage systems) in the global market.

The new role of the director of information technology

Information technologies make a huge contribution to improving the efficiency of most business processes and are therefore perceived as the most important source of competitive advantage in the market.

It would seem that the CIO should play a strategic role in the company, since it determines the vector of innovation and helps to maximize the benefits from the use of technology, but traditionally it is the person who is responsible for the smooth operation of the IT infrastructure and the integrity of corporate information. Therefore, its activities are aimed primarily at improving the efficiency of IT operations, maintaining the infrastructure and managing the IT department. In other words, the CIO performs primarily tactical functions and is less involved in the work on the company's strategic objectives.

More IT projects are being initiated by business users. According to an IDC study conducted in 2013, 43% of the more than 1,200 business executives surveyed run local IT projects on their own, and 61% still finance them without IT. Obviously, in such conditions, the CIO is directly interested in strengthening its position in the organization, expanding its functions and acquiring new competencies. But as with everything related to information technology, none of the current responsibilities of a CIO disappear - only new ones appear.

As before, the main task of the CIO is the orderly and efficient management of the infrastructure. Its focus should be on the cost, complexity, and consistent implementation of new systems in the existing IT environment. Traditional systems account for 65-70% of the company's total IT budget. However, technologies of the Third Platform, such as virtualization, convergent systems and cloud computing, will play a key role in further reducing costs.

Among the new competencies that a CIO should have today are not only knowledge of the structure, business processes and goals of the company, but also participation in the development of corporate strategy and business planning. For example, in developed markets, the IT director has been a member of the board of directors for quite a long time and actively influences the company's business processes, while in Russia this trend is just beginning to gain momentum.

An important place in the work of a CIO should be assigned to the functions of assessing and managing risks, which can arise when planning and implementing information technologies: from choosing a non-optimal automation solution and design errors to meeting deadlines and going beyond the allocated budget. Here the director’s task is to draw up a detailed list of possible risks at the project planning stage and determine the most effective ways to eliminate them.

Competition in most markets is constantly increasing, so companies are now vitally necessary before introducing a new IT system to calculate future profits and correlate them with the costs of implementation and maintenance. This defines an additional aspect in the activities of the CIO, related to participation in investment planning of capital investments in IT and evaluation of the economic efficiency of projects.

The scale of IT projects is growing, their portfolio is constantly increasing, they can be dispersed across different departments of the company, covering several regions or even countries. Therefore, CIOs also require exceptional leadership and communication skills. He should not only create an effective team of IT professionals, but also be a kind of ideological leader who could convincingly tell at various levels of the organization about the practical benefits of new technologies, their impact on business and financial results, as well as assist employees in their development.

Such a complex participation of the CIO in the company's activities implies that the existing model of the entire IT department of the company must change. The existing business support model should gradually be transformed into a full-fledged proactive business partnership, which is based on the promotion of business goals and the development of the company.

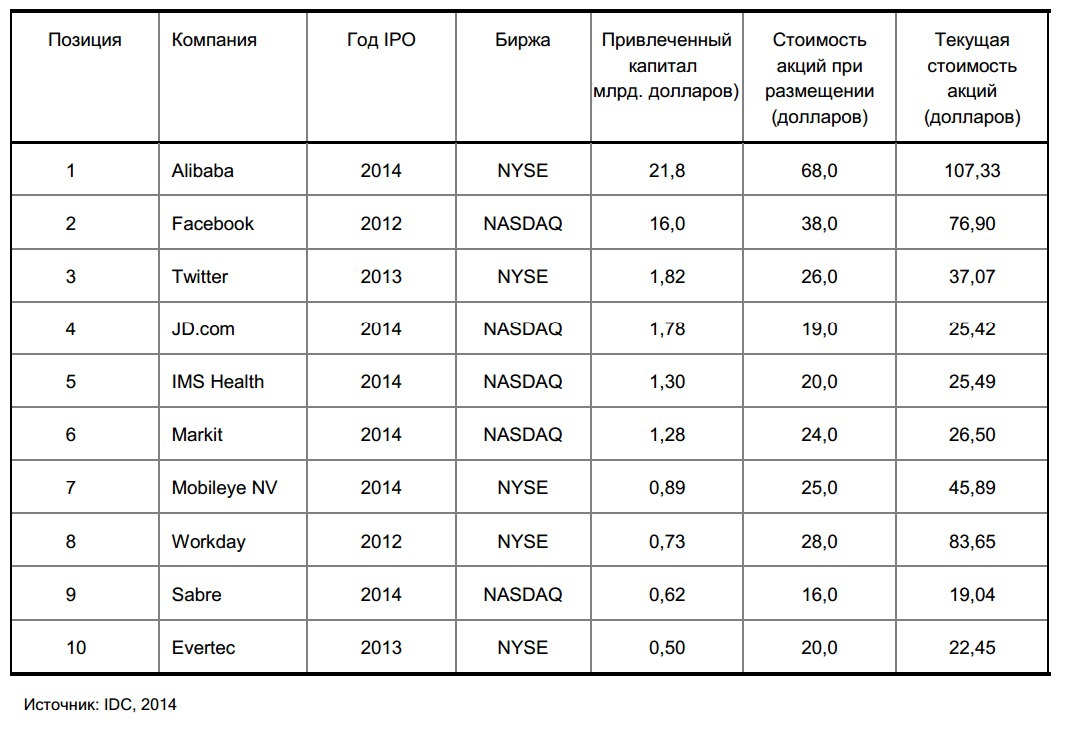

IT investments: Top 10 most successful IPOs of global companies over the past three years

Over the past three years, the technology sector is among the world leaders in the number of initial public offerings on the exchange. The reasons for entering the IPO of a company are pursued by the most diverse: from acquiring assets and raising funds for development to increasing the flexibility of the company and its recognition.

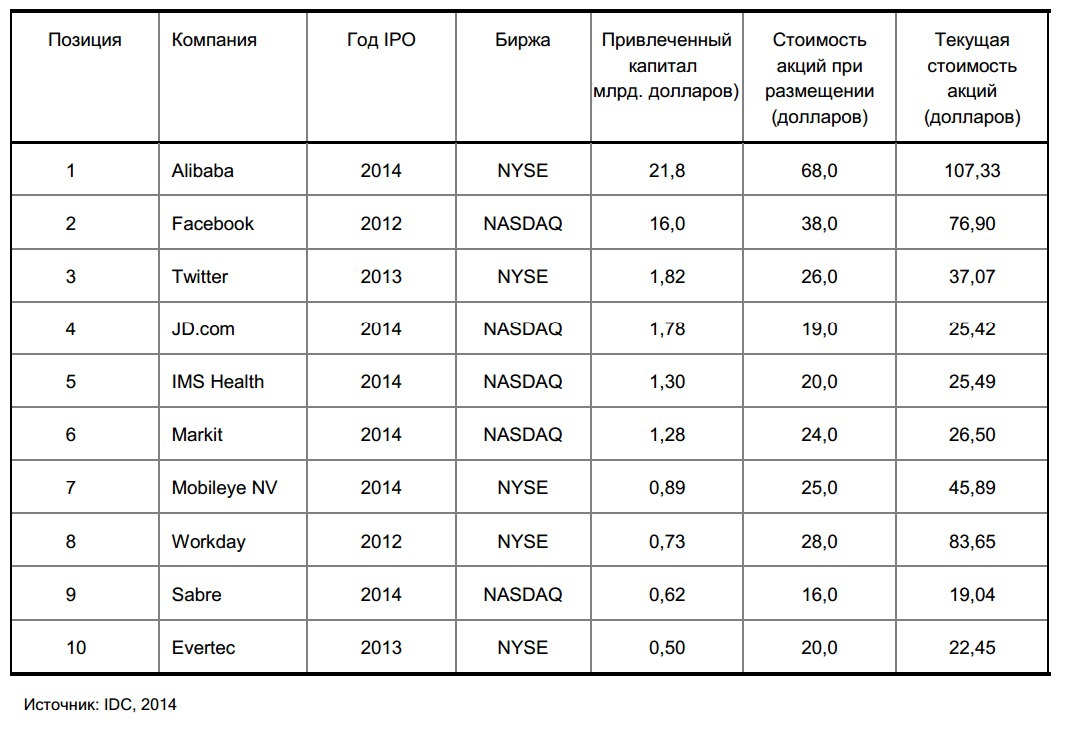

In September 2014, the initial public offering of the Chinese online retailer Alibaba on the New York Stock Exchange was the largest in history. At the end of the first trading session, the paper companies went up to 93.89 dollars, which is 38% more compared to the price of placement. Alibaba’s IPO brought in $ 21.8 billion, while the company's capitalization reached $ 231.4 billion. With the implementation of the option to sell additional shares, Alibaba's placement volume reached $ 25 billion, exceeding the previous best result achieved in 2010 on the Hong Kong stock exchange Agriculture Bank of China ($ 22 billion). It is expected that due to the IPO of Alibaba, the total volume of initial offerings in 2014 will exceed $ 80 billion, which is the best result since 2000.

One of the most successful exits among the technology sector companies was Twitter's IPO microblogging service, held in November 2013. Trading in the company's securities started on the New York Stock Exchange at a price 73% higher than the offering price and to close was $ 44.9. In the course of trading, Twitter attracted $ 1.82 billion in investment, and the value of the company exceeded $ 25 billion. By the end of 2013, Twitter shares went up almost three times compared to the price of $ 26, reaching a historic high of 74.73 dollars. At that time, according to market capitalization, Twitter caught up with the Internet company Yahoo and

social network LinkedIn.

The largest IPO of 2012 was the placement on the NASDAQ stock exchange shares of the social network Facebook. At the end of trading, with a starting price of $ 38 per share, the company attracted $ 16 billion in investments, and its capitalization reached $ 104 billion. Facebook's placement was at that time among the three largest IPOs in US history after Visa and General Motors, and became the most significant in the technology sector. However, the social networking IPO is also considered one of the most unsuccessful in recent years, since in the first days after the Facebook stock exchange shares fell below the offering price and did not come close to it for more than a year. It was possible to return to the growth of social network quotes only after in the middle of 2013 it became known about the growth of Facebook revenue from sales of mobile advertising and the development strategy of this business line was presented. Currently, about two-thirds of the company's revenue from advertising falls on mobile users, and the value of its shares exceeds $ 70.

Table 1 lists the ten most successful IPO technology companies over the past three years, depending on the amount of capital raised. One of the largest IPOs of 2014 was the placement of Japan Display shares on the Tokyo Stock Exchange, which on the first day of trading attracted 3.13 billion dollars of investments. However, the company is not included in this list, since a Japanese manufacturer of screens for smartphones and tablets cannot be named as successful on Tokyo Stock Exchange. With a starting offering price of $ 8.85 per share on the first day of trading, Apple’s main supplier’s securities fell 15.2%, which made Japan Displays the placement of the worst IPOs of Asian and Pacific companies with over $ 1 billion attracted since 2008.

Ten most successful IPOs of IT companies for 2012-2014

Of the Russian companies, the most successful access to the stock exchange was carried out by Yandex and Mail.ru Group. The initial public offering of Yandex was held in May 2011 at a price of $ 25 per share. During the IPO, investors acquired 52.2 million shares of the company, resulting in a placement volume of 1.3 billion dollars. IPO "Yandex" was the largest for Internet companies after Google, which in 2004 attracted 1.67 billion dollars. Mail.ru Group was one of the first Russian companies to place their securities on a foreign trading platform. In November 2010, Mail.ru Group held an IPO on the London Stock Exchange at a price of $ 27.7 per share. As a result, Mail.ru Group shareholders received $ 912 million for 17% of the company's shares, and the company’s value was estimated at $ 5.71 billion.

Major IT companies and markets

The United States accounts for more than half of the supply of information technology in the world. The headquarters of the leading IT companies are located in the United States. At the same time, manufacturing companies from India and China are beginning to play an increasing role in the global market. For example, Indian company IT service provider Tata Consultancy Services outperforms Dell and EMC in terms of market capitalization. And Chinese Internet giants - Baidu, Tencent Holdings and NetEase.com - are among the leaders in the IT industry in terms of revenue growth and profitability.

Ten largest public IT companies in the world

The United States is not only the main supplier of information technology on the world market, but also their largest consumer, which accounts for about a third of the total turnover of the entire market.

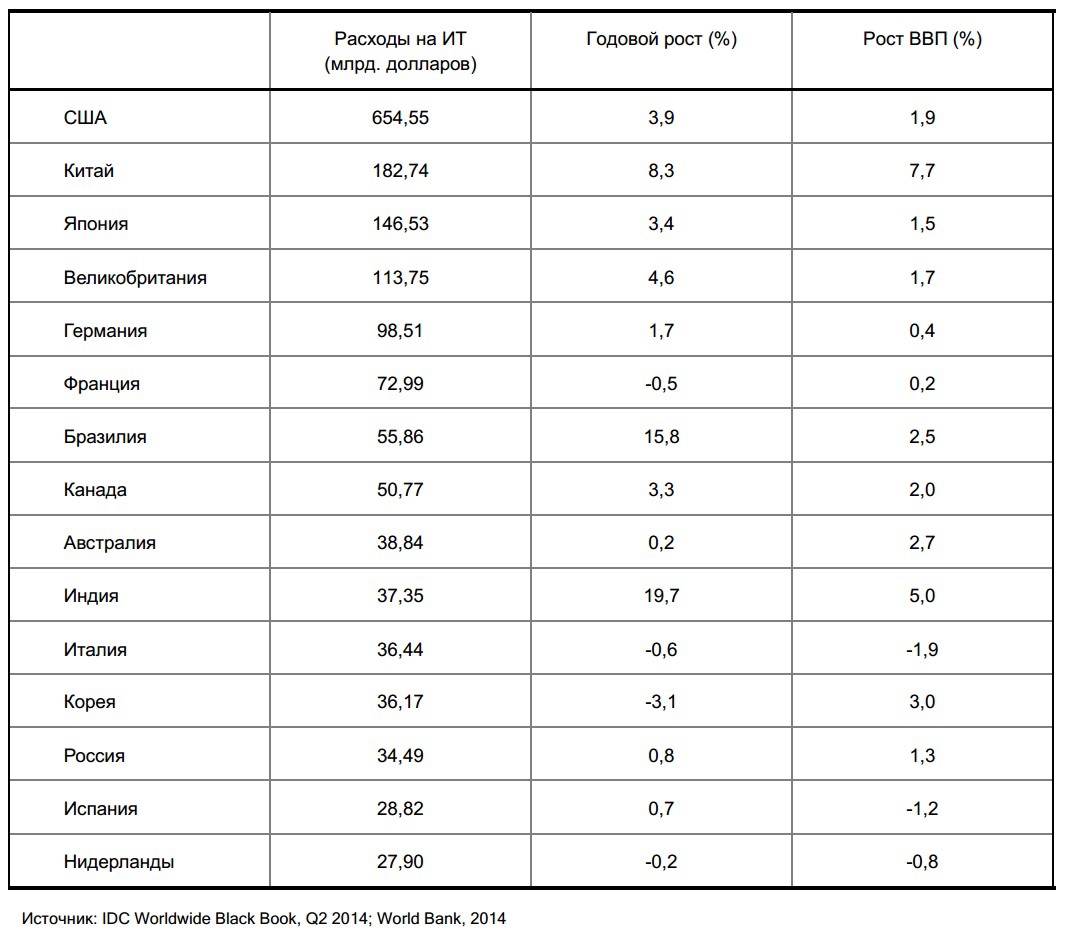

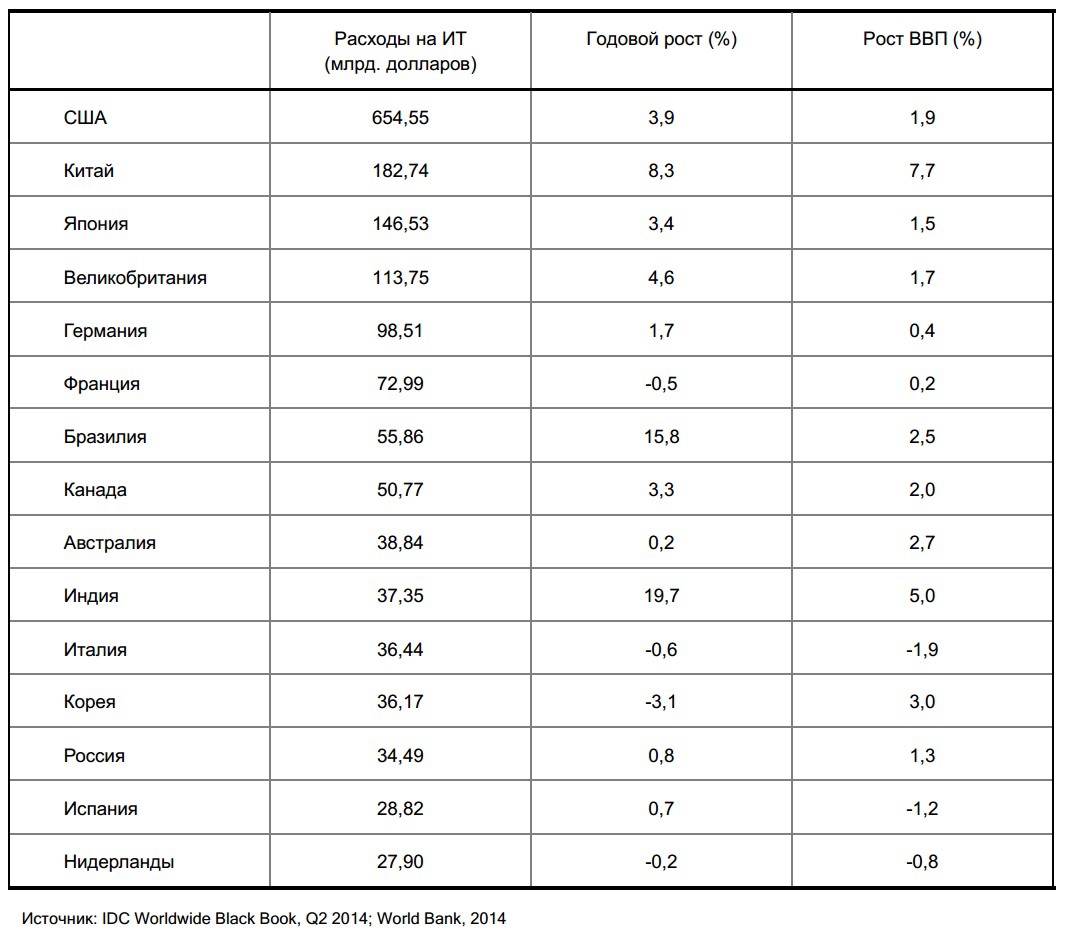

Leading 15 countries in IT spending in 2013

The largest IT consumer countries - the USA, China, Japan, the UK and Germany - account for 60% of the total volume of the global IT market.

China is not only the second largest in the world in terms of IT spending, but is also one of the fastest growing markets, whose volume is increasing annually by more than 8%.

The double-digit annual growth rates are shown by developing countries, including Brazil, India, and some countries in the Asia-Pacific region. In them, the growth rate of IT spending significantly exceeds the annual GDP growth rate, which indicates the priority use of information technology to increase the competitiveness of these countries in the world.

In Western European countries, against the backdrop of an economic recession, there is a slowdown in the growth rate of IT spending to a level of 1.7% per year (for the region as a whole).

Russia is on the 13th place in the world in terms of IT spending, well ahead of developed countries such as the Netherlands, Sweden and Switzerland.

Analysis of the Russian information technology market

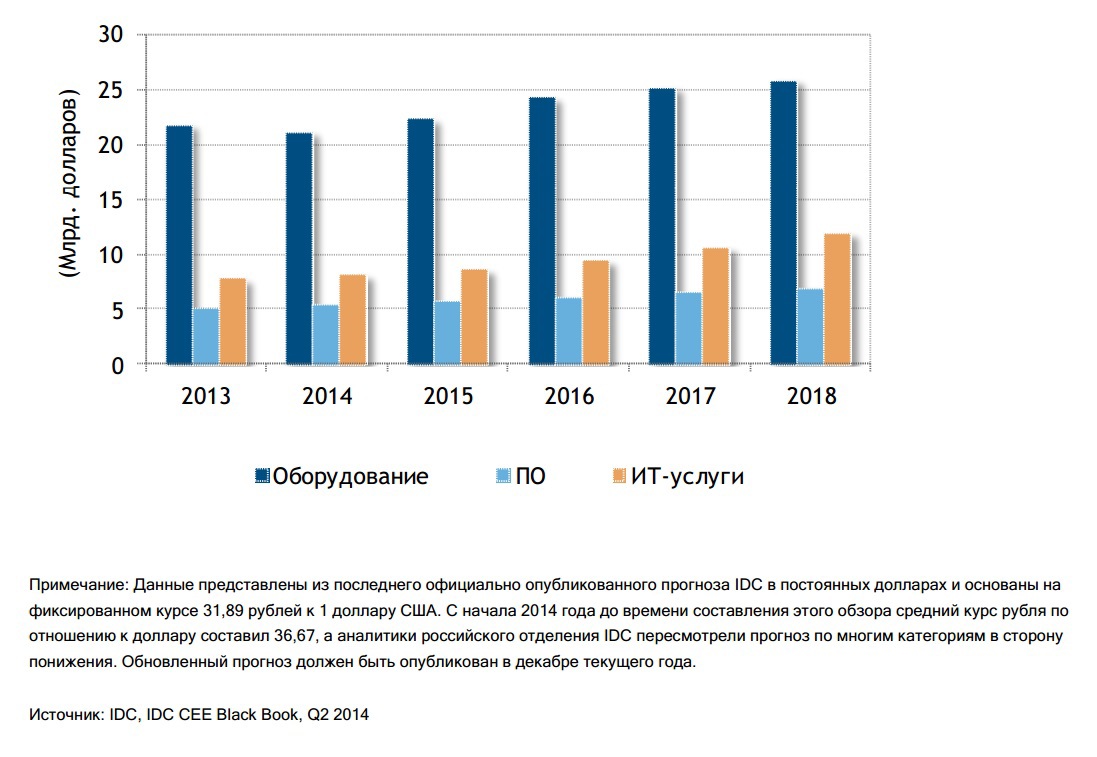

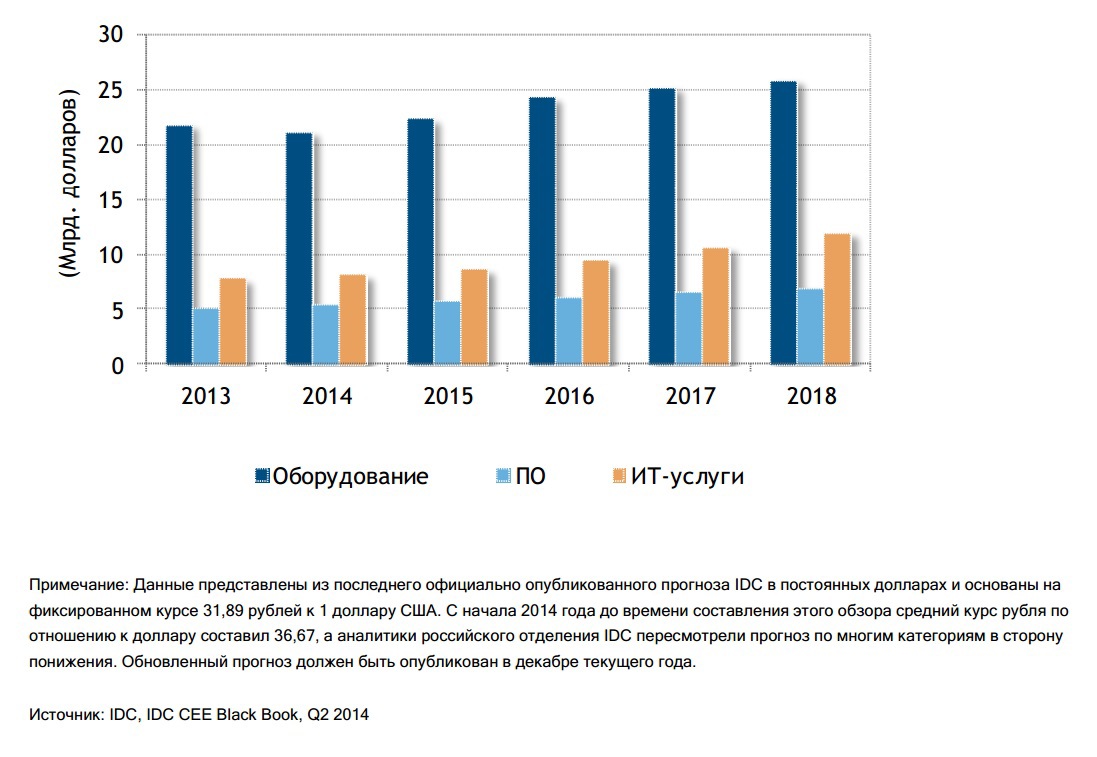

According to IDC, the volume of the Russian IT market in 2013 amounted to 34.49 billion dollars, which is 0.8% more than a year earlier.

Key Drivers and Limiters of the Industry

In the long term, there are a number of macroeconomic and infrastructural factors that have a significant impact - stimulating or limiting - on the development of the Russian IT market as a whole.

A serious constraint on the development of the entire market is the weak diversification of the Russian economy. According to the forecast of the European Bank for Reconstruction and Development, at the current rates of energy production, Russia's proven oil and gas reserves will suffice only for the next 20 years. The development of new fields in Eastern Siberia and the Arctic will require large investments that may be inaccessible due to declining economic growth and economic sanctions. Weak diversification of the economy leads to excessive dependence of the country on the energy sector and fluctuations in energy prices.

A negative factor in the development of the entire market is the inefficiency of large state projects. Weak interaction between federal and regional authorities leads to an increase in the cost of IT projects, violation of the terms of their implementation and bloated budgets.

The development of the market is stimulated by the growth of volumes of processed information. Further automation of business processes covers all new areas and forces companies and organizations, regardless of industry and size, to process and store huge amounts of information, which forces them to modernize their IT infrastructure.

Another important long-term market growth factor is Internet penetration. More and more services in Russia are provided via the Internet. Consumers increasingly prefer online services to traditional ones, which leads to an increase in the use of cloud file-sharing systems. The spread of online services has a positive effect on the Russian IT market as a whole. About half of the 140 million people in Russia are Internet users - in absolute terms more than in any other European country, except Germany.

A positive factor so far has been the desire of foreign investors to invest in cloud technologies in Russia. Leading international manufacturers continue to invest in IT infrastructure to provide cloud services in Russia. IBM has invested in the construction of three data centers in Moscow and one in St. Petersburg. In April 2014, SAP announced plans to invest $ 20 million in building data centers in Russia in order to support its cloud services.

In addition to the above factors, new factors began to have a significant impact on the market.

At the end of 2013, as a result of the slowdown in the Russian economy, the ruble began to weaken. In 2013, GDP growth was only 1.3%, and hopes for recovery next year did not materialize. The crisis in Ukraine and the deployment of economic sanctions against Russia, announced by the US and the EU, put additional pressure on the Russian currency. In the fall, with the fall in oil prices, the ruble fell to a historic low.From the first exchange day to the second half of November of the current year, the ruble has lost more than 40% of its value against the dollar. Further weakening of the national currency can lead to serious consequences for the entire economy, and the situation on the IT market will correspond to the general economic situation in the country.

One of the main current negative factors is political and economic uncertainty. The ongoing crisis in Ukraine reinforces negative sentiment, and further cooling of relations between Russia and the West undermines investor confidence. The deepening of the Russian-Ukrainian conflict will increase geopolitical risks, and uncertainty may be exacerbated by further sanctions and retaliatory actions by Russia. This will increase market volatility and make the prospects for recovery even more elusive.

Weak ruble, political and economic uncertainty accelerate the outflow of capital from the Russian Federation. According to the Central Bank of Russia, the net capital outflow from the country in the first three quarters of 2014 amounted to $ 85 billion, which is almost twice

as high as a year earlier. In general, the net capital outflow from Russia for the year, according to the Ministry of Finance of Russia, could reach 120-130 billion dollars.

Finally, a surge in inflation and a rise in prices for imported products also significantly hamper the development of the IT market, forcing Russian and foreign entrepreneurs to abandon ruble investments. High inflation undermines consumer confidence and

adversely affects the entire market.

It should be noted that along with new negative factors, several factors have appeared that contribute to the development of the Russian market.

This should include the planned adoption of a law on the storage and processing of personal data within the country. This change in legislation will significantly increase the need for data storage systems of companies operating in Russia. An important positive factor is the plans for import substitution and development of domestic IT products, including processors, which will also entail significant costs for IT services, especially custom software development, IT consulting and system integration.

New opportunities for the development of the IT market in the country may arise due to the development of cooperation with China, as well as the creation in 2014 of the Eurasian Economic Union (EAEU). In addition to the largest gas contract in the history of Russia, Russia and China signed a number of agreements affecting the banking, aerospace, telecommunications, transportation and other industries, which will stimulate the modernization of the IT infrastructure. The EAEU will begin its work in 2015 and will become the largest common market in the post-Soviet space with a GDP of 2.7 trillion. dollars. Russian suppliers of IT products and services will have access to a wider market and will be able to participate in joint projects in the member countries of the union.

Overview of the Russian IT market by sector and development forecast until 2018

Market of hardware manufacturers (computer and network equipment)

Results and main trends

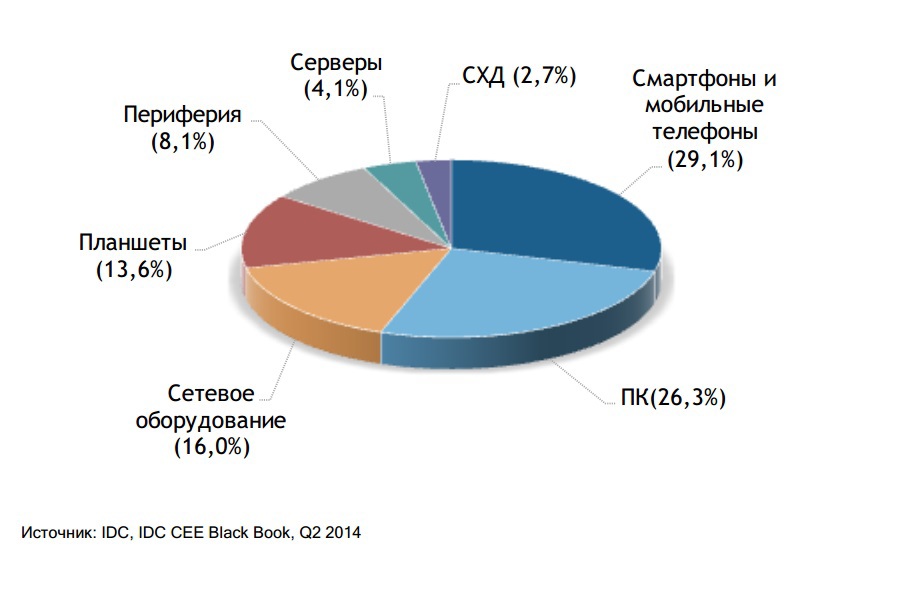

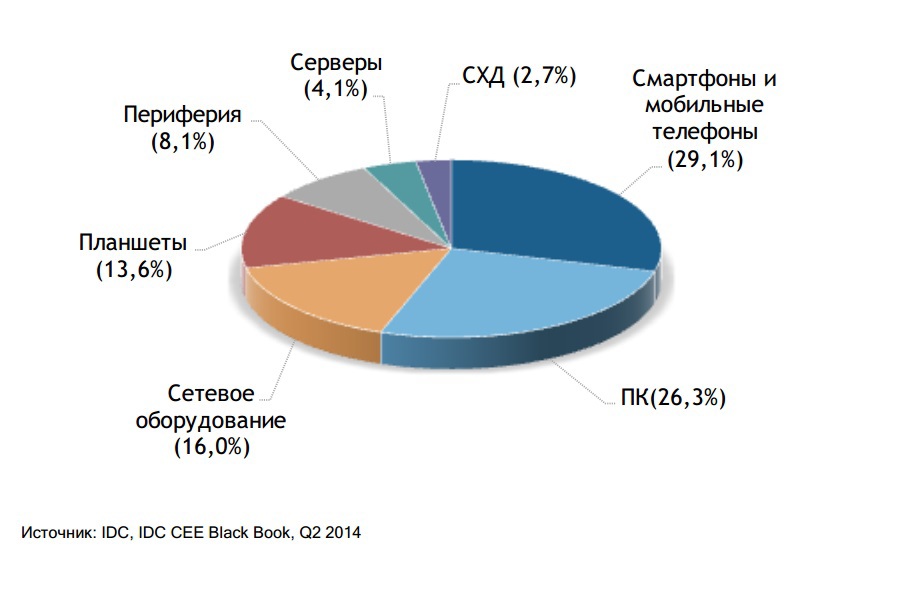

Equipment still occupies a large part of the market (63.1%), however, compared to the previous year, its share decreased by 2.4%. After 2012, when the market reached its maximum ($ 22.4 billion), equipment supplies in 2013 were reduced by almost 3% due to falling demand for PCs and servers.

Server and client equipment remain the most expensive part of the IT budgets of most Russian companies. However, if in 2012 this segment occupied one third of the entire Russian IT market, then a year later this figure decreased by more than 5%. It is expected that the downward trend will continue in the future, and the purchase of expensive equipment will become typical only for large organizations that prefer to have their own IT infrastructure. Small and medium-sized businesses are gradually reorienting to cloud solutions, which will allow them to save significant funds.

Currently, the following trends are observed in the equipment segment:

Below is more detailed information on the categories of IT equipment.

Costs by category of IT equipment in Russia in 2013

Servers

In 2013, the decline in the server market was about 30% (to $ 894.23 million), with the largest decrease in supply was recorded in the server segments of the middle and higher price segments. This was due not only to the high cost of these products, but also to the lack of new technical solutions. The market was supported by large state infrastructure projects for which a large number of standard architecture servers were purchased, which is why the decline in this segment was only 20%.

At the beginning of 2014, the standard architecture servers still occupied about 70% of the market, however, the demand for them was caused by the desire of large customers to make purchases for the future against the background of fears around sanctions, as well as the introduction of the SORM-3 system designed for accumulation, storage and processing of statistical information on the communication services provided with the subsequent provision of access to this information to authorized state bodies for carrying out operational search activities on the network of the telecommunications operator.

The launch of the search engine “Sputnik” of the company “Rostelecom” and the development of a network of data processing centers in the interests of state structures (the Federal Tax Service, the Federal Security Service, the Pension Fund and others) also have a positive effect on the market. The adoption of amendments to federal law No. 152-, prescribing to process and store personal data of Russians in the country, will also have a positive effect on it.

The negative aspects affecting the market at the beginning of 2014 include a decrease in business activity due to changes in the tender legislation - repeal No. 94- and adoption No. 44- on the contractual system of procurement of goods, works, services for state and municipal needs.

In the second half of 2014 and beyond, an increase in the number of data processing centers and an increase in the consumption of their services will serve as a stimulus for the consumption of standard rack-mount architecture servers. Growth in blade server sales will be driven by an increase in the number of business intelligence application installations.

The fall in the advertising market, caused by the overall unfavorable economic situation, will have an effect in reducing the companies' spending on advertising on the Internet. The fading of the Internet advertising market, as well as the consolidation of its main players, will lead to the fact that Internet companies will no longer buy servers in their previous volumes.

The growth of the server market will be determined by deliveries as part of the development of automation systems for the procurement process via the Internet (eprocurement) and the electronic public service delivery system (egovernment).

External storage systems

Deliveries of external disk storage systems declined in 2013 by almost 2% to 552.91 million dollars. In 2014, the market returned to growth in both quantitative and monetary terms. The development of the market was facilitated by the further accumulation of data volumes, as well as the requirements of the Federal Tax Service, which obligate companies to keep information on financial transactions for a fixed time, which makes it impossible to reuse the already established data storage capacities.

The expansion of the network of data processing centers in the interests of government agencies has a positive effect on the storage systems market, while the development of software solutions for data deduplication slightly reduces the growth rate of companies' need for external disk storage systems.

Technological advances and the trend towards unification of system software within the product line of each manufacturer of external disk storage systems allow customers to migrate from higher price segment systems to more affordable middle class systems, while maintaining compatibility within the entire software stack.

Client migration between different manufacturers in the future will decrease with increasing complexity of storage systems and increasing the number of installed systems of a single infrastructure. At the same time, the lack of breakthrough development in data storage technologies and the slow evolution of interfaces will not allow to satisfy all data storage needs of users, which promises a good future for the growth of the market as a whole.

The expansion of the market for external disk storage systems is possible not only at the expense of companies from Southeast Asia, but also at the expense of local players who are rapidly increasing their technological potential and are likely to be able to create complex systems soon.

Personal computers

The PC market (desktop and laptop computers) reached its maximum value in 2011, but after two years it significantly reduced the volumes. In 2014, the market continued to decline, while due to the growth in demand for tablets in the segment of home users, the rate of decline in the supply of notebooks was significantly higher than the same figures for desktop PCs. The overall decline in supply is due to the stagnation of demand and the saturation of the market, which is caused by the absence of fundamental reasons for starting the process of replacing an existing fleet of equipment.

According to IDC methodology, the notebook market consists of: traditional laptops with a full component base; ultra-thin devices with a thickness of not more than 21 mm, while having the functionality of traditional computers and the mobility of tablets; laptops with a transformation mechanism in the Tablet PC; as well as netbooks - compact devices based on Intel Atom processors. With the advent of tablets, we can say that the category of netbooks almost ceased to exist. Segments of ultra-thin laptops and transformers laptops appeared on the market relatively recently and still remain niche products with an insignificant level of demand. The reason for this is the high price of devices and the lack of options for a significant reduction in price. The largest and most stable segment of the notebook market are budget devices with a diagonal of 15 inches.

The desktop market keeps its pace of decline, while the share of candy bars continues to increase. The commercial segment remains the main consumer of desktop computers, while home users prefer laptops. Since the budgets of companies and IT costs are directly dependent on macroeconomic indicators, and the economic situation continues to be difficult, many organizations postpone purchases of new technology. Evidence of this is a sharp decline in tender activity in the public sector.

Price erosion has such a negative effect on the stagnant market that for some manufacturers, the PC market at all ceases to be a priority. Since in a falling market, small producers are in an even more difficult situation than large ones, further consolidation and reduction in the number of players in the market is expected.

Tablets

From 2010 to 2013, the Russian tablet computer market was developing at a rapid pace — its volume increased from 196.65 million to 2.95 billion dollars. However, since the beginning of 2014, inexpensive laptops and smartphones with large screens have become a significant competition to tablets. Now the tablet market is shrinking in piece and monetary terms. In terms of terms, the fall is due to the gradual saturation of the market in Moscow and major cities, and in monetary terms, this is due to a significant expansion of offers in the budget segment and an increase in the share of second-level brands.

Many manufacturers are quite difficult to adapt to negative growth rates and continue to maintain high volumes of shipments, creating serious stocks. Some manufacturers are guided by the fact that the rapid growth in demand for tablets has passed, and is reviewing their business plans, reducing shipments and reducing the pressure on distribution channels.

The main trend in 2014 was the penetration of Asian and Russian manufacturers of tablet computers to the market, which are not inferior in quality to products from well-known Western brands. At the same time, the products of such companies are significantly cheaper. Tablet PCs are now available to consumers with any budget. The largest segment of the market are 7-inch devices at a price of 50-70 dollars.

Today, the Tablet PC segment is aimed at home users, most of whom consume ready-made content. In this regard, the tablet is easier to use, more ergonomic and attractive in price than personal computers. These factors contribute to the active growth of the popularity of tablet devices. The penetration of tablets into the business segment is slow. The commercial sector is only looking at the tablet PC, and the two-in-one devices (a hybrid of a tablet and a laptop) are of most interest.

The most popular operating system in tablet PCs is Android, which accounts for more than 85%. The Apple iOS operating system ranks second with a share of about 10%, while Windows occupies the third place, occupying less than 5% of the market. The growing popularity of Windows-based tablets will have a positive impact on the share of these devices in the commercial sector, since the Microsoft platform facilitates integration in terms of software infrastructure.

Peripherals

The market for peripheral devices in Russia decreased in 2013 by 4.8% in quantity and by 3.7% in monetary terms, or to 3,985,778 units in the amount of 982.64 million dollars.

The main trends in the peripheral market in 2013 were a decline in sales of mono-functional devices (printers, copiers and scanners) and an increase in sales of multi-function devices (MFPs); transition from entry-level inkjet devices to more expensive ones, as well as a general decline in the share and volume of inkjet printers. The only segment of the peripheral printing devices market that showed double-digit growth rates in 2013 was color laser printers and multifunction printers based on them. Reducing the average price of these devices gives grounds to predict a further increase in their supply.

In 2014, the market continued to shrink. The falling ruble has significantly reduced the purchasing power of private users, highlighting corporate customers. Sales of inkjet devices are decreasing due to the gradual “flushing” of the input level inkjet devices from the market (with a price of less than $ 100) due to their unprofitability for manufacturers, while sales of inkjet printers and MFPs equipped with a continuous ink supply system are growing. In the current environment, end users tend to reduce peripheral costs while improving its efficiency. Low-cost MFPs with color options and low cost of ownership will be in demand among home users and small businesses.

If we take into account the number of installed periphery per capita in the countries of Western Europe (almost twice the Russian figures), the Russian market of printing and peripheral devices is still far from saturation. The gradual transition from monochrome to color printers will continue and affect the office infrastructure.

Print management services are becoming increasingly popular; In addition, in the corporate environment, there is a steady increase in demand for multifunctional multifunction devices with extended functionality.

The development of the market for visualization tools will also affect the print market, which will lead to an increase in interest in mobile printing and the use of cloud solutions in printing devices.

Smartphones and mobile phones

Sales of smartphones in Russia for the first time exceeded sales of ordinary mobile phones in the first quarter of 2014. In total, by the end of the year, the share of smartphones will exceed 60% of the total volume of the Russian mobile phone market (about 42 million units).

In monetary terms (retail prices excluding VAT) the volume of the mobile phone market in 2013 amounted to 6.63 billion dollars. Similar results are expected in 2014. If last year, smartphones accounted for more than 80% of the market in monetary terms, in 2014 this figure could exceed 90%.

The fall of the ruble exchange rate will certainly have a significant impact on the mobile phone market. According to IDC forecasts, the main trend in this market will be a shift in demand towards low-cost models of smartphones, but not a reduction in demand for smartphones as such. The total number of phones sold in 2015 may slightly decrease. About 75% of all phones sold will be smartphones.

Sales of ordinary mobile phones are declining rapidly. The number of handsets sold in 2014 will be almost half the size of the previous year. The fall of this market segment in monetary terms will be even more significant.

The future and influence of the Third Platform

According to IDC forecasts, the further development of the corporate equipment market in Russia will be largely associated with products intended for use in the data center environment. Small organizations will gradually abandon their own server rooms and use the services of commercial data centers. Large organizations are more likely to use their own data centers.

Convergent platforms based on compatible and integrated hardware and software will be in greater demand than disconnected products from multiple manufacturers. There is a potential for the development of domestic software and hardware development, as well as greater use of Chinese suppliers.

The growth in the use of mobile phones and tablets, as well as the availability of a wide range of devices to connect to the Internet, will significantly increase Internet traffic. With the rapid growth of traffic, the priority direction of investments for enterprises and telecom operators in the next five years will be the modernization of networks and network architecture.

Mobile, cloud and social technologies will contribute to changes in daily business practices. Habitual office will no longer be necessary for the implementation of an increasing number of work processes. This, in turn, will also affect the structure of demand for IT equipment.

Software Market

Results and main trends

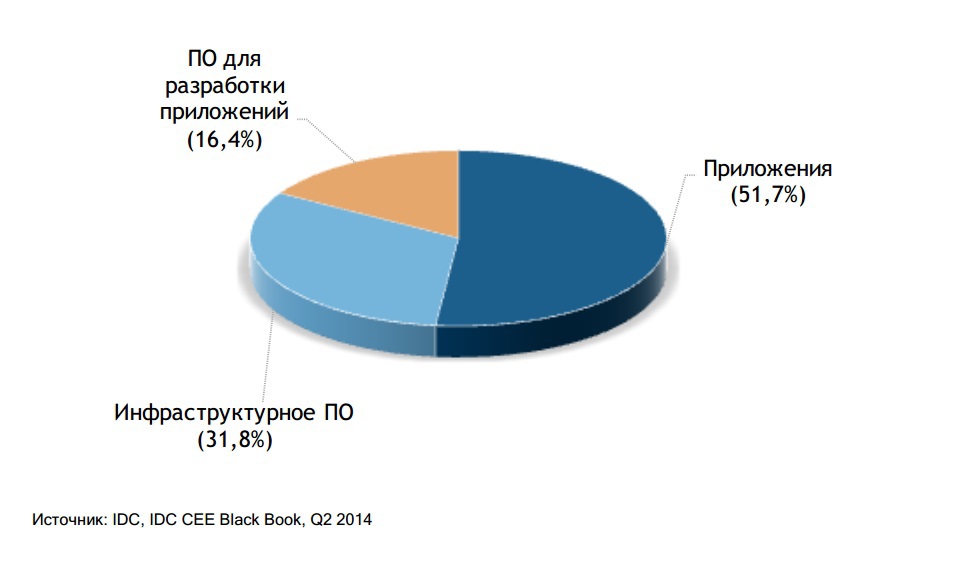

The Russian software market showed strong growth rates until 2012, adding annually an average of 17% each. In 2013, against the background of a generally unfavorable economic situation and a recession in the manufacturing sector, the growth of the software market slowed down, but reached its maximum historical value of 4.99 billion dollars. More than half of this amount falls on various applications, about 30% - on infrastructure software, a little less than 20% - on application development software.

Costs by software category in Russia in 2013

In the application segment, the most popular in 2013 were solutions for automating enterprise management systems: enterprise resource management systems ($ 514.39 million), business intelligence systems ($ 210.05 million), and operations management applications (134, 98 million dollars). The largest demand for such solutions was from large companies, which accounted for about two thirds of the entire market. Among the most active consumers were companies engaged in manufacturing, retail, energy, transportation and business services. In 2013, the public sector demonstrated the largest increase in costs for this type of software, exceeding the corresponding figures of the previous year by 50%.

The security software market continued to grow despite increased competition from alternative protection systems, such as hardware and security services. In 2013, he added 9.2%, reaching $ 412.62 million, with the greatest contribution being made to protect workstations, which accounted for 56.6% of the total security software market. Also, the demand for network protection, monitoring systems for managing vulnerabilities and solutions for protecting messages has had a significant impact on market growth. In the future, a hybrid approach to security will prevail, and organizations will decide for themselves which method of protection is more economically beneficial for them with a given IT infrastructure.

Despite a slight decline in 2012 in the data storage systems market, sales of data storage software in 2013 showed an increase of almost 19%. High growth rates and a significant amount of unused server capacity in the country attracted new suppliers to the market, such as Kaseya, OpenText and RedHat. Data storage in the cloud, deduplication solutions, software and storage virtualization became more popular in Russia last year. In the coming years, all of these technologies will allow companies to make their data storage systems more productive, easier to manage and occupy much less space. It is expected that the spread of virtualization and the introduction of cloud technologies, as well as the growth of projects related to big data, will force companies to make further investments in data storage software.

For both Russian and foreign software suppliers, there are currently two key areas of research and development. The first is software as a service. Gradually, all major applications become available on demand over the Internet and are less and less frequently acquired as resident programs installed on a specific computer. The second direction is the provision of access to applications via mobile devices: software versions that can be launched via a phone or tablet running on iOS, Android or another mobile operating system. Open source software has long attracted Russian users as an opportunity to avoid dependence on any one foreign supplier. There are many examples of implementing such solutions among customers in the public sector.The main difficulty here has always been the availability of qualified specialists who are necessary not only to create, but also to support and update these solutions. In the near future, it is highly likely that interest in solutions using open source software will grow in areas of strategic importance to the state.

Gradually, the decision-making process on the acquisition of this type of software moves from technical managers to managers responsible for the areas for which these products are intended. This is partly due to the fact that it is becoming easier and faster to implement this kind of new applications. In addition, directors of such areas as marketing, finance, logistics, are beginning to realize that the success of their activities increasingly depends on their ability to use information technology.

Investments from large companies still determine a large part of the software market in Russia, however, the share of costs from medium and small businesses continues to increase. Large companies have already passed the main phase of automating their business processes, and the interest of software vendors for several years has been aimed at attracting small and medium business customers. Most software vendors operating in the Russian market have specialized solutions for medium and small enterprises. In addition, the use of the cloud model makes the automation of business processes of these companies much more accessible.

The future and influence of the Third Platform

The software consumption model of customers will change dramatically. Customers will gradually move from purchasing licenses to subscribing to applications. The subscription mechanism will also change over time - customers will be able to choose various options for using applications (pay for one-time use, per hour, for a certain amount of traffic, etc.).

The process of using cloud technologies in Russia lags far behind world figures. In the general structure of the software market, the cost of cloud solutions does not exceed a few percent. A large Russian business is still hardly giving up on internal corporate solutions. The most likely scenario is the use of hybrid clouds, in which individual units in the company will use cloud services. Such a model is already being implemented and will continue to evolve. Applications that are not business critical, such as mail, human resource management, electronic procurement, and supply chain optimization, are transferred to public clouds.

Small and medium businesses will migrate more actively to the cloud model of software delivery, guided by the principle of minimizing IT costs and the flexibility of resources consumed. This is important in a period of economic uncertainty. In mobile versions of the main applications, there will be a significant expansion of functionality and access capabilities.

Providing access to corporate resources to various groups of users in a company, and not just top managers, determines the further development of the mobile application market. The main tasks are the use of mobile applications by employees providing services outside the office. The use of corporate mobile applications by this group of employees allows you to increase

the effectiveness of their work, minimize the influence of the human factor and errors, work with relevant information in a mode close to real time.

The next stage in the development of mobility is the transfer of data to the system not only from mobile users, but also from devices. Mobile developers should take this trend into account.

Software companies will try to individualize their relationships with their customers as much as possible. More and more software will be sold directly to customers through all sorts of app stores. This, in turn, can qualitatively change the role of partners in Russia. One of the possible business models for them will be the provision of consulting services, the other is the sale of additional services related to one or another solution acquired by the customer.

IT services market (consulting, outsourcing, system integration)

Results and main trends

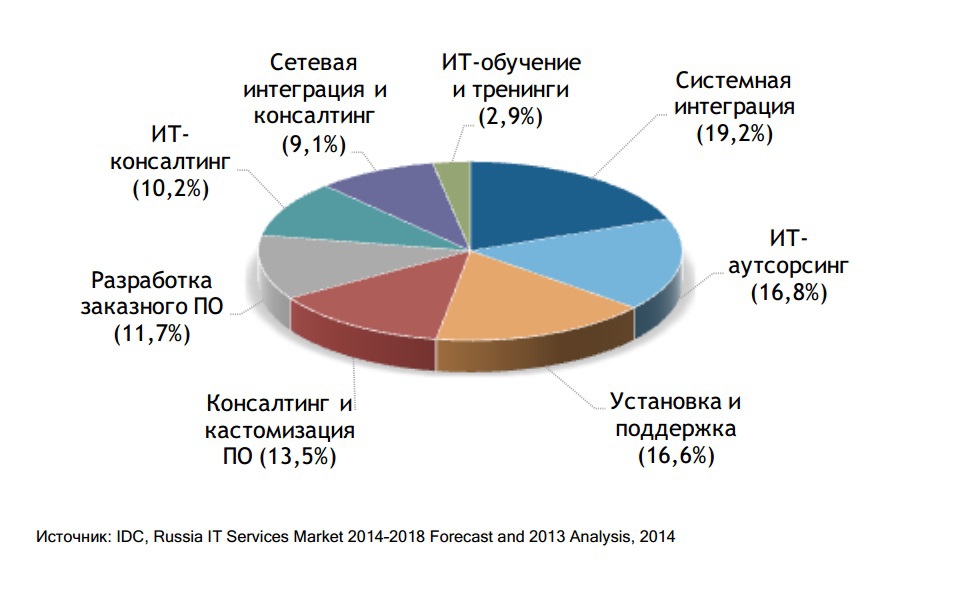

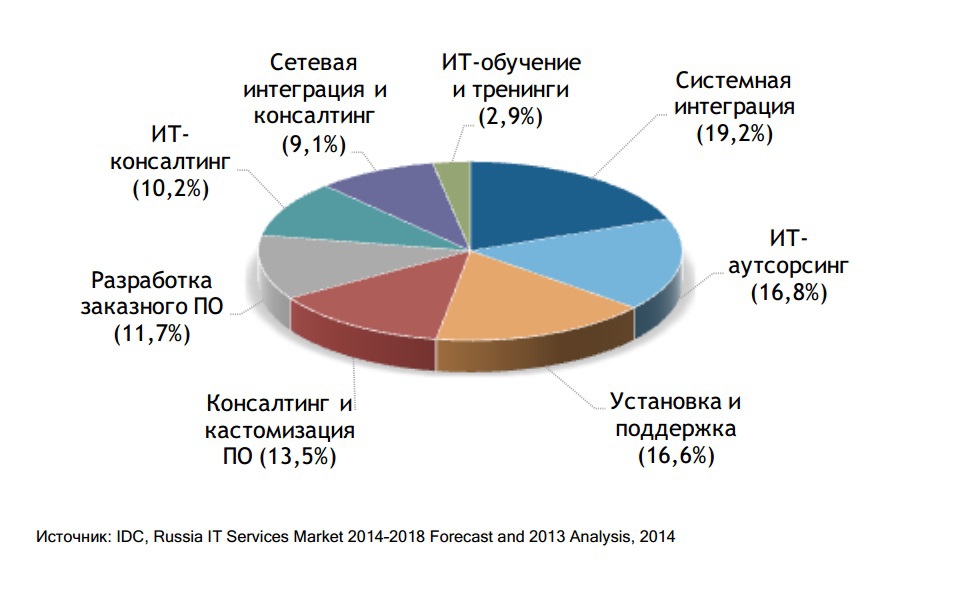

Despite major investment projects, such as e-government and the Winter Olympics in Sochi, as well as high oil prices, the IT services market in 2013 showed the lowest growth rates in the past few years and stood at 7.73 billion . dollars, which is only 8.1% more than a year earlier.

The Russian IT services market is still not transparent enough, as many Russian supplier companies do not reveal all the details of their activities. In many projects related to new technologies, the names of customers are not disclosed under the terms of confidentiality agreements and remain inaccessible to the public.

Difficult relations with the West once again stressed the need to reduce Russia's dependence on Western IT systems, expand the development of its own open-source solutions, strengthen the IT infrastructure, especially in the public sector and the military-industrial complex. Nevertheless, despite the current situation, the main international high-tech companies continue to engage in large-scale projects in Russia. It is expected that in the coming years, the IT services market will strongly depend on the economic situation in the country and the presence of large state projects.

Expenditures on the basic markets of IT services in Russia in 2013

System integration continues to occupy the largest share of the IT services market. Systems integration projects are usually long, complex and costly. The growth of IT resources and the demand for their centralization will require new projects related to system integration.

The market share of support services associated with the installation of new hardware and software will decline with a decrease in the margin of income from these services.

Equipment maintenance services will continue to enjoy steady demand .

The share of the IT education and training segment will decline with the increase in low-cost online courses and the possibility of free training in social networks. Compared to Western countries, the share of outsourcing in the Russian IT services market remains rather small. The advantages of cloud technologies, such as the ability to quickly get IT infrastructure for rent, use it on demand and

pay for consumption, are known to users, but many Russian organizations are still afraid to introduce these technologies, which is due to the lack of a common outsourcing culture, as well as security.

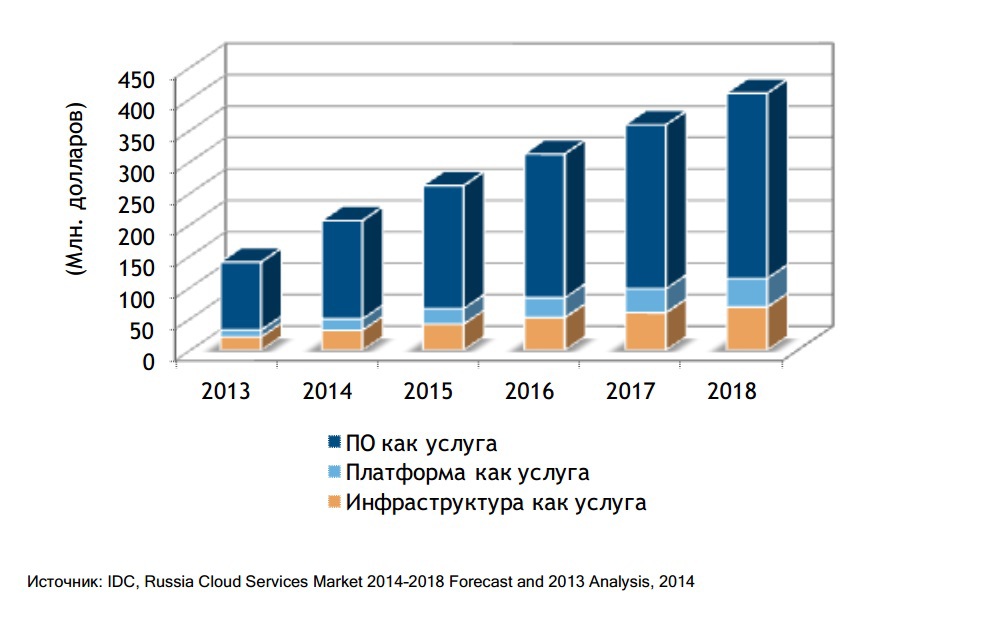

The growth rate of cloud services will significantly exceed the growth rate of traditional IT services. The advantages of cloud technologies, such as the ability to quickly get IT infrastructure for rent, use it on demand and pay for consumption, are obvious to many users, however, many Russian organizations are still wary of introducing these technologies. This is partly due to the lack of a general culture of outsourcing, as well as security issues. The share of project costs in private clouds is still very high.

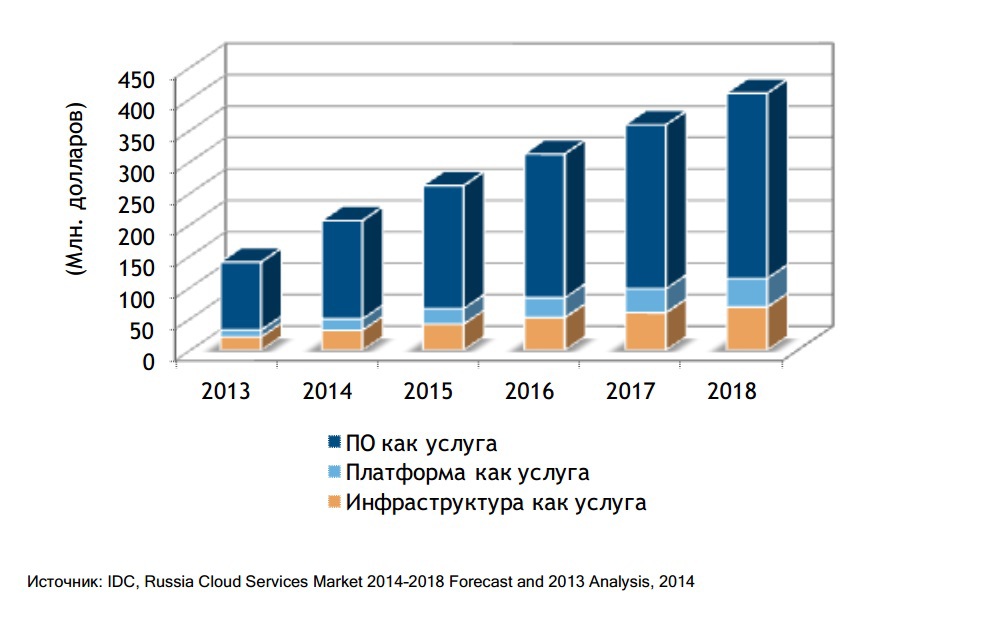

Expenses for public cloud services in Russia

Services based on public clouds are resorted to, first of all, companies of medium and small businesses. For them, the transition to the cloud model is not perceived as undesirable from a security point of view, but on the contrary, as a step towards better protection of information assets, as they begin to use licensed software.

Large Russian organizations, by contrast, less willingly resort to the services of public clouds and mostly build private clouds. At the current stage of IT development in Russia, cloud technologies are mainly used to support non-business-critical applications and test environments.

The future and influence of the Third Platform

On the one hand, IT service providers as high-tech companies are starting to introduce new technologies of the Third Platform in order to be able to test them and demonstrate them to the customer. So, many system integrators in Russia are transferring their IT infrastructure to the cloud and developing mobile technologies. Most suppliers have begun to provide support to users, not only by phone and email, but also through social media. Big data technologies are used by IT service providers to optimize their professional activities, for example, to predict failures in customer equipment and to provide services proactively.

On the other hand, IT service providers are increasingly engaged in consulting, training and implementation of solutions based on technologies of the Third Platform. There is a growing demand for cloud hosting services. New types of services are emerging - such as cloud brokers. A cloud broker acts as an intermediary between cloud providers and cloud consumers, integrates cloud services from different manufacturers, and controls the use, performance, and security of an integrated cloud solution. The introduction of mobile solutions requires from suppliers of IT services new projects for managing mobile devices, stimulates the development of custom software. An increasing number of Russian IT service providers are starting to engage in big data ─ they train specialists and create centers of competence in this area.

IT Costs in Russia

In the structure of the Russian IT market, the equipment will retain a dominant role, and the development of the segment will follow global trends. Traditional desktops will be replaced by laptops and ultrabooks, and the release of low-end models by Asian manufacturers will contribute to the spread of various mobile devices. The need to store personal data of citizens exclusively in the territory of the Russian Federation will require the opening of additional data processing centers and will ensure a stable demand for various types of server and network equipment and data storage systems. Demand for printing and copying equipment, in

particular, MFP, will remain.

In the software segment, there will be a demand for security solutions and management of heterogeneous infrastructure, including workstations, mobile devices, virtual and cloud environments. High demand will remain for various categories of solutions for working with information, including databases, analytical applications, and reporting systems. Traditional office applications (for example, MS Office) will increasingly be distributed on the software model as a service. Demand for enterprise resource management and customer relationship management solutions will be provided by bringing specialized industry solutions and the cloud delivery model to the market.

The increasing complexity of information systems and the lack of staff in the staff of most companies with the competencies necessary for their effective implementation and support will ensure a steadily growing demand in the IT services market. The direction of IT outsourcing will actively develop, including in the field of ensuring comprehensive infrastructure security.

Export volume on the Russian information technology market

According to the non-profit partnership “Russoft”, the export of Russian software and services for its development in 2013 grew by 15% to $ 5.2 billion, and by 2015 it will increase to 7.2 billion dollars. IDC considers this estimate to be significantly overestimated. First of all, this is due to differences in taxonomy. Under the export of software from Russia IDC understands the turnover from the sale of licenses and their support. Programs developed by domestic firms and embedded in foreign DSP processors do not apply to software exports. IT rendering

services to foreign companies, according to the IDC taxonomy, also applies to software exports, and not to IT services. At the same time, IT services include not only writing custom code, but also consulting, implementation, testing, training, etc. Writing software by employees of development centers of foreign companies in Russia, according to the IDC taxonomy, is not classified as “software export”.

IDC estimates the volume of software exports from Russia in 2013 at the level of $ 980 million., And the

volume of exports of IT services at the level of $ 1.2 billion.

Considering the crisis period in the Russian market, IDC expects that a greater number of companies will target foreign markets, with the result that software exports in dollar terms will increase by about 8% by 2018, while the Russian IT services market will grow by about 10 %

The export of IT equipment of Russian manufacturers makes up a very small share of the volume of the hardware market of domestic brands. Today, tablet devices of some Russian manufacturers are represented in the markets of the countries of the Customs Union (Digma, Explay, iRU, PocketBook, Texet, Wexler). In addition, the Russian manufacturer of T-Platforms supercomputers is present in the US and European markets. In 2012, the company won a tender for the supply of a supercomputer at New York State University at Stony Brook. However, in March 2013, the Bureau of Industry and Security, subordinate to the US Department of Commerce, announced the inclusion of T-Platforms and the company's two branches in Germany and Taiwan in the “List of organizations and individuals acting contrary to US national security and foreign policy interests.”Excluded from this blacklist the company in

the beginning of this year.

The total volume of exports of IT equipment in monetary terms in 2013, according to IDC, did not exceed $ 10 million. Taking into account the small base, it is difficult to give a numerical forecast to the change in exports for the period up to 2018, although in percentage terms the growth is likely to be higher than for the software and IT services market.

The main consumers on the IT market in Russia: an assessment of the level of IT penetration into various industries

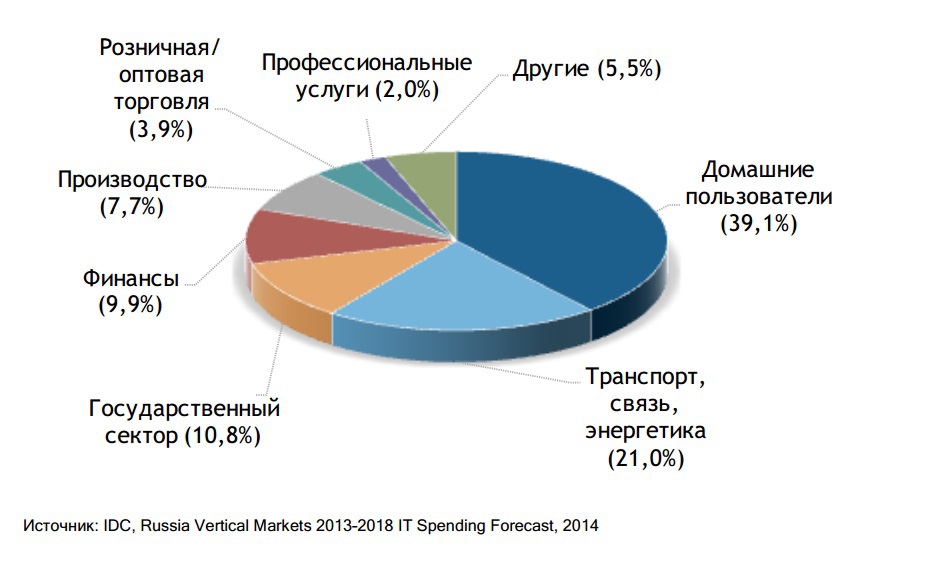

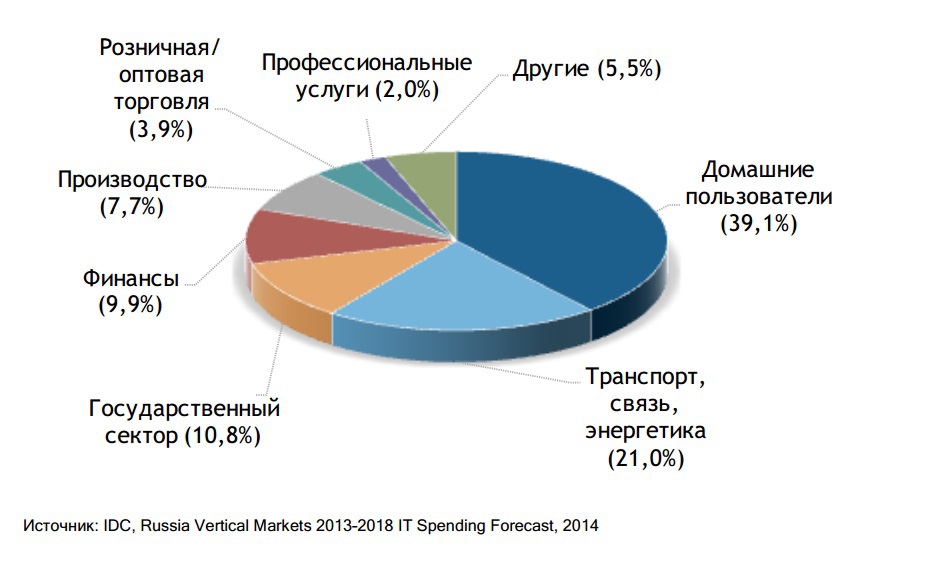

In the structure of IT consumption in Russia, home users still play a large role. In 2013, their IT spending exceeded $ 13.41 billion, representing almost 40% of the total market.

More than 90% of this amount was spent on various devices, most of which were smartphones, tablets and personal computers. At the same time, the cost of tablets and smartphones increased by 50.8% and 39.5%, respectively, which is higher than the similar indicators for all other types of equipment. In total, these devices accounted for $ 8.01 billion, or almost 60% of all home user spending on IT in 2013.

In terms of investment in software, home users rank second. The main share of their costs in this segment is accounted for by security systems. Home users are becoming increasingly aware of the need to protect not only personal computers, but also tablets and mobile devices, especially if they use them for online purchases, banking, social networking, and media consumption.

The second place in terms of investment in IT in Russia belongs to the vertical market represented by organizations of the transport, communications and energy sectors.

The transport sector, especially in large cities, is growing thanks to public investments aimed at developing the public transport system and reducing the number of people traveling by personal transport. Concepts for the development of the urban network of paid parking, land transport, and metro are inextricably linked with the introduction of technologies such as GLONASS, solutions in the field of enterprise resource management and customer relationships, business intelligence, and the development of Internet services.

Telecommunications and media companies are also major IT investors, however, 85% of IT companies spend on IT for specialized telecommunications equipment. At the same time, the development of communication technologies is one of the factors for the increasing distribution of mobile devices. Telecommunications companies, in particular, the Big Three mobile operators, continue to invest in the development of LTE networks. The introduction of cloud services requires improving the quality of communication services. Telecom companies account for just over 11% of all software costs in the country. The main costs here fall on security software, business intelligence systems and other application solutions.

Large telecom companies make long-term investments and are less susceptible to short-term economic factors. Planned changes to the laws on personal data and on the access of special services to telecommunications networks may cause a significant increase in investment in this sector.

IT costs in the energy sector are mainly related to the modernization of the existing infrastructure through the implementation of business intelligence solutions aimed at creating a dynamic payment system, redistributing workloads and creating so-called “intelligent networks”.

In 2013, the fastest-growing vertical market was the retail market, which demonstrated an increase in IT investment by 15.2%. The development of mobile technologies, the further spread of IT outsourcing, the introduction of analytical solutions and the use of cloud computing are the main directions in the development of IT infrastructure for retailers.

Rapid growth is observed in the online trading sector. Companies such as Ozon, Wildberries and Yulmart have proven that online stores are able to attract customers and deal with the problems of online payments and delivery. In this sector, there is a growing demand for creating applications (including mobile ones) that can be used to implement the end-to-end selection and delivery functions with one click of goods from the online store catalog. Also, companies are implementing solutions to optimize work with suppliers. In addition, retail can be one of the first industries to implement the concept of “Internet of Things”.

The introduction of advanced IT solutions is becoming critical for the successful operation of online stores. The problem of efficient delivery of goods purchased on the Internet is solved by implementing comprehensive IT solutions that ensure effective route planning, remote monitoring of vehicles and minimizing losses associated with inefficient logistics.

Large customers of IT equipment have traditionally been banks and other financial institutions. At the end of 2013, they accounted for more than 5% of all equipment costs, and the costs spread to many technological segments, including corporate networks, servers of all types, printers and MFPs, monitors and personal computers, as well as external disk storage systems.

Financial organizations have traditionally been the driving force of the IT services market and occupy a share of more than 20%. In 2013, banks and other financial institutions spent $ 1.7 billion on IT services. In total, over the past three years, the cumulative cost of these institutions for IT services has exceeded 4.4 billion dollars. Banks, insurance companies and other financial organizations invest in IT infrastructure consolidation, business process automation, protection of trade secrets and personal data, as well as solutions aimed at increasing customer loyalty. As a rule, banks already have an advanced IT infrastructure, which limits their need for significant new investments.

Russian banks are increasingly shifting branch operations to remote channels - ATMs, kiosks, online and mobile banking. Providing customers with opportunities for independent financial transactions is one of the important tasks for the industry. The introduction of a modular approach in key banking systems simultaneously with the partial transfer of critical calculations to private cloud environments will be a fundamental condition for analyzing customer behavior in real time in order to provide supply channels and product lines.

In an effort to streamline business and technology processes, enterprises in the production vertical market invest in business intelligence solutions, enterprise software and security systems. Since 2010, the growth rate of industrial production in Russia has consistently declined, reaching 0.1% by 2013. With the introduction of sanctions against Russia and the import substitution program adopted in the country, as well as the ban on the import into Russia of certain types of agricultural products, raw materials and food, the situation began to change. Many manufacturing companies began to think about updating their IT infrastructures, while military-industrial enterprises, supported by state investments, began to spend more and more money on developing IT products.

In the defense and automotive industries, Russian manufacturers traditionally invest heavily in IT. Enterprise resource management, product life cycle management (PLM) and operational production management (MES) are still in demand. With their help, the most successful production companies were able to provide optimization of business processes and increase productivity. Also in demand is system integration, which is becoming an important step towards cloud architecture and its associated cost savings.

Stable and desirable customers for IT service providers remain government organizations. The planned reduction in the flow of investment from private companies is partly able to compensate for the state, which has adopted the program for the development of the IT industry until 2025 and considers it an important element in the development of the country. Large-scale projects related to the supply of equipment, system integration, network integration and consulting will be implemented by government customers.

During the period of unfavorable economic conditions, investment in education and health care tends to decrease. However, consolidation and integration within the framework of the reorganization of these industries are associated with the need for significant investments in IT infrastructure, which was previously very poorly developed. It is expected that IT budgets in these segments will not be reduced. AT

In particular, the restructuring of educational and healthcare institutions provides for the integration of servers, storage of information and accounting systems into a single information space.

IT spending by branches of the Russian economy in 2013 A

sharp deterioration in the economic environment at the end of 2014 led to a correction of industry trends in the Russian IT market. In addition to the long-term industry-specific factors described above, a number of additional trends are unfolding related to the response of various industries to the two main adverse macroeconomic factors — the devaluation of the national currency (largely linked to world oil prices) and sanctions imposed on Russia, introduced in stages by the United States. and the EU.

By blocking access to capital markets for large Russian banks, the sanctions dramatically hindered the possibility of finding financing for both Russian companies and Russian projects abroad. Thus, in August 2014, Rosneft requested a loan of $ 42 billion from the Russian government, citing the need to resist sanctions as the reason.

Lack of sources of funds for investment will affect IT consumers in various sectors of the economy, will lead to a decrease in the number of new projects, will affect infrastructure renewal cycles and modernization plans. In the public sector, we should expect a correction in the IT budgets of local governments. In the oil and gas sector, IT demand is expected to decline as a result of a ban on the supply of equipment and services in support of long-term exploration projects and the development of new raw materials. Due to import restrictions, growth is slowing down and IT investment in retail trade may decline, while in the energy, banking and transport sectors, it is not expected that IT budgets of systemically important organizations for the Russian economy will decrease.

The devaluation of the Russian currency at the same time gives a short-term advantage to all Russian producers competing in the import market. An additional effect of the same kind is created by Russian sanctions against food imports from Europe. The food industry and the agro-industrial complex as a whole may benefit from the situation. Subsequently, some other industries may also benefit as the price of imported products rises significantly.

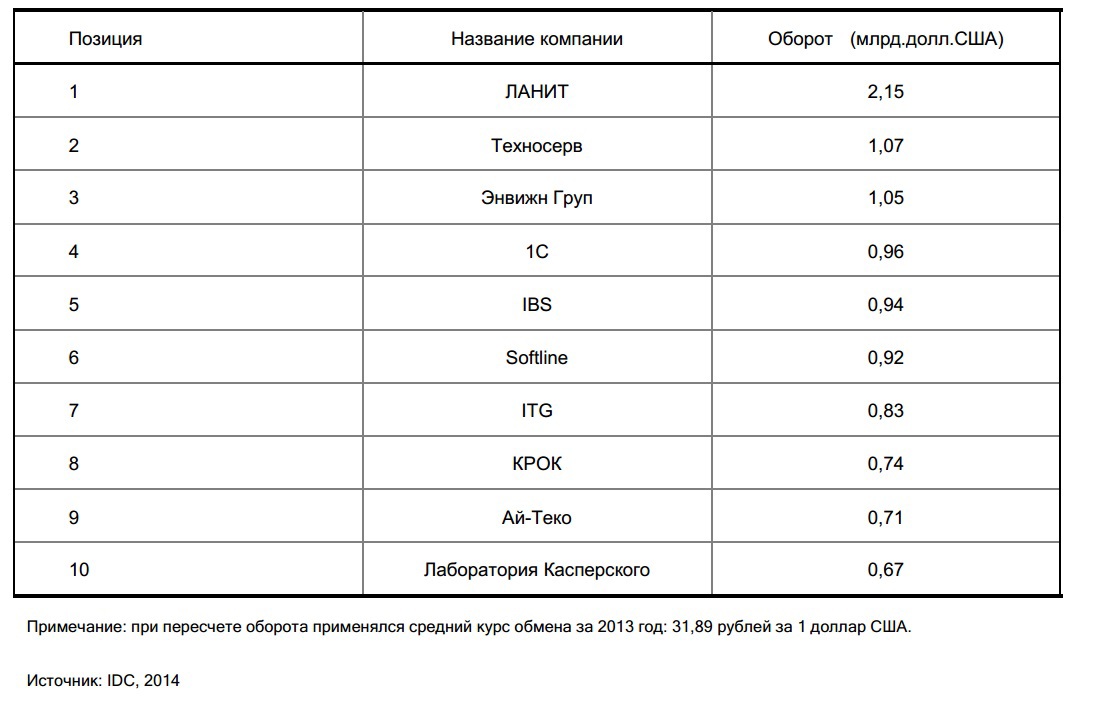

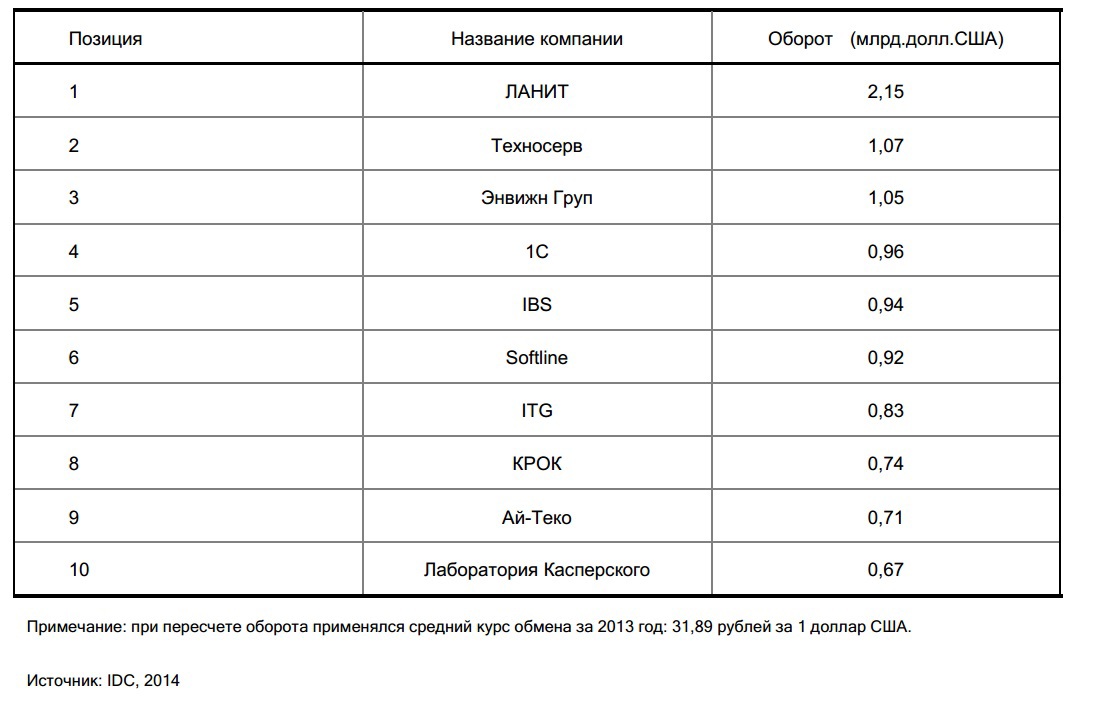

Ten largest Russian IT companies in 2013

Above is a table of the largest by annual turnover of companies operating in the Russian IT market. In accordance with the definition of the boundaries of the Russian IT market, adopted in IDC standard reports, the list includes companies operating in one of the three components of the IT market - the software market, the IT equipment market, or the IT services market. Therefore, we did not include in the table, for example, Yandex and Mail.ru - they do not belong to any of these categories, they are not taken into account in the figures of the Russian IT market volume provided by IDC. Turnover data is based on information provided by companies participating in the IT market in IDC and verified by IDC analysts.

If you have read our long post to this place, we want to thank you sincerely, we have done a great job to make this detailed review. The full version can be downloaded on our website moex.com/n8686/?nt=106

We present a fresh analytical review of the IT market, prepared jointly with the RVC Foundation and IDC.

In this review

')

The first part of the review is devoted to a review of the global information technology (IT) market. Particular attention is paid to describing the future market development factors, such as the spread of cloud computing, the exponential increase in data, and the use of mobile devices and social networking technologies in the corporate environment. The evolution of the role of the director of information technology is considered separately.

The second part of the review contains an overview of the Russian IT market, including a detailed description of market segments and their development trends. Separately highlights the main provisions of the state policy in the field of IT and gives a rating of sectors of the economy in terms of the cost of IT. It also provides a description and a list of the main players in the Russian market.

The review contains a forecast of the development of the global and Russian IT market by major categories for the period 2014-2018.

The present study was prepared by IDC in collaboration with the Moscow Exchange Innovation and Investment Market and the Russian Venture Company.

Overview of the global information technology market

To date, the cumulative amount of the global IT market exceeds two trillion US dollars.

The largest segment of the market in terms of expenditure is equipment. The explosive growth of information volumes stimulates the demand for servers and data storage systems. The ubiquity of data centers and cloud solutions provides a steady demand for various types of network equipment. The personal computer market is gradually shrinking, while the mobile device market is growing steadily. Deliveries of printing and copying equipment are relatively stable, and sales of monitors are steadily declining.

The demand for IT services is provided by the growing diversity and complexity of the corporate IT systems used, which require large installation, integration, training and maintenance costs. IT outsourcing, that is, the transfer of third-party organizations to support and maintain IT infrastructure, is one of the promising areas in this market.

The most dynamic segment of the global IT market is software, whose annual growth in the past few years has exceeded 6%. Over half of the total volume of the segment is formed by various categories of applications, the rest falls on system software and development tools. The category of applications for organizing collaboration, especially solutions for corporate social networks and file sharing, is developing most rapidly: their volume increases by more than 20% annually. The category of database management and analytics solutions is also dynamically developing with an annual growth of more than 8%. Permanently strong demand remains for solutions for managing enterprise resources and customer relations, as well as security solutions.

Among the strategic directions of IT development, a special place is occupied by cloud technologies, big data analytics, integration of mobile devices and social networking technologies into the corporate environment. The combination of these technologies and processes of IDC unites the collective term “Third Platform”, the development of which in the next few years will lead to the transformation of business models in most industries.

Scientific and technological trends and the fastest growing segments in the global IT market

Stages of development of the IT industry IDC is in the form of three platforms. The first platform was built on the basis of mainframes and terminals, on which thousands of applications and users worked. The second platform is based on traditional personal computers, the Internet, client-server architecture and hundreds of thousands of applications. The third platform is characterized by a rapidly growing number

mobile devices that are constantly connected to the Internet, combined with the extensive use of social networks and a developed cloud infrastructure used to solve complex analytical tasks.

Applications, content and services based on technologies of the Third Platform are available to billions of users. Cloud computing, big data, mobile and social technologies stimulate mutual development. Indeed, users of a growing number of mobile devices are producing more and more content that is conveniently stored in the clouds. Due to the growth of mobile devices, user activity in social networks is increasing. The content they accumulate becomes an important source for analyzing and extracting valuable information using big data technologies.

Three platforms in the evolution of the IT market

A typical example of a solution based on the technologies of the Third Platform is the use of an application from a mobile device to gain access to corporate or social media information, analyze this data in real time and align activities depending on the information received. At the same time, both the application and the data can be located in different clouds, private or public.

As noted, the concept of the Third Platform is based on four elements: big data, mobile devices, cloud services and social technologies.

Big data means new generation technologies and architectures for cost-effective extraction of value from large-format multi-format data through their rapid capture, processing and analysis. Big data technology has three distinguishing features: speed, variability, and volume. The volume is expressed in the fact that huge amounts of data are analyzed in tens of terabytes. The speed indicates that the capture and data processing is performed in near real-time mode, or that the organization accumulates data at high speed. Variability suggests that data is collected from one or more sources in different formats.

The cost of big data technology in the world