Using graphs to reveal insider plans

Image: NPR.org

When power and money are put on the line, people will go to any tricks for the sake of winning the competition. In professional sports, this is doping, and on the financial market, insider trading. To understand the role that data analysis plays in the investigation of fraud cases, it is enough to consider the case of the former SAC manager Matthew Martoma, charged in the case of possibly the largest insider trading case.

')

At the very edge

Matthew Martho was a portfolio manager at SAC Capital Advisors, a US hedge fund. SAC Capital Advisors (now known as Point72 Asset Management ) is headed by Stephen Cohen , a hedge fund legend; the company's net worth is estimated at $ 11 billion. The two-digit annual growth rate of SAC has generated rumors about the methods used by Steve Cohen to achieve consistently high profits.

In September 2014, Matthew Martho was accused of taking part in the largest insider transaction in history, which brought $ 276 million in net income.

Matthew Martho, Image: Business Insider

Insider trading is “trading in stocks or other securities (such as bonds or stock options) of a public company, carried out by those who have access to the private information of the company. In a number of countries, trading based on insider information is illegal. ”

Matthew Martoma was engaged in speculation on the shares of two companies: Elan and Wyeth. Both companies have been developing a drug called Bapineuzumab or “Bapi”. They have invested hundreds of millions of dollars in creating Bapi and testing its use in the treatment of Alzheimer's disease . Due to the fact that the success of Elan and Wyeth in the development of Bapi was questioned, Matthew Marta tried to find all possible information about the results of clinical studies.

For investors, finding information about the companies with which they do business is a standard procedure. Usually, search refers to reading publicly available materials disclosed by companies. Matthew Martoma went far beyond these limits. He consulted a doctor who was directly involved in conducting clinical trials and was able to gain his confidence. In July 2008, during their relationship, he learned (before the public announcement by Wyeth and Elan) that Bapi could not be a successful drug. A few days later, Matthew Martho liquidated his position of $ 700 million in both companies and continued to reduce it. During this process, his company SAC received $ 275 million in net profit.

Only 6 years after this success, Matthew Martho is sentenced to 9 years in prison for insider trading. This is a rare case, as it is well known that it is not easy to prove insider crimes.

In cases of insider trading information exchange two or more people. As a rule, they both benefit from the commission of such a crime, and therefore they have a serious motive to go unnoticed. In addition, insider trading participants are educated people. For example, Matthew Martho attended the Harvard Law School and received a degree in ethics. He had a good idea of what could be used against him and actively tried to defend himself. His mail and text messages to his boss, Stephen Cohen, contained brief instructions, since they exchanged secret information verbally.

For proof of Matthew Martho’s guilt in committing insider trading , the US Securities and Exchange Commission [Eng. The Securities and Exchange Commission, SEC ], which is the federal authority responsible for regulating the securities industry, had to answer one question: how did Marta access the Bapi test information? Finding such a connection is a difficult task. SEC has access to numerous data, as it can arrange interviews and request information about phone calls and mail. The problem is how to find a hidden connection among all this data?

How did the SEC build the graph and reveal the insider transaction plans?

When SAC Capital Advisors turned an unexpected announcement of Bapi’s failure into a major success, the SEC was informed about this. SEC investigators decided to find out how Stephen Cohen and his team could have such a supernatural ability to predict the future. They knew that something was wrong, but could not prove anything.

That all changed when they studied the recording of a telephone conversation with Dr. Sid Gilman, a distinguished professor who participated in the Bapi tests. Dr. Sid Gilman spoke regularly with Matthew Martho on the phone. And the SEC found a connection between Marta and the Bapi trials.

Of course, a few phone calls to prove it would not be enough. A more thorough investigation revealed that Martha first contacted Dr. Gilman through GLG, which provided expert advice for the financial industry. Martoma gradually built a relationship with Dr. Gilman and obtained insider information to which he had access.

This led to a series of events, the result of which a month later was the Bapi conference in Chicago in July 2008:

- Dr. Gilman sent an email to Marthe with the theme “Some News,” since Elan and Wyeth appointed him responsible for presenting the results of Phase II clinical trials;

- After receiving a letter from Dr. Gilman, Martha ordered a consultation with him through GLG to discuss "treatment methods for multiple sclerosis";

- Dr. Gilman receives a PowerPoint presentation with the latest test results;

- Dr. Gilman and Martoma spent 105 minutes talking on the phone on the day Dr. Gilman received a presentation of the test results;

- During his visit to Ann Arbor, Martha meets with Dr. Gilman and spends an hour with him before heading back to New York;

- Martoma makes a call on Cohen's home phone number on Sunday and they talk for 20 minutes;

- Cohen and Martoma secretly sell all the shares of Elan and Wyeth;

- At a public conference in Chicago, Dr. Gilman announces the sad results of recent tests;

The SEC collected testimony, telephone records, emails and computer-technical expertise data and restored the chain of these events. It was probably a long and difficult process.

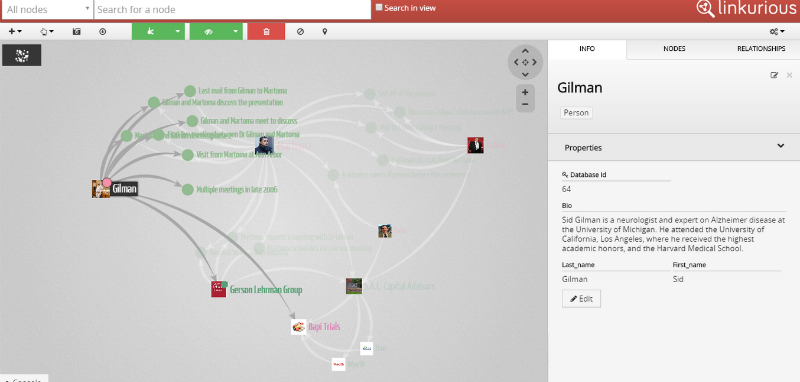

Accidentally or not, the SEC created the graph. Using various data sources, she built a network of related events, people, dates, locations or companies. She could do this with technology using graphs.

Visual presentation of the case against Matthew Marta

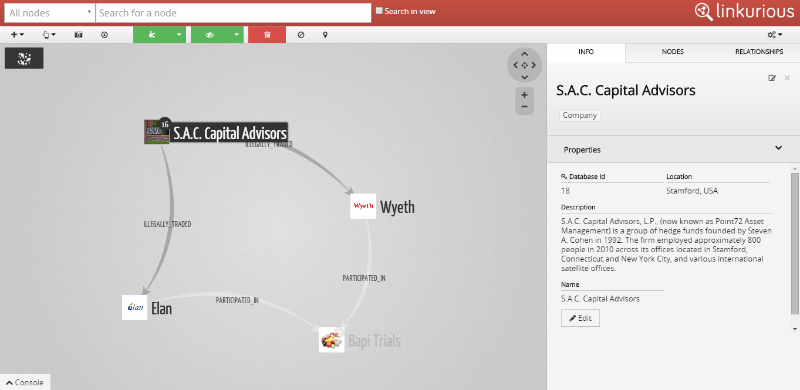

The beginning of the investigation SEC put intuition. Pharmaceutical companies participated in the testing of a new drug called Bapi. SAC Capital Advisors traded their shares based on illegally obtained information.

SAC Capital Advisors traded on Elan and Wyeth: Is it legal? (click to open the full size image)

But how to prove the connection between the trading activities of SAC Capital Advisors and the collection of illegally obtained information. If insider information was used, then who got it? From whom? In order to answer these questions, the SEC selected several key players who are associated with SAC Capital Advisors and Bapi trials. The goal was to find a hidden link.

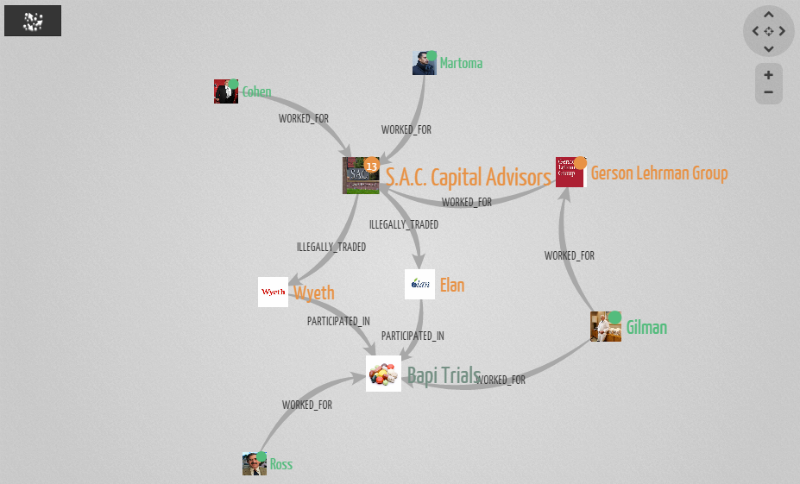

The main actors in the case (clickable image)

The graph above shows how each of the several main actors is related to the SEC case. Stephen Cohen was CEO of SAC Capital Advisors. He worked there with Matthew Martha. Dr. Ross and Dr. Gilman participated in the Bapi trial, the first as a research physician, the second as a member of the Safety Testing Committee.

Interestingly, we can see how SAC Capital Advisors are linked to clinical trials with the help of the Gerson Lehrman Group and Dr. Gilman. The Gerson Lehrman Group is a company that provides hedge funds with access to specialists in a specific field. Dr. Gilman worked for the Gerson Lehrman Group, which in turn worked for SAC Capital Advisors. This is precisely the source of the leaked information.

In order to understand how this leaked information was obtained, it is necessary to add the means of communication of our heroes to our graph.

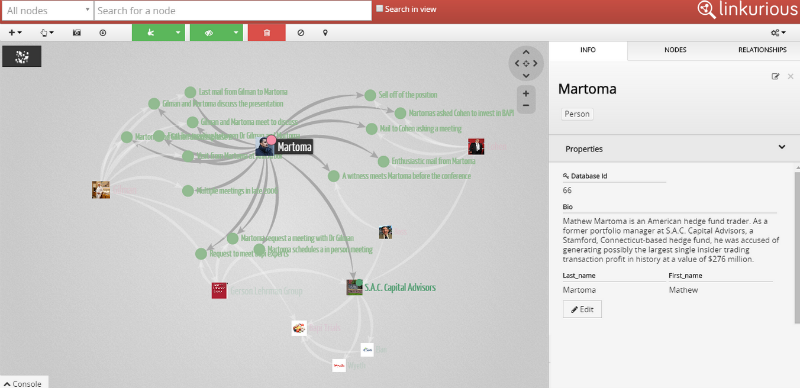

Martoma received illegal information with the help of Dr. Gilman:

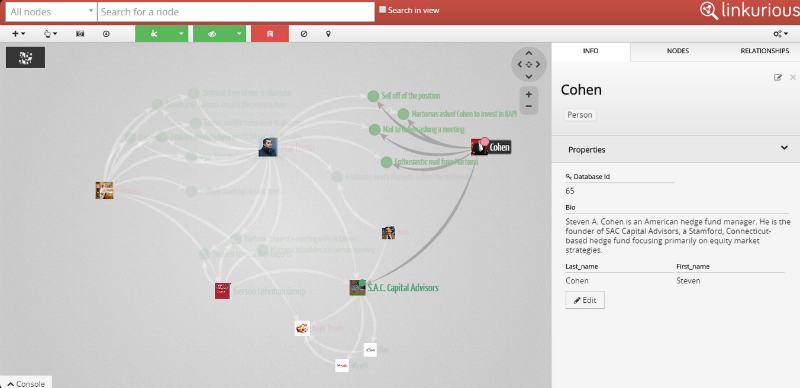

Stephen Cohen received information from Marta and used it to make transactions on the stock exchange:

Gilman gave Marto the information to which he had access:

Letters, meetings, phone calls: the case participants used a variety of communication tools:

The messages above are based on what picture the SEC was able to recreate during the investigation. She demonstrates how Matthew Martho could receive insider information from Dr. Gilman, and how it was used to carry out the largest insider transaction in history.

Why graphs are the basis for researching data with a complex structure

To identify cases of insider trading, as well as most types of fraud, it is necessary to analyze a huge amount of data in order to find the answers and guarantee the result (in the form of charges, confiscated funds, etc.).

Researcher must:

- process information from various sources (telephone calls, testimony, documents, mail, information from public sources, etc.);

- combine these sources to recreate a single "big picture";

- find key facts hidden in the data;

- to link various facts together in one convincing story.

Graph usage technologies can facilitate this work:

- the graph is an ideal model for representing complex relationships associated with actual data;

- graph usage technologies are ideal for detecting weak, indirect relationships between potential accomplices;

- A visual representation in the form of a graph is a great way to get at the core of the data and describe it.

Using a database-based graphing system, for example, you can save phone call records, information from public sources (such as Facebook or Twitter), email correspondence, and other relevant data sources within the same data model. Instead of working with several separate data sources, the researcher can store all the necessary data in one place. A potential attacker may have a social network account, a phone number or an email address: if you put everything together, finding answers becomes easier.

For storing the obtained data of the system for constructing graphs, databases are used as the basis. Building queries to such databases allows you to select a clear structure in them. For example, a researcher may need to find out what means of communication are usually used by two potential suspects. Using such tools, you can conduct such a search and find the answer in a matter of seconds. In addition, visualization in the form of a graph is the best way to describe the result of complex research.

Investigations into insider trading cases are confusing. Graph usage technologies can speed up the process, allowing researchers to discover hidden links within large databases.

PS If you notice a typo, mistake or inaccuracy of the translation - write a personal message and we will fix everything promptly.

PPS Recently, citizens of Russia can easily buy shares of foreign companies (like Google, Apple, Facebook) - such an opportunity has appeared on the St. Petersburg Stock Exchange .

Source: https://habr.com/ru/post/249697/

All Articles