Ruined by harpies. History of high-speed trading

On January 28, 1790, the representative of the State of Georgia, James Jackson, spoke at a rather young at that time house of representatives at a meeting in New York. His goal was to expose high-speed traders.

"Three ships, sir," shouted Congressman Jackson, "sailed from this port within two weeks with the intention of speculating; they are going to acquire the entire State and other securities of the ignorant ... "

Jackson scolded these people, calling them "greedy wolves ... who profit from the misfortunes of their neighbors and use their hopeless position for selfish purposes."

')

What terrible crime did these people commit? Murder? Change

Hardly. Jackson and one of his fellow congressmen discussed the proposal of Finance Minister Alexander Hamilton that the new US government at that time should pay for the long-standing debts that the states and the Continental Congress got during the Revolution; a proposal that became known as the 1790 Debt Repayment Act [Eng. Funding Act of 1790 ].

Traders who learned about the discussion immediately rented speedboats to get ahead of the messengers and began to buy out the old debt, correctly reasoning that the adoption of the Law would raise the market value of the old debt, which in some cases was sold for 10% or less of its nominal value.

Jackson was indignant: he demanded that Congress take measures to "save distant inhabitants from ruin by these robbers." The “remote inhabitants” that Jackson spoke of were his voters from Georgia; although we, in a sense, are “remote residents” of Congressman Jackson, who still hope that they will be saved from robbers.

Criticism of the information advantage, which the “speculators” owned, was common in American society from the moment the country was founded right up to today. Now, many complain that “high-frequency traders” who use mathematical algorithms have an unfair advantage over those whose algorithms are not so good, or that their (HFT-traders) tons of raiding systems are faster than other players.

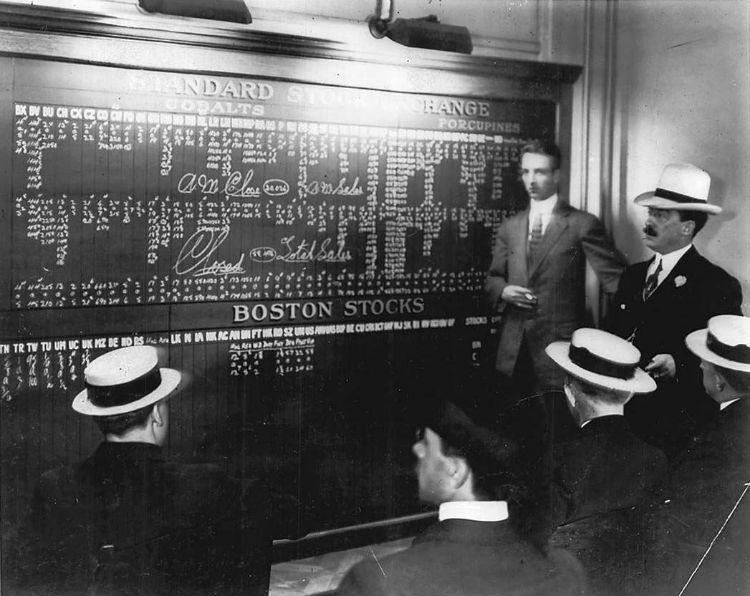

The clerks of the New York Stock Exchange have a ticker, approx. 1915

From the very beginning, there was a deep fear in society regarding brokers who were ready to buy or sell your stock, bond or your product for a certain amount. There was a suspicion that these middlemen know something that buyers and sellers do not know.

Anyway, this discontent emphasizes one more significant historical fact: any technology that increases the speed of information flow is immediately adopted by the community of traders in Europe and in the United States. Traders used all known vehicles to make transactions faster and make less effort. They were among the first to master high-speed boats, faster crews and private courier services. Securities trading was one of the first uses of the telegraph.

Mastering these high-frequency trading methods had two characteristics: 1) they significantly reduced the price difference between the markets, and 2) those who mastered them more slowly complained bitterly that new technologies create an unfair advantage over all market participants.

Then, as now, the people involved in buying and selling, and the government desperately tried to keep the situation at the same level. In 1792, Congress founded the US Postal Service with the specific purpose of "transmitting information" to "every part of the States." By setting low rates of transportation of newspapers containing information that is sensitive to the market, it remained only to hope that citizens could be aware of events affecting the market and be ahead of the “robbers”.

But speculators were much faster than newspapers. In 1817, when a ship arrived in London from New York with news that caused a sharp increase in stocks, three speculators immediately jumped into the crew heading for Philadelphia to buy up the stocks. Thanks to significantly improved road quality, travel time between New York and Philadelphia was reduced to two days, leading to a lively stock exchange between the Philadelphia Stock Exchange (founded in 1790) and the early version of the New York Stock Exchange (founded 1792). ).

When the station carriage broke down, they hired their own crew and arrived in Philadelphia before the crew arrived with the news. They immediately bought stocks, and when the mail arrived, prices rose sharply. It seemed to those who had lagged behind that the speculators paid the cabman to delay the mail.

Traders instantly created a network of high-speed "private express trains", moving along the newly created networks of highways and wide postal routes from New York to New Orleans. By 1825, Postmaster General John McLean, outraged by speculation in the cotton market, tried to convince Congress to close these high-speed trading networks and build a government system by which newspapers could be delivered at the same speed as letters to prevent speculators.

“According to all the principles of fair transactions,” McLean wrote, “the owner of the property must be aware of its value before parting with it ...”.

The government’s attempts to block roads for high-speed traders were so serious that the United States Postal Service used high-speed horse-drawn sledding that tied New York and New Orleans from 1836 to 1839 and delivered news reports on paper from loose material to journalists instead of much more expensive newspapers.

Traders, who are constantly in search of trading advantages, soon shortened the time interval for information transfer - they stopped using horses and carts! In the late 1830s, a broker from Philadelphia, William Bridges, had a personal signaling station between New York and Philadelphia, transmitting to him and his patrons (and no one else) news of the stock market. Signals were transmitted using an “optical telegraph,” which consisted of a series of shields on a pole mounted on a hill that could be seen through a telescope. Messages indicate that they could transmit information about the stock market to anywhere in New York to Philadelphia in 10-30 minutes. In the 1830s it was a high-speed trading!

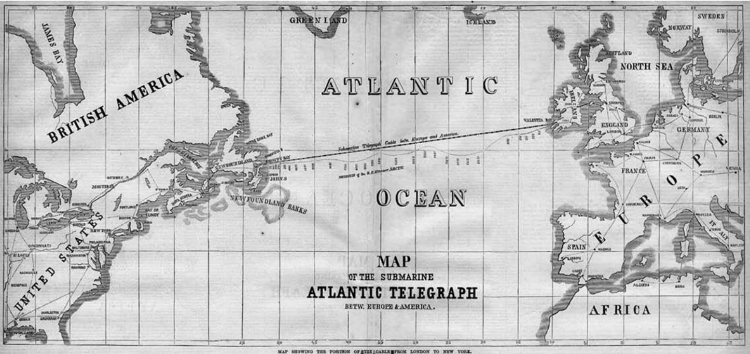

Map showing the location of the transatlantic cable between New York and London

It is not surprising that complaints began to come in from speculators from New York who were not involved in this system and who had enjoyed a significant advantage before this time. Residents of Philadelphia were also unhappy. When the system was closed after the appearance of the telegraph in 1846, it was written in a local newspaper report that “speculators who contributed to the creation of the telegraph were responsible for many of the ingenious moves in the stock and commodity markets of Philadelphia. Undoubtedly, speculators have well paid its creators. ”

Sure. Unfortunately, the “organized” community of traders did not strongly strive for openness. At the initial stage of its existence, the NYSE (the New York Stock Exchange, at that time known as the New York Stock and Exchange Board ) did not allow the public to listen to trading sessions (the sessions were inaccessible to the public until 1869). Competing traders (over-the-counter traders, literally from outside) who intended to sell information about trading on the NYSE, were enraged by the fact that they could not be located near the stock exchange. In 1837, the NYSE found that over-the-counter traders had drilled a hole in the brick wall of the stock exchange building in order to eavesdrop on the bidding process.

While the public was pondering how to get ahead of fast horses, a new technology appeared in the arena that turned trading into a region of really high speeds: the telegraph, which came into use after 1844.

He was the greatest invention of his time. It took time to release newspapers, and for the most part they were issued at regular intervals. A telegraph worked constantly, and it could be used for personal communication.

He was a high-speed trader’s dream come true. The first customers were stock brokers and speculators selling lottery tickets. On March 3, 1846, the New York Herald reported that "certain groups of individuals used the telegraph to speculate on actions in New York and Philadelphia."

As expected, the use of telegraph to transmit "secret knowledge" has caused outrage. Several of the inventors of the first telegraphs were forced to stop their experiments, warning that they might be persecuted for spreading information faster than mail. Telegraph lead inventor Samuel FB Morse supported the introduction of telegraph into mass production for personal and public purposes, in particular, to protect it from being used for speculation.

Everything was in vain. Congress, ultimately, refused to attempt to introduce a telegraph system, partly because competition for information about market changes and the limited length of wires available at that time were quite sensitive factors. This competition arose not only between traders, but also between them and their main competitor - the press.

In the early 1800s, modern newspaper production was born, and one of the main goals of the first such newspapers was the accelerated publication of financial news. James Gordon Bennett Sr., who founded the New York Herald in 1835, is one of the first "tabloid" publications in the country, stressed that the nascent press destroyed the minority information monopoly:

“Speculators should not have an advantage in receiving news before the general public receives them,” he said.

Suddenly, the newspaper publishing houses have boats. And optical telegraphs. Publishers of the Journal of Commerce [eng. Journal of Commerce ], formed in 1827 with the aim of providing news to the financial community, there were high-speed boats at the disposal, which were met by ships arriving from abroad. Optical telegraph systems, like private systems between Philadelphia and New York, were installed between Sandy Hook, New Jersey and New York City and informed the editors of the arrival of ships.

The magazine of commerce and their competitor, The Courier and Enquirer, were even organized by competing postal services on shifters operating between New York and Philadelphia, and later reaching Washington. Even pigeons were involved in their rivalry: a group of owners of tabloid newspapers paid $ 2,000 for a flock of pigeons to send news to Philadelphia, Washington and Baltimore.

In turn, traders for a certain price provided great support. One news entrepreneur, Daniel Craig, made a fortune by selling European news to traders. Combining pigeons with couriers of express services, he received news from European steamers that moored in harbors from Halifax in Nova Scotia to Boston earlier than anyone. The information was then telegraphed to New York.

Attempt to send a message using mail pigeons, 1898

Craig was so good at collecting information earlier than others that he was later invited to work at the newly formed New York Associated Press. The press showed dissatisfaction with the traders and agents supplying them with information. Particular hostility was shown to the telegraph companies, which were thought to be in close relations with traders; The editors complained that the telegraph fell into "bad hands."

Getting the information first was so valuable that in times of cooperation with telegraph companies, some speculators, after receiving the news, could cut the telegraph wire! Due to the fact that the telegraph companies received valuable information among the first, some of them ousted all the speculators and began to do this business on their own. This went on for decades: when a civil war broke out, some Western Union employees became rich in the gold market, taking advantage of early news from the front.

Forty years later, the telegraph was still the main instrument of speculators. In 1887, the president of Western Union stated that 87% of the company's revenues were accounted for by speculators in the stock and commodity markets and those who made money on races.

The acquisition of a faster vessel that would cruise the Atlantic was even more profitable for traders. In the middle of the 19th century, the Atlantic Ocean could be crossed in eight days, and anyone who could learn important news from overseas could profit from it faster. A vivid example: when in 1865 in New York it became known that the Southerners had lost the war, financier Jim Fisk chartered several ships, faster than the postal vessels of the time, and sent them to London, ordering their brokers to sell off short-term confederation bonds. When London became aware of the defeat of the South, the value of the bonds fell to zero, and Fisk, of course, became rich.

Just as the telegraph was immediately mastered by stock traders in the United States, stock trading and other commercial activities were one of the first transatlantic cable applications. The first cable was successfully laid in 1866 between New York and London, and significantly reduced the information advantage that traders used before; brokers could now telegraph a request to London and receive confirmation within five minutes. Soon the difference in the rates of securities began to shrink.

The stock ticker, which appeared in 1867, became the next greatest electronic device, immediately mastered by the community of traders. Before its appearance, stock exchange transactions were usually carried out with the help of “runners” [eng. "Pad shovers" ] - boys who ran back and forth from the exchange "pit" to the brokerage offices. He had a great superiority over the telegraph for several reasons: 1) traders no longer needed to physically be in the exchange "pit"; 2) its appearance has reduced transaction costs; 3) he helped to disseminate information continuously, in real time; and 4) his invention has reduced the number of annoying intermediaries such as telegraph companies and newspaper editors. Not surprisingly, journalists and editors are worried that the introduction of the ticker will force them out of the lucrative financial news trade.

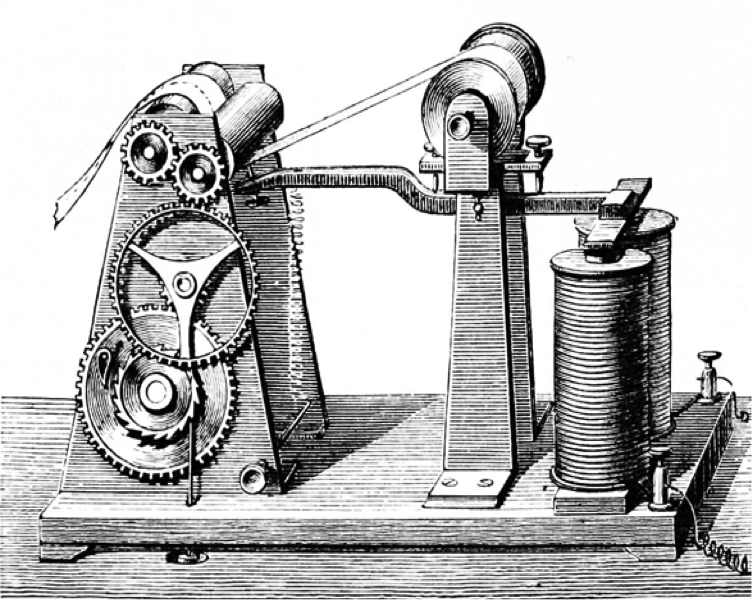

Morse telegraph drawing, which appeared in the magazine Popular Science Monthly, ca. 1872-1873

The ticker was not invented by Thomas Edison, but the latter made a number of significant improvements in its design, including the quadruplex invention in 1873, which made it possible to simultaneously transmit four messages on one wire. Western Union has found good use of this additional bandwidth: they leased communication lines to private networks controlled by Wall Street companies. By 1879, these firms had contact with their offices on the basis of telegraph devices in Boston and Philadelphia, and by 1881 in Chicago. These private lines were faster than the "nationwide" telegram. In addition, they were more reliable and were laid in secret.

Wall Street was glad to put its money into this project, as the quickest access to market data, as always, played a crucial role in making a profit: by 1894, brokers on the Boston Stock Exchange learned about transactions on the NYSE for 30 seconds .

Among other things, the use of the stock ticker marked the beginning of a new wave of speculation in the stock market, which this time was carried out by working class investors, who began to speculate through the newly created over-the-counter brokerage firms, also equipped with tickers. Professional traders, who used to have a colossal advantage, complained bitterly: “The indiscriminate distribution of stock prices in pubs and other establishments greatly interfered with business,” said John T. Denny, a broker from New York, in 1889. - "Everyone could go to the bar and look at the quotes."

Despite the fact that over-the-counter brokerage offices were engaged in fraud (the actual transfer of shares did not occur, so the "depositors" only made bets against other players in the brokerage "kitchen"), many laid out a tidy sum for fast telegraph communication; in 1887, the NYSE found that one of the over-the-counter brokerage firms received stock exchange data seven minutes earlier than the “normal” data transfer using a ticker, thanks to the support of Western Union.

This continued further, with the advent of the exchange trading system in the 1860s, the invention of the telephone (first tested by Bell in 1876; by 1878, the NYSE already had its own telephone), and a little later with the creation of pneumatic mail, a computer in the 1950s , punched cards in the 1960s, with the first appearance of electronic trading, when the Nasdaq exchange began its work in 1971, and algorithmic trading in the 1990s. The same disputes arose: someone received the information before the others, and some could trade, because they had a faster ship / horse / carriage / telegraph line / computer connection / algorithm.

A man using a new “high-speed” stock ticker, 1930. The original signature read: “Western Union ordered 10,000 [tickers] and began installing them in broker offices across the country. The company will spend 4.5 million dollars to try to speed up the transfer of stock quotes ... to keep up with the new era, when they sell six or eight million shares per day on the stock exchange. ”

The reaction of society and the government to the “thirst for speed” of traders differed, but one factor remained almost unchanged: the informational advantages, after mastering any new technologies, seemed to disappear with time. From the very beginning, shrewd observers have noted this fact.

Let us return to Congressman Jackson and the controversies in 1790, the main problem of which was the question of whether the Congress should take action and prohibit “speculation” (rent of high-speed vessels). After the protests of several congressmen who claimed that such activity could not be stopped, and it was always like this, Jackson objected that he understood perfectly well - there was “speculation in the fund of every country that had a national debt”, but in this case everything was different: people traded owning information that was not owned by others. This, he said, was disgusting and frankly unfair.

One of the congressmen, Elias Boudinot, a representative of the state of New Jersey, agreed: along with the fact that speculation had risen to an “alarming mark,” as he said, the only effective solution that would stop it would be “recognition of the public debt how data in the hands of creditors will acquire its true value. "

Budino argued that the only way out was to admit that the amount of debt had increased, and added that the active dissemination of information — greater openness — was the most effective salvation. Budino fully recognized that the early beneficiaries of any new technology (in this case, the creation of faster ships) received the initial advantage. Despite this, the advantages in question were short-lived, since others also adopted new technologies. This is especially clearly seen in cases with a telegraph and a stock ticker.

So what happened to the debates around debt and “robbers” trying to cash in on it? The bill was passed in 1790, the US government assumed responsibility for the debt of the Continental Congress and the states, and the new government issued bonds.

Immediately followed by a lively trade in these bonds among wholesalers and auctioneers, the very same “robbers” that Congressman Jackson complained about. This business turned out to be so profitable that some began to specialize in trading in these same securities. Two years later, on May 17, 1792, 24 brokers gathered near a plane tree on Wall Street and allegedly tried to form a monopoly over the sale of this debt and several shares available for trading, promising to "give preference to each other in their Negotiations." This group of people has become what is now known as the New York Stock Exchange.

Bob Pisani is a financial correspondent for CNBC

Source: https://habr.com/ru/post/248415/

All Articles