Situation: Shares of Russian technology companies are getting cheaper again

The situation in the economy continues to be difficult. The ruble exchange rate is declining (experts predict an expensive dollar for a long time), and Russian stock indices are beating antirecords. How do shares of large domestic technology companies behave in this situation? In short - and there were no surprises.

11% per day

Earlier this week, depositary receipts for Yandex shares traded on the NASDAQ US exchange dropped significantly. During the trading session on December 8, the price fell by more than 11%, and the search capitalization decreased to $ 6.95 billion (the rate later rose slightly).

')

Since the beginning of 2014, Yandex depositary receipts have more than doubled in price. In early January, they cost 43 dollars apiece, now - a little more than 20 dollars

At the same time, according to the reporting for the first half of 2014, the revenue of the Internet company increased - Yandex could increase it by 34% (23 billion rubles).

Much of the search engine revenue is generated through online advertising, and here Yandex even grew faster than the market. According to experts of the advertising market, in particular, the Association of Communication Agencies of Russia, the cost of Internet advertising in RuNet has increased - in the first half of the year, the increase was 20% to 38 billion rubles.

The decline in quotations is explained not only by common reasons for all companies from Russia, such as the economic downturn and unfavorable political situation, but also by investors' concerns (including foreign ones) with the theme of possible increased control over the Runet.

A case in point is that after it became aware of consultations about the disconnection of the Russian network segment from the global Internet “in a critical situation”, the shares of technologically giants also sank in price — despite assurances from politicians that they did not want to restrict access to the network, Yandex lost 5 % of the cost of Akitsy - the price fell to $ 26.45 per share (Mail.Ru shares at the same time depreciated by 4% - to $ 26.99).

Not only "Yandex"

Investors sold depositary receipts for stocks and other domestic companies. For example, on December 8, MTS went down by 8.4%, VimpelCom - by 7.3%, Qiwi - by 6.4%. Journalists of the Meduza edition compared the dynamics of these stocks with the indicators of foreign stock indices - in the same period, the American NASDAQ index fell by 0.84%, Dow Jones - by 0.59%.

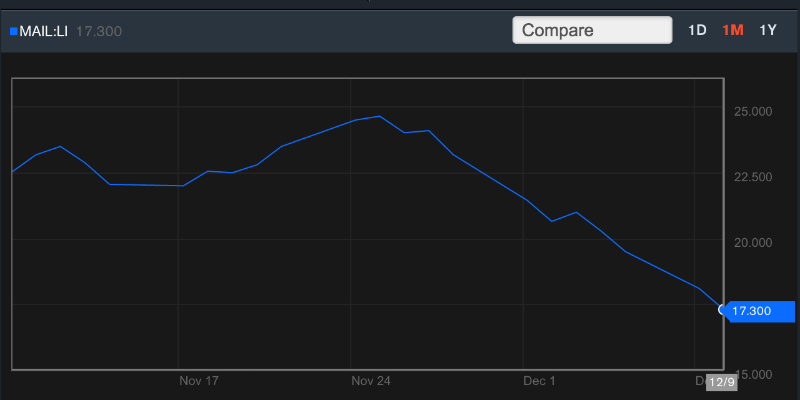

Sale of securities of Russian companies not only on American trading floors. Mail deposit receipts. Ru Group, traded on the London Stock Exchange fell on October 8 by 7.18%.

Shares of foreign technology companies

Unlike large Russian technology companies, which are getting cheaper together, the shares of foreign IT giants behave differently. For example, Apple shares traded on the Nasdaq, at the beginning of the year were worth about $ 80 apiece, and this week their price exceeded $ 114.

At the same time, the value of Google shares in 2014 decreased (partly due to complaints from the EU authorities, who wanted to divide Google’s business in Europe).

Is everything so bad for Russian IT companies?

Chief economist of ITinvest Sergey Egishyants names among the main reasons for the decline in the value of Yandex shares in the fall of the ruble exchange rate and the behavior of high-tech companies in general:

In dollars, the prices of all Russian companies are falling very actively now. High-tech always fluctuates with a larger amplitude than the more traditional industries - hence the average drop in size, although small (from the beginning of the year, RTS -40%, Yandex -50%): if a turn happens in the market and everything grows , then there will be the same picture, only in the opposite direction - technology firms are more expensive than the market as a whole.

There is nothing catastrophic here, in the sense that there is nothing that goes beyond all other processes with Russian markets and economies: the collapse of oil prices has patted them well, and the effect of it has also been reinforced many times by incompetent actions of the Bank of Russia lesser degree) of government.

In October, when the shares of Yandex and Mail.Ru also became cheaper, the RBC publication interviewed Russian analysts - experts continue to see prospects in the shares of these companies, and do not advise those investors who have already bought them to get rid of their assets.

How to buy shares of technology companies

Previously, it was not so easy to buy shares of technology companies on foreign stock exchanges - Russians needed to open accounts with foreign brokers who were not always eager to work with clients from our country.

At the end of November 2014, the situation improved - the St. Petersburg Stock Exchange launched trading in foreign securities . Now, Russian investors can buy shares in foreign companies that make up the number of the 50 most liquid organizations in the S & P 500 index. Technology companies such as Apple, Yahoo, Cisco Systems, Facebook, Google and Intel are among the pioneers.

ITinvest provides access to trading in foreign securities on the St. Petersburg Stock Exchange - for this you need to leave a request on the site . Experts of the company help to choose investment targets. We told about how to buy shares of “Yandex” in one of our previous materials

That's all for today. Thanks for attention!

PS In a blog on Geektimes, we publish weekly reviews of the situation in the financial and stock markets. Subscribe to be aware of the current economic situation!

Source: https://habr.com/ru/post/245575/

All Articles