How to work with foreign currency accounts?

The jumping ruble exchange rate left no one indifferent. The boom of currency transactions has motivated us to closely consider all the features of currency legislation.

The jumping ruble exchange rate left no one indifferent. The boom of currency transactions has motivated us to closely consider all the features of currency legislation.With foreign partners, settlement most often occurs in a foreign currency. To pay an order or get income from a buyer in foreign currency, you must have a currency account.

How to open a currency account

You can open a currency account in the bank where you already have a ruble settlement account, or in some other one. As always, it all starts with the preparation of a package of documents. Requirements for documents required for opening a currency account are different for each bank, so it is best to contact a bank in advance to find out the list of documents or to clarify this information on the bank’s website.

A sample list of documents for opening a currency account:

- application for opening a currency account;

- bank account agreement in foreign currency;

- constituent documents, if you have an organization;

- certificate of state registration;

- certificate of registration;

- extract from the state register (EGRIP / Register);

- card with specimen signatures and seal imprint;

- passports and documents confirming the powers of the officials indicated on the card with samples of signatures and seal imprint.

If you decide to open a currency account in the same bank where you have a regular checking account, the list of documents may be significantly reduced. Usually, in this case, only an application for opening a bank account and concluding a contract is required.

')

In fact, you will have two currency accounts: transit and current

To any currency account, a transit account is always opened. This is an internal account of the bank, it is necessary for the bank to control the receipt of money from abroad. Initially, money from foreign counterparties will always be transferred to a transit account. Only after the bank conducts currency control and receives the necessary documents from you, will you be able to transfer money to the current currency account or immediately sell the currency. When you pay your expenses in a foreign currency, payments will be made from the currency account immediately to the counterparty, bypassing the transit account.

To any currency account, a transit account is always opened. This is an internal account of the bank, it is necessary for the bank to control the receipt of money from abroad. Initially, money from foreign counterparties will always be transferred to a transit account. Only after the bank conducts currency control and receives the necessary documents from you, will you be able to transfer money to the current currency account or immediately sell the currency. When you pay your expenses in a foreign currency, payments will be made from the currency account immediately to the counterparty, bypassing the transit account.Currency control

For operations in foreign currency, the bank is obliged to conduct currency control. Your interaction with the bank will be structured as follows: when you receive money in a transit account, you will receive a notice about it. Usually, within 15 working days from the receipt of the money in the transit account to the bank, you need to provide supporting documents for the transaction: a certificate of currency transactions, a contract or passport of the transaction (made out if the amount of the contract exceeds 50 thousand US dollars), along with the transaction passport provides documents for the import and export of goods, acts, invoices, etc., a certificate of supporting documents.

Now banks can issue all necessary references for you. You only need to provide a package of supporting documents for the transaction. Which ones, the bank will tell you.

If you decide to pay the supplier in a foreign currency, you will need to provide the same list of documents along with the order to transfer money to the bank. Well, or the bank will prepare them for you, after requesting the necessary information.

The bank and tax have the right to ask you for documents on foreign exchange transactions for carrying out currency control and verification. Documents that need to be kept in order are listed in the law , here is a sample list:

- identity document;

- certificate of registration of the IP or LLC;

- tax registration certificate;

- contract and additions to it;

- transaction passport;

- customs declarations;

- Bank statements;

- bank documents confirming the commission of currency transactions;

- notice of opening an account (deposit) in a bank outside the Russian Federation.

How to pay USN tax when making payments in foreign currency

Revenue in foreign currency must be included in the calculation of the tax already at the date of receipt of money on the transit account. The amount must be converted into rubles at the rate of the Central Bank of the Russian Federation, which is set on this date. The course of the Central Bank of the Russian Federation can always be viewed on the website cbr.ru

Good news has appeared for users of Elba . Recently, when working with foreign currency accounts, it is enough for them to import a bank statement, and the system is already independently recalculating income in foreign currency into rubles at the rate that was valid on the day of receipt.

With expenses in foreign currency should be a little more careful. As you know, expenses when calculating tax are not always taken into account at the date of debiting money from the account. According to the rules of the Tax Code, expenses should be taken into account when calculating the tax on the later date:

- date of payment to the supplier;

- the date you received the purchased materials or work and services from the supplier;

- the date on which you shipped the goods to your final buyer, if you purchased goods for resale;

After the date of expenditure is determined, the amount must be recalculated at the rate of the Central Bank of the Russian Federation set for that day.

For example, if you ordered software development abroad and paid for work in foreign currency, the amount of expenditure should be recalculated into rubles at the rate of the Central Bank of the Russian Federation on the date of payment or on the date of signing the act - depending on what was later.

In addition, there are still exchange differences. But not the one that arises due to the change in the exchange rate of the currency itself, when it remains in your account, for the PI this difference does not matter (unlike organizations that will have to take it into account in accounting).

You need to take into account only the exchange rate difference that arises when selling foreign currency at a rate higher than the CBR exchange rate on the same day, or when buying a currency at a lower rate than the CBR exchange rate on the same day. In such cases, you have a benefit, which will have to pay tax. Negative exchange difference in expenses of the simplified taxation system is not taken into account.

Practical example:

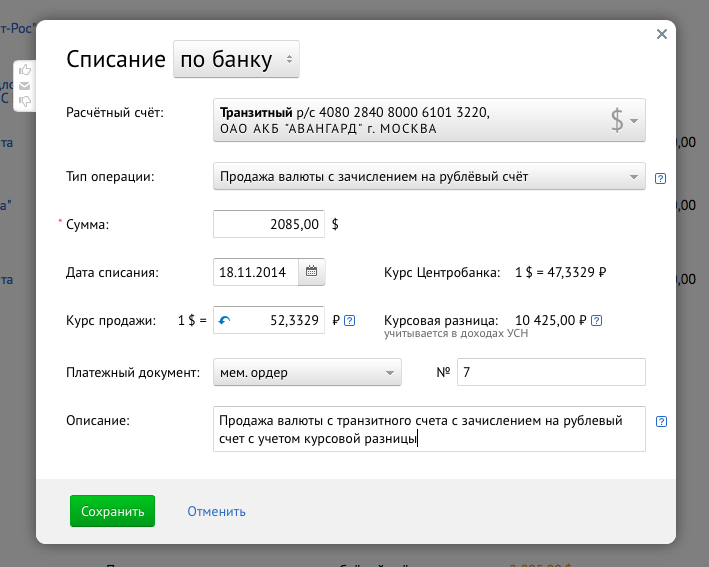

On November 17, 2014, you received $ 2,085 in the currency account. The next day, November 18, 2014, the bank sold the currency at the rate of 52.3300 R. The rate of the Bank of Russia as of November 18, 2014 was 47.3329 R.

On November 17, 2014, you received $ 2,085 in the currency account. The next day, November 18, 2014, the bank sold the currency at the rate of 52.3300 R. The rate of the Bank of Russia as of November 18, 2014 was 47.3329 R.In addition to the income in foreign currency, it is necessary to reflect a positive exchange rate difference, because the sale of currency was at a higher rate than the Central Bank of the Russian Federation.

Exchange difference = 10,418.95 R.

Calculation: $ 2,085 x (52.3300 R. / $ - 47.3329 R. / $) = 10,418.95 R.

When working in the Elbe, this happens automatically. Just indicate the rate of sale or purchase of currency, and if it turns out to be more profitable than the CBR rate, a positive difference will be taken into account in income when calculating the tax.

You can see for yourself how easy it is to work with currency accounts in Elba . If you have any questions, we will be happy to help you.

Source: https://habr.com/ru/post/243633/

All Articles