GDP, money supply and dynamic equilibrium

In the article “Balanced monetary unit and multilateral clearing,” I described a model of international payments based on clearing and ETS, a balanced monetary unit.

Here I will try to numerically simulate the economy of a single state participating with such a system.

I'll start with a description of the numerical model.

')

Let 20 independent subjects participate in the country's economy.

Each produces some abstract product - for the amount of 100 ETS per unit of time.

Given the initial amount of money for each subject.

We will conduct three tests - with initial amounts of 50, 100 and 150 units of national currency, respectively.

The initial rate of ETS to national currency is set to 1.

In each unit of time, each subject can sell from 0 to 15 percent (a random number) of the product abroad and earn money from it.

The rest of the product is consumed.

The same subject can spend from 0 to 15 percent (random number) of their money to purchase imported goods.

The country's initial balance in the clearing system is zero.

Consider three cases:

1. Course ETS is fixed.

2. There is a time-independent feedback between the clearing balance of the country and the ETS rate.

3. Time-dependent feedback.

The results of numerical modeling under the cut.

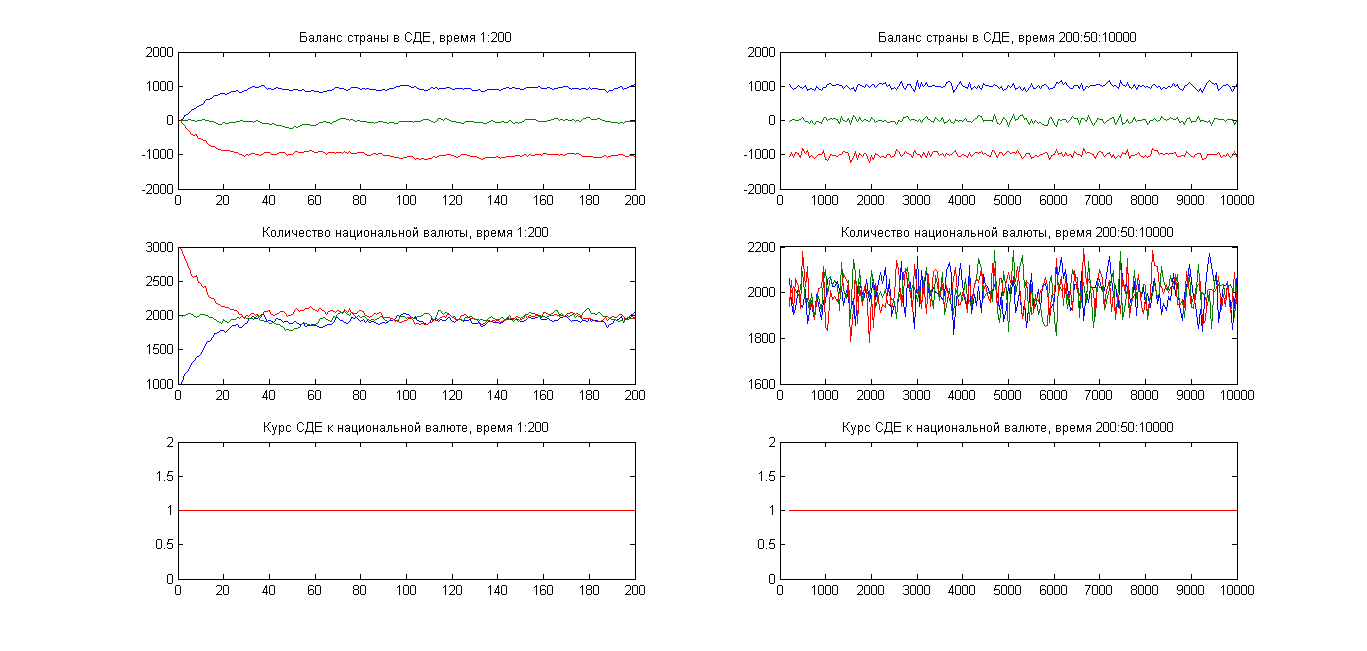

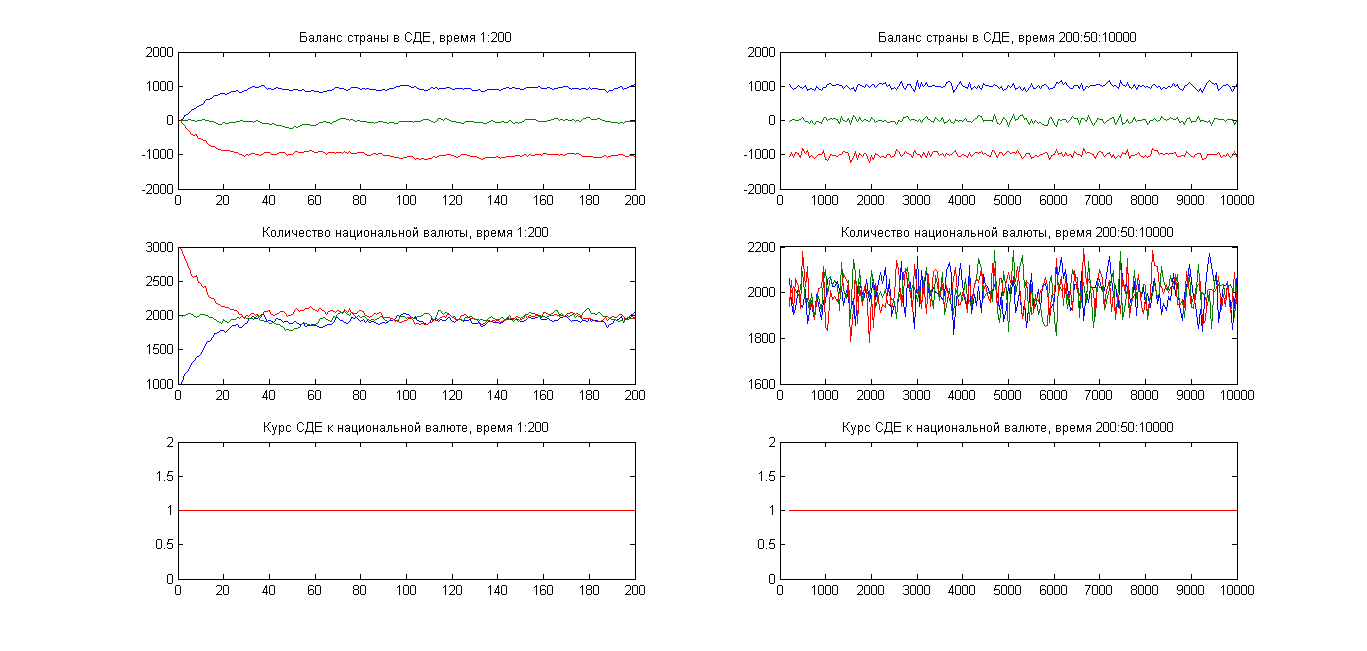

Fixed rate ETS.

The results on the graphs below.

On the graphs on the left - the time from 1 to 200, on the graphs on the right - from 200 to 10,000.

It can be seen that if the initial money supply is too large, it gradually drops to the equilibrium value, and, accordingly, increases if initially it is too small.

The clearing balance of the country goes, respectively, in minus or in plus, and stabilizes at a certain value.

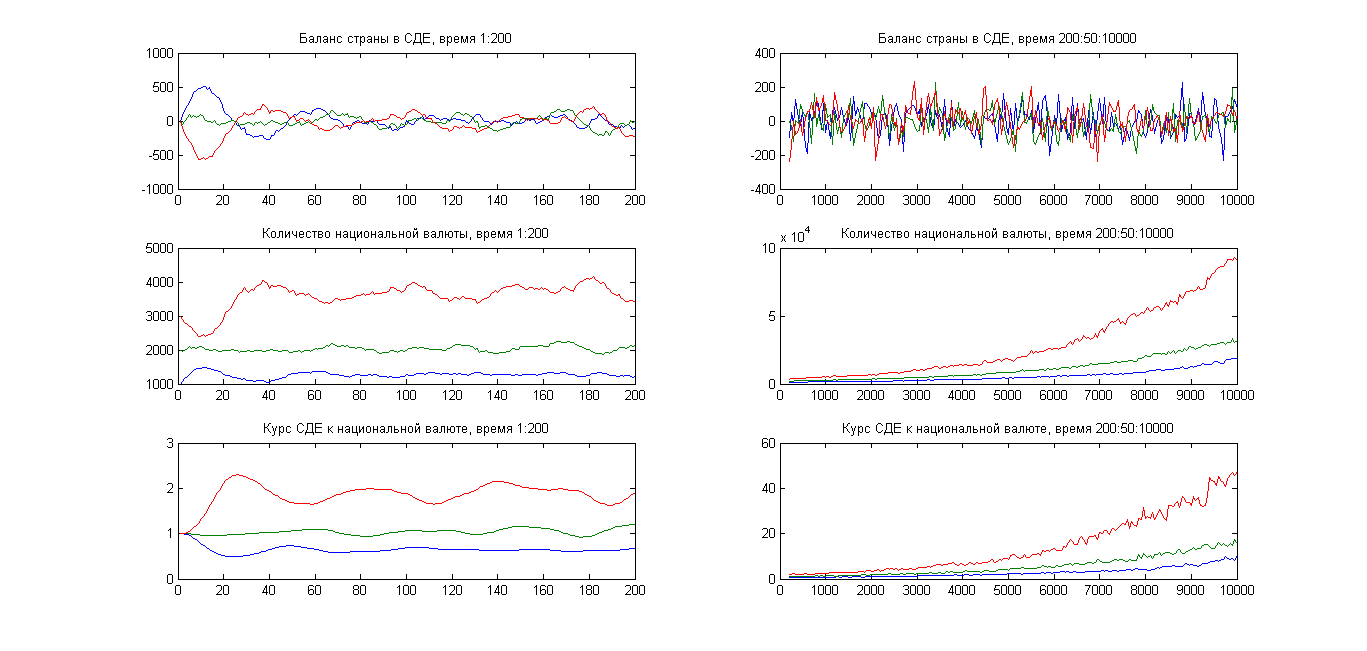

Feedback, not dependent on time.

The following feedback is used:

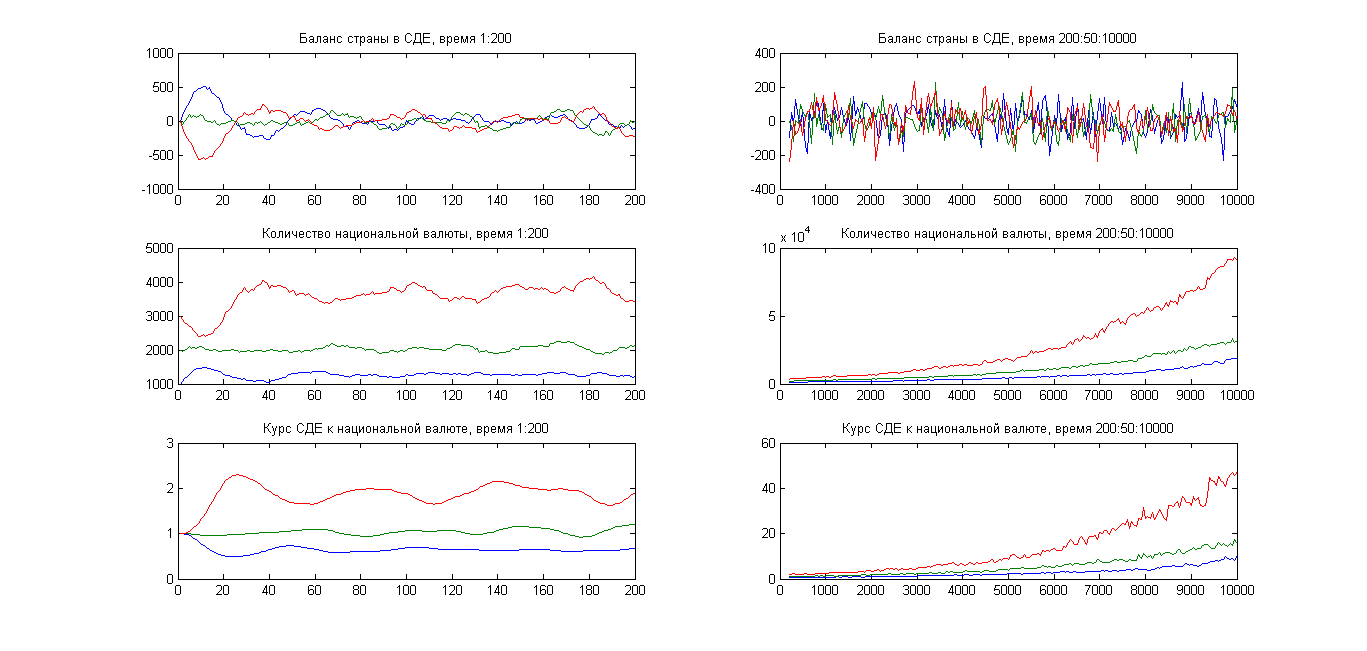

The results are as follows:

As you can see, the clearing balance of the country gradually goes into fluctuations around zero.

But at the same time, there is a constant increase in the money supply and an increase in the rate of the ETS, in other words - inflation.

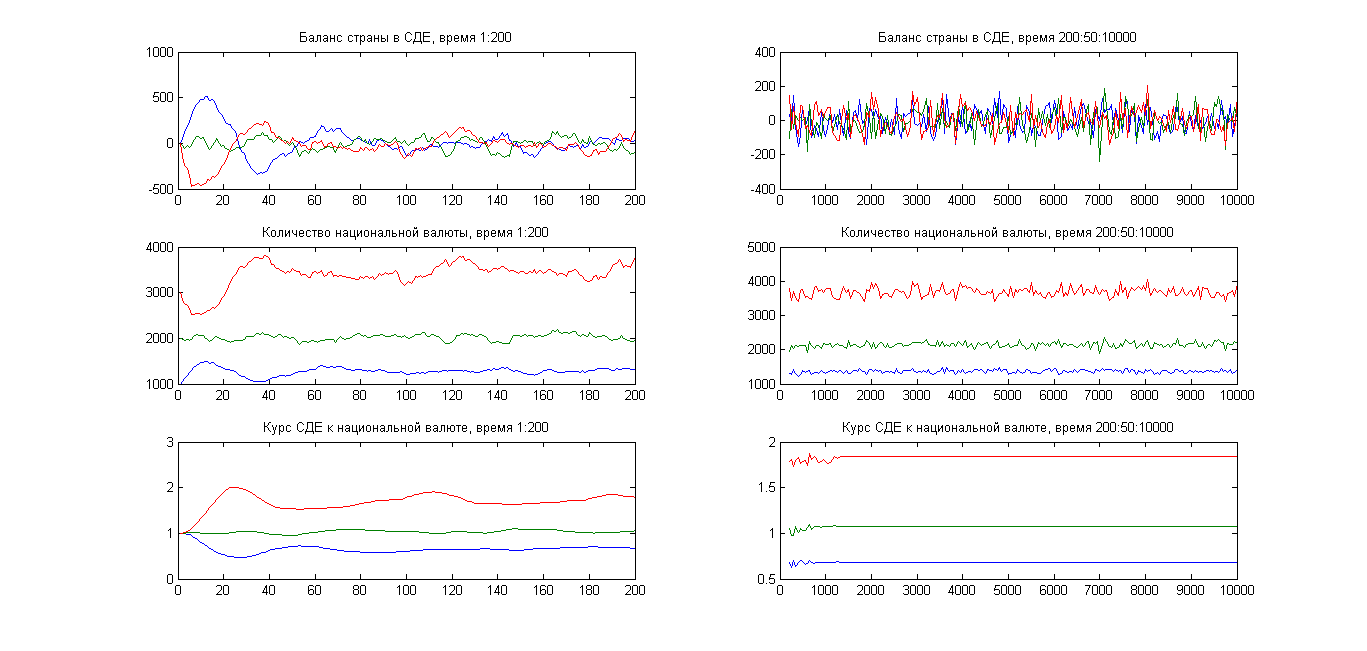

Time-dependent feedback (control).

Feedback is as follows:

That is, over time, it gradually weakens.

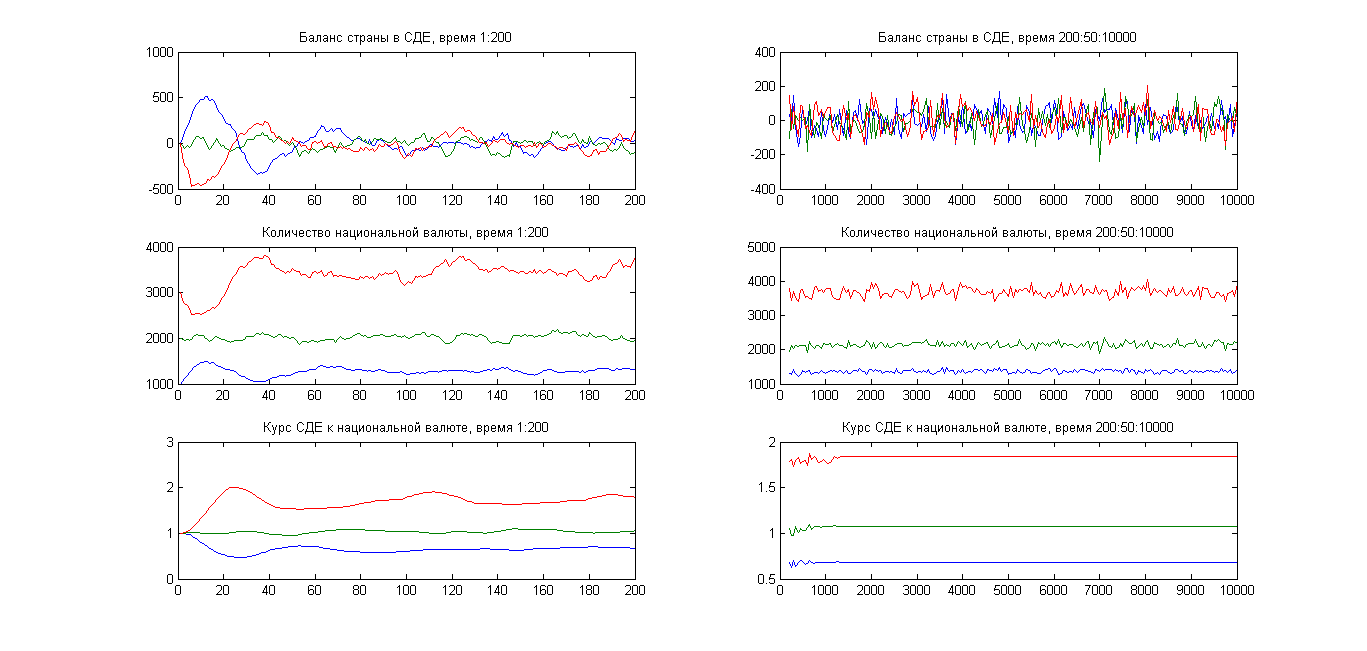

Result:

As you can see, the money supply and the ETS rate will stabilize over time.

At the same time, the country's clearing balance fluctuates around zero.

That is, dynamic equilibrium arises in the system.

Scripts here: github.com/tabatsky/jatx/tree/master/BMU

Here I will try to numerically simulate the economy of a single state participating with such a system.

I'll start with a description of the numerical model.

')

Let 20 independent subjects participate in the country's economy.

Each produces some abstract product - for the amount of 100 ETS per unit of time.

Given the initial amount of money for each subject.

We will conduct three tests - with initial amounts of 50, 100 and 150 units of national currency, respectively.

The initial rate of ETS to national currency is set to 1.

In each unit of time, each subject can sell from 0 to 15 percent (a random number) of the product abroad and earn money from it.

The rest of the product is consumed.

The same subject can spend from 0 to 15 percent (random number) of their money to purchase imported goods.

The country's initial balance in the clearing system is zero.

Consider three cases:

1. Course ETS is fixed.

2. There is a time-independent feedback between the clearing balance of the country and the ETS rate.

3. Time-dependent feedback.

The results of numerical modeling under the cut.

Fixed rate ETS.

The results on the graphs below.

On the graphs on the left - the time from 1 to 200, on the graphs on the right - from 200 to 10,000.

It can be seen that if the initial money supply is too large, it gradually drops to the equilibrium value, and, accordingly, increases if initially it is too small.

The clearing balance of the country goes, respectively, in minus or in plus, and stabilizes at a certain value.

Feedback, not dependent on time.

The following feedback is used:

BMU_course(t) = BMU_course(t-1)*BMU_feedback(BMU_balance(t-1),t); %%%%%%%% function [feedback] = BMU_feedback(BMU_balance, t) q1 = 0.0001; feedback = exp(-q1*BMU_balance); end The results are as follows:

As you can see, the clearing balance of the country gradually goes into fluctuations around zero.

But at the same time, there is a constant increase in the money supply and an increase in the rate of the ETS, in other words - inflation.

Time-dependent feedback (control).

Feedback is as follows:

function [feedback] = BMU_feedback(BMU_balance, t) q1 = 0.0001; q2 = 0.003; feedback = exp(-q1*BMU_balance)^exp(-q2*t); end That is, over time, it gradually weakens.

Result:

As you can see, the money supply and the ETS rate will stabilize over time.

At the same time, the country's clearing balance fluctuates around zero.

That is, dynamic equilibrium arises in the system.

Scripts here: github.com/tabatsky/jatx/tree/master/BMU

Source: https://habr.com/ru/post/241810/

All Articles