How do Apple shares behave after the release of new devices

After a certain number of financial quarters with predictable results, Apple was surprised by its sales figures, which were 3.74% higher than expected according to the forecast [the original article was published in the 2nd quarter of 2014 - approx. trans .]. This may not seem so important, but since the company introduced a new forecasting method in the first quarter of last year, the company's announced revenue exceeded the previously set limit by about 1%.

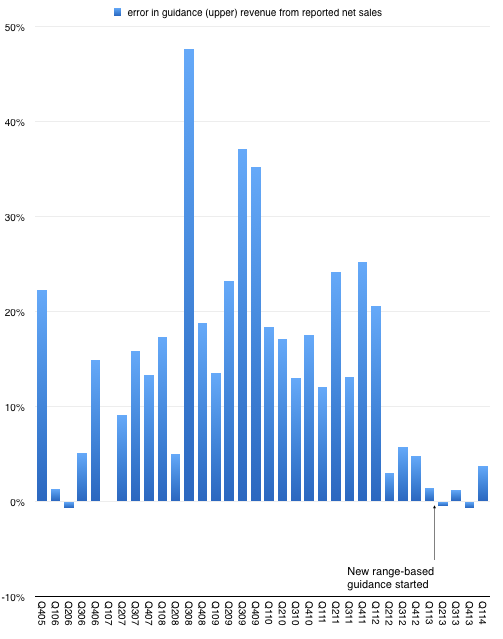

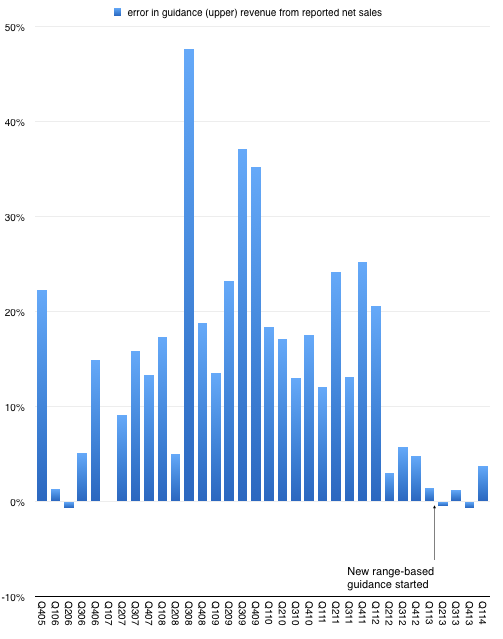

This is in stark contrast with the values of previous years. Below is a graph that shows a “mistake” in the forecast as a percentage difference between the announced sales and the forecasted ones. [one]

')

Click image to open in full size.

So, until the last quarter we mistakenly believed that the forecast with almost perfect accuracy determines the future of the company. As I wrote on Twitter, because of this, making forecasts for Apple lost its excitement. All the analytics needed to do was to take the growth rates of the main product, which would allow to achieve an indicative sales volume, and then deduct the operating expenses (indicators that were kindly provided by the company) and the tax rate (also kindly provided) to get the amount of profit. The only so far unknown value in determining earnings per share is the number of outstanding shares. [2]

Knowing Apple, I can say that the average selling price is also very rigidly fixed, so that the degree of freedom of analysis became extremely limited.

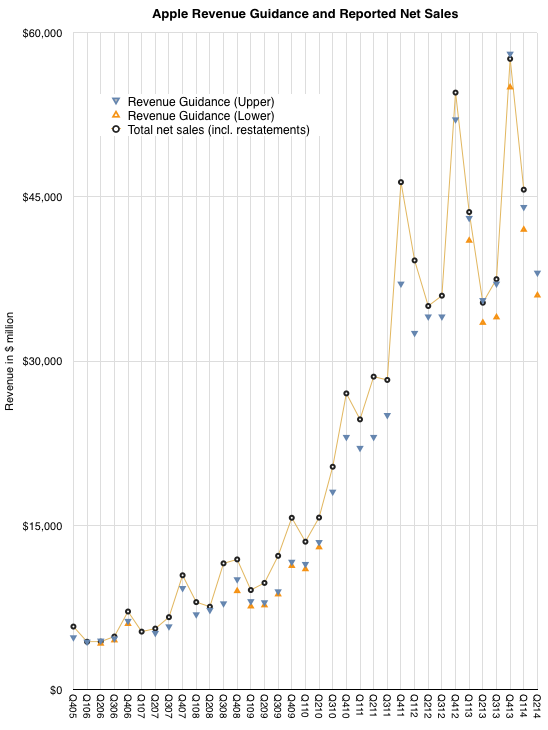

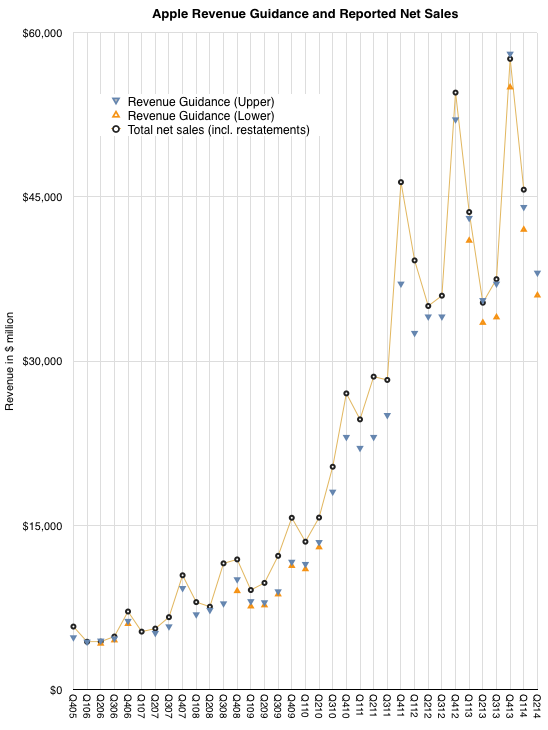

But the moment you feel that you understand how the system works, it changes. The company was surprised by its performance of third-party analysts. The chart below shows the estimated range and the actual income received. [3]

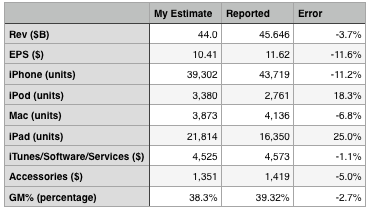

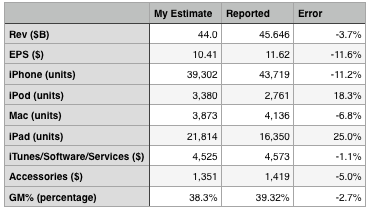

It seems that the answer is iPhone sales have improved. The following table shows my expectations, which were built in accordance with the profitability indicator in the upper part of the forecasted range.

Regarding the supply / sales, I underestimated the iPhone and Mac, and also overestimated the iPad and iPod. I definitely appreciated iTunes and underestimated the sale of accessories by 5%. Also, by and large, I very closely determined the level of profitability, however, I pointed out 1 point less in gross profit.

The conclusion was that the unexpected level of income and profits can be attributed to the significant outpacing dynamics of sales of the iPhone, which could compensate for less significant non-compliance with the planned figures for the iPod.

IPhone sales grew by 14% - this was enough to compensate for iPad sales falling by 13% and allow total revenues to grow by 5%. Since the company did not expect a jump in growth, these 5% were a big surprise.

Someone may ask if the increase in iPhone sales by 14% will cause significant changes in the long-term development strategy of the product. This is a hard question. The way the iPhone is positioned makes it successful in the premium segment of the market, but does not place in competition with an estimated 80% of the market, which apparently is formed from the point of view of lower prices.

Still, let's not forget that pricing correlates with the market, but is not determined by it. Making a purchase decision is a complicated process, and the price is just one of the aspects that influence this decision. But there are many other factors. Availability of goods, communication channels, service, brand - all that matters. The mistake of many analysts is that they believe that the price and only the price affects the behavior of the buyer. This may be the case with commodities, but let me remind you that these products are new, and they have been used recently, and their perceptions of value have changed quickly. Buyers adhere to the learning curve, in the sense of discovering use options and the value of products. Such learning curves can be modeled for several years (sometimes decades) for many generations between early followers and the late majority.

We don’t know exactly where the iPhone is in a particular region on the learning curve, which means that we can still expect a surprise in the dynamics of its growth.

Notes:

The link is an interview with Horace Dediu about surprises on the market after the release of the new iPad, which he gave to Bloomberg journalists in October 2014: www.bloomberg.com/video/apple-s-ipad-unveil-were-there-any-surprises-bqKlwc4sSqCSupwehzbsJA .html [ru].

Posts and related links:

PS If you notice a typo, mistake or inaccuracy of the translation - write a personal message and we will fix everything promptly.

This is in stark contrast with the values of previous years. Below is a graph that shows a “mistake” in the forecast as a percentage difference between the announced sales and the forecasted ones. [one]

')

Click image to open in full size.

So, until the last quarter we mistakenly believed that the forecast with almost perfect accuracy determines the future of the company. As I wrote on Twitter, because of this, making forecasts for Apple lost its excitement. All the analytics needed to do was to take the growth rates of the main product, which would allow to achieve an indicative sales volume, and then deduct the operating expenses (indicators that were kindly provided by the company) and the tax rate (also kindly provided) to get the amount of profit. The only so far unknown value in determining earnings per share is the number of outstanding shares. [2]

Knowing Apple, I can say that the average selling price is also very rigidly fixed, so that the degree of freedom of analysis became extremely limited.

But the moment you feel that you understand how the system works, it changes. The company was surprised by its performance of third-party analysts. The chart below shows the estimated range and the actual income received. [3]

So what happened?

It seems that the answer is iPhone sales have improved. The following table shows my expectations, which were built in accordance with the profitability indicator in the upper part of the forecasted range.

Regarding the supply / sales, I underestimated the iPhone and Mac, and also overestimated the iPad and iPod. I definitely appreciated iTunes and underestimated the sale of accessories by 5%. Also, by and large, I very closely determined the level of profitability, however, I pointed out 1 point less in gross profit.

The conclusion was that the unexpected level of income and profits can be attributed to the significant outpacing dynamics of sales of the iPhone, which could compensate for less significant non-compliance with the planned figures for the iPod.

IPhone sales grew by 14% - this was enough to compensate for iPad sales falling by 13% and allow total revenues to grow by 5%. Since the company did not expect a jump in growth, these 5% were a big surprise.

Someone may ask if the increase in iPhone sales by 14% will cause significant changes in the long-term development strategy of the product. This is a hard question. The way the iPhone is positioned makes it successful in the premium segment of the market, but does not place in competition with an estimated 80% of the market, which apparently is formed from the point of view of lower prices.

Still, let's not forget that pricing correlates with the market, but is not determined by it. Making a purchase decision is a complicated process, and the price is just one of the aspects that influence this decision. But there are many other factors. Availability of goods, communication channels, service, brand - all that matters. The mistake of many analysts is that they believe that the price and only the price affects the behavior of the buyer. This may be the case with commodities, but let me remind you that these products are new, and they have been used recently, and their perceptions of value have changed quickly. Buyers adhere to the learning curve, in the sense of discovering use options and the value of products. Such learning curves can be modeled for several years (sometimes decades) for many generations between early followers and the late majority.

We don’t know exactly where the iPhone is in a particular region on the learning curve, which means that we can still expect a surprise in the dynamics of its growth.

Notes:

- The upper edge of the range in those blocks where the range of oscillations is given.

- The company itself cannot know what the number of shares in circulation will be, since their purchase during the quarter is unplanned.

- The next quarter also counted.

The link is an interview with Horace Dediu about surprises on the market after the release of the new iPad, which he gave to Bloomberg journalists in October 2014: www.bloomberg.com/video/apple-s-ipad-unveil-were-there-any-surprises-bqKlwc4sSqCSupwehzbsJA .html [ru].

Posts and related links:

- Statistics: why you should not buy Apple stock after the release of the new iPhone

- How to buy shares of IT companies before, during and after the IPO

- Alibaba IPO: what investors will actually buy

- Analytical materials about the stock market

PS If you notice a typo, mistake or inaccuracy of the translation - write a personal message and we will fix everything promptly.

Source: https://habr.com/ru/post/241189/

All Articles