The latest credit history or bank guide from Bankle.ru

Money is never enough. Not even enough for those who, it would seem, a lot. Paradoxically, people with high incomes take loans more often than the middle class. Either requests overtake opportunities, or the goal becomes business development. Exceptions of course, always exist, but basically the moment when a person becomes a borrower, having applied for a loan at a bank, is almost inevitable. It is common to take out loans in many countries, and over the past decade, the lending industry has developed significantly in Russia. It has developed to develop, but that's just not everyone can get a loan. The past does not give. The phrase "credit history" is familiar to all who at least once in their life burdened themselves with obligations to the bank. For those who, for various reasons, didn’t always fulfill them or didn’t perform them at least once, appropriate notes are made in the credit history.

Let's start from afar. There is such a service in the States - Credit Karma. It has been functioning since 2008 and, thanks to its existence, it makes life easier for bank customers who decide to take a loan. The service provides them with a free credit history and, optionally, for a fee, it provides online information and consulting services of various kinds and makes good money on advertising. This is how it lives. From time to time successfully attracts investment. For example, at the end of September, as a result of the next round, Credit Karma received $ 75 million from Google Capital and Tiger Global Management funds, as a result of which the total volume of attracted investments amounted to $ 193.5 million with a capitalization of $ 1 billion.

')

There is no such service in Russia yet. Of course, you can find out your credit history. To do this, there are several ways - less reliable and more. A number of web services offer to learn credit history online, but you should not trust them unconditionally. This is due to the fact that there are several credit history bureaus in the country, the data in which may differ from each other. A certain service, as a rule, is associated with one of them and often cannot provide complete information,although there are also frank fraudsters . The surest way to find out about your credit past in the eyes of banks is to contact the National Bureau of Credit Histories by submitting an appropriate request. This can also be done online for money, through accredited partners of the NBCH, and once a year for free, and an unlimited amount for the money, by contacting the NBCH directly. But it will take a long time to wait. To do this, you need to download the request form, fill it in and send it, waiting for a response in about 10 working days, or send a request by telegram (details on the NBCH site ).

As a result, you get your credit history. But you get in its pure form, without any recommendations, what can be done with it. There are services on the Internet where you can pass a scoring test and find out your chances when dealing with your history for a loan to federal banks. But the result will be very approximate. As a result, a citizen who wants to take a loan spends time and nerves on bypassing several banks, where he eventually receives refusals. According to statistics, 71% of Russians have problems obtaining a loan.

These were the sources from which one Russian start-up originates. Having studied the state of things in the domestic credit market, two of his cofounders, who have experience in Sberbank and Renaissance Credit Bank and experience in creating a successful automated loan service, decided to correct the situation radically. As a result, the idea of a self-learning online service appeared, which will analyze the user's credit history and issue a personal instruction with the addresses of banks in his city. It is those where the chances of getting a loan in his case will be maximum.

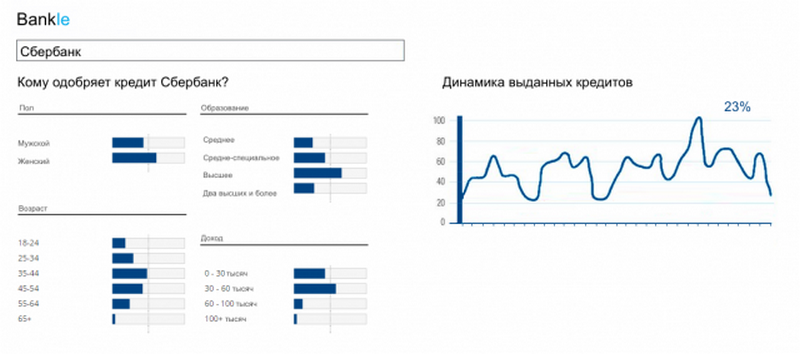

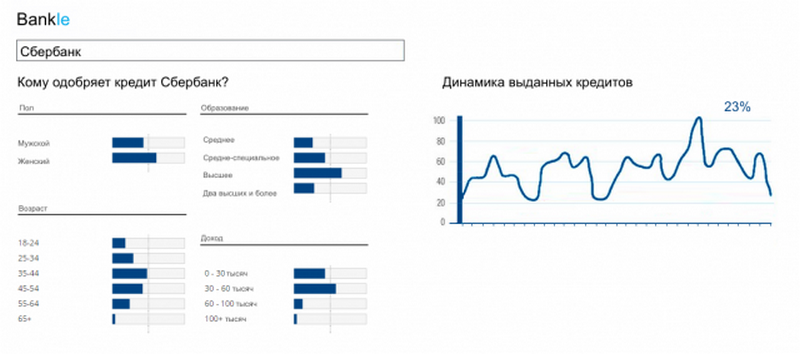

For the end user, the work of the service will be as follows. An abstract citizen (let's call him Vasily Pupkin) from the city of Upper Kozhemyaki, wants to buy Maserati Quattroporte S 4 at a reasonable price. He doesn’t have enough money to buy it. In order to find out his chances of getting a loan, Pupkin goes to the Bankle.ru website (this is the name of this startup) and enters his passport data or legal data in a special form. faces. The system immediately automatically checks its credit history and draws conclusions. As a result, in a few seconds Pupkin receives a specific instruction on the addresses of banks in Kozhemyaki, who will be favorable to him, takes his loan and immediately buys his dream car.

Service is able to self-learn. If, in a couple of days, Pupkin suddenly again wants to take another loan and search for another bank for this, the system will give him the information taking into account the previous loan. That is, there is an automatic post-analysis of receiving credits by users.

Who will benefit from the service?

All bank customers needing loans. Individual entrepreneurs and other small business representatives (Annually, refusals from banks receive up to 200 thousand individual entrepreneurs and representatives of an LLC) are forced to apply to consumer credit cooperatives and microfinance organizations (MFOs).

Sources of monetization

The creators of the service see several possible models for achieving payback (according to calculations of the founders of a startup, Bankle will pay off in 8-12 months).

- Partnership programs with banks and microfinance companies (lead generation).

- Advanced functionality of additional services to credit brokers.

- Providing API service for more than 4,000 microfinance companies to assess customer solvency.

Current state

An agreement has been reached with the two largest credit bureaus in the Russian Federation; two more are planned by the end of November. The layout of the site, which will be available to users from November 10, 2014, is completing.

Currently, the service is at the seed stage. Work on the system is carried out completely for the money of cofounders. In order to develop further, the startup has placed its project on our VCStart collective investment platform, where users can invest any amount in it (the lower VCStart threshold is $ 30).

The current valuation of the company is $ 600 thousand, the potential assessment in a year is $ 2.5 million. After the service was put into operation in November, the co-founders hope to attract more investments by selling shares in the startup to potential buyers - funds investing in financial services .

Microinvestors who bought shares in a startup on our platform , the service offers preferential terms of use: all investors get free access for themselves and friends for 50 free uses + all additional services. Investors investing from $ 100 will receive an unlimited “Business account”, which allows you to use the services of the service for life.

Let's start from afar. There is such a service in the States - Credit Karma. It has been functioning since 2008 and, thanks to its existence, it makes life easier for bank customers who decide to take a loan. The service provides them with a free credit history and, optionally, for a fee, it provides online information and consulting services of various kinds and makes good money on advertising. This is how it lives. From time to time successfully attracts investment. For example, at the end of September, as a result of the next round, Credit Karma received $ 75 million from Google Capital and Tiger Global Management funds, as a result of which the total volume of attracted investments amounted to $ 193.5 million with a capitalization of $ 1 billion.

')

There is no such service in Russia yet. Of course, you can find out your credit history. To do this, there are several ways - less reliable and more. A number of web services offer to learn credit history online, but you should not trust them unconditionally. This is due to the fact that there are several credit history bureaus in the country, the data in which may differ from each other. A certain service, as a rule, is associated with one of them and often cannot provide complete information,

As a result, you get your credit history. But you get in its pure form, without any recommendations, what can be done with it. There are services on the Internet where you can pass a scoring test and find out your chances when dealing with your history for a loan to federal banks. But the result will be very approximate. As a result, a citizen who wants to take a loan spends time and nerves on bypassing several banks, where he eventually receives refusals. According to statistics, 71% of Russians have problems obtaining a loan.

These were the sources from which one Russian start-up originates. Having studied the state of things in the domestic credit market, two of his cofounders, who have experience in Sberbank and Renaissance Credit Bank and experience in creating a successful automated loan service, decided to correct the situation radically. As a result, the idea of a self-learning online service appeared, which will analyze the user's credit history and issue a personal instruction with the addresses of banks in his city. It is those where the chances of getting a loan in his case will be maximum.

For the end user, the work of the service will be as follows. An abstract citizen (let's call him Vasily Pupkin) from the city of Upper Kozhemyaki, wants to buy Maserati Quattroporte S 4 at a reasonable price. He doesn’t have enough money to buy it. In order to find out his chances of getting a loan, Pupkin goes to the Bankle.ru website (this is the name of this startup) and enters his passport data or legal data in a special form. faces. The system immediately automatically checks its credit history and draws conclusions. As a result, in a few seconds Pupkin receives a specific instruction on the addresses of banks in Kozhemyaki, who will be favorable to him, takes his loan and immediately buys his dream car.

Service is able to self-learn. If, in a couple of days, Pupkin suddenly again wants to take another loan and search for another bank for this, the system will give him the information taking into account the previous loan. That is, there is an automatic post-analysis of receiving credits by users.

Who will benefit from the service?

All bank customers needing loans. Individual entrepreneurs and other small business representatives (Annually, refusals from banks receive up to 200 thousand individual entrepreneurs and representatives of an LLC) are forced to apply to consumer credit cooperatives and microfinance organizations (MFOs).

Sources of monetization

The creators of the service see several possible models for achieving payback (according to calculations of the founders of a startup, Bankle will pay off in 8-12 months).

- Partnership programs with banks and microfinance companies (lead generation).

- Advanced functionality of additional services to credit brokers.

- Providing API service for more than 4,000 microfinance companies to assess customer solvency.

Current state

An agreement has been reached with the two largest credit bureaus in the Russian Federation; two more are planned by the end of November. The layout of the site, which will be available to users from November 10, 2014, is completing.

Currently, the service is at the seed stage. Work on the system is carried out completely for the money of cofounders. In order to develop further, the startup has placed its project on our VCStart collective investment platform, where users can invest any amount in it (the lower VCStart threshold is $ 30).

The current valuation of the company is $ 600 thousand, the potential assessment in a year is $ 2.5 million. After the service was put into operation in November, the co-founders hope to attract more investments by selling shares in the startup to potential buyers - funds investing in financial services .

Microinvestors who bought shares in a startup on our platform , the service offers preferential terms of use: all investors get free access for themselves and friends for 50 free uses + all additional services. Investors investing from $ 100 will receive an unlimited “Business account”, which allows you to use the services of the service for life.

Source: https://habr.com/ru/post/240757/

All Articles