How to buy gold?

Pension for ITshnika.

Here it would be necessary to write “what to do in old age?”, “No one can deny the state”, “nowadays everyone should ...” and other blah blah blah and bi-bi-bi. But I'm lazy, because - immediately to the point.

What is the main value of gold? The fact that it is valuable in itself. Just because it is gold. A lot of people appreciate the despicable metal is much more expensive than it really is - this is purely instinctive impulse. "Eternal and lasting value," as any marketer would say.

And more?

And gold is moving in antiphase with the stock market. That is, when there is a typhoon in the economy, all investors run into gold as the most reliable asset. Well, and vice versa, naturally ... This makes gold an ideal tool for building a “simpleton portfolio”.

What is this portfolio? It's simple. Bought assets, 2 or 3 or more - who likes what. According to a predetermined ratio. For example - stocks and gold, in the proportion of 50 to 50. And once a year rebalancing is performed. If one asset has risen in price, and the other has fallen in price - the ratio is broken, it is necessary to align. That is, to sell part of the risen asset and buy cheaper. As you know, the best method of generating income in any volatile market is to buy low and sell high. This is what our modus operandi promotes.

')

Portfolio strategies can be long spread thoughts, but today we are not about that.

So how to buy gold?

I know several ways.

Prices will be relevant where possible. For reference, today's gold quotation for the Central Bank is 1,490 rubles per gram.

1. Material gold

This will seem to someone the most reliable option. Here it is, always in hand, you can always sell it, but you can not sell if you do not like the price, and go look for another one. in theory.

1a. Natural gold: sand and nuggets.

In short - in Russia are prohibited by law. In any case, owning them to an average IT person will fail.

1b. Bank bars.

You can buy at the price of the bank-seller. I looked now in Sberbank - they sell for 1562, buy back for 1422.

You have to understand that if you take the bar out of the bank, you will have to pay 18% VAT. And back when selling it will not be returned!

Still from pleasures - personal income tax, if you own an ingot for less than 3 years (or drink your purchase documents) - you will have to pay a tax of 13%.

A bundle of documents is given to the ingot, without them it is very difficult to sell and the price tag falls.

It must be kept carefully and carefully, otherwise the bank will not take it back, or it will, but with a horse discount - that is, it will not be possible to bury it in the garden in the grandfather's village 8-)

Therefore, the ingot to the category of "material gold" can be quite relative.

1c. Coins.

Sell the banks too. An important advantage is that they are not subject to VAT, but the tax on personal income is valid on a general basis.

That is - again all the same: we draw up a pack of documents for each coin, and store them no less carefully than the coins themselves. Otherwise - oh. Prices are not happy even once. the popular "Victorious", for example, in a savings bank sell for 15,200 rubles. And they buy it back for only 10,500. With a coin weight of 7.78 grams, it gives us the price of gold at 1953 rubles with kopecks - almost one and a half times more expensive than gold quotes. But they are buying at a cheaper rate from the Central Bank, if it is comforting someone 8-) Yes, and it is necessary to keep it almost in the hermobox, otherwise the bank will again turn its nose.

1d. Decorations.

A popular theme is to buy jewelry with the lowest added value in the form of work. For example - the cheapest wedding rings. It will cost about 2000 rubles per gram. However, hunters watch all kinds of promotions, which sometimes gives results almost as low as the official rate. Only you need to understand that the sample for such cheap products will never be 999, but something simpler. 375, for example. But then here you are a complete master: even dig in the ground, even sell in the doorway. Neither the documents are not required, nor the filing of the personal income tax declaration. That is, according to the law, of course, you need to file and pay a tax return. But ... options are possible 8-)

It is considered the best option for "survivors" in case of any disaster.

2. Virtual gold.

There is only one option - OMC, impersonal metal accounts. It's all pretty primitive: you come to the bank and open a “deposit”, a procedure, I think, familiar to almost all people today. Only on the account are not ruble-dollars-Tugriks, but grams (well, or tons of very rich Buratin) of gold. Or silver, at worst. They even - theoretically - can be obtained from there by hand in the form of ingots, only you have to pay VAT. OMS itself is not subject to VAT. Revenues are taxed as usual.

What is bad: this account completely inherits all the risks of the bank, since under the deposit insurance system does not fall.

There is still a spread between buying and selling - it has the same sber as it does for ingots. That is, if you make an account for 10 grams of gold today, and today you close it, the loss will be 1400r, almost 10%.

There are kinder banks with less margin. It also happens that the bank deducts a certain insignificant interest on an urgent MHI.

A variation of the MLA is the purchase of ingots without their removal from the bank’s certified vault. Documents are processed as if you bought bars, but you do not need to pay VAT.

3. UIF.

there are at least a dozen mutual funds with the suffix “GOLD” in the market. Twist them most often large banks. The problems, commissions and risks they all have are approximately standard for the mutual fund scheme in general:

- the percentage of the management company will have to be paid regardless of the results of its activities

- the difference between buying and selling is significant

- additional fees are often applied in case of early withdrawal from the fund

- the inability to change the Criminal Code without the sale of assets

- the prices of the shares are under the full control of the MC. He wants - tomorrow everything will be worth 10% from yesterday. and do nothing.

What else is interesting: at least several of these funds (the largest), which I looked carefully at, are not stored in gold at all. And in shares of other funds, foreign, which are certainly gold, yeah ...

4. Well, and my favorite: ETF.

ETFov everyones in bulk. It began - as usual - in the states, and most of them there and is traded. All of them are mom, that their quotes exactly follow the quotes of real gold. The most famous is SPDR Gold.

They are all bought through the infrastructure of exchanges and brokers, that is, as well as stocks. The plus is that the broker can be changed, if the old one is guilty of 8-) That is, the direct operator is divorced from the asset, it is not necessary to sell the asset to change the broker.

Another great thing is that the spread is quite small. Right now my ETF is trading at 339-341r. That is, with a minimum lot of 10 pieces, it turns out to go in and out will cost 20 rubles + broker and depository commission, which in my case is so small that it is not worth mentioning. This is less than 1% in total - much nicer than any other option, in which immediately at the time of purchase you lose at least 10 percent! Again, the rebalancing of the portfolio is carried out within one account, which is also very convenient for me. Sold a part of something - bought a part of something. unnecessary and unnecessary, respectively 8-)

Oh yes, I completely forgot: my ticker is FinEx Physically Held Gold ETF. Mom swear that in London is all, everything, everything to the last ton of gold belonging to investors.

IMPORTANT UPD:

The fund "pereobulsya" - from the physical became synthetic. Now they are allegedly buying some kind of Swiss derivatives. Personally, I sold all this stuff completely.

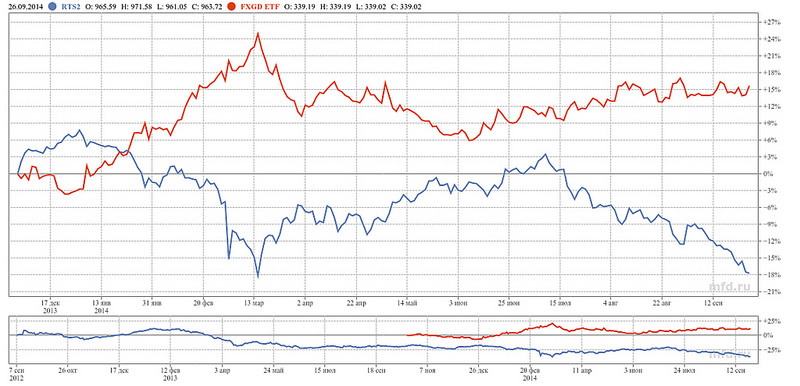

Traded on the MICEX, you can see the charts and compare them with the price of gold. in my opinion - quite wow corresponds:

Even better if you look closely. This is achieved due to the fact that before the inevitable fall of the quotation, the management company sells a part of gold and waits in money.

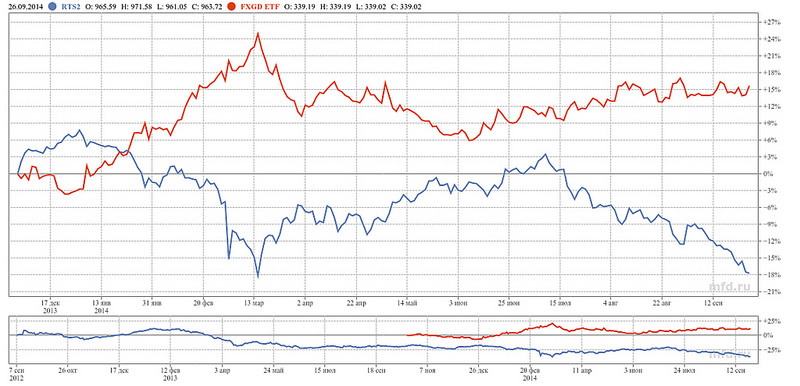

And here is a picture for building lazy portfolios:

It can be seen that the stock market and quotes of our fund go strictly in antiphase. By this, increased incomes are achieved: you sell what is expensive and buy what is cheap.

Good luck to you to save earned by overwork!

For pictures thanks to the portal mfd.ru.

Anticipating possible questions - I am in no way connected with any broker or fund or bank, I am not a professional at the securities market, I am writing only about my personal investment experience. No, I don’t take money in management either.

If anyone is interested in what brokerage office I serve in - welcome to the PM.

Here it would be necessary to write “what to do in old age?”, “No one can deny the state”, “nowadays everyone should ...” and other blah blah blah and bi-bi-bi. But I'm lazy, because - immediately to the point.

What is the main value of gold? The fact that it is valuable in itself. Just because it is gold. A lot of people appreciate the despicable metal is much more expensive than it really is - this is purely instinctive impulse. "Eternal and lasting value," as any marketer would say.

And more?

And gold is moving in antiphase with the stock market. That is, when there is a typhoon in the economy, all investors run into gold as the most reliable asset. Well, and vice versa, naturally ... This makes gold an ideal tool for building a “simpleton portfolio”.

What is this portfolio? It's simple. Bought assets, 2 or 3 or more - who likes what. According to a predetermined ratio. For example - stocks and gold, in the proportion of 50 to 50. And once a year rebalancing is performed. If one asset has risen in price, and the other has fallen in price - the ratio is broken, it is necessary to align. That is, to sell part of the risen asset and buy cheaper. As you know, the best method of generating income in any volatile market is to buy low and sell high. This is what our modus operandi promotes.

')

Portfolio strategies can be long spread thoughts, but today we are not about that.

So how to buy gold?

I know several ways.

Prices will be relevant where possible. For reference, today's gold quotation for the Central Bank is 1,490 rubles per gram.

1. Material gold

This will seem to someone the most reliable option. Here it is, always in hand, you can always sell it, but you can not sell if you do not like the price, and go look for another one. in theory.

1a. Natural gold: sand and nuggets.

In short - in Russia are prohibited by law. In any case, owning them to an average IT person will fail.

1b. Bank bars.

You can buy at the price of the bank-seller. I looked now in Sberbank - they sell for 1562, buy back for 1422.

You have to understand that if you take the bar out of the bank, you will have to pay 18% VAT. And back when selling it will not be returned!

Still from pleasures - personal income tax, if you own an ingot for less than 3 years (or drink your purchase documents) - you will have to pay a tax of 13%.

A bundle of documents is given to the ingot, without them it is very difficult to sell and the price tag falls.

It must be kept carefully and carefully, otherwise the bank will not take it back, or it will, but with a horse discount - that is, it will not be possible to bury it in the garden in the grandfather's village 8-)

Therefore, the ingot to the category of "material gold" can be quite relative.

1c. Coins.

Sell the banks too. An important advantage is that they are not subject to VAT, but the tax on personal income is valid on a general basis.

That is - again all the same: we draw up a pack of documents for each coin, and store them no less carefully than the coins themselves. Otherwise - oh. Prices are not happy even once. the popular "Victorious", for example, in a savings bank sell for 15,200 rubles. And they buy it back for only 10,500. With a coin weight of 7.78 grams, it gives us the price of gold at 1953 rubles with kopecks - almost one and a half times more expensive than gold quotes. But they are buying at a cheaper rate from the Central Bank, if it is comforting someone 8-) Yes, and it is necessary to keep it almost in the hermobox, otherwise the bank will again turn its nose.

1d. Decorations.

A popular theme is to buy jewelry with the lowest added value in the form of work. For example - the cheapest wedding rings. It will cost about 2000 rubles per gram. However, hunters watch all kinds of promotions, which sometimes gives results almost as low as the official rate. Only you need to understand that the sample for such cheap products will never be 999, but something simpler. 375, for example. But then here you are a complete master: even dig in the ground, even sell in the doorway. Neither the documents are not required, nor the filing of the personal income tax declaration. That is, according to the law, of course, you need to file and pay a tax return. But ... options are possible 8-)

It is considered the best option for "survivors" in case of any disaster.

2. Virtual gold.

There is only one option - OMC, impersonal metal accounts. It's all pretty primitive: you come to the bank and open a “deposit”, a procedure, I think, familiar to almost all people today. Only on the account are not ruble-dollars-Tugriks, but grams (well, or tons of very rich Buratin) of gold. Or silver, at worst. They even - theoretically - can be obtained from there by hand in the form of ingots, only you have to pay VAT. OMS itself is not subject to VAT. Revenues are taxed as usual.

What is bad: this account completely inherits all the risks of the bank, since under the deposit insurance system does not fall.

There is still a spread between buying and selling - it has the same sber as it does for ingots. That is, if you make an account for 10 grams of gold today, and today you close it, the loss will be 1400r, almost 10%.

There are kinder banks with less margin. It also happens that the bank deducts a certain insignificant interest on an urgent MHI.

A variation of the MLA is the purchase of ingots without their removal from the bank’s certified vault. Documents are processed as if you bought bars, but you do not need to pay VAT.

3. UIF.

there are at least a dozen mutual funds with the suffix “GOLD” in the market. Twist them most often large banks. The problems, commissions and risks they all have are approximately standard for the mutual fund scheme in general:

- the percentage of the management company will have to be paid regardless of the results of its activities

- the difference between buying and selling is significant

- additional fees are often applied in case of early withdrawal from the fund

- the inability to change the Criminal Code without the sale of assets

- the prices of the shares are under the full control of the MC. He wants - tomorrow everything will be worth 10% from yesterday. and do nothing.

What else is interesting: at least several of these funds (the largest), which I looked carefully at, are not stored in gold at all. And in shares of other funds, foreign, which are certainly gold, yeah ...

4. Well, and my favorite: ETF.

ETFov everyones in bulk. It began - as usual - in the states, and most of them there and is traded. All of them are mom, that their quotes exactly follow the quotes of real gold. The most famous is SPDR Gold.

They are all bought through the infrastructure of exchanges and brokers, that is, as well as stocks. The plus is that the broker can be changed, if the old one is guilty of 8-) That is, the direct operator is divorced from the asset, it is not necessary to sell the asset to change the broker.

Another great thing is that the spread is quite small. Right now my ETF is trading at 339-341r. That is, with a minimum lot of 10 pieces, it turns out to go in and out will cost 20 rubles + broker and depository commission, which in my case is so small that it is not worth mentioning. This is less than 1% in total - much nicer than any other option, in which immediately at the time of purchase you lose at least 10 percent! Again, the rebalancing of the portfolio is carried out within one account, which is also very convenient for me. Sold a part of something - bought a part of something. unnecessary and unnecessary, respectively 8-)

Oh yes, I completely forgot: my ticker is FinEx Physically Held Gold ETF. Mom swear that in London is all, everything, everything to the last ton of gold belonging to investors.

IMPORTANT UPD:

The fund "pereobulsya" - from the physical became synthetic. Now they are allegedly buying some kind of Swiss derivatives. Personally, I sold all this stuff completely.

Traded on the MICEX, you can see the charts and compare them with the price of gold. in my opinion - quite wow corresponds:

Even better if you look closely. This is achieved due to the fact that before the inevitable fall of the quotation, the management company sells a part of gold and waits in money.

And here is a picture for building lazy portfolios:

It can be seen that the stock market and quotes of our fund go strictly in antiphase. By this, increased incomes are achieved: you sell what is expensive and buy what is cheap.

Good luck to you to save earned by overwork!

For pictures thanks to the portal mfd.ru.

Anticipating possible questions - I am in no way connected with any broker or fund or bank, I am not a professional at the securities market, I am writing only about my personal investment experience. No, I don’t take money in management either.

If anyone is interested in what brokerage office I serve in - welcome to the PM.

Source: https://habr.com/ru/post/238247/

All Articles