How I tried five payment systems for my site

More than three years ago I wrote a post about choosing a payment system for accepting payments on my past project. Since then, quite a lot of time has passed and much has changed in the methods of accepting payments. Now I will tell you how I did accept payments on the site poiskvps.ru .

At present, the task looks exactly the same: I had to make it so that an individual could receive payments from users automatically on his website, having a small turnaround.

')

From a technical point of view, the following operations are performed during payment: the user is issued an invoice for payment, the user selects a convenient payment method, goes to the website of the payment system, makes a payment and returns to the website. In case of successful payment, the payment system notifies the store that the user has paid the bill.

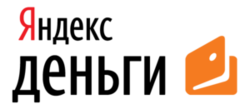

Yandex money

3 years ago, this payment system did not work with shops-individuals. That is, Yandex.Money could be taken directly only by registering a legal entity and having great momentum. Otherwise, the Yandex.Money payment system offered to work with various aggregators

Now the situation has changed, and Yandex.Money began to work with individuals without any contracts. The only condition to avoid problems is to pass identification.

A field appeared in the wallet settings in which you can set a link for notification of payments made, and users can pay for services with both Yandex.Money and bank cards.

The Yandex.Money commission is the lowest of all payment systems: the system charges 0.5% of the payment amount for transferring local currency, only 2% when paying by bank cards, and this fee does not depend on the payment amount. The fact that the commission does not depend on the amount of payment is beneficial when carrying out small operations. For example, in addition to 3.9% for the operation, PayPal also takes a fixed amount of 10 rubles for each transaction and, for example, 100 rubles, the store will receive only 86 rubles, paying almost 14% of the payment system.

Yandex.Money offers the standard to use either a “button-acceptor” or “form-acceptor”. In both cases, a frame is embedded on the site, which is severely limited in the possibilities of modernization and design change.

However, if you search hard, you can find documentation for creating your form for making payments: money.yandex.ru/i/forms/guide-to-custom-p2p-forms.pdf

The volume of documentation is not large, and at the very end you can find a working example of html-code for integration with the site:

<form method="POST" action="https://money.yandex.ru/quickpay/confirm.xml"> <input type="hidden" name="receiver" value="41001xxxxxxxxxxxx"> <input type="hidden" name="formcomment" value=" «»: -24"> <input type="hidden" name="short-dest" value=" «»: -24"> <input type="hidden" name="label" value="$order_id"> <input type="hidden" name="quickpay-form" value="donate"> <input type="hidden" name="targets" value=" {order_id}"> <input type="hidden" name="sum" value="4568.25" data-type="number" > <input type="hidden" name="comment" value=" ." > <input type="hidden" name="need-fio" value="true"> <input type="hidden" name="need-email" value="true" > <input type="hidden" name="need-phone" value="false"> <input type="hidden" name="need-address" value="false"> <input type="radio" name="paymentType" value="PC">.</input> <input type="radio" name="paymentType" value="AC"> </input> <input type="submit" name="submit-button" value=""> </form> After the user makes a payment, Yandex.Money “transfers” the user to a predetermined page, and at this time the store is notified of a successful payment and the money is credited to the user's account.

Webmoney

Over the past few years, little has changed on the part of this payment system. To receive payments, you need to go through identification (get a personal certificate) and set up payment acceptance on the site. Documentation can be found here: wiki.webmoney.ru/projects/webmoney/wiki/nastroyka_priema_webmoney_na_sayte_prodavtsa

An example of html code for integration:

<form id=pay name=pay method="POST" action="https://merchant.webmoney.ru/lmi/payment.asp"> <p> Web Merchant Interface</p> <p> 1 WMZ...</p> <p> <input type="hidden" name="LMI_PAYMENT_AMOUNT" value="1.0"> <input type="hidden" name="LMI_PAYMENT_DESC" value=" "> <input type="hidden" name="LMI_PAYMENT_NO" value="1"> <input type="hidden" name="LMI_PAYEE_PURSE" value="Z145179295679"> <input type="hidden" name="LMI_SIM_MODE" value="0"> </p> <p> <input type="submit" value="submit"> </p> </form> From the advantages of this payment system, I can note the presence of a “sandbox”, which makes the setup and debugging process more enjoyable.

For any operation, the system takes a standard commission of 0.8% and, unlike all other payment systems, this commission is taken from the buyer, and not deducted from the amount received by the seller. I had no technical difficulties with setting up payments, the system works correctly and does not cause any problems. After setting up the store, you must pass a moderation, which, as a rule, is carried out during the day.

QIWI wallet

I didn’t have the most pleasant impressions from this payment system. First, quite unexpectedly, the commission for performing operations was raised three times: from 1% to 3%, and secondly, qiwi technical support leaves much to be desired. The answer can wait for weeks, and the quality of such answers is extremely low. At some point, a working site, in which absolutely nothing has changed, stopped making payments through this payment system. The problem was on the side of qiwi and consisted in the wrong signature of the payment notification. As a result, any request from qiwi was not conducted in the system due to the incorrect signature of this request. Technical support could not solve the problem within one and a half weeks ...

This payment system proposes to use either the form for invoicing, which is set on the site as a frame, or similarly to the previous PS to use the html form.

For automatic notification of the store about payments, only the SOAP protocol was used earlier, which, in my opinion, is less convenient than the standard version with an http request. Problems with SOAP arose from the moment of setup and arose in use. Not so long ago, the REST protocol appeared in this payment system and it became easier to work. A description of this protocol can be found here: static.qiwi.com/ru/doc/ishop/protocols/Visa_QIWI_Wallet_Pull_Payments_API.pdf

As a result: I don’t recommend cooperating with PS qiwi, since The connection is long and complicated, and in case of problems, technical support cannot be counted on.

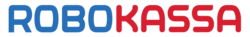

RoboCassa

Robokassa is not a payment system, but is an aggregator - a service through which you can pay in various ways, ranging from WebMoney and ending with banks and communication salons.

Not so long ago, the site was updated at Robokassa and became more user-friendly.

The documentation is written in sufficient detail so that I have no connection problems. Link to documentation: www.robokassa.ru/ru/ru/doc/ru/Interface.aspx

Of the benefits, like WebMoney, there is a sandbox and the work can be tested without sending real money.

Robokassa offers to use on its website either universal buttons or html code with advanced features.

Sample html code

<form action="https://auth.robokassa.ru/Merchant/Index.aspx" method="post"> <input type="hidden" name="MerchantLogin" value="poiskvps" /> <input type="hidden" name="OutSum" value="100" /> <input type="hidden" name="InvId" value="6023" /> <input type="hidden" name="Desc" value=" #6023 (100 .)" /> <input type="hidden" name="SignatureValue" value="axcea6c657c6d3452v0071e829e508a5" /> <input type="submit" value=" 100 ." /> </form> RoboCass Commission takes a large enough (sometimes up to 12%) and that is not very convenient, this commission is always charged to the user.

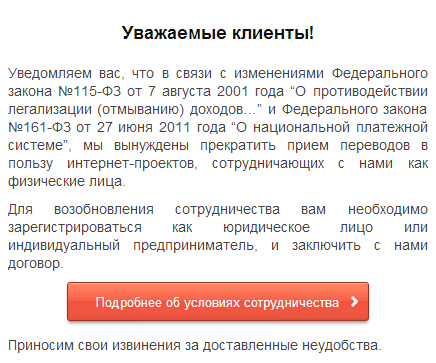

RBK Money

For quite a long time I collaborated with RBKMoney. There were not many payments through this system, there were no problems with setting up or working, therefore, developing poiskvps.ru, I decided to add this PS. Of the benefits, I can note the quality technical support - at any time of the day or night they have an online chat in which you can talk with a live person.

Unfortunately, on May 23, it was reported that RBKMoney ceases cooperation with individuals:

Therefore, the acceptance of payments through this PS was suspended, although working with them was quite convenient.

Paypal

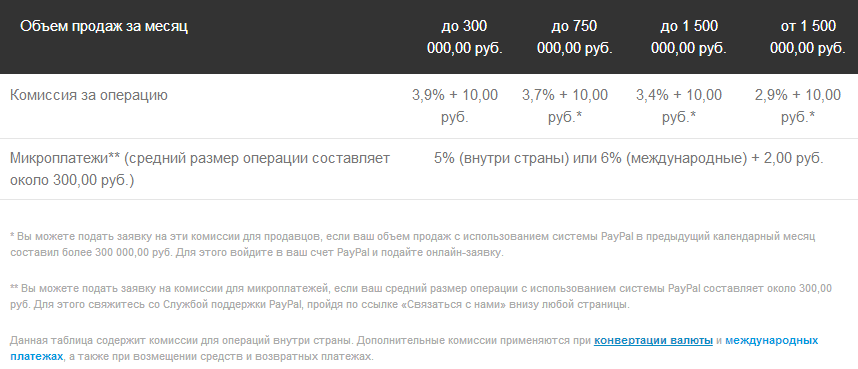

I did not start cooperation with this rather popular PS because of the large size of the commission. Fixed commission in the amount of 10 rubles. for each successful payment with small amounts of the operation makes the use of this PS is not profitable. With a turnover of less than 300 thousand rubles. per month PayPal takes 3.9% of its turnover and 10 rubles. for each operation. Accordingly, during the operation in the amount of 100 rubles. PayPal holds almost 14% of this amount. PS offers work at other rates for micropayments (up to 300 rubles): 5-6% of turnover and 2 rubles. for the operation. But this proposal loses to other PS (for example, Yandex.Money).

But PayPal started accepting Bitcoins - however, so far only in the USA.

Withdrawal of money

Well, now the most interesting thing: what can you spend honestly earned on.

Yandex.Money offers to spend money without a commission online or to issue a bank card, which can be paid in stores also without a commission. For withdrawing funds to a bank account, the commission is 3% + 15 rubles.

WebMoney offers to spend money in online stores (with a standard commission of 0.8%). The system also offers to transfer money by bank transfer at no extra charge. The cost of the payment order is only 15 rubles + standard commission. Money is credited to the account, usually within a day.

QIWI offers the only way to withdraw - to your kiwi wallet. Next - spend in online stores or issue a bank card for purchases in “real” outlets.

Robokassa offers to withdraw money exclusively to WebMoney, and there is no need to pay a withdrawal fee. Those. if the account in Robokassa is 1000 rubles, then in the WebMoney wallet there will be 1000 rubles.

Results

5th place: QIWI

wide network of terminals

wide network of terminals high commission, withdrawal complexity, poor support

high commission, withdrawal complexity, poor support4th place: PayPal

known system

known system high commission at low speed

high commission at low speed3rd place: Robokassa

many ways to accept payments

many ways to accept payments big commission

big commission2 place: WebMoney

Low commission, cheap withdrawal

Low commission, cheap withdrawal need to go through tedious identification

need to go through tedious identification1st place: Yandex.Money

low commission, the ability to accept bank cards

low commission, the ability to accept bank cards dear "cashing".

dear "cashing".

PS Thank you andorro for help with preparing the text.

PPS I thank the hosting company VDSina.ru for supporting the project.

Source: https://habr.com/ru/post/237969/

All Articles