Statistics: why you should not buy Apple stock after the release of the new iPhone

It would seem that an excellent plan is to buy Apple stock right now, wait until the presentation of the company, which is expected to feature the new iPhone and ... bam! Instant wealth. It sounds just fine, but not everything is so “i-simple.”

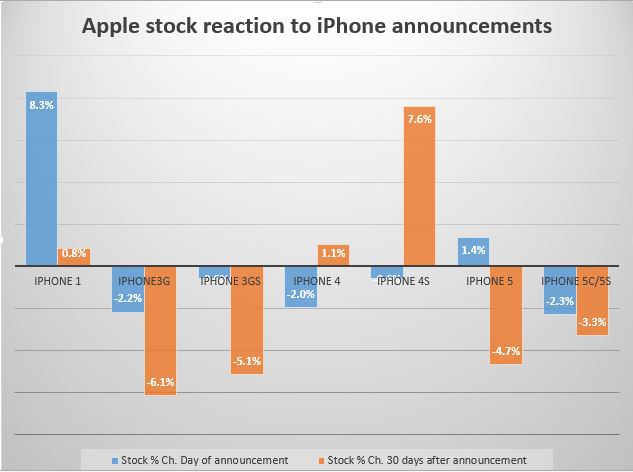

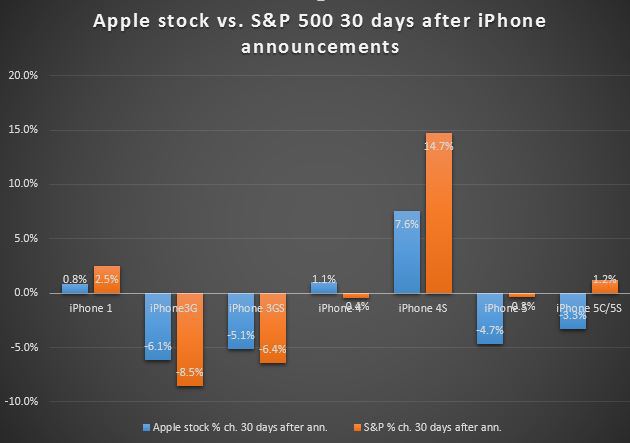

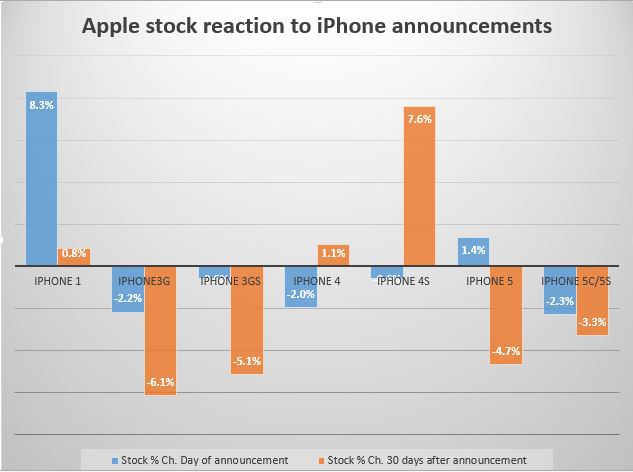

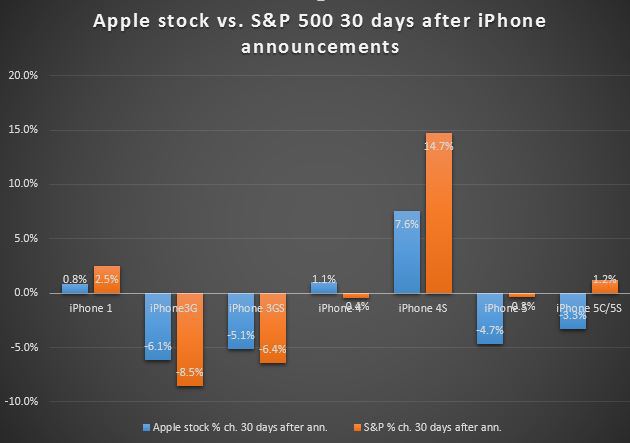

There are a large number of such clever people on the market, and they have done this trick many times already, which led to a decrease in the possible profit from similar speculations. Each time, the stock market is more calmly responding to the release of the new iPhone. If you look from the moment of release of the very first model, which took place on January 9, 2007, then on average, Apple shares after each release grew in price by 0.3% - the same average growth was shown by the S & P 500 index over the same period of time.

')

You need to understand that even such average values are due to a significant surge that occurred after the release of the very first iPhone. In the future, no new Apple smartphone has caused the same enthusiastic reaction of investors in the stock market. If you do not take into account the release of the first smartphone of the company from Cupertino, then after the release of the new iPhone, the next company’s shares fell by an average of one percent.

When considering a longer time period of 30 days after the launch of the new device, the results of Apple shares are not much better - on average, the share price fell by 1.4% during the month after the release of the last seven device modifications. For comparison, the S & P 500 index added 0.4% in value over the same period.

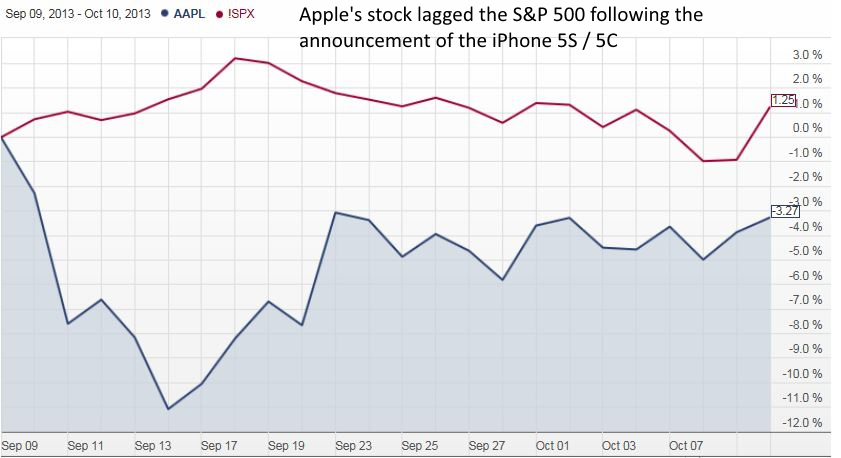

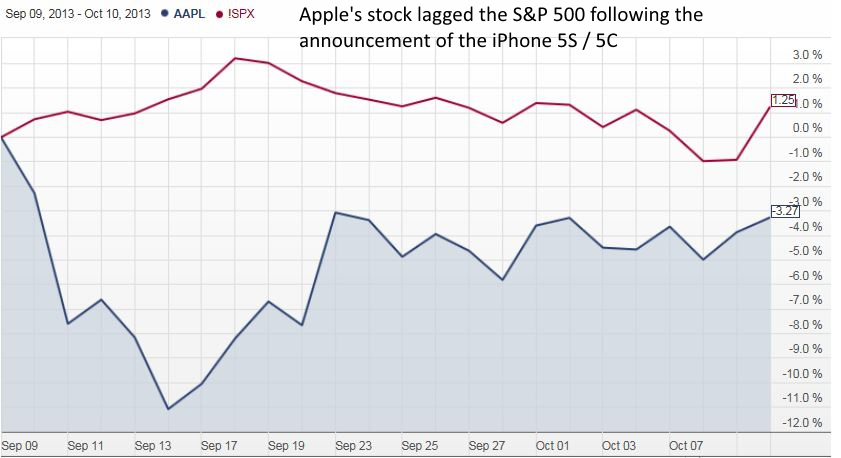

Let's look, for example, at the market response to the latest to date, iPhone modifications - 5S and 5C. On the day of their release, Apple shares fell 2.3%, and thirty days later, the figures were even worse - minus 3.3%. It would be much more profitable to invest in the S & P 500 index, which grew by 0.7% on the day of the company's presentation, and added another 1.2% in the following month.

There is no doubt that in the long run Apple shares are a good option for investment, and the iPhone has become a defining product for the company - according to Trefis, almost half of its value is explained by the success of this gadget. Nevertheless, investors who consider it a good idea to buy shares in a company before presenting new devices in the hope of a quick profit may be quite disappointed in their strategy.

UPD:

Despite the fact that during the presentation at the Flint-center, Apple shares mainly grew, eventually, the sale ended with a reduction in their value by 0.38%:

Posts and related links:

PS If you notice a typo, mistake or inaccuracy of the translation - write a personal message and we will fix everything promptly.

PPS On the Moscow Exchange, the Best Private Investor Competition for Stock Traders Starts - Traders compete financially with each other. This time, ITinvest is playing an additional prize pool among its customers. Details on our site .

There are a large number of such clever people on the market, and they have done this trick many times already, which led to a decrease in the possible profit from similar speculations. Each time, the stock market is more calmly responding to the release of the new iPhone. If you look from the moment of release of the very first model, which took place on January 9, 2007, then on average, Apple shares after each release grew in price by 0.3% - the same average growth was shown by the S & P 500 index over the same period of time.

')

You need to understand that even such average values are due to a significant surge that occurred after the release of the very first iPhone. In the future, no new Apple smartphone has caused the same enthusiastic reaction of investors in the stock market. If you do not take into account the release of the first smartphone of the company from Cupertino, then after the release of the new iPhone, the next company’s shares fell by an average of one percent.

When considering a longer time period of 30 days after the launch of the new device, the results of Apple shares are not much better - on average, the share price fell by 1.4% during the month after the release of the last seven device modifications. For comparison, the S & P 500 index added 0.4% in value over the same period.

Let's look, for example, at the market response to the latest to date, iPhone modifications - 5S and 5C. On the day of their release, Apple shares fell 2.3%, and thirty days later, the figures were even worse - minus 3.3%. It would be much more profitable to invest in the S & P 500 index, which grew by 0.7% on the day of the company's presentation, and added another 1.2% in the following month.

There is no doubt that in the long run Apple shares are a good option for investment, and the iPhone has become a defining product for the company - according to Trefis, almost half of its value is explained by the success of this gadget. Nevertheless, investors who consider it a good idea to buy shares in a company before presenting new devices in the hope of a quick profit may be quite disappointed in their strategy.

UPD:

Despite the fact that during the presentation at the Flint-center, Apple shares mainly grew, eventually, the sale ended with a reduction in their value by 0.38%:

Posts and related links:

- How to buy shares of IT companies before, during and after the IPO

- What are stock indices and why are they needed?

- How economic news affects the stock market

- How-to: How to buy shares of technology companies on the example of "Yandex"

- Analytical materials on the stock market from ITinvest experts

PS If you notice a typo, mistake or inaccuracy of the translation - write a personal message and we will fix everything promptly.

PPS On the Moscow Exchange, the Best Private Investor Competition for Stock Traders Starts - Traders compete financially with each other. This time, ITinvest is playing an additional prize pool among its customers. Details on our site .

Source: https://habr.com/ru/post/236247/

All Articles