Electronic money in Russia: a comparison of the financial success of market players

Electronic money systems do a good job of accounting for the money of their users.

Let's try to swap places and count money in the pocket of the payment systems themselves.

Electronic money is money that is used only on the Internet. This money cannot be touched, they are not physically fit, but are on electronic media. With their help, you can pay for goods in online stores, mobile communications and utilities, make transfers to other users, exchange money for other forms and much more.

The market of electronic money is becoming more and more popular in Russia every year. The market is regulated by the Central Bank of Russia, and the main law to which all participants in this market are subject is “On the National Payment System” N 161- of June 27, 2011.

')

Immediately it is worth making a reservation that the article will not deal with multiple illegal Internet resources that loudly call themselves payment systems, but actually violate the law of the country (performing illegal banking operations), as well as not giving even minimal guarantees for the safety of their customers.

Overview of market participants

At the time of the preparation of the article, the Russian e-cash market is represented by the following national companies registered with the Bank of Russia as payment NPOs (Payment Non-Bank Credit Organization):

| Name of PNKO | The brand | Registration date | Site | Direction of activity |

|---|---|---|---|---|

| Moneta.Ru | Moneta.Ru | 04.06.2012 | moneta.ru | For instant secure online payments. |

| Electronic payment service | RBK Money | 27.06.2012 | www.rbkmoney.ru | The platform for making transfers in various ways, as well as payment in online stores. |

| Money.Mail.Ru | 02.08.2012 | money.mail.ru | Payments by cash and bank cards, instant money transfers, payment of receipts | |

| Yandex money | 02.08.2012 | money.yandex.ru | Payment for services, transfers and replenishment, acceptance of payments on sites. Simplicity and convenience of payment technologies. | |

| Single ticket office | Wallet One | 08.10.2012 | walletone.com | Multicurrency wallet, email and telephone transfers, multiple points of replenishment and withdrawal of funds worldwide |

| Delta Kay | Delta Kay | 12/18/2012 | deltakey.ru | Money transfers in terminals and ATMs, accepting payments, personal and corporate wallets. |

| Premium | Telepay | 02.21.2013 | telepayural.ru | Large terminal network of Yekaterinburg, payment acceptance |

| PayPal RU | Paypal | 03/13/2013 | paypal.ru | Payment in the address of online stores (including eBay). In fact - the Russian representative office of American PayPal |

| Payyu | Payu | 04/08/2013 | payu.ru | Intergator of various payment methods in online stores (international card payment systems and Russian electronic money) |

| MOBI.Money | MOBI.Money | 10/22/2013 | mobi-money.ru | Mobile payment system - payment for online purchases from a card or phone bill. |

For clarity, there are also brands of credit institutions, the websites of these companies and the line of business (according to information from these sites).

Hereinafter, for ease of perception of information, the brand will be used instead of the name of the credit institution.

The peak of the emergence of national companies in the Russian market of electronic money accounted for 2012. For the year, six payment NPOs appeared. Companies registered in 2012 will participate in the analysis of the electronic cash market, since analytics will be carried out on the basis of work in 2013, and it would be incorrect to compare companies that have worked throughout the year with those who have worked only part of the year.

Financial results for 2013

Let's compare our participants by the main indicators of activity for 2013 (according to the financial statements submitted to the Central Bank of the Russian Federation).

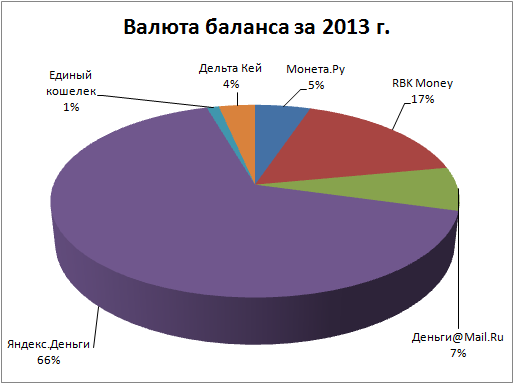

| Balance currency, thousand rubles | 146 951 | 477 906 | 207 411 | 1 878 248 | 32 411 | 95 500 |

| % | 5.18% | 16.84% | 7.31% | 66.17% | 1.14% | 3.36% |

| Commission income, thousand rubles | 277 875 | 377 501 | 136 485 | 1,043,557 | 10,420 | 44 805 |

| % | 14.70% | 19.97% | 7.22% | 55.20% | 0.55% | 2.37% |

| Commission expenses, thousand rubles | 163 020 | 366,015 | 75,272 | 304 250 | 2,410 | 18 022 |

| % | 17.55% | 39.40% | 8.10% | 32.75% | 0.26% | 1.94% |

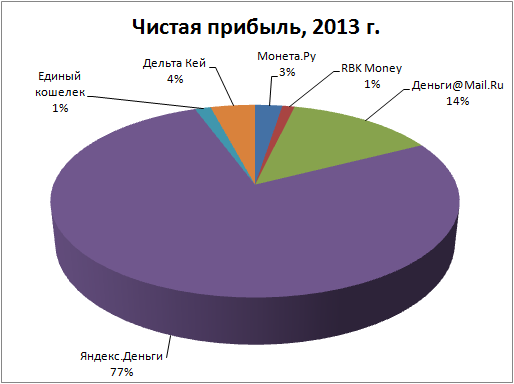

| Net profit, thousand rubles | 3,234 | 1,457 | 17,527 | 97,604 | 1,874 | 5,262 |

| % | 2.55% | 1.15% | 13.81% | 76.88% | 1.48% | 4.14% |

| Equity, thousand rubles (Form 0409808) | 21,988 | 19,116 | 35,084 | 115,592 | 20,761 | 20,610 |

| The ratio of capital adequacy of the bank (H1.1) | 22.00 | 4.6 | 24.90 | 6.8 | 197.00 | 70.00 |

| Liquidity ratio (H15.1) | 146.60 | 112.1 | 145.20 | 106.60 | 305.40 | 253.30 |

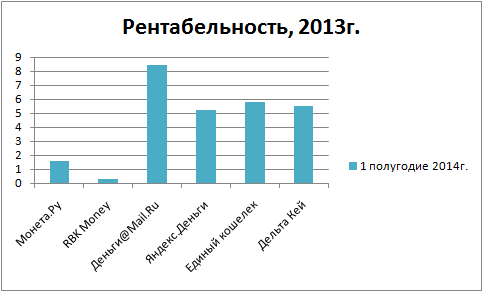

| Profitability | 1.59 | 0.30 | 8.45 | 5.19 | 5.78 | 5.5 |

Alignment of forces

Yandex.Money is the most popular online payment service. For many years, the Yandex brand has been widely known in Russia, which largely predetermined the fate of these electronic money. Commission income Yandex. Money exceeded 1 billion rubles, which indicates a large number of users of this system.

RBK Money, Money @ Mail.Ru and Moneta.Ru are also popular among the population. Their market share is 16.84%, 7.31% and 5.18% respectively. At the same time, RBK Money has very high commission expenses, which entails not a high level of net profit. Also, the standards of capital adequacy and liquidity of RBK Money quite a bit exceed their minimum values.

At the end of 2012, United Cash Register (Brand One Wallet) and Delta Key were registered. By the end of 2013, the Delta Cay market share was 2.37%, which is a good result for the newly established company. Its net profit on 01/01/2014 amounted to more than 5 million, which indicates the effectiveness of its activities. It is worth noting the high value of mandatory standards N1.1 and H15.1 (capital adequacy ratio and liquidity ratio), which characterizes NPOs as a stable and reliable company. According to the results of 2013, the performance of NCO is not as optimistic as Delta Kay. Its market share slightly exceeded 0.5%.

The net profit indicators of most companies are similar to the value of their market share in terms of balance sheet total. The exception is, as already noted, RBK Money, which, with a 17% market share in the balance sheet currency, accounts for only 1% of the profits.

Below is a comparison of compliance with standards of liquidity and capital adequacy by credit organizations. It should be noted that for all credit institutions, these indicators exceed the minimum standards set by the Central Bank of Russia.

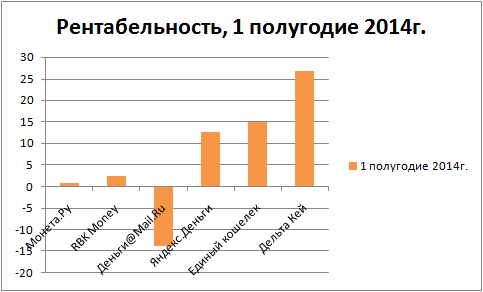

Profitability:

Dynamics - the first half of 2014

Consider the activities of these NGOs in dynamics. The table below presents the main indicators for the first half of 2014.

| Balance currency, thousand rubles | 154,869 | 255 808 | 95,689 | 691,850 | 40,095 | 110,944 |

| % | 11.48% | 18.96% | 7.09% | 51.28% | 2.97% | 8.22% |

| Commission income, thousand rubles | 100 044 | 244 002 | 77 594 | 230 535 | 27,099 | 48 699 |

| % | 13.74% | 33.52% | 10.66% | 31.67% | 3.72% | 6.69% |

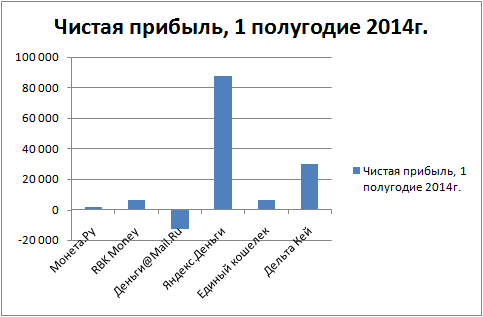

| Net profit, thousand rubles | 1,462 | 6,530 | -13,071 | 87,285 | 6,037 | 29,708 |

| % | 1.24% | 5.54% | -11.08% | 74.00% | 5.12% | 25.19% |

| Equity (Basel III) | 23,412 | 25,825 | 24,174 | 135 486 | 26,434 | 50,559 |

| The ratio of capital adequacy of the bank (H1.1) | 23.94 | 7.73 | 32.82 | 7.81 | 64.65 | 82.38 |

| Liquidity ratio (H15.1) | 147.97 | 117.84 | 183.18 | 107.64 | 157.15 | 415.03 |

| Profitability | 0.94 | 2.55 | -13,66 | 12.62 | 15.06 | 26.78 |

Change the balance of power

It can be seen how the balance of power changed in 2014. Yandex.Money and RBKMoney continue to be confidently in the first two places. Money @ Mail.Ru went down to 5th place in market share, while Delta Key climbed 4 (its market share was 8.22%, and in absolute terms more than in the whole 2013), and Moneta.Ru - on the 3rd place. It should also be noted a slight decline in the share of revenues of Yandex.Money NPOs, but this did not affect its leadership positions.

Net profit

The main income that an NPO receives is the commission income from all completed transactions. The higher the level of commission income, the more transactions the company conducted during the reporting period, and accordingly - the higher the demand for its services.

If we consider the company in terms of net profit for the 1st half of 2014, the first three places were as follows:

1. Yandex.Money - 87 million rubles.

2. Delta Kay - 30 million rubles.

3. RBK Money - 7 million rubles.

In this top three, Delta Key is particularly noteworthy, which in such a short period of time hit the top three along with such a giant as Yandex.Money, well ahead of RBKMoney in this indicator.

Profitability

One of the main indicators of the effectiveness of the organization has always been profitability. In this case, consider the profitability of commission income, i.e. the degree of profitability of NGOs in the first half of 2014

The diagram shows that for the first half of 2014. The most effective was NCO Delta Kay, whose profitability was 26.78%. Also, a high level of profitability should be noted at Yandex.Money NPO and NPO United Cashier.

Money @ Mail.Ru in the first half of 2014 had a loss. This is all the more surprising that by the end of 2013. This particular NPO had the highest rate of return.

Moneta.ru and RBK Money have low profit margins due to a small net profit against the background of a rather high level of commission expenses.

Summarizing

The growth of the electronic cash market is getting higher and higher every year, and according to forecasts for the next few years, this dynamic will only increase. It should be noted that along with such giants as Yandex.Money, younger companies are confidently entering the market, whose high growth rates help to ensure healthy competition in the electronic money market.

The article was prepared on the site cbr.ru and published in open sources of financial reporting.

Source: https://habr.com/ru/post/236095/

All Articles