Apple: "value monopolist" in the smartphone market

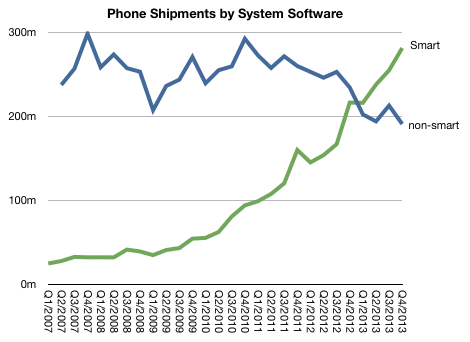

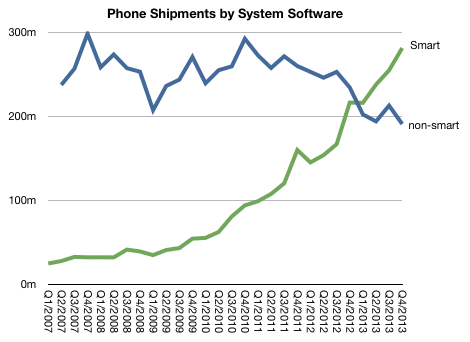

The smartphone market continues to grow. In 2013, the total volume of deliveries amounted to about a billion units (for comparison: in 2012 this figure was 683 million). At the same time, the supply of conventional mobile phones continued to decline: 800 million in 2013 against 987 million in 2012.

This trend is shown in the graph:

')

Please note that until 2012, the market for ordinary mobile phones seemed to remain stable, unless, of course, we take into account the growth in the smartphone market. Nobody took seriously the idea that smartphones would become universal devices. Of course, I heard many objections about my forecast for 2010. My hypothesis was that smartphones will not only become ubiquitous, but over time it will become more and more difficult to find and buy something else. (And this despite the obvious demand for low-cost conventional mobile devices). [one]

I also suggested that it would soon be meaningless to emphasize the difference between the phone and the “smart” prefix, this will go back to normal, and we will begin to call such devices just phones. This is already happening, at least judging by the discussions in which I also participated.

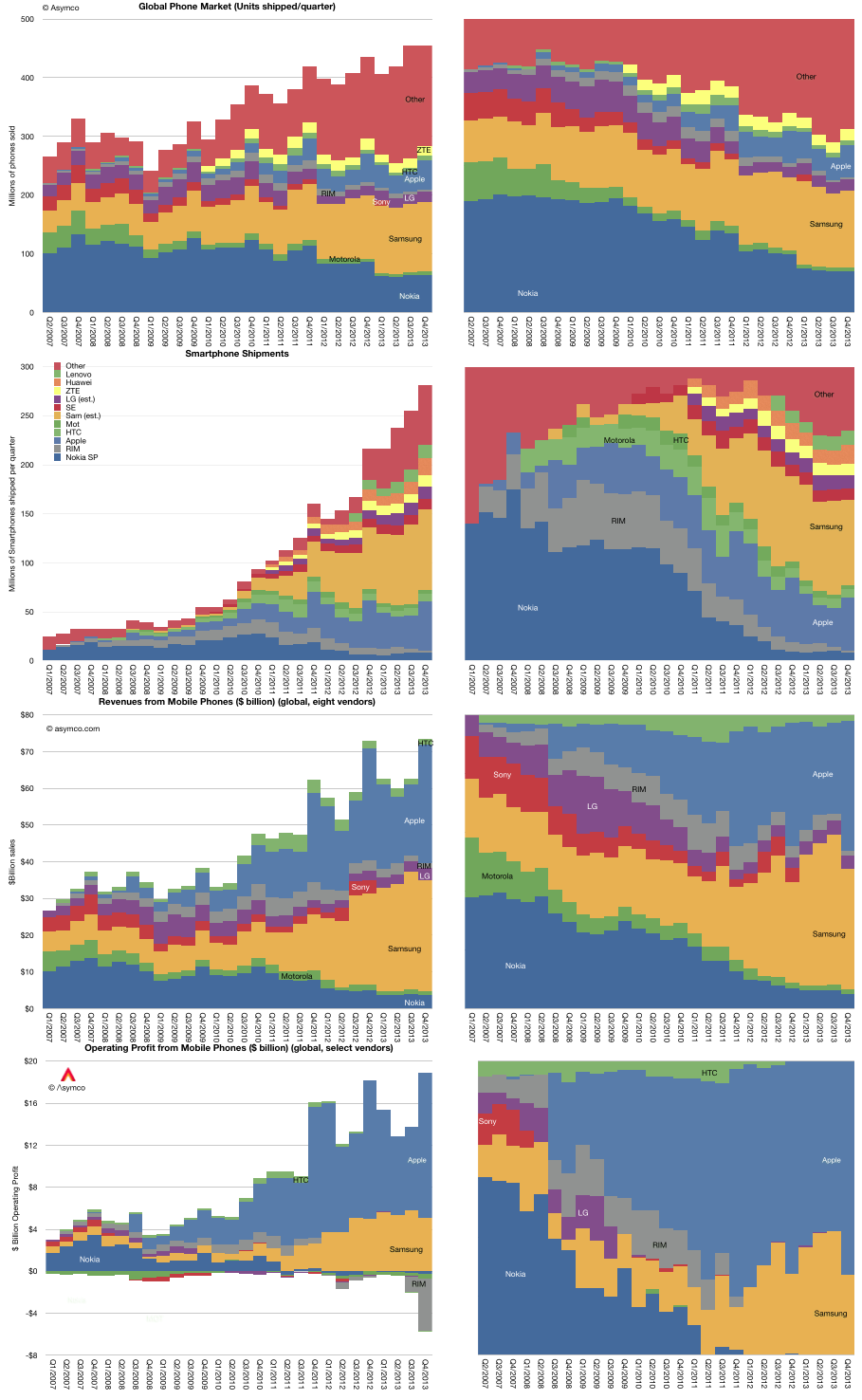

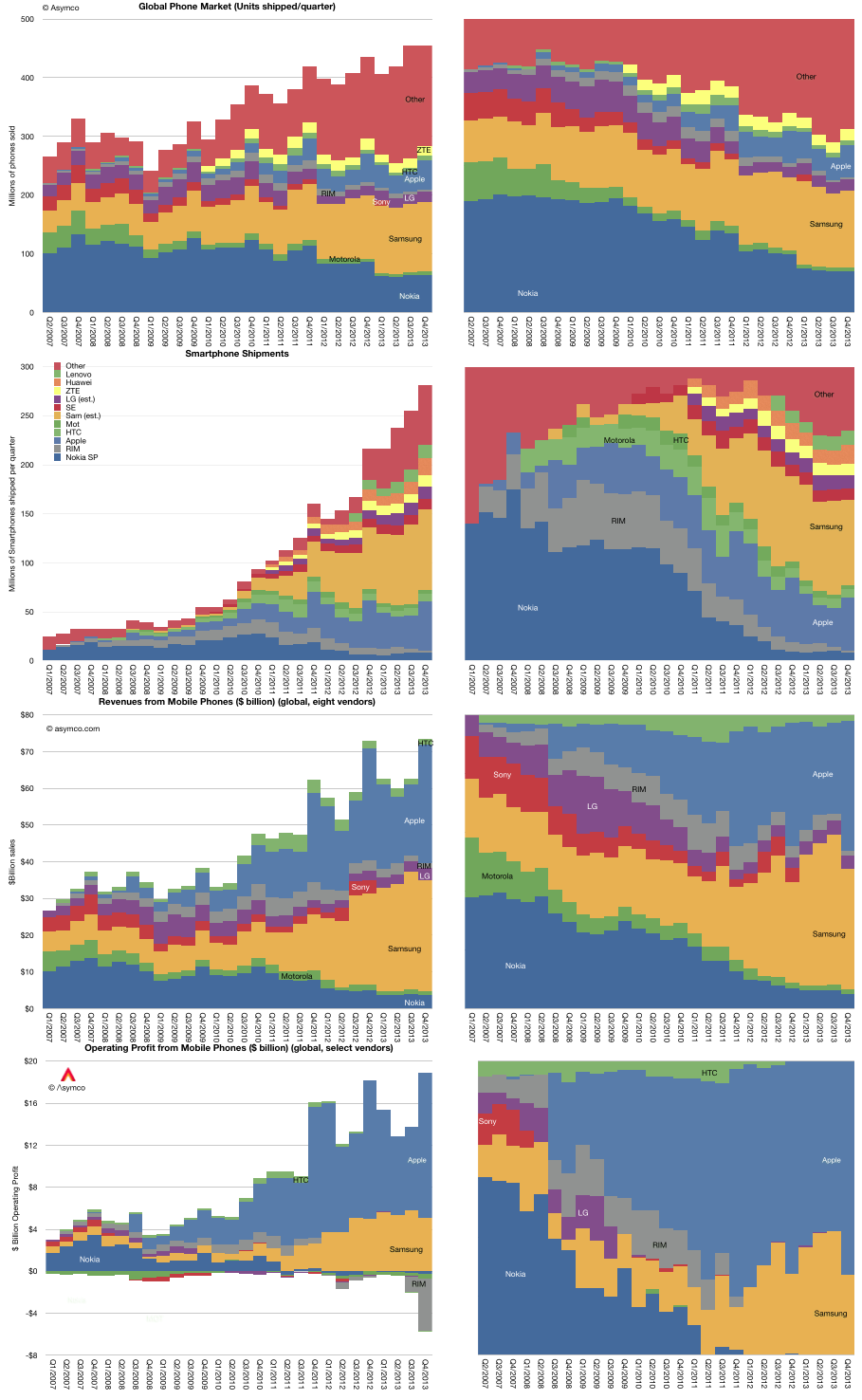

So, if we are just talking about “mobile phones” and it is expected that all mobile phones will become smartphones, what situation can we see in the market? The graphs below show the absolute and relative indicators of supply, revenue and profitability of the most important brands.

On these graphs, you can observe the “breakthrough” effect, which has the simple addition of the prefix “smart”. For some short few years [2], the revenues in the industry have radically redistributed.

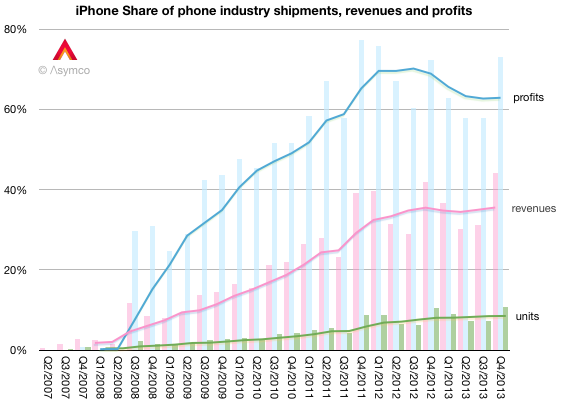

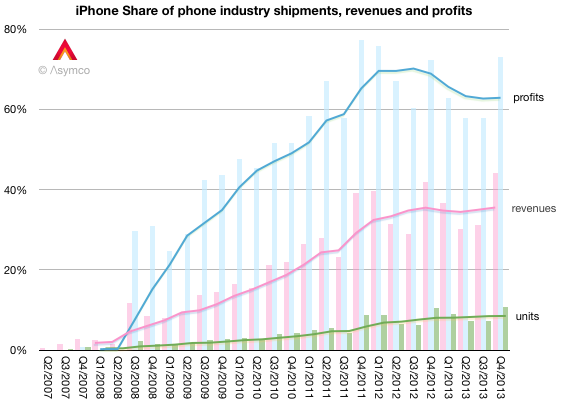

Indeed, since entering the iPhone market, the net profit earned by the already mentioned leading market players has reached $ 215 billion. Of these, 60% were earned by Apple, which at the time was new to the market. This figure has strengthened on an ongoing basis, reaching 60% in 2011, and has since changed only slightly.

The very fact that this happened without a corresponding increase in the supply of units of goods is a sign of a striking phenomenon: the formation of a stable value of the company itself.

It is difficult to earn a profit, to extract it without increasing supply volumes, it is even more difficult to do this all the time, thus making it difficult for competitors to enter the market, the most difficult. This is typical only for situations of monopoly or a protected market (in other words, protection). The lack of a market monopoly at Apple, combined with almost complete dominance in revenues, can only be explained by the disproportionate formation of brand value.

Thus, the mystery is how to create a monopoly in the formation of values.

Footnotes:

[1] A suitable analogy here is to become a state of the market for black and white TVs at the time of the growing popularity of color TVs. It is possible that monochrome TV continued to be in demand even after their release was discontinued, but this is irrelevant: outdated technologies are becoming increasingly rare due to economies of scale.

[2] The graph shows the last 6 years, but the effect is noticeable in the interval of 4 years.

[3] In my opinion, this event marked the beginning of a new [current] era in the industry

[4] $ 234 billion in gross profit versus $ 19 billion in operating expenses.

This trend is shown in the graph:

')

Please note that until 2012, the market for ordinary mobile phones seemed to remain stable, unless, of course, we take into account the growth in the smartphone market. Nobody took seriously the idea that smartphones would become universal devices. Of course, I heard many objections about my forecast for 2010. My hypothesis was that smartphones will not only become ubiquitous, but over time it will become more and more difficult to find and buy something else. (And this despite the obvious demand for low-cost conventional mobile devices). [one]

I also suggested that it would soon be meaningless to emphasize the difference between the phone and the “smart” prefix, this will go back to normal, and we will begin to call such devices just phones. This is already happening, at least judging by the discussions in which I also participated.

So, if we are just talking about “mobile phones” and it is expected that all mobile phones will become smartphones, what situation can we see in the market? The graphs below show the absolute and relative indicators of supply, revenue and profitability of the most important brands.

On these graphs, you can observe the “breakthrough” effect, which has the simple addition of the prefix “smart”. For some short few years [2], the revenues in the industry have radically redistributed.

Indeed, since entering the iPhone market, the net profit earned by the already mentioned leading market players has reached $ 215 billion. Of these, 60% were earned by Apple, which at the time was new to the market. This figure has strengthened on an ongoing basis, reaching 60% in 2011, and has since changed only slightly.

The very fact that this happened without a corresponding increase in the supply of units of goods is a sign of a striking phenomenon: the formation of a stable value of the company itself.

It is difficult to earn a profit, to extract it without increasing supply volumes, it is even more difficult to do this all the time, thus making it difficult for competitors to enter the market, the most difficult. This is typical only for situations of monopoly or a protected market (in other words, protection). The lack of a market monopoly at Apple, combined with almost complete dominance in revenues, can only be explained by the disproportionate formation of brand value.

Thus, the mystery is how to create a monopoly in the formation of values.

Footnotes:

[1] A suitable analogy here is to become a state of the market for black and white TVs at the time of the growing popularity of color TVs. It is possible that monochrome TV continued to be in demand even after their release was discontinued, but this is irrelevant: outdated technologies are becoming increasingly rare due to economies of scale.

[2] The graph shows the last 6 years, but the effect is noticeable in the interval of 4 years.

[3] In my opinion, this event marked the beginning of a new [current] era in the industry

[4] $ 234 billion in gross profit versus $ 19 billion in operating expenses.

Source: https://habr.com/ru/post/234145/

All Articles