Enlarge your pension-3. Examples Everything is relative

The first comment to the previous topic about extinguishing the fire with kerosene was the question of the contribution of empiricism to the formation of the accumulative portfolio. This is a very good, correct and timely question; the sensibility of the Habro community is immediately felt. Of course, “empirically” with the hindsight you can get any kind of good numbers. The Markowitz portfolio theory itself is not used in the forehead precisely because all the characteristics of assets tend to change over time, including after the formation of a portfolio of assets. With asset classes easier.

In the west, there is such a term “simpleton portfolio”, “lazy bag”. Let me be a simpleton (this assumption is not far from the truth) and I have no economic education. I choose where to invest. What markets can come to my mind? There are not so many of them:

- Shares (shares);

- Debt (bond) markets and money markets;

- Commodity markets (or at least gold);

- Real Estate ( REIT funds).

Since I am simple, I do not quite understand the meaning of the words “and if everything falls.” This term means that certain assets will decrease in price. Expressed in what? In the money (which, men say, generally not provided with anything ), well, let it be in gold. Consequently, money and instruments with fixed interest payments will increase my purchasing power in this situation when “everything has fallen”. So, you need more gold! such assets should be in my portfolio. Obtained from the growth of this share of the portfolio, I will be able to spend or invest with the annual rebalancing in that same everything else that “fell”, hoping for the excessiveness of temporary pessimism (and the authority of Nobel Schiller, who ate this dog) and post-crisis recovery.

In general, it is possible to go further in generalizations and say that capital is forced to flow between the listed markets depending on economic conditions. We do not know exactly when and where the capital will go (and the interest of investors), we do not know when the economy will switch to which mode, but we know that capital has no place to go from these markets. In the comments of the first topic, it was rightly noted that, with hopelessness, capital is paradoxically forced to flow into money and American debts, and this is almost so. Fuh, mastered to formulate, never using the term "deflation" ...

')

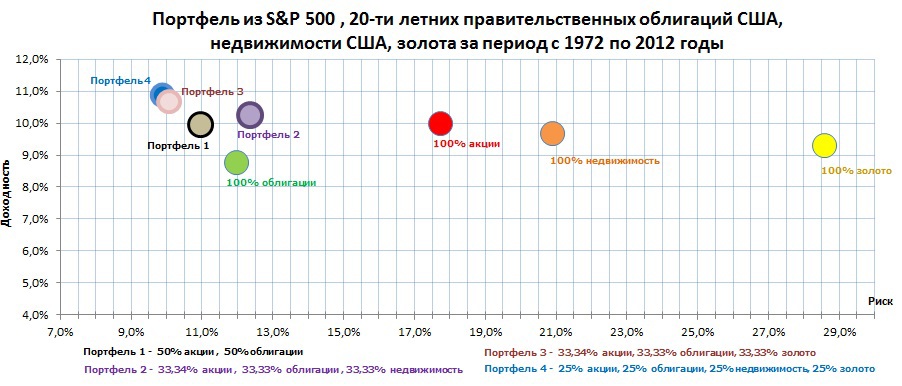

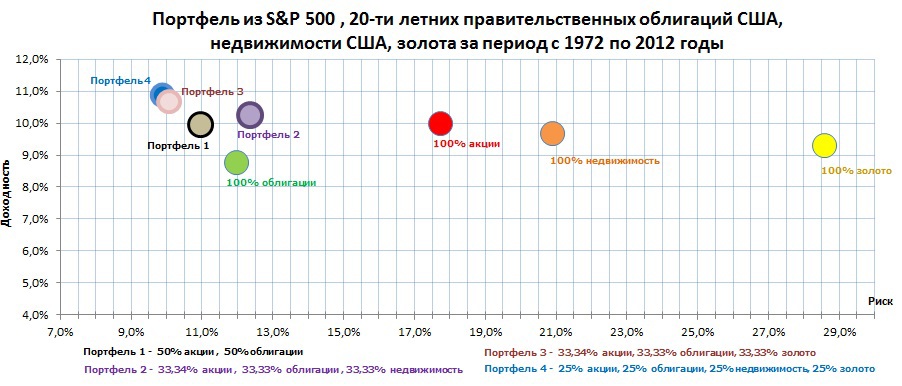

So I, as a simpleton, can try to solve the problem simply. I will record in my portfolio for the start equal shares of equity funds, bonds, real estate and gold. I’ll get these characteristics for the period from 1972 (there used to be just not enough indexes, but there were Bretton Woods agreements):

We look at the drawing and remember that upwards means “more profitable”, to the right - “more risky”, to the left - “more reliably”. Our miracle portfolio (number 4) was in the upper left corner, smashing all the other options mentioned in all respects. Fans of gold and real estate can easily compare their favorite assets for risk and return. In the future I will give data on real estate in different countries, and not only in the United States.

Finally, consider the Russian market. Financial consultants like to cite as an example a portfolio of equities, bonds and gold in equal parts by a third for the Russian market.

“Shares” - shares of the open-end fund of Dobrynya Nikitich shares of the UK “Dvoika-Obrolog”;

“Bonds” - shares of the open fund of bonds “Ilya Muromets” of the same UK “How many-Uvolok”;

“Gold” is the discount price for gold of the Central Bank of Russia (in rubles per 1 g).

Continuing the tradition of naming above, the portfolio should be called “St. Basil”.because only the blessed will keep pension savings in assets with a rating near Be-Be-Be

Financial advisors prefer to start the demonstration of such a portfolio from December 31, 1997, so that all the growth from the bottom and crazy interest on bonds will be included in the statistics - a statistical artifact that we hardly ever meet in such a cumulative form. Since we do not have the task to push the reader something, we will take the data more modestly, without an attractive artifact.

Since 2000, the dynamics:

The weather results of the portfolio with annual rebalancing were as follows:

As we see, in 2008 this portfolio lost as much as 25%. PIF shares lost 70% that year, bonds pip lost 30%, gold rose 25%. The following year, the equilibrium portfolio showed + 76% and recouped the losses (in the comments of the first topic they asked for a set of assets to recover from the fall of 2008). Over the past two years, the portfolio has been losing inflation a little, but there is nothing perfect, any asset sometimes goes down in price or loses inflation; a long-term result that is on the level of the stock market is important for us.

Further, on average, the equilibrium portfolio grew by 24%, and mutual fund shares grew by 22% per year. Those. reducing fluctuations, we also raised the yield.

To be continued .

In the west, there is such a term “simpleton portfolio”, “lazy bag”. Let me be a simpleton (this assumption is not far from the truth) and I have no economic education. I choose where to invest. What markets can come to my mind? There are not so many of them:

- Shares (shares);

- Debt (bond) markets and money markets;

- Commodity markets (or at least gold);

- Real Estate ( REIT funds).

Since I am simple, I do not quite understand the meaning of the words “and if everything falls.” This term means that certain assets will decrease in price. Expressed in what? In the money (

In general, it is possible to go further in generalizations and say that capital is forced to flow between the listed markets depending on economic conditions. We do not know exactly when and where the capital will go (and the interest of investors), we do not know when the economy will switch to which mode, but we know that capital has no place to go from these markets. In the comments of the first topic, it was rightly noted that, with hopelessness, capital is paradoxically forced to flow into money and American debts, and this is almost so. Fuh, mastered to formulate, never using the term "deflation" ...

')

So I, as a simpleton, can try to solve the problem simply. I will record in my portfolio for the start equal shares of equity funds, bonds, real estate and gold. I’ll get these characteristics for the period from 1972 (there used to be just not enough indexes, but there were Bretton Woods agreements):

We look at the drawing and remember that upwards means “more profitable”, to the right - “more risky”, to the left - “more reliably”. Our miracle portfolio (number 4) was in the upper left corner, smashing all the other options mentioned in all respects. Fans of gold and real estate can easily compare their favorite assets for risk and return. In the future I will give data on real estate in different countries, and not only in the United States.

Finally, consider the Russian market. Financial consultants like to cite as an example a portfolio of equities, bonds and gold in equal parts by a third for the Russian market.

“Shares” - shares of the open-end fund of Dobrynya Nikitich shares of the UK “Dvoika-Obrolog”;

“Bonds” - shares of the open fund of bonds “Ilya Muromets” of the same UK “How many-Uvolok”;

“Gold” is the discount price for gold of the Central Bank of Russia (in rubles per 1 g).

Continuing the tradition of naming above, the portfolio should be called “St. Basil”.

Financial advisors prefer to start the demonstration of such a portfolio from December 31, 1997, so that all the growth from the bottom and crazy interest on bonds will be included in the statistics - a statistical artifact that we hardly ever meet in such a cumulative form. Since we do not have the task to push the reader something, we will take the data more modestly, without an attractive artifact.

Since 2000, the dynamics:

| Assets | Nominal annual average profitability 2000-2012 | Annual average yield adjusted for inflation 2000-2012 |

| Ruble | 0% | -12.1% |

| U.S. dollar | + 1.5% | -10.7% |

| Euro | + 3.6% | -8,5% |

| Inflation | + 12.1% | |

| Gold | + 17.4% | + 5.2% |

| Accommodation in Moscow | + 19.8% | + 7.7% |

| MICEX Index | + 20.3% | + 8.2% |

| UIF Bond Ilya Muromets | + 22.1% | + 10.0% |

| Mutual fund shares Dobrynya Nikitich | + 22.3% | + 10.2% |

| Portfolio "St. Basil" | + 24.4% | + 12.2% |

The weather results of the portfolio with annual rebalancing were as follows:

| 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 |

| + 45.3% | + 52.9% | + 38% | + 20% | + 15.2% | + 41% | + 23% | + 13.2% | -25% | + 76% | +24.7 | -0.2% | + 6.6% |

As we see, in 2008 this portfolio lost as much as 25%. PIF shares lost 70% that year, bonds pip lost 30%, gold rose 25%. The following year, the equilibrium portfolio showed + 76% and recouped the losses (in the comments of the first topic they asked for a set of assets to recover from the fall of 2008). Over the past two years, the portfolio has been losing inflation a little, but there is nothing perfect, any asset sometimes goes down in price or loses inflation; a long-term result that is on the level of the stock market is important for us.

Further, on average, the equilibrium portfolio grew by 24%, and mutual fund shares grew by 22% per year. Those. reducing fluctuations, we also raised the yield.

To be continued .

Source: https://habr.com/ru/post/232287/

All Articles