How we choose investment funds. Where dreams lead

For a very useful link in the comments to the first topic “Enlarge your pension size” you can see the results of the work of pension funds for several years already. Question to mathematicians - how many observations do we need to draw conclusions based on statistics? thirty? And if we only have 3?

Learning to correctly understand the information provided is a separate task. For example, in the years of stagnation in the economy, when investment opportunities are not particularly visible, the high result of a certain fund leads to its popularity. Knowing the features of the work of pension funds, it can be assumed that this yield is most likely caused simply by the fact that the fund invests, for example, in profitable (risky) bonds, which are actually the best investment in the current economic situation. The problem is that very soon the conditions will change (they tend to change), investments in those bonds will become far from adequate, and then this fund can move from the top of the ranking to the bottom.

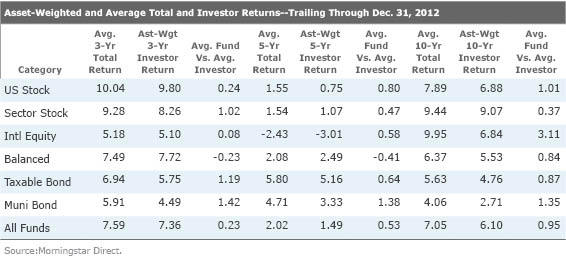

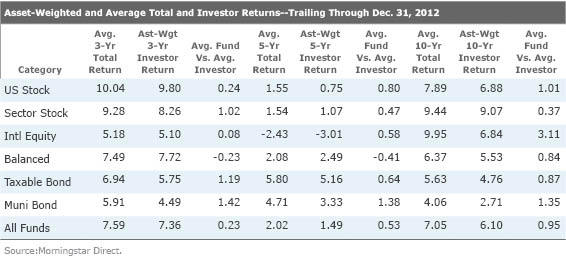

What is the focus on the recent performance of the foundation, in detail illustrates the agency MorningStar:

')

In this table, three columns show the average annual yield of funds and the profitability of investors of this fund for periods of 3, 5 and 10 years. Every third column of numbers is the difference between the results of the funds and the results of their investors. Horizontally, the rows indicate the assets in which the funds specialize. Please note that investors consistently manage to get results worse than the very funds in which they invest! It is because of the orientation to past results.

The second important point - the investors of the “balanced” funds in the interval of 3 and 5 years managed to surpass the results of their funds :) This is very significant in the context of the topic of asset allocation ...

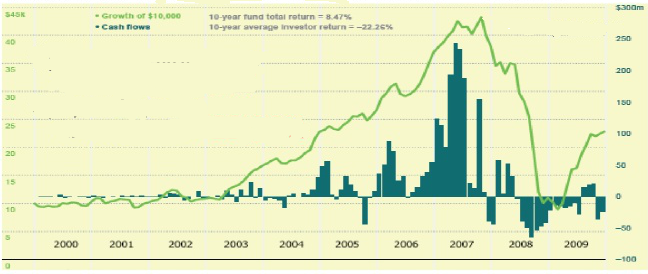

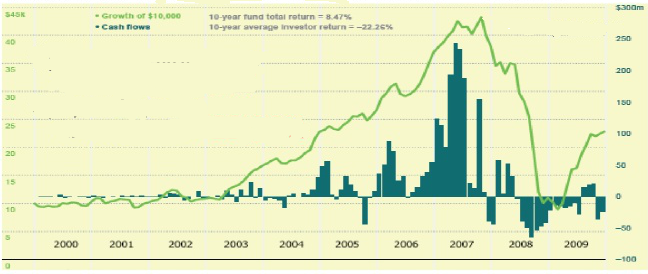

In addition, Morningstar illustrates what exactly happens to investors:

Dark bars are the inflow / outflow of funds into investment funds, the Green Line is the dynamics of the initial hypothetical investment of 10 thousand dollars. Despite the fact that for 10 years, investment funds earned more than 8% per year, investors managed to lose more than 22% of funds per year on average.

Due to the fact that the inflow of investments in funds increased at the highs of growth, and vice versa, investors took away funds for drawdowns, which turned out to be temporary. Those. investors bought the higher-priced units of funds at maximum prices and got rid of those that fell at the lowest prices. Rebalancing implies the opposite effect ...

To interpret this data can be different. It seems to me personally that financial markets (as well as the economy) are switching between different modes of operation, which somewhat helps investors in balanced funds, but greatly hinders those who are trying to adjust to the “last year’s snow”.

Learning to correctly understand the information provided is a separate task. For example, in the years of stagnation in the economy, when investment opportunities are not particularly visible, the high result of a certain fund leads to its popularity. Knowing the features of the work of pension funds, it can be assumed that this yield is most likely caused simply by the fact that the fund invests, for example, in profitable (risky) bonds, which are actually the best investment in the current economic situation. The problem is that very soon the conditions will change (they tend to change), investments in those bonds will become far from adequate, and then this fund can move from the top of the ranking to the bottom.

What is the focus on the recent performance of the foundation, in detail illustrates the agency MorningStar:

')

In this table, three columns show the average annual yield of funds and the profitability of investors of this fund for periods of 3, 5 and 10 years. Every third column of numbers is the difference between the results of the funds and the results of their investors. Horizontally, the rows indicate the assets in which the funds specialize. Please note that investors consistently manage to get results worse than the very funds in which they invest! It is because of the orientation to past results.

The second important point - the investors of the “balanced” funds in the interval of 3 and 5 years managed to surpass the results of their funds :) This is very significant in the context of the topic of asset allocation ...

In addition, Morningstar illustrates what exactly happens to investors:

Dark bars are the inflow / outflow of funds into investment funds, the Green Line is the dynamics of the initial hypothetical investment of 10 thousand dollars. Despite the fact that for 10 years, investment funds earned more than 8% per year, investors managed to lose more than 22% of funds per year on average.

Due to the fact that the inflow of investments in funds increased at the highs of growth, and vice versa, investors took away funds for drawdowns, which turned out to be temporary. Those. investors bought the higher-priced units of funds at maximum prices and got rid of those that fell at the lowest prices. Rebalancing implies the opposite effect ...

To interpret this data can be different. It seems to me personally that financial markets (as well as the economy) are switching between different modes of operation, which somewhat helps investors in balanced funds, but greatly hinders those who are trying to adjust to the “last year’s snow”.

Source: https://habr.com/ru/post/232141/

All Articles