Stock market and saving finances: How to buy gold bars

In our blog, we have already discussed the issues of saving savings (in particular, in relation to IT specialists ) and considered the possibilities that the stock market can offer in this regard in comparison with the usual banks. Today we would like to highlight in more detail one of the most popular ways of preserving capital in the history of mankind - the purchase of precious metals.

What is it about?

Since the fall of 2013, precious metals trading has been available on the main Russian stock exchange, the Moscow Stock Exchange. Anyone who has opened a special account in a brokerage company accredited to work in this "metal" market can buy and sell non-cash gold and silver.

')

How it works?

In order to carry out operations with precious metals, the broker gets the client a corresponding "metal" account on the stock exchange, after which he can buy and sell metals (the price is formed per gram, the standard lot is 10g of gold and 100g of silver).

Currently, only four brokerage companies in Russia provide clients with access to trading in precious metals - one of them is ITinvest (you can open an account for buying gold and silver on the company's website).

Those who want to buy gold or silver in the stock market, can participate in the auction, which take place daily from 10:00 to 23:50 Moscow time. Gold is designated in the trading terminal as GLDRUB, and silver SLVRUB - the purchase of metals is carried out in rubles.

Where is gold (and silver) stored

To participate in the auction, customers open anonymous metal accounts at the National Clearing Center (NCC), which are used to account for operations on precious metals.

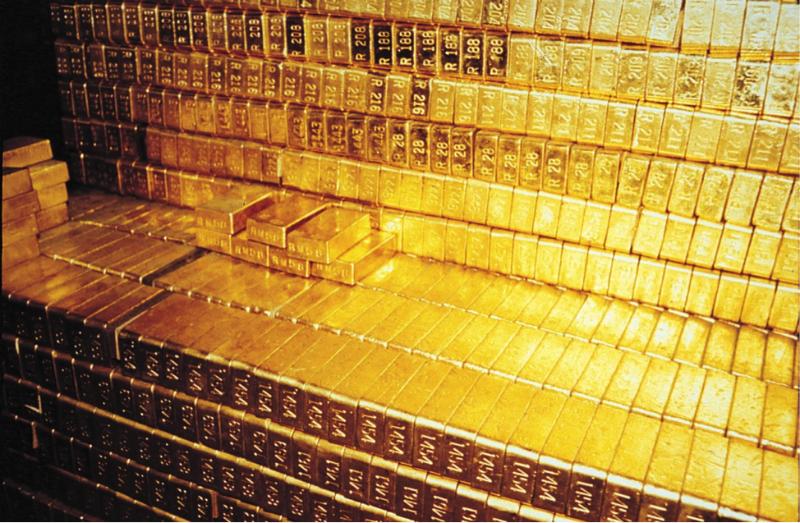

The account of the amount of gold or silver that belongs to a particular investor is maintained by the National Settlement Depository of Ukraine (National Accounting Depository). And the metal itself is stored in the central vault of the Bank of Russia (here is its location on the map ) or the vault of the NCC.

By prior agreement, you can organize the procedure for "removing" the metal, that is, removing it from storage - a commission in the amount of 0.05% of the value of the gold bar and 0.25% of the value of the silver bar is charged for this operation.

findings

Precious metals can be another tool for working in the stock market, along with traditional stocks and derivatives ( futures and options ). Precious metals can be not only sent to the repository, but also used as collateral for trading. In addition, the Moscow Exchange market allows, waiting for a bargain price, to buy and sell gold and silver in a couple of clicks in the trading terminal, whereas in everyday life it is a rather complicated and slow procedure - you need to issue a lot of papers, and only after that the owner can pick up his ingots from storage.

Of course, investing in precious metals with the help of the Moscow Stock Exchange is unlikely to be the main way to increase the population’s capital, however, in a situation where licenses continue to be withdrawn from an increasing number of banks and exchange rates “ jump ” depending on the political situation, it is obviously worth thinking diversification of their investments.

PS For those who are interested in the stock market and want to test themselves, we have a special competition “League of Traders” (and “Test League of Traders”, where trading is virtual money) during which stock traders compete and compare the results of their trading. Most recently, we have summed up the results of the next season, announced the winners and told about the innovations in the rules.

Posts and related links:

Source: https://habr.com/ru/post/228347/

All Articles