Brave new world: mobile operators, as the largest providers of advertising data

Information about customers, which is available to mobile operators, exceeds in volume and quality everything that other representatives of the IT industry can receive. Operators know the demographics of a person, his approximate income level, his place of residence, features of the use of the mobile Internet and to whom he is calling. At the moment, this information is stored “inside” of each telecom company, but it may happen that this data will become a new source of profit for them - the advertising industry players are willing to pay huge amounts of money for them.

Information about customers, which is available to mobile operators, exceeds in volume and quality everything that other representatives of the IT industry can receive. Operators know the demographics of a person, his approximate income level, his place of residence, features of the use of the mobile Internet and to whom he is calling. At the moment, this information is stored “inside” of each telecom company, but it may happen that this data will become a new source of profit for them - the advertising industry players are willing to pay huge amounts of money for them.This is because the collection of statistics on mobile users (which is becoming more and more - some people spend more time on the network through a smartphone than through a computer) is hampered by the problem with cookies. On desktop computers, they use the Internet through a browser in which there are cookies, but in a mobile environment most of the use falls on applications that do not use them. Therefore, advertisers are extremely interested in using data from mobile operators - this would allow an increase in the accuracy and efficiency of mobile advertising by an order of magnitude.

Today we will talk about how and what can change for network users and business representatives, if the data of mobile operators will indeed be revealed to advertisers.

')

What data do operators have?

Mobile operators have more data on user behavior than most other organizations in the IT industry. They receive it from contracts paid by users, in addition, they have access to information about people's calls, as well as which applications and in which situations they use, are known to operators and the place of residence of the subscriber.

For example, a young man who recently graduated from a university can, at a bargain price, buy an iPhone at the operator’s store, complete with a tariff plan. The agreement may well be a clause that he is not opposed to anonymization and processing of their data for marketing purposes. Then this subscriber downloads mobile applications, sends email messages and visits websites on the Internet. He visits Facebook a couple of times a day, uses Yandex cards to find the right place in the city — for example, the offices of companies, because he recently graduated from the university and actively attends interviews.

Here is what data an operator can collect about such a user:

- Use: visited sites, calls and messages (including the type of messages and their frequency);

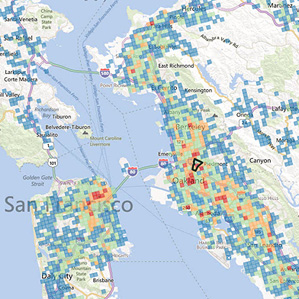

- Geography: where the mobile device is located at a specific moment (the level of accuracy may vary from area to area);

- Demographics: household income, number and age of children living;

- Income level: tariff plan, payment history, shopping pattern;

- Multiplatform: using data on different devices and types of network connection (3G, WiFi, etc.).

And the number of customers of large market players suggests that, if desired, they could become the largest data providers for advertising.

However, until this happens, advertisers and owners of Internet resources can use data from various sources to monetize their mobile traffic, choosing the most effective ones for a particular situation. A / B testing of advertising networks (for example, Advertone ) solves such problems .

Use in advertising

Operators can not only sell “raw” data, but also personally analyze them, identifying various dependencies and patterns of behavior of people, and already sell this information to marketers, advertising agencies and advertising platforms.

For example, such companies may collect data about the time of day at a certain place in the city there are most people - from this, in turn, can be compared with information about the interests of users for a more effective location of outdoor advertising, including near highways .

Working with a mobile audience is still the weak point of most advertising platforms, and mobile operators could solve this problem. If they reveal information about the applications launched by subscribers, browsers used and online purchase histories, advertisers could adjust their advertising campaigns, targeting more promising potential customers.

In the case of the implementation of the scenario described above, operators can become a serious player in the advertising market, and can seriously compete with existing DMP and DSP data more accurately than no one else has.

Situation in the world

In fact, the future time used above in the topic is rather arbitrary - in the US market (and Europe), cellular operators have long since come close to a new business line.

One of the first forces in advertising was tried by AT & T. In 2011, the operator launched the AdWorkds division, through which advertisers could access data (the so-called “advertising inventory”) of users. A large-scale advertising campaign with the participation of Foursquare and the Levi's brand was also launched, the goal of which was to attract customers to offline stores by displaying 10 billion mobile advertising banners aimed at users selected by analyzing mobile data from AT & T. In May 2013, AdWorks launched the Blueprint platform, through which advertisers could access anonymized data for 70 million users to target advertising campaigns on the web, mobile and on TV.

Five months later, the AdWorks direction was quietly minimized, but the process of transition of cellular operators to a new type of business was already unstoppable.

In October 2012, another operator, Verizon, announced the launch of the Precision Market Insights initiative. As part of the program, advertisers could access mobile user data to increase the effectiveness of outdoor and online advertising. Verizon stated that user data will be transmitted for analysis to marketers only with their consent - the same clause in the example of a university graduate contract in several paragraphs above. In addition, the venture unit of Verizon Ventures invested $ 1.5 million in the development of a startup Run, which is developing a system for advertising procurement and analytics.

The launch of its own advertising exchange in April 2014 was announced by the Spanish telecom operator Telefónica. The company has joined forces with the investment company Blackstone and bought the technology of the bankrupt MobClix exchange. As a result, Axonix was created, which will act as an intermediary between advertisers and Internet sites around the world, with the United States, Europe and Latin America being the key markets.

The company plans to provide data on the age, field and location of 330 million Telefónica customers from around the world to advertisers who can use them to more accurately target their advertisements for mobile device users.

According to Akshay Sharma, director of research for Gartner Research’s Carrier Network Infrastructure organization, mobile operators can identify the smartphone owner with far more accuracy than the current mobile advertising market leaders Google and Facebook - for example, they determine where they are up to 15 meters.

Google understands the risk, so last year the company entered into an agreement with the mobile operator Orange, according to which he transferred some of his data to Google.

As you can see, in the USA and Europe, operators are increasingly beginning to explore a new market for selling advertising data. In Russia, too, the first movements in this area are beginning - on Habré they already wrote that one of the advertising services offered Internet providers a new source of income through the introduction of DPI traffic control and management systems (Deep Packet Inspection).

Such systems can track any unencrypted user traffic. With the help of DPI, operators can enter new tariff plans - for example, make free access to their own sites or significantly reduce the speed of access to the network for users who have exhausted the daily traffic limit. DPI in Russia is already using Megafon (since 2009 - hereinafter according to Vedomosti), MTS (since 2010) and VimpelCom (since 2010).

Perspectives

On the way of providers who decided to start selling data for advertising purposes, there is not only user dissatisfaction (after Snowden’s revelations, few people are glad to spread information about themselves, even if impersonal), but in some cases, the laws of various countries. Another risk is user data leakage. In the process of buying data, several counterparties are involved, some of which are protected from hacker attacks far worse than telecom operators, for whom this is vital.

Otherwise, the prospects for the development of cooperation of operators with advertisers is limited only by the desire of the first to engage in building a new business line. According to eMarketer, in 2014 the mobile advertising market in the world will reach $ 31 billion, and according to ZenithOptimedia estimates, by 2016 this figure could reach $ 45 billion. As you can see, the volume of the mobile advertising market is growing so rapidly that it will be difficult for operators to ignore it .

Source: https://habr.com/ru/post/227257/

All Articles