Stock Market Toolkit: What are Options and How Do They Work?

In the previous materials of our blog, the topic of derivative financial instruments ( derivatives ) has been repeatedly raised; several topics were also devoted to futures exchange contracts (for example, one and two ). Futures today are one of the main financial instruments in the derivatives market, however, business is not limited to them, and modern exchange platforms cannot be imagined without option contracts. Today it will be about them.

Option History

The roots of modern options go back to the times of ancient Greece. One of the first references to the use of options is found in the work of Aristotle, who describes an example of successful speculation carried out by another philosopher, Thales. He wanted to prove that, despite poverty, a philosopher can easily make money with the help of the mind, he is simply not very interested in financial gain.

')

Thales, thanks to his knowledge of meteorology, suggested that the harvest of olives next summer will be rich. Having a certain amount of money (very small), he rented presses to extract oil from their owners in the cities of Miletus and Chios , who were not at all sure that their services would be in demand at that time - that is, Thales acquired the right to use the press in the future. , but if I didn’t want it, I couldn’t do this if I lost the money paid.

When the summer came and the olive harvest really turned out to be rich, Thales was able to make good money on granting the right to use the rented presses to anyone.

The authenticity of this story is questioned by some researchers (Thales’s ability to predict the olive harvest for half a year ahead causes especially many questions), the description of the details of the transaction itself is not clear, but it is often compared with the modern concept of the put option (put option — more about it further ).

Another example of the use of options in ancient times is contained in the Bible - according to the plot Laban offered Jacob the right to marry his youngest daughter Rachel in exchange for seven years of service. This example illustrates the risk faced by options traders in the early stages of the development of this financial instrument - the likelihood of failure of one of the parties to fulfill obligations. As it is known, after 7 years, Laban refused to give Rachel for Jacob, asking him to marry his other daughter.

As in the case of futures, options came into circulation due to the fact that farmers had to protect themselves from losses due to poor harvests, and resellers of goods could save money with such contracts (with good luck).

The evolution of trade relations led to the emergence of stock exchanges and speculative asset trading on them - in the Middle Ages, stock exchanges appeared both in Europe (for example, in Antwerp) and in Asia - for example, the Dojima rice market in Osaka.

A famous example of the use of options and futures is the period of the so-called tulip mania in Holland of the 1630s. Then the demand for tulip bulbs became very large and exceeded supply. Therefore, on the Amsterdam Stock Exchange, traders could enter into contracts for the purchase or sale of bulbs at a certain price - in the case of options, it was precisely the right, not the obligation, that characterized futures. When the agreed date comes, the buyer / seller could use his right to buy or sell at the agreed price, and he could change his mind without taking any action.

The next stage in the development of options was the appearance of similar contracts for shares on the London Stock Exchange in the 1920s (although the first option contract for goods was concluded on this stock exchange at the end of the 17th century). The volume of options trades for that period was quite small, and in the United States at the end of the century such operations were generally prohibited on some exchanges.

Until 1973, options trading was conducted in very small volumes (although some speculators like Jesse Livermore tried to cash in on them). This year, the Chicago Options Exchange CBOE was founded, on which active trading in this financial instrument began. The exchange launched a standardized trade in option contracts. Helped the development of this type of trade and the US government, allowing banks and insurance companies to include options in their investment portfolios.

What is a modern option

At the moment, an option means the right to buy or sell a certain asset (it is called basic) in the future at a certain price. It looks like the futures we examined in one of the previous materials, with one difference - futures is an obligation to make a deal within a specified period at an agreed price, and an option is a right. The buyer of the option may use his right to buy or sell an asset, or he may not. Therefore, compared to futures, options are a non-linear tool that allows stock traders to implement flexible strategies.

Like futures, options are traded on the stock exchange - usually in the same sections (on the Moscow stock exchange, this is the derivatives market ). As an underlying asset, options are usually used the same assets as futures. In addition, the underlying asset of the option may be futures itself.

Similarly with futures, the option has a date of execution (expiration). By the method of execution options are divided into American and European. American can be executed at any time before the expiration date, and European only strictly on this date.

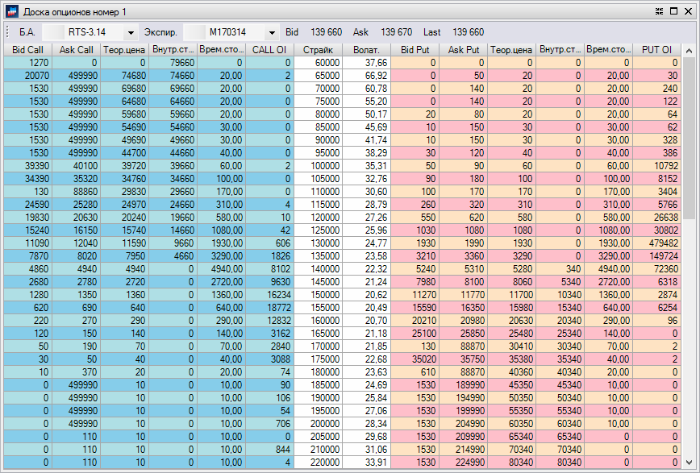

For the convenience of displaying all options parameters, they are usually traded using a special interface in the terminal, which is called an option board.

SmartX Terminal Option Board

How it works

Options are of two types - call (call option) and put (put option). Buyers of call options (also called holders) acquire the right to buy the underlying asset in the future at a certain price - it is called the strike price. Accordingly, call option sellers (or subscribers) sell such a right to the buyer for a certain amount of money, called option premium. If the buyer decides to exercise his right, the seller will be obliged to deliver the underlying asset to him at a predetermined price, receiving money in return.

In the case of a put option, the holder, on the contrary, acquires the right to sell the underlying asset in the future at a certain price, and the seller, accordingly, sells the right to the buyer for money. If the buyer further decides to exercise his right, the seller of the put option will be obliged to accept the underlying asset from him and pay the agreed amount for it.

It turns out that for the same underlying asset with the same maturity four transactions can be concluded:

- Buy the right to purchase an asset;

- Sell the right to buy an asset;

- Buy the right to sell an asset;

- Sell the right to sell an asset.

If by the time of expiration date the market price of the underlying asset increases (P> P), then the call buyer’s income will be:

Ds = (-) -,

where P is the market price of the asset at the expiration date of the contract, P is the price of the asset designated in the contract, strike price or strike price, K is the number of assets under the contract, C is the purchase price of the option (option premium).

If, by the time the contract is completed, the market value has decreased (P <P), then the option owner will refuse to buy assets and lose an amount equal to the option price: DS = -C.

We illustrate by example. Suppose an investor wants to conclude an put-type option contract for the sale of 100 shares of any issuer at a price of 100 rubles per piece after six months, given that the current value of the asset is 120 rubles. An investor, buying an option, expects the stock price to fall in the next 6 months, the seller of the option, on the contrary, hopes that the price will at least not fall below 100 rubles.

Here the seller of the option (subscriber) is more at risk - if the stock price falls below 100 rubles, he will have to buy an asset for 100 rubles, although the actual price in the market may already be lower. The option buyer’s income will be even greater, since he buys cheap stocks on the market and sells them at a predetermined higher price — and the other side of the deal will have to buy them from him.

As in the case of futures, the exchange acts as an intermediary and guarantor of the parties to the transaction, which blocks the guarantee deposits on the seller’s and buyer’s accounts, thus guaranteeing the fulfillment of the agreed conditions.

Why do we need options

Options are used both to extract profits from speculative operations and to hedge risks. They allow the investor to limit the risk of financial losses only to a certain amount that he pays for the option. At the same time, the profit can be any. This favorably distinguishes options from futures, where, regardless of whether the investor’s assumptions about market conditions are true, he is obliged to make a deal on the agreed terms on a specified day.

Options are a risky type of investment, but their plus is that the risk is known in advance - the investor risks losing only the price of the option.

Due to this particularity, options are very popular with speculators (who bring liquidity to the market, which we wrote about in our previous materials), and investors get a flexible tool for building complex trading strategies.

Options have come a long way hundreds of years. Having originated in a world that was not at all similar to the present, they were modified in order to solve the tasks of modern investors and traders. Now, thanks to the flexibility and the possibility of obtaining acceptable results, this financial instrument is at the peak of popularity, and its use is constantly growing.

Articles and related links:

Source: https://habr.com/ru/post/226829/

All Articles