Easy integration of P2P service transfers to the site and in the application

The emergence of card-to-card transfer services has led to an explosive growth of P2P payments and the development of services that use the possibilities of collective financing. According to Alfa-Bank, the leader of P2P transfers in Russia, the total amount of urgent money transfers from card to card increased in 2013 compared with the corresponding period of 2012 by 385% in ruble terms. The number of transfers increased by 250%.

A year ago, Habré already compared P2P money transfer services from card to card Visa and MasterCard . The post was considered and P2P service PayOnline. Today, we are introducing this service in a new format to the habrasoobschestvu: free and free, available for integration into third-party sites and mobile applications.

With it, you can easily give users the ability to send money to each other, you can accept payments to your card without sending your data to anyone, you can earn a commission. Details - under the cut.

The card-to-card transfer service was launched in 2013 for the participants of the customer loyalty program of the processing center. Within six months, without any additional PR and promotion, bank card holders who made purchases at online stores accepting payments through PayOnline and those who learned about the service through word of mouth of social networks and Internet resources began to use the service massively. including Habra. Users were attracted by the ability to make transfers between cards issued by any issuing banks, and an adequate commission rate.

In parallel with this, requests for the integration of the service into mobile and web services for collective financing and collective lending began to be received. It was there that P2P services turned out to be the most demanded. Now we have decided to release our free floating P2P service and give developers the opportunity to tailor it to their needs. The first users of the service were the FriendsMoney application, which allows you to borrow money from a friend or lend him money bypassing banks, and the BezBank virtual financial platform.

In standard practice, to complete a transfer, it is necessary to enter the data of the sender’s bank cards (in full) and the recipient (number only). And such data can be entered only on secure payment pages of sites that are certified PCI DSS, and applications that are certified according to the PA DSS standard. But with the advent of our P2P service, the problem of having a certificate has become irrelevant. P2P transfer service can be implemented on any website, and payment data will be processed in the processing center.

And for those who do not own a security certificate, we implement a simple card binding scheme. A user who wants to make a transfer must go to the PayOnline page once to link his card to the account on your resource: after that he is assigned a unique RebillAnchore. This is the procedure for binding a bank card.

')

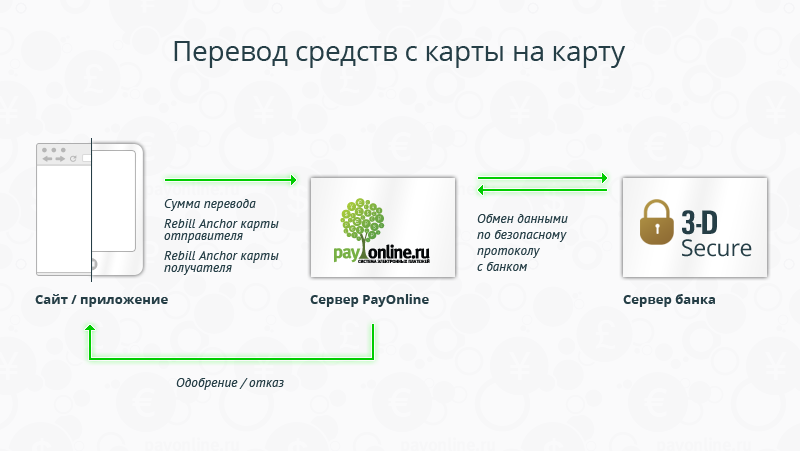

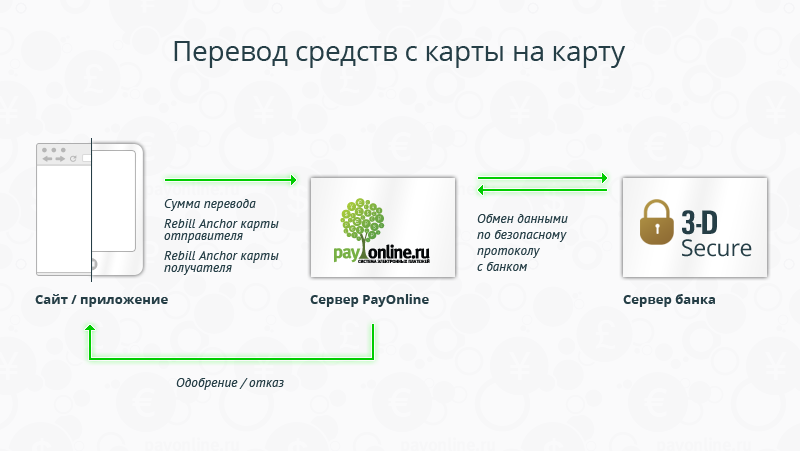

To make further transfers, the user will not need to go to the secure page of the processing center and re-enter the card data. From the user's point of view, the translation will take place directly between the users of the site or application. And already the card will be “tied” to the accounts on the side of the processing center. This is the procedure for making a transfer between two “linked” cards.

The user making the transfer will only need to be verified using 3-D Secure. It is worth noting that only a card subscribed to the 3-D Secure protocol can be linked to an account.

Everything is simple here. You want to receive transfers to your card: from customers, friends, partners who sympathize with your work, etc. You link your card and give site users the opportunity to make transfers to it. For the transfer of the system will be charged 1.5% + 20 rubles. We remind you: the card with which the transfer is made must be signed with 3D-Secure.

We also want to draw attention to the fact that entrepreneurial activity in Russia is subject to taxation. And according to the law, it is impossible to provide services and sell goods without paying taxes. And the receipt of transfers to the card is not taxed, therefore, we should note that the receipt of commercial payments to the card is illegitimate.

There are many reasons why people transfer money to each other, even if you exclude commercial relations. We send money to parents and children, "throw off" for gifts and trips, borrow to our friends until the salary, etc.

Having created a card-to-card transfer service on a website or in an application, you will provide users with a convenient tool that will not only increase the usefulness of the resource, but also give users a reason to return to it again and again. All questions on transfers that may arise from users of a P2P service will not be asked to you, but to specialists of the round-the-clock support service of the processing center.

Collective financing and collective lending - that is the name of modern “bank killers”. One of the first customers to use our P2P service was the developer of a mobile application that allows “friends” from social networks to borrow each other at arbitrary interest rates.

Only legal entities, including individual entrepreneurs, can earn on P2P transfers. By giving your users the ability to make P2P transfers, you can appoint your agent commission.

There are limitations on the minimum amount of commission and the standard scheme for calculating the agency commission. The minimum commission rate at the exit (minimum sell rate) should not be less than 1.5% + 20 rubles for one transfer. The service sells agents a commission for 1.3% + 20 rubles (buy rate). The agent's earnings are [(sell rate - buy rate) / 2].

You can get technical documentation and discuss the details of the implementation of the P2P translation service by submitting an application on the website of our processing center or by contacting specialists by phone. After submitting your application, you will receive a personal identifier, technical documentation and access to the "Personal Account", where you can track translations made on the website or in the application.

If the developer plans to make money on the service, he will need a legal entity to enter into an agency agreement with the processing center.

In the comments to the post we will answer all questions, take into account the comments and suggestions: we are ready for a constructive dialogue :)

A year ago, Habré already compared P2P money transfer services from card to card Visa and MasterCard . The post was considered and P2P service PayOnline. Today, we are introducing this service in a new format to the habrasoobschestvu: free and free, available for integration into third-party sites and mobile applications.

With it, you can easily give users the ability to send money to each other, you can accept payments to your card without sending your data to anyone, you can earn a commission. Details - under the cut.

Prehistory

The card-to-card transfer service was launched in 2013 for the participants of the customer loyalty program of the processing center. Within six months, without any additional PR and promotion, bank card holders who made purchases at online stores accepting payments through PayOnline and those who learned about the service through word of mouth of social networks and Internet resources began to use the service massively. including Habra. Users were attracted by the ability to make transfers between cards issued by any issuing banks, and an adequate commission rate.

In parallel with this, requests for the integration of the service into mobile and web services for collective financing and collective lending began to be received. It was there that P2P services turned out to be the most demanded. Now we have decided to release our free floating P2P service and give developers the opportunity to tailor it to their needs. The first users of the service were the FriendsMoney application, which allows you to borrow money from a friend or lend him money bypassing banks, and the BezBank virtual financial platform.

How it works

In standard practice, to complete a transfer, it is necessary to enter the data of the sender’s bank cards (in full) and the recipient (number only). And such data can be entered only on secure payment pages of sites that are certified PCI DSS, and applications that are certified according to the PA DSS standard. But with the advent of our P2P service, the problem of having a certificate has become irrelevant. P2P transfer service can be implemented on any website, and payment data will be processed in the processing center.

And for those who do not own a security certificate, we implement a simple card binding scheme. A user who wants to make a transfer must go to the PayOnline page once to link his card to the account on your resource: after that he is assigned a unique RebillAnchore. This is the procedure for binding a bank card.

')

To make further transfers, the user will not need to go to the secure page of the processing center and re-enter the card data. From the user's point of view, the translation will take place directly between the users of the site or application. And already the card will be “tied” to the accounts on the side of the processing center. This is the procedure for making a transfer between two “linked” cards.

The user making the transfer will only need to be verified using 3-D Secure. It is worth noting that only a card subscribed to the 3-D Secure protocol can be linked to an account.

The possibilities of using the service

- Get transfers to your card.

- Provide users of the site or application the ability to make transfers from card to card.

- Earn on user translations by adding your commission to the service commission.

Getting transfers to your card

Everything is simple here. You want to receive transfers to your card: from customers, friends, partners who sympathize with your work, etc. You link your card and give site users the opportunity to make transfers to it. For the transfer of the system will be charged 1.5% + 20 rubles. We remind you: the card with which the transfer is made must be signed with 3D-Secure.

We also want to draw attention to the fact that entrepreneurial activity in Russia is subject to taxation. And according to the law, it is impossible to provide services and sell goods without paying taxes. And the receipt of transfers to the card is not taxed, therefore, we should note that the receipt of commercial payments to the card is illegitimate.

Providing users with the ability to make P2P transfers

There are many reasons why people transfer money to each other, even if you exclude commercial relations. We send money to parents and children, "throw off" for gifts and trips, borrow to our friends until the salary, etc.

Having created a card-to-card transfer service on a website or in an application, you will provide users with a convenient tool that will not only increase the usefulness of the resource, but also give users a reason to return to it again and again. All questions on transfers that may arise from users of a P2P service will not be asked to you, but to specialists of the round-the-clock support service of the processing center.

Using P2P service to solve your business problems

Collective financing and collective lending - that is the name of modern “bank killers”. One of the first customers to use our P2P service was the developer of a mobile application that allows “friends” from social networks to borrow each other at arbitrary interest rates.

Only legal entities, including individual entrepreneurs, can earn on P2P transfers. By giving your users the ability to make P2P transfers, you can appoint your agent commission.

There are limitations on the minimum amount of commission and the standard scheme for calculating the agency commission. The minimum commission rate at the exit (minimum sell rate) should not be less than 1.5% + 20 rubles for one transfer. The service sells agents a commission for 1.3% + 20 rubles (buy rate). The agent's earnings are [(sell rate - buy rate) / 2].

Obtaining technical documentation, control and management of payments

You can get technical documentation and discuss the details of the implementation of the P2P translation service by submitting an application on the website of our processing center or by contacting specialists by phone. After submitting your application, you will receive a personal identifier, technical documentation and access to the "Personal Account", where you can track translations made on the website or in the application.

If the developer plans to make money on the service, he will need a legal entity to enter into an agency agreement with the processing center.

This is a brief description of our P2P service.

In the comments to the post we will answer all questions, take into account the comments and suggestions: we are ready for a constructive dialogue :)

Source: https://habr.com/ru/post/226647/

All Articles