A pianist in a brothel? How to explain this to the bank

No, I don’t have music education, just filling out an application for a credit card, I remembered an old joke about a programmer who couldn’t explain to his son by whom he works.

Recently, I decided to go with the times and get a real credit card. One snag is that I am officially an unemployed slacker, so there will not be many people willing to give me long.

')

Like many representatives of the

I am not officially employed anywhere, I am formally a drone and due to all the rules I must live for 101 km without any credit card. That is, it seemed that the bank would either not give me a card, or that it seemed even more real, the card would be issued, the cost of annual service would be written off, and I would know the size of the credit limit of 3,000 rubles later, when there was no way back.

The goal is to get a credit card with a decent limit and additional bonuses.

But as a real experimenter, I decided to go all the way and find out the truth. Card selection was short-lived. I am convinced that the best level of service for a person who is used to doing everything remotely, in our country, is provided by Tinkoff Bank (not advertising!). I already had the experience of opening a debit card with them, and a couple of times I called them to the contact center with different current questions, moreover, I even once tried to do something unusual - I asked the bank for a certificate of my account status to apply for a visa to the embassy one beautiful country. And all these my requests were basically quickly and efficiently resolved, even the blue stamp certificate was sent to me by mail. However, when she arrived, I no longer needed her, but then I blame rather the Post of Russia and my hindsight.

So, TCS OneTwoTrip and TCS All Airlines hit the short list of cards (there is a comparison of the cards here ). First, from 2 to 5%, the money spent can be spent on air tickets. Secondly, these cards are positioned by the bank as cards for good

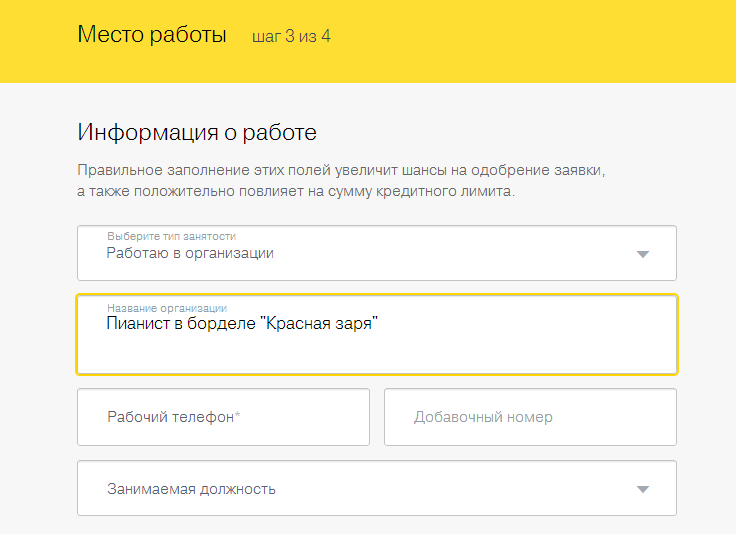

With these thoughts, I filled out a form on the site. I was a little upset that I had to enter passport data - I hate all these unit codes, it immediately smells like the passport desk or the police. True to the credit of the bank, it can be said that their input form is excellent. I will take an example from them.

By the way, they still need a landline phone. So, if you are working from your yacht in the Mediterranean, then you will have to specify the phone of your cousin aunt. And later, when communicating with the bank operator, I was asked to indicate one more contact number, so it’s good to have two aunt.

Borrower's portrait

I appreciate myself through the eyes of the bank:

- I am 32 years old, married and not officially employed.

- In the online questionnaire, I just indicated that I have my own business. From intimate details, only the monthly personal income was asked (aka salary). When communicating by phone with a bank specialist, I clarified that I was engaged in Internet business and investment. These words turned out to be enough for them; I was not drawn into the discussion of the prospects of the NASDAQ.

- I already have a Tinkoff Black debit card for a year and keep on deposit a minimum amount of 30 tr., Which allows you not to pay for annual maintenance. I don’t make almost all the revolutions on the card. Initially, there was a desire to use the map to build the TCS ladders, but it immediately became lazy and I never built any ladders.

- I have a repaid mortgage in 2007 in Sberbank. I don’t know if there were credit bureaus in those dark times, but if so, then I’m a good borrower, because I took out a loan and carefully paid it back (even much faster than the schedule).

We are waiting for a decision

After a minute or two, a letter came to the box that my application was accepted for consideration and the decision would be made within 1-2 days. I was a little upset here, I thought that a positive decision would have been taken right away, and so it would most likely be refused. About the same SMS came to the phone.

During the day I was really called back and clarified some details. The main focus of the operator was focused on the correctness of addresses, passport data, phones. They also called my mother-in-law — I indicated her phone as stationary — and asked if I was a good person.

And the next day they called me and said that the OneTwoTrip card was approved for me and I need to arrange delivery with the courier. In fact, I have already made a choice in favor of All Airlines after I had to hand over tickets through OneTwoTrip (tickets purchased on the Aeroflot website are much easier and more profitable to hand over tickets). It turned out that the bank overdid it a bit in an attempt to process an incomplete application. A couple of days before I started filling out the application for OneTwoTrip, I entered only the data of the 1st page, without even specifying the correct phone. The bank, apparently, in its customer base correctly linked this application to me, found the correct telephone and started this particular application.

In general, I asked the OneTwoTrip card not to deliver to me, but to make an All Airlines card. I was called a few more times, made a claim and eventually delivered the right card. It took about a week.

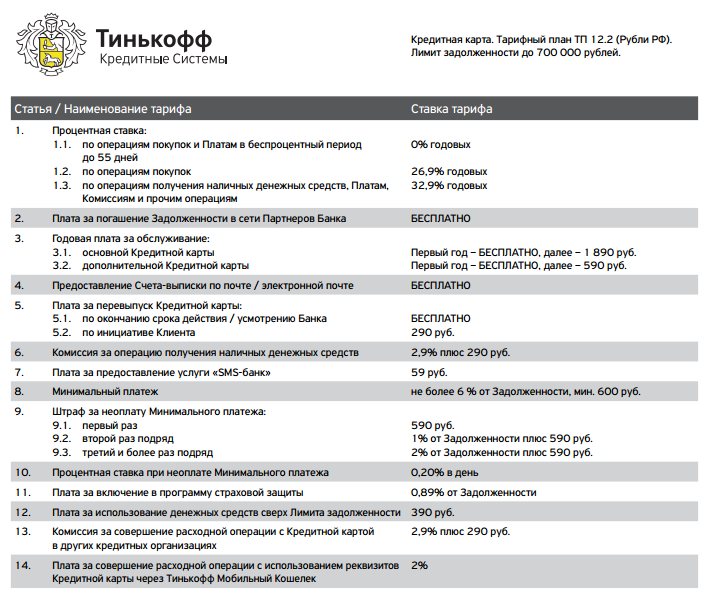

All this time I did not know what kind of credit limit and tariff plan in question - many of the parameters of the tariff plan are set individually and you learn about them only at the time of receiving the card.

I got the courier completely unstudied - it was one of the first days of his work at TKS. Together with the card, the employee handed me a piece of paper with a tariff. It was at that moment that I found out that the limit of 120 thousand rubles and Tadaam was approved for me !!! FREE SERVICE! True, only in the first year.

In fact, it was even better than I expected. Immediately refused SMS information and insurance. However, this can be done with the activation of the card and later in the Internet bank.

Life Hack - if you think you are good, but the bank does not know about it, just call the bank and ask you to remove the annual service on the card, it is likely that you will succeed. If the first year with free service comes to an end, call and say that you want to close the card due to expensive service. Again, it may be possible to save.

Taking the opportunity, the next day I ordered an additional card for my wife - if the main card has free maintenance, then the additional one will also be free. That means bonuses will accumulate faster.

Findings:

- Without a documented income and workbook, you can get a good credit card with a good limit.

- You can even get a nice gift in the form of free service.

Where did you get the cards? Did the credit limit please you? Share your experience in the comments - let's create together a database of banks loyal to self-employed and freelancers.

Source: https://habr.com/ru/post/225687/

All Articles