How to legalize income from Google AdSense for PI

Relatively recently, Google AdSense has a new payment method, namely, the transfer of funds to a currency account in USD. While this method is experimental and installed on request to the support service. It so happened that I became a participant in the experiment and talked about my experience of transferring money from Google directly to IP in Russia.

1. We register a USD currency account in our bank. For this you need to get an extract from the tax. Do not forget to notify the tax authority of the registration of currency accounts (current and transit).

2. We agree with Google on the possibility of connecting the method of transferring funds from Ireland directly to your account in Russia (it is better to learn about the possibilities for you before registering a currency account). We are connecting a new transfer method in the payment settings (on your own, most likely this will not work, I wrote to the support). And add the details ( FAK on bank transfer from Google ). We are waiting for the date of transfer.

')

3. Once you have received money from Google, you have 15 business days to transfer them from the transit currency account to the current currency account. I handed over all documents for currency control of my Avant-garde bank through the Internet bank and I did not even have to go anywhere. What exactly needs to be done in your bank is better to find out in advance by telephone from the currency control staff, mine helped me throughout the whole process, for which many thanks to them.

a) Certificate of currency transaction .

If your income exceeds $ 50,000, you will need to issue a passport transaction. In my case, the passport was not issued.

To help must provide:

- contract offer Google in pdf (we take from here the Russian version and save in pdf, in the Word did not accept currency control)

- screenshot of the receipt of funds transfer

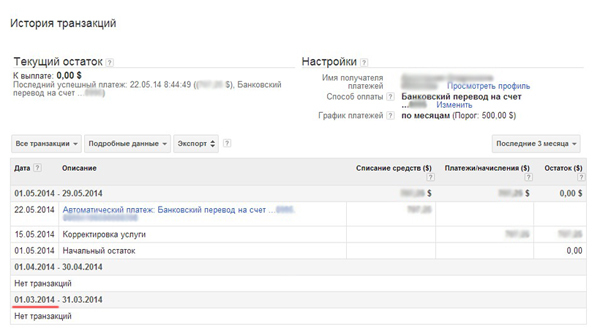

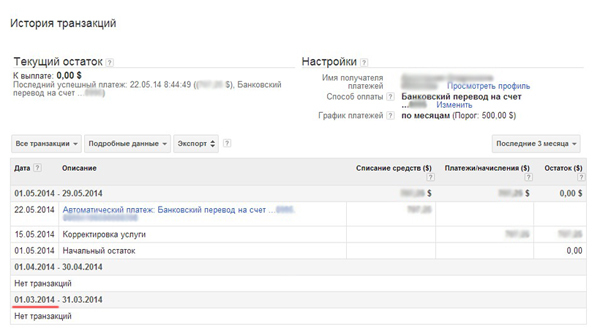

- screenshot of the interface where you can see the movement of funds and the date is desirable .

- A letter with a stamp in free form about the date of the agreement . - This is what Vanguard asked me to do.

For currency control of the bank

Annex to the public offer

Please consider the date of the agreement with Google Ireland ltd 03/01/2014. Separately attached are screenshots of the Google Adsense advertising system interface and a copy of the money transfer receipt.

From the first time the certificate did not pass, but my currency control called me and helped me figure it all out. They picked up the currency operation code 21500.

b) Document for domestic currency transfer .

Here we ask the bank to transfer money from the transit account to the current currency account on the basis of a certificate of a currency transaction.

Currency control asked to add the number and date of transfer.

Purpose of payment:

Transfer of funds from the transit account to the current one

Comment for currency control:

The certificate of currency operation No. 1 of 06/03/2014 was created. Translation notification number from 05.22.2014.

For individual entrepreneurs, the USN needs to pay only 6% of the amount of income, but the question was how much to pay.

Here the opinions of lawyers are divided. Some say it is necessary to pay upon the transfer to a transit one at the rate of the Central Bank, others upon the fact of transferring to the current one. Most insist on the amount of the transfer to the current and in general it is logical, because It was with the transfer to the current account that you received income. So, as soon as we have dealt with currency control, we go to the cbr.ru website, look at the USD rate at the date of receipt of the currency on the current account, count and get the amount from which the tax must be paid.

It is not necessary to pay any other taxes except for 6% for individual entrepreneurs - in this, all lawyers came to a common opinion. The only thing is if during the conversion the amount turned out to be greater than that which turned out for the tax, then again with the difference, you have to pay the tax, because you made a profit again.

The cost of converting to a ruble account and how to do it - you need to check with your bank.

In general, everything is not as difficult as it seems. Well, of all the legal ways this is the most profitable. For example, if you receive money as a physical person on Rapida, you must pay 13% of the income tax, which is already 2 times more. But again, everything depends on your earnings on the system and the ability to contain IP.

The main actions of IP for the transfer and legalization of income from Google

1. We register a USD currency account in our bank. For this you need to get an extract from the tax. Do not forget to notify the tax authority of the registration of currency accounts (current and transit).

2. We agree with Google on the possibility of connecting the method of transferring funds from Ireland directly to your account in Russia (it is better to learn about the possibilities for you before registering a currency account). We are connecting a new transfer method in the payment settings (on your own, most likely this will not work, I wrote to the support). And add the details ( FAK on bank transfer from Google ). We are waiting for the date of transfer.

')

3. Once you have received money from Google, you have 15 business days to transfer them from the transit currency account to the current currency account. I handed over all documents for currency control of my Avant-garde bank through the Internet bank and I did not even have to go anywhere. What exactly needs to be done in your bank is better to find out in advance by telephone from the currency control staff, mine helped me throughout the whole process, for which many thanks to them.

So, it was necessary to provide the bank

a) Certificate of currency transaction .

If your income exceeds $ 50,000, you will need to issue a passport transaction. In my case, the passport was not issued.

To help must provide:

- contract offer Google in pdf (we take from here the Russian version and save in pdf, in the Word did not accept currency control)

- screenshot of the receipt of funds transfer

- screenshot of the interface where you can see the movement of funds and the date is desirable .

- A letter with a stamp in free form about the date of the agreement . - This is what Vanguard asked me to do.

For currency control of the bank

Annex to the public offer

Please consider the date of the agreement with Google Ireland ltd 03/01/2014. Separately attached are screenshots of the Google Adsense advertising system interface and a copy of the money transfer receipt.

From the first time the certificate did not pass, but my currency control called me and helped me figure it all out. They picked up the currency operation code 21500.

b) Document for domestic currency transfer .

Here we ask the bank to transfer money from the transit account to the current currency account on the basis of a certificate of a currency transaction.

Currency control asked to add the number and date of transfer.

Purpose of payment:

Transfer of funds from the transit account to the current one

Comment for currency control:

The certificate of currency operation No. 1 of 06/03/2014 was created. Translation notification number from 05.22.2014.

We pay taxes

For individual entrepreneurs, the USN needs to pay only 6% of the amount of income, but the question was how much to pay.

Here the opinions of lawyers are divided. Some say it is necessary to pay upon the transfer to a transit one at the rate of the Central Bank, others upon the fact of transferring to the current one. Most insist on the amount of the transfer to the current and in general it is logical, because It was with the transfer to the current account that you received income. So, as soon as we have dealt with currency control, we go to the cbr.ru website, look at the USD rate at the date of receipt of the currency on the current account, count and get the amount from which the tax must be paid.

It is not necessary to pay any other taxes except for 6% for individual entrepreneurs - in this, all lawyers came to a common opinion. The only thing is if during the conversion the amount turned out to be greater than that which turned out for the tax, then again with the difference, you have to pay the tax, because you made a profit again.

The cost of converting to a ruble account and how to do it - you need to check with your bank.

In general, everything is not as difficult as it seems. Well, of all the legal ways this is the most profitable. For example, if you receive money as a physical person on Rapida, you must pay 13% of the income tax, which is already 2 times more. But again, everything depends on your earnings on the system and the ability to contain IP.

Source: https://habr.com/ru/post/225657/

All Articles