High-frequency trading and everything you need to know about it. Part 2 (final)

High-frequency traders can follow different strategies - active, passive or mixed.

Passive traders are trying to earn at the same time on the spread of purchase and sale prices of securities and rebates from trading platforms for attracting liquidity to them. Through their automated equipment, technology provided by trading floors, and statistical models, these brokers can simultaneously process orders for multiple securities. This strategy is usually called automatic liquidity attraction (the original name is Electronic Liquidity Provision or ELP), or rebate arbitrage (“rebate arbitrage”).

Passive strategies can also be peculiar detectors of market signals. For example, when the implementation of an ELP strategy causes a negative impact on it of prices, changing the current spread between the prices of the seller and the buyer, this may indicate the presence of a large order from an institutional investor in the market. Then the broker can use this information in transactions for their benefit.

In turn, active high-frequency brokers monitor the market for placing large orders, paying attention to the sequence in which calls are made to different trading platforms. As soon as a large order is noticed on the market, the broker makes the appropriate transactions, taking into account that this large order will be placed in the near future, and what consequences this entails. Then the broker forcibly closes its position as soon as it understands that a large order is placed. As a result, the broker benefits from the consequences of placing the noticed order. For an investor, the broker’s actions are undesirable, since they directly affect the results and efficiency of the investor’s activities, reducing its final arbitration.

')

The most advanced high-frequency brokers use self-learning algorithms and artificial intelligence techniques to consider market structure and capital flow data when looking for opportunities for arbitrage.

The widespread use of high-frequency trading methods also means that when placing orders, it is necessary to take into account the features of the order routing system (the original name is “smart order routing”), which takes into account such concepts as arbitration, based on the time lag between the actions of market participants, application size, etc.

For convenience, we more clearly illustrate this point below:

And we again return to the question - is it true that the essence of high-frequency trading is just a game of anticipating the events on the market (legal or not)?

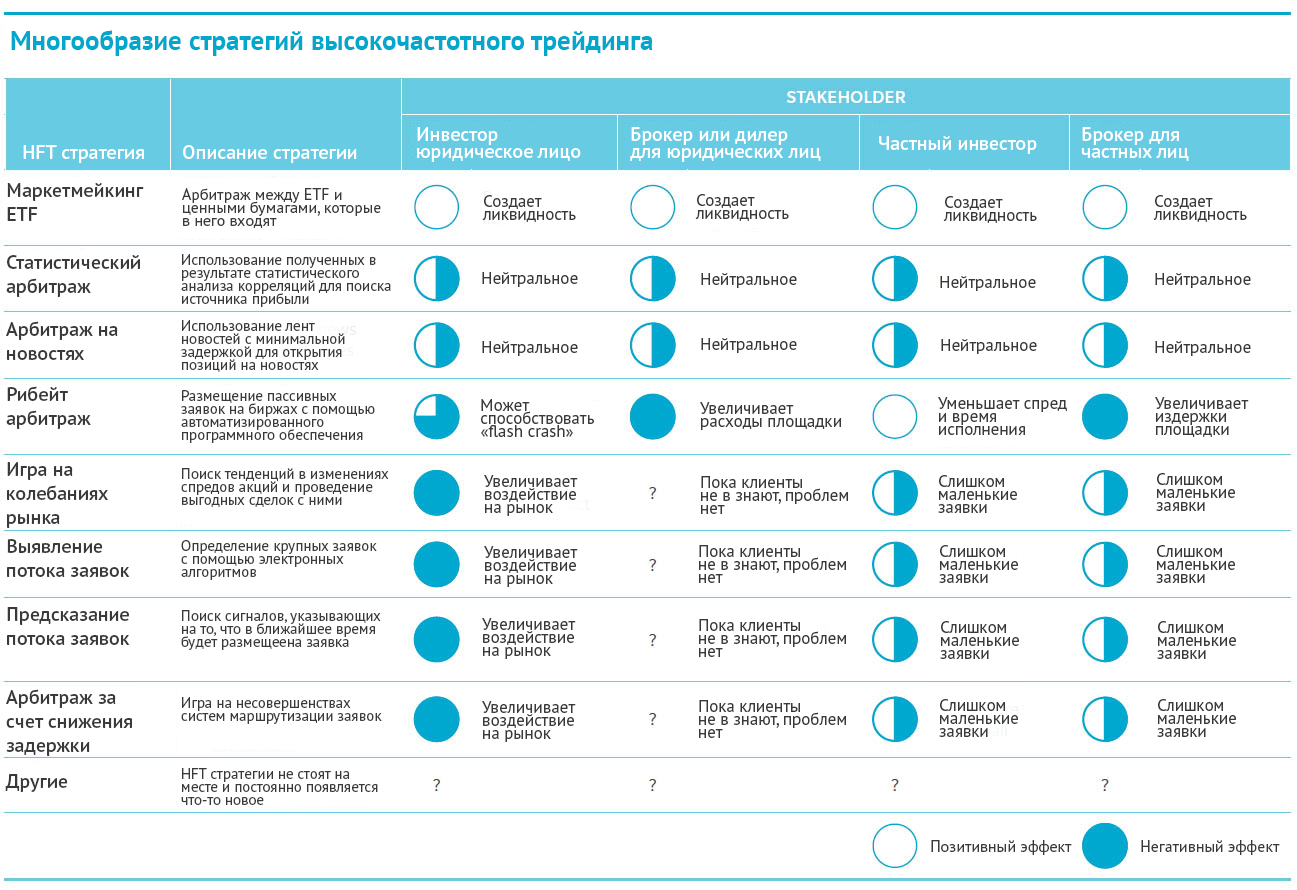

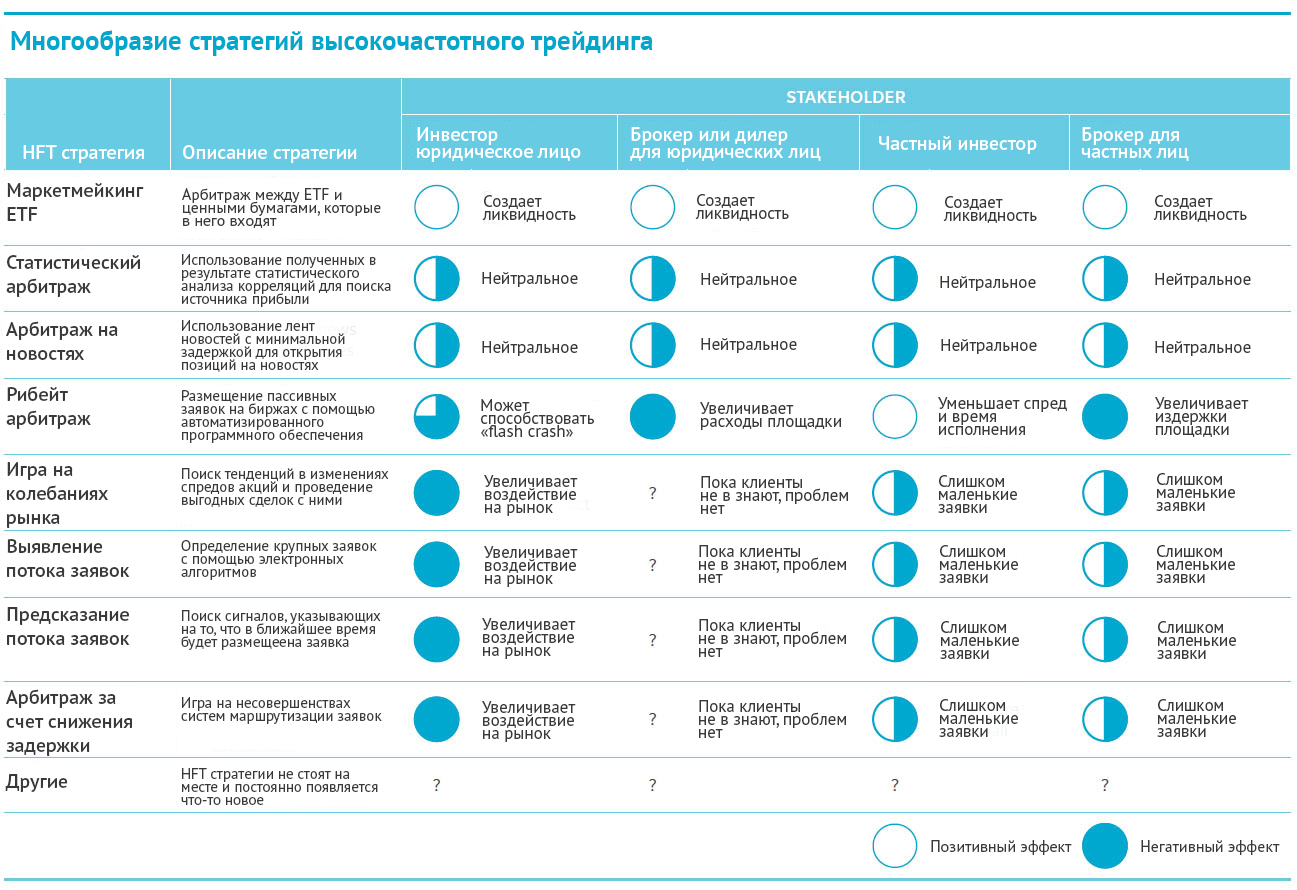

The answer to this question is negative (or at least not firmly positive). A complete list of HFT strategies, with an explanation of how each affects the different market players, is provided below. At least in theory, some of them are beneficial to small investors. However, it is quite a controversial question whether there are any small investors in the modern market, where the trading volume is reduced to the level of a decade ago, and frequency trading constitutes the main share of open trading.

And although in theory, frequency trading promises brokers benefits, history shows that its effects are almost exclusively negative. Even if we forget about the question of how ethical it is to play ahead, it is much more serious that high-frequency trading, without having this direct task, contributed to destabilization of trading floors and their susceptibility to unexpected and inexplicable collapses. We will not revert to the events of instantaneous market crash (also known as “Flash crash”) in May 2010 - recently the securities market has also repeatedly felt the detrimental effect of a fragmented, over-oriented environment on profit margins, prevailing on trading floors. In some cases, these events were the result of unpredictable interactions of trading algorithms; in others - the result of program failures or equipment overloads:

2012:

KNIGHT CAPITAL suffered losses of more than 450 million dollars as a result of a failure in trading programs

The problem caused the random placement of a number of incorrect orders on the New York Stock Exchange. Later, the US Securities and Exchange Commission began a formal investigation into the incident.

2013:

"GOLDMAN SACHS" lost tens of millions of dollars due to an error when buying options

Due to technical failures during the internal renewal of the trading system, a number of options were purchased on several American exchanges unplanned. And the prices for a number of orders were set by default and differed significantly from the market.

Presumably, losses from these operations amounted to tens of millions of dollars, although the company denied that they suffered any losses.

3-hour stop of trading on the NASDAQ due to connection problems

Representatives from NASDAQ reported that the exchange was experiencing technical problems with receiving bids from bidders. In addition, for a number of other messages, there was also a failure in the system for displaying data on changes in stock prices of companies hosted on NASDAQ.

Another NASDAQ trades stop for an hour due to data transfer problems.

Because of the problems that occurred, the NASDAQ composite index had to be frozen for about an hour to prevent losses, while the main trading was not affected, although it was necessary to suspend trading of some options linked to the index. According to the NASDAQ, the problems were due to human factors. Although there have been no losses on the market, this problem — far from being the first — causes serious concerns.

So, here we come to the culmination of a 50-year evolution in the securities market - namely, a shift in the investor-broker relationship.

Traditionally, investors made every effort to find opportunities for arbitrage, and brokers were required to find a source of liquidity - usually it was on the “over-the-counter” over-the-counter market or on the stock exchange. The exchange was actually a tool for consolidating liquidity. So, besides searching for arbitration, the investor had only one task left - to choose a broker with whom he will work. Now the search for arbitration is still in the priority of investors, but the trading process, in which they extract their arbitration, has become much more difficult.

Modern scenery in the field of securities trading is a highly fragmented market with profit-oriented trading platforms that actively fight each other for liquidity (which is primarily attracted to high-frequency traders).

The new environment puts brokers in a rather difficult position. On the one hand, they need to act in the interests of their clients and for their benefit. This obliges them to invest in new technologies to search for profitability and protection from high-frequency traders. In addition, since many trading platforms now pay rebate to players for attracting liquidity (as we have already said, they are mainly for high-frequency players), the payment of fees for withdrawing liquidity from the platform falls on our brokers.

And at the same time, customers are asking them to reduce the amount of paid commissions.

The tense situation of brokers becomes a source of their conflicts with clients. Of course, it is possible to reduce the size of trade commissions, their rates vary depending on the site - however, this option may not be the most profitable for an investor in terms of profit.

Sophisticated investors now require brokers with detailed information about what transactions are made for them to make sure that everything is at the highest level.

And this information is really useful for investors - now they can conduct a more comprehensive analysis of the effectiveness of their market activities, including evaluating and comparing the performance of the brokers themselves who work for them.

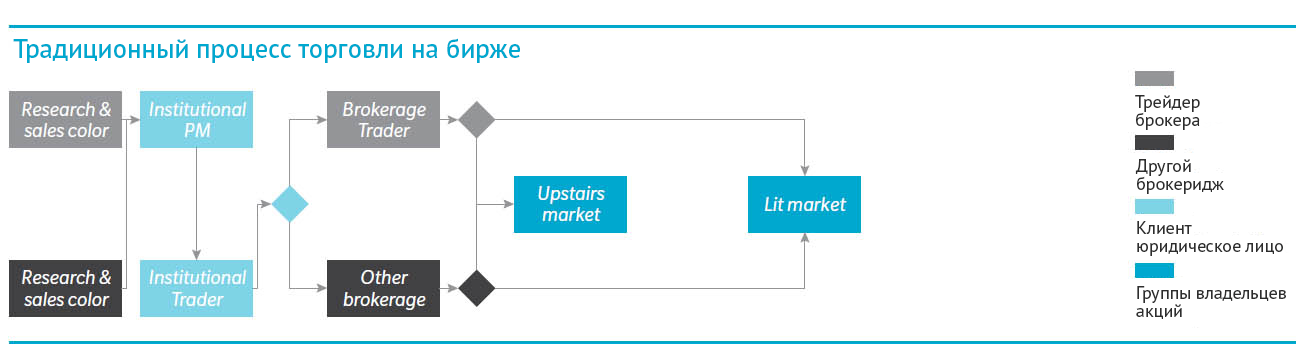

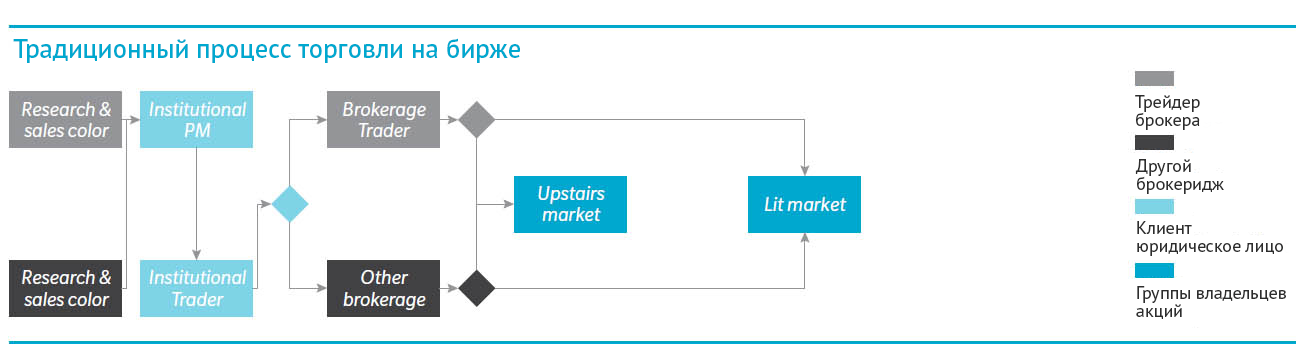

For clarity, let's compare the schematic images of a typical workflow in the stock market before:

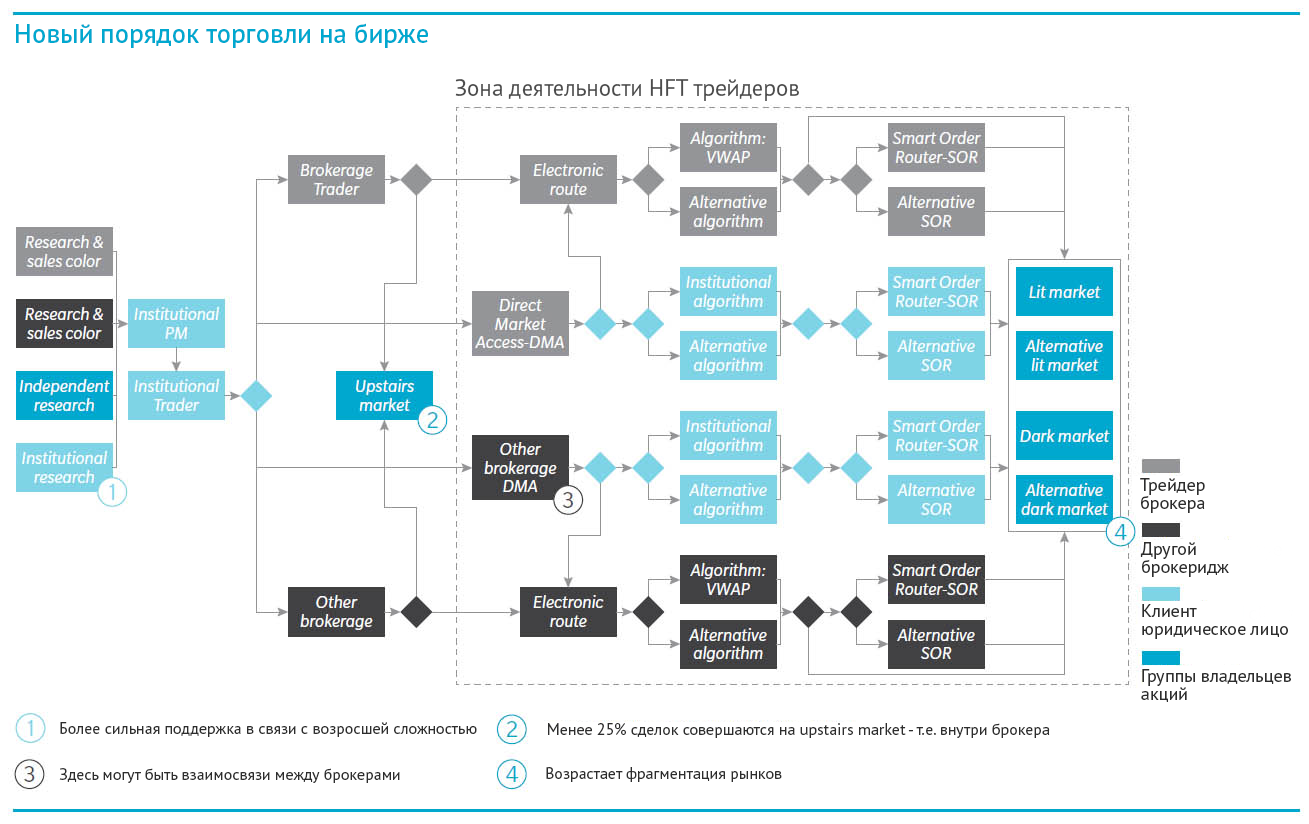

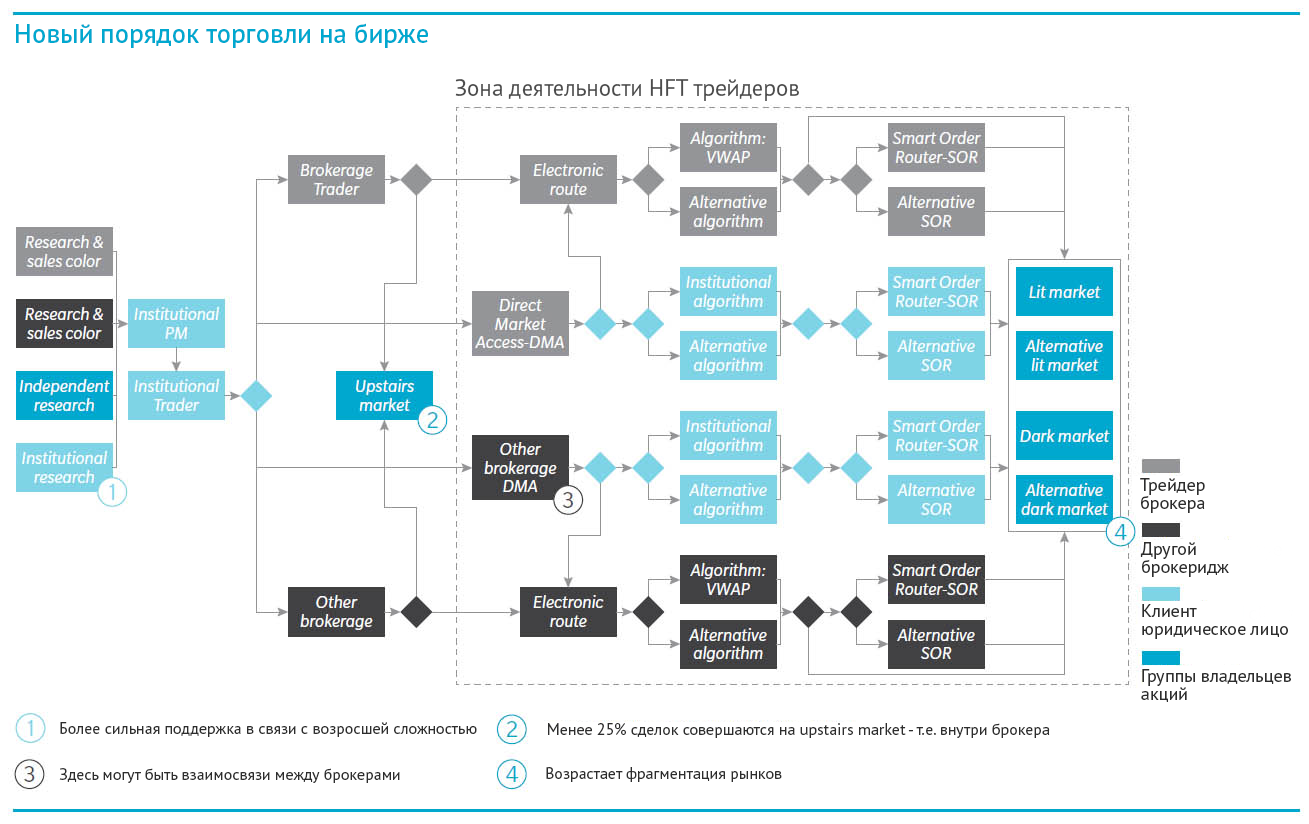

and now:

Probably no longer need additional words to describe how the market has changed?

Summarizing all the above, let's define what is happening now with the stock market and what are the players doing about it? Ironically, if you leave behind all the technological “bells and whistles”, we get nothing more than a good old search for arbitration and a game of ahead of the rest of the market. At the same time, all players, trying to adapt to changing realities, adhere to one or another strategy of behavior, the main element of which is the level at which they analyze and use the information they have.

The full range of strategies is presented in the table below (“Strategies for adaptation of players in the securities market”).

All typical investors who have chosen a more or less passive strategy — or ignoring changes around themselves (roughly speaking — implementing the “ostrich policy”) or using information only for solving basic tasks can be attributed to the light gray area in the table. Most high-frequency traders belong to the “Strategist” light blue area - they manage the available information and build their business model based on it. Taking advantage of the knowledge of this information, and finding arbitration, the company is moving further and further along the scale of adaptation.

We give a little explanation to the table indicators that measure the performance of the company:

1) Complexity: This is an indicator of the level at which information is used in developing an action plan. It doesn't matter what is specifically meant by information — commercial data or publicly available market news — the point is that it can be used more or less “intricately” —from elementary arithmetic operations and ending with the application of statistical methods in combination with deep strategic thinking.

Using simple arithmetic operations, you can get only basic indicators of volume, losses and winnings. Statistical methods allow to draw deeper conclusions, on the basis of which a further strategy can be formed. Strategic analysis using game theory methods can predict the reaction of other market participants to one or another chosen strategy.

2) Regularity: An investor can view each trading operation not only from the point of view of profitability, but also as an opportunity for learning. Collecting and processing information on each transaction can help an investor understand how the same transactions can play in the future. The more regular such an analysis is, the more relevant and useful the conclusions that an investor will receive.

3) Repetition: The implementation of any analysis makes sense if the resulting conclusions are applied. The trick is to use information to make certain decisions, the results of which are also in turn analyzed and taken into account in future behavior. Thus, there must be a continuous continuous cycle, leading to ever more efficient activities.

4) Cooperation: Exchange of information on similar issues (for example, between institutional investors) could lead to an increase in the efficiency of all market participants. Working together, they can share experiences and data and, as a result, develop the most optimal strategies to protect against market challenges.

Firms engaged in high-frequency trading are most likely to stop in their evolution at stage 4, “Strategist”, since it is not their nature, and it is not profitable! - share your information; how they trade is their own intellectual asset.

Institutional investors, on the other hand, have the potential to advance to stage 5, the Optimizer. For institutional investors, intellectual capital is usually the sum of their investment decisions, and not the means of their implementation. Therefore, they are more willing to cooperate with each other and develop new solutions to protect against strategies that reduce their market power.

Regardless of the investor’s attitude to trading strategies, whether he uses technological advances or adheres to more traditional methods of doing business, it is important to understand that technologically advanced trading is the reality of today. Investors should in any case take them into account and not forget about important measures to protect against potential negative influences of these realities, and at the same time develop their skills and expertise in seeking arbitration in the conditions of a new market.

So, what we have in the dry residue after all of the above

.

High-frequency trading is a legal game in advance of the market ... but also something more. In fact, the methods of such trading have already penetrated so much into the fundamentals of the modern stock market that it remains only to laugh at any serious proposals to eradicate it.

In essence, this will have to press the big red reset button of the entire market - after all, high-frequency trading methods are used not only by micro-level traders, but also lie deeply at the heart of the principles of the US Federal Reserve and central banks of many countries. And including for this reason, the numerous discussions of officials, legislators and lobbyists have not had any practical result.

The final thought of our article is this - if dark times still come for dark times, it is better to be ready for them. Not sure, of course, that this will really help to overcome them without losses - after all, the use of high-frequency trading substantially caused the stock crash in May 2010 and the general destabilization of the market after that (manifested, including in almost monthly drops), given this threat of expulsion from the market of traders who are responsible, we recall, for 70% of the volume of this market itself, is fraught with consequences comparable to the collapse of “Lehman Brothers”.

Postscript: If someone else has doubts about what lies behind the term high-frequency trading, we assume that the scheme below dispel the last of them:

Passive traders are trying to earn at the same time on the spread of purchase and sale prices of securities and rebates from trading platforms for attracting liquidity to them. Through their automated equipment, technology provided by trading floors, and statistical models, these brokers can simultaneously process orders for multiple securities. This strategy is usually called automatic liquidity attraction (the original name is Electronic Liquidity Provision or ELP), or rebate arbitrage (“rebate arbitrage”).

Passive strategies can also be peculiar detectors of market signals. For example, when the implementation of an ELP strategy causes a negative impact on it of prices, changing the current spread between the prices of the seller and the buyer, this may indicate the presence of a large order from an institutional investor in the market. Then the broker can use this information in transactions for their benefit.

In turn, active high-frequency brokers monitor the market for placing large orders, paying attention to the sequence in which calls are made to different trading platforms. As soon as a large order is noticed on the market, the broker makes the appropriate transactions, taking into account that this large order will be placed in the near future, and what consequences this entails. Then the broker forcibly closes its position as soon as it understands that a large order is placed. As a result, the broker benefits from the consequences of placing the noticed order. For an investor, the broker’s actions are undesirable, since they directly affect the results and efficiency of the investor’s activities, reducing its final arbitration.

')

The most advanced high-frequency brokers use self-learning algorithms and artificial intelligence techniques to consider market structure and capital flow data when looking for opportunities for arbitrage.

The widespread use of high-frequency trading methods also means that when placing orders, it is necessary to take into account the features of the order routing system (the original name is “smart order routing”), which takes into account such concepts as arbitration, based on the time lag between the actions of market participants, application size, etc.

For convenience, we more clearly illustrate this point below:

And we again return to the question - is it true that the essence of high-frequency trading is just a game of anticipating the events on the market (legal or not)?

The answer to this question is negative (or at least not firmly positive). A complete list of HFT strategies, with an explanation of how each affects the different market players, is provided below. At least in theory, some of them are beneficial to small investors. However, it is quite a controversial question whether there are any small investors in the modern market, where the trading volume is reduced to the level of a decade ago, and frequency trading constitutes the main share of open trading.

And although in theory, frequency trading promises brokers benefits, history shows that its effects are almost exclusively negative. Even if we forget about the question of how ethical it is to play ahead, it is much more serious that high-frequency trading, without having this direct task, contributed to destabilization of trading floors and their susceptibility to unexpected and inexplicable collapses. We will not revert to the events of instantaneous market crash (also known as “Flash crash”) in May 2010 - recently the securities market has also repeatedly felt the detrimental effect of a fragmented, over-oriented environment on profit margins, prevailing on trading floors. In some cases, these events were the result of unpredictable interactions of trading algorithms; in others - the result of program failures or equipment overloads:

2012:

KNIGHT CAPITAL suffered losses of more than 450 million dollars as a result of a failure in trading programs

The problem caused the random placement of a number of incorrect orders on the New York Stock Exchange. Later, the US Securities and Exchange Commission began a formal investigation into the incident.

2013:

"GOLDMAN SACHS" lost tens of millions of dollars due to an error when buying options

Due to technical failures during the internal renewal of the trading system, a number of options were purchased on several American exchanges unplanned. And the prices for a number of orders were set by default and differed significantly from the market.

Presumably, losses from these operations amounted to tens of millions of dollars, although the company denied that they suffered any losses.

3-hour stop of trading on the NASDAQ due to connection problems

Representatives from NASDAQ reported that the exchange was experiencing technical problems with receiving bids from bidders. In addition, for a number of other messages, there was also a failure in the system for displaying data on changes in stock prices of companies hosted on NASDAQ.

Another NASDAQ trades stop for an hour due to data transfer problems.

Because of the problems that occurred, the NASDAQ composite index had to be frozen for about an hour to prevent losses, while the main trading was not affected, although it was necessary to suspend trading of some options linked to the index. According to the NASDAQ, the problems were due to human factors. Although there have been no losses on the market, this problem — far from being the first — causes serious concerns.

So, here we come to the culmination of a 50-year evolution in the securities market - namely, a shift in the investor-broker relationship.

Traditionally, investors made every effort to find opportunities for arbitrage, and brokers were required to find a source of liquidity - usually it was on the “over-the-counter” over-the-counter market or on the stock exchange. The exchange was actually a tool for consolidating liquidity. So, besides searching for arbitration, the investor had only one task left - to choose a broker with whom he will work. Now the search for arbitration is still in the priority of investors, but the trading process, in which they extract their arbitration, has become much more difficult.

Modern scenery in the field of securities trading is a highly fragmented market with profit-oriented trading platforms that actively fight each other for liquidity (which is primarily attracted to high-frequency traders).

The new environment puts brokers in a rather difficult position. On the one hand, they need to act in the interests of their clients and for their benefit. This obliges them to invest in new technologies to search for profitability and protection from high-frequency traders. In addition, since many trading platforms now pay rebate to players for attracting liquidity (as we have already said, they are mainly for high-frequency players), the payment of fees for withdrawing liquidity from the platform falls on our brokers.

And at the same time, customers are asking them to reduce the amount of paid commissions.

The tense situation of brokers becomes a source of their conflicts with clients. Of course, it is possible to reduce the size of trade commissions, their rates vary depending on the site - however, this option may not be the most profitable for an investor in terms of profit.

Sophisticated investors now require brokers with detailed information about what transactions are made for them to make sure that everything is at the highest level.

And this information is really useful for investors - now they can conduct a more comprehensive analysis of the effectiveness of their market activities, including evaluating and comparing the performance of the brokers themselves who work for them.

For clarity, let's compare the schematic images of a typical workflow in the stock market before:

and now:

Probably no longer need additional words to describe how the market has changed?

Summarizing all the above, let's define what is happening now with the stock market and what are the players doing about it? Ironically, if you leave behind all the technological “bells and whistles”, we get nothing more than a good old search for arbitration and a game of ahead of the rest of the market. At the same time, all players, trying to adapt to changing realities, adhere to one or another strategy of behavior, the main element of which is the level at which they analyze and use the information they have.

The full range of strategies is presented in the table below (“Strategies for adaptation of players in the securities market”).

All typical investors who have chosen a more or less passive strategy — or ignoring changes around themselves (roughly speaking — implementing the “ostrich policy”) or using information only for solving basic tasks can be attributed to the light gray area in the table. Most high-frequency traders belong to the “Strategist” light blue area - they manage the available information and build their business model based on it. Taking advantage of the knowledge of this information, and finding arbitration, the company is moving further and further along the scale of adaptation.

We give a little explanation to the table indicators that measure the performance of the company:

1) Complexity: This is an indicator of the level at which information is used in developing an action plan. It doesn't matter what is specifically meant by information — commercial data or publicly available market news — the point is that it can be used more or less “intricately” —from elementary arithmetic operations and ending with the application of statistical methods in combination with deep strategic thinking.

Using simple arithmetic operations, you can get only basic indicators of volume, losses and winnings. Statistical methods allow to draw deeper conclusions, on the basis of which a further strategy can be formed. Strategic analysis using game theory methods can predict the reaction of other market participants to one or another chosen strategy.

2) Regularity: An investor can view each trading operation not only from the point of view of profitability, but also as an opportunity for learning. Collecting and processing information on each transaction can help an investor understand how the same transactions can play in the future. The more regular such an analysis is, the more relevant and useful the conclusions that an investor will receive.

3) Repetition: The implementation of any analysis makes sense if the resulting conclusions are applied. The trick is to use information to make certain decisions, the results of which are also in turn analyzed and taken into account in future behavior. Thus, there must be a continuous continuous cycle, leading to ever more efficient activities.

4) Cooperation: Exchange of information on similar issues (for example, between institutional investors) could lead to an increase in the efficiency of all market participants. Working together, they can share experiences and data and, as a result, develop the most optimal strategies to protect against market challenges.

Firms engaged in high-frequency trading are most likely to stop in their evolution at stage 4, “Strategist”, since it is not their nature, and it is not profitable! - share your information; how they trade is their own intellectual asset.

Institutional investors, on the other hand, have the potential to advance to stage 5, the Optimizer. For institutional investors, intellectual capital is usually the sum of their investment decisions, and not the means of their implementation. Therefore, they are more willing to cooperate with each other and develop new solutions to protect against strategies that reduce their market power.

Regardless of the investor’s attitude to trading strategies, whether he uses technological advances or adheres to more traditional methods of doing business, it is important to understand that technologically advanced trading is the reality of today. Investors should in any case take them into account and not forget about important measures to protect against potential negative influences of these realities, and at the same time develop their skills and expertise in seeking arbitration in the conditions of a new market.

So, what we have in the dry residue after all of the above

.

High-frequency trading is a legal game in advance of the market ... but also something more. In fact, the methods of such trading have already penetrated so much into the fundamentals of the modern stock market that it remains only to laugh at any serious proposals to eradicate it.

In essence, this will have to press the big red reset button of the entire market - after all, high-frequency trading methods are used not only by micro-level traders, but also lie deeply at the heart of the principles of the US Federal Reserve and central banks of many countries. And including for this reason, the numerous discussions of officials, legislators and lobbyists have not had any practical result.

The final thought of our article is this - if dark times still come for dark times, it is better to be ready for them. Not sure, of course, that this will really help to overcome them without losses - after all, the use of high-frequency trading substantially caused the stock crash in May 2010 and the general destabilization of the market after that (manifested, including in almost monthly drops), given this threat of expulsion from the market of traders who are responsible, we recall, for 70% of the volume of this market itself, is fraught with consequences comparable to the collapse of “Lehman Brothers”.

Postscript: If someone else has doubts about what lies behind the term high-frequency trading, we assume that the scheme below dispel the last of them:

Source: https://habr.com/ru/post/225487/

All Articles