High-frequency trading and everything you need to know about it. Part 1

The technique of high-frequency trading (English High Frequency Trading) has existed for more than a year, but especially close attention and a new surge of interest in it arose after the sensational release in late March of Michael Lewis’s “Fast Boys” (Flash Boys, Michael Lewis). The book has not yet been published in Russian, and we can only offer the most impatient readers to order it in English.

Considering how much information is available now to anyone interested in this issue, and to what extent it is contradictory, biased, replete with complex technical terms, or even simply wrong, in our opinion, it is worthwhile to put together all the facts behind this phenomenon.

In fact, the methodology of high-frequency trading is difficult to call revolutionary or even new. Although now, speaking of him, all at once represent high-performance computers and automatic programs with elements of artificial intelligence, if you leave these technological “tricks” and terms behind brackets, everything becomes much simpler. In fact, we are dealing with a business model, when using various technical solutions, players quickly collect information and can act on the basis of it before the rest of the market. And it is not necessarily talking about computer circuits and complex programs.

')

Do not be surprised, but even the medieval merchants were engaged in virtually the same as the modern players on the exchange. When the telescope was invented, the merchants actively used it to observe the merchant ships approaching the port and to consider the cargo they were carrying. If the merchant were able to determine which goods should soon arrive on these ships, this would give him a great advantage relative to the rest of the market. For example, if he himself had surplus products that a ship was taking to the harbor, he could sell them before the ship arrives and an increase in the supply of goods reduces the market price for them. However, it is believed that the main introduction of this technique to trading occurred in the 1960s with the establishment of the NASDAQ (National Association of Securities Dealers Automated Quotation), the first substantially automated system of exchange trading.

Paradoxically, the essence of high-frequency trading was revealed for the first time in October 1987, when the first instantaneous collapse of the stock market occurred - these events were called Black. This market crash was caused by the excessive spread of the so-called software trading (when securities are traded based on computer program readings). It is impossible to keep and not to draw a parallel between the lack of a full understanding of this tool at the time - and the attitude to high-frequency trading now (we will proceed to analyze the risks associated with it a little further).

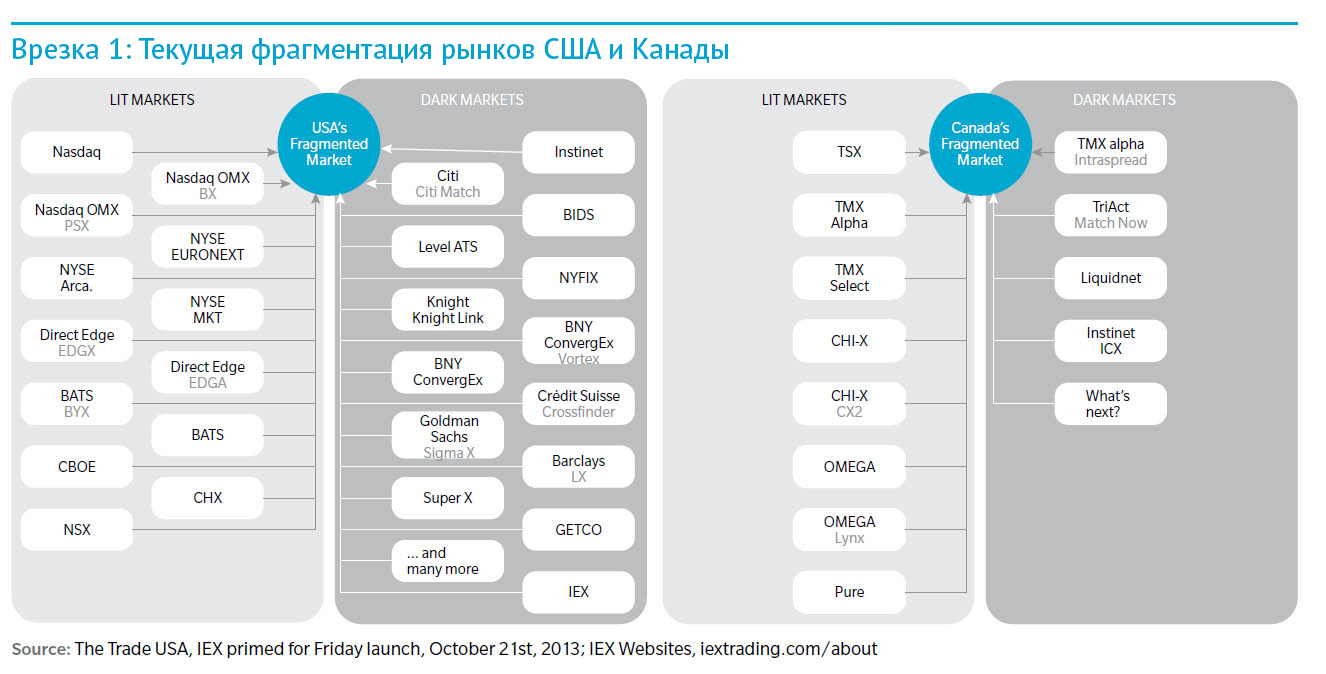

But back to history - many believed that the events of that Black Monday would be a lesson for regulatory agencies and careless traders. In any case, the penetration of automated and algorithmic methods of trading has only accelerated, so now high-frequency trading accounts for almost three-quarters of the total volume of exchange operations. In addition to this, the role of hidden pools and other over-the-counter transactions (markets that are not available to most players) has greatly increased - they account for up to 40% of the total trade volume compared to 16% six years ago.

This is how the evolution of algorithmic trading in securities (of which high-frequency trading is a kind) over the past half century has gone by:

Over the past decade, the securities market has undergone significant fragmentation - in many respects this was facilitated by a number of implemented legislative initiatives, which in fact were supposed to stimulate competition between trading platforms. The unplanned result of the introduction of new norms and acts was the dissipation of liquidity across multiple sites (both open exchanges and hidden pools). Coupled with the computerization of trading platforms, this has created lucrative prospects for technologically advanced players - and here we go directly to what high-frequency traders are doing now.

They use superfast connections with trading platforms and trading algorithms to play on the imperfections created by the new market structure and to identify patterns of third-party trading behavior that can be used to their advantage. Traditional investors, of course, are less likely to welcome such new market trends. The rules of the game have changed - and now venerable institutional investors are lagging behind their new opponents, since they do not have the tools for effective competition.

So, we come to the first and very important result of our thinking - a person’s participation in securities trading has changed. Now, any player in the market must understand the various methods of electronic trading, when they should be used and when they should be expected that the same methods can be used against you.

Let us return to the competition between trading platforms, which the authorities controlling the US stock market wanted so much to achieve. They began their crusade with the introduction of legislation on alternative trading systems in 1998 (the original name - Alternative Trading System regulation). It was supposed to provide the basis for a competitive environment between trading platforms. In 2007 National Market System Regulation has further extended the scope for this competition - from this point on, all players were guaranteed the best available prices (“best displayed prices”), which could be obtained from open automated sources. These rules were to promote efficient and fair pricing in the securities markets. With the appearance on the market of new and new trading sites that used new flexible conditions, market liquidity was dissipated between them.

In order for brokers to quickly and optimally obtain a summary of all available prices that they could now see, they had to master and introduce new technologies into their practice that would have access to data from all sites and would quickly process them. This can be, for example, various routing technologies when placing exchange orders or algorithms that again regroup fragmented liquidity into a whole and give the broker the result. The changes also affected hidden pools (dark pools) - if earlier they were platforms for anonymous e-commerce of large volumes of securities, now they have begun to expand the range of their tasks and trade them in smaller volumes. This allowed dealers to internalize their financial flows, and for institutional investors to hide their deals from unscrupulous exchange opportunists.

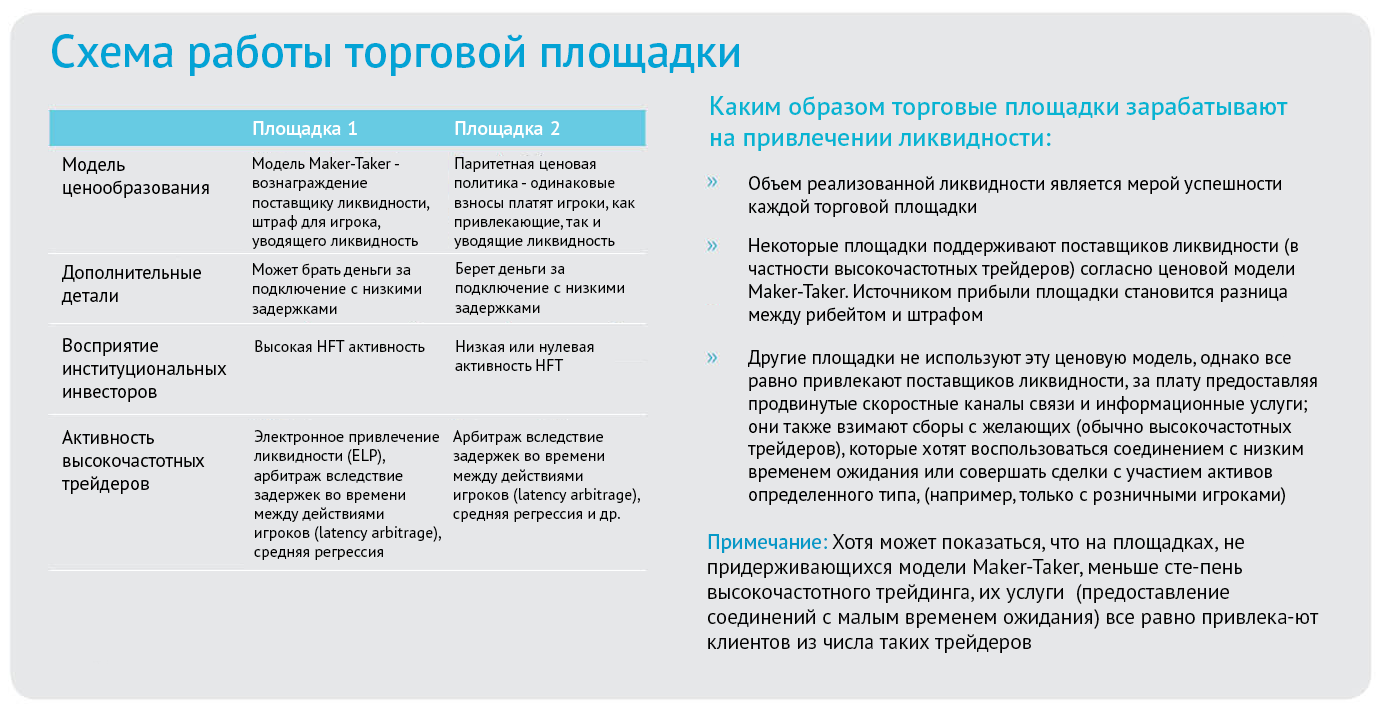

However, the use of these technologies is fraught with leaks of trade information that can be used by competing players. Information can open up when there is some pattern in electronic algorithms when trading. When this pattern is noticed by high-frequency traders, taking it into account, they can conclude profitable deals in advance — play ahead of the rest of the market. As a result of tougher competition for liquidity between trading sites, they were forced to move away from the traditional pricing model (in which each party in a transaction must pay an exchange fee to the site) towards schemes when sites charge maintenance fees only and reward participants who attract liquidity and penalize those who withdraw it.

Soon after, brokers-dealers noticed that they were the party that most often paid a commission for making a deal, which then went to the players who attracted liquidity. To avoid this and internalize their active flows (thus hiding them from individual investors), broker-dealers also began to use hidden pools. By internalizing flows or even submitting them to third-party trading companies, they may not pay a trade commission, which the sites charge to remove liquidity from their order books.

The irony is that in their attempts to rationalize and simplify the securities market with the help of new acts and regulations, the regulators themselves created an intricate system from trading platforms, sources of information leakage and countless opportunities for traders to play ahead of transactions of both institutional and retail investors .

You can see this by looking at the current US and Canadian stock market charts below:

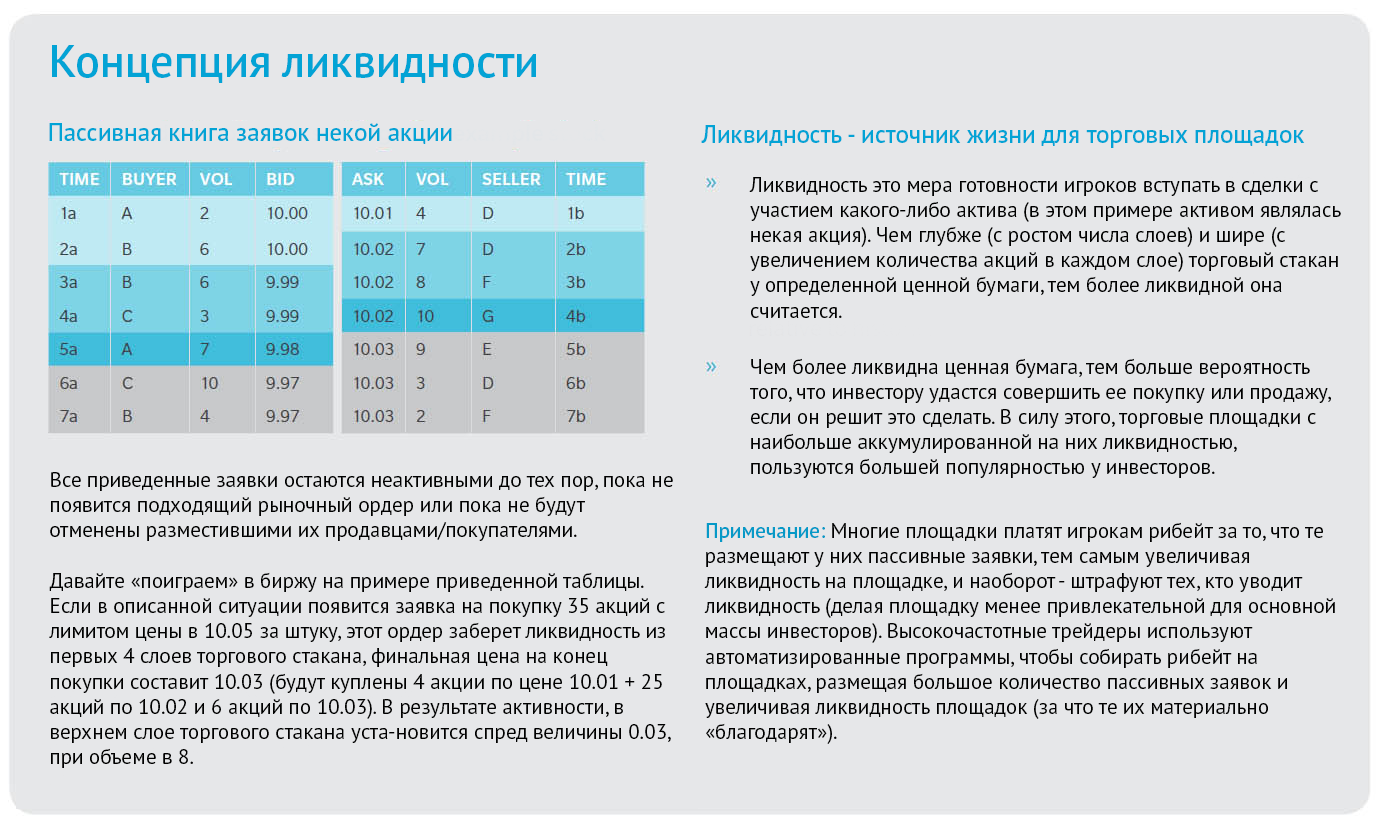

Before continuing our thoughts further, we suggest just in case refresh the memory of the principles of stock trading - this is very useful for the future understanding of the place of high-frequency traders in this system.

Moreover: it is more correct to consider not Liquidity as such, but “Implementation Shortfall”, also known as Slippage, which is the collection that HFT traders take from investors - most often, this is the cost of the spread between buying and selling or forward transaction The cost of "lack of execution" consists of two parts: The cost of time delay (Timing Delay Costs) - any cost of delay between the client's decision on the transaction and the placement of the application by the broker. It can be considered the price of seeking liquidity; and Market Impact Costs - the difference between the price in the broker’s application and the current market price.

Are you wondering why so much importance is attached to liquidity and the one who attracted it, and who stole it from the exchange? The fact is that the concept of liquidity goes hand in hand with the concept of a modern exchange, according to which the volume of liquidity realized as part of a transaction is a key factor in determining the success of a trading platform. This explains the fact of close cooperation between high-frequency traders and stock exchanges, moreover, beneficial to each of the parties. For example, in 2012, analysts Zero Hedge stated that HFT accounts for a very significant share of the revenues of trading platforms (in different cases it is from 17 to 32%).

This close relationship between the platform and the dominant principles of conducting financial activity led to numerous assumptions (quite true) that to a large extent the spread of high-frequency trading should be blamed on the existing stock model. In English terminology, it is known as the Maker-Taker model - since there is no more capacious Russian-language term, we will continue to denote it in the following way.

So, in accordance with the principles of this model, the pricing on the site is as follows: a broker who attracts liquidity to the trading floor (this is a broker- “Maker”), rely on a premium, or rebate (even if he placed limit requests for microscopic amounts, playing on advance of a large application, which will be posted soon). And vice versa - the broker, who by his transactions takes liquidity from the site (according to the “Taker” broker), is subject to fines. The box below illustrates the model below:

We will not further analyze the causes and factors, one thing is already clear: for sure, high-frequency trading turned out to be unusually in demand.

With the automation of securities markets and the adjustment of prices to a cent (compared to the maximum accuracy of only one eighth dollar earlier), traditional market participants, who continued to play "manually," realized that it was extremely difficult for them to compete with new, technologically savvy firms. The new rules of the game were clearly in favor of high-frequency brokers using ultra-fast computers, connections to stock markets and direct data flows with minimal delay, for implementing the hidden Alpha (or Grail) ... or, as some say, leading transactions.

To be continued…

Source: https://habr.com/ru/post/224279/

All Articles