How to create and earn money on SaaS (Part 7 / why isn’t SaaS sold?)

Only SaaS and nothing more

(A.K. - Alexey Kalachnikov Quickme ) Today my guest is ex-Director for work with partners of the company Megaplan Alexander Prozorov. A year ago, Alexander left Megaplan and began working on a startup in the field of the Internet of things.

(A.P. - Alexander Prozorov ) Thank you for the presentation, Alexey. The Internet of Things project is very similar to SaaS. The difference is that to achieve success, the product must match the client's lifestyle to an even greater extent than in SaaS. But let's leave aside the Internet of things and try to derive a formula for successful projects in SaaS. We will derive the formula based on a common understanding of the patterns of doing business on the web. Technologies and new product ideas will be left out of our discussion.

(AK) Before the meeting, Alexander proposed an interesting discussion structure, but it was more about clouds in general. To make the conversation not very boring, I convinced Alexander to talk only about SaaS in the format of "ISV-Partner-User" or "ISV-User" in business automation applications. The main argument was - “the user receives the service, and everything else that stands behind the provision of the service remains on the side of the provider”. This means that the user gets a specific functionality in the browser and a full stop, or do you disagree, Alexander, and consider that everything should be transparent to the user - from hardware to virtualization shell and information security tools?

')

(A.P.) Yes, this is a good argument - the user pays for the finished service and he is only concerned about her quality, and not what her giblets consist of. In general, the “guts” worry the paranoids who are trying to predict their risks in advance, thinking that as soon as they recognize the “guts”, therefore, they will understand the prospects for development and the likely loss of quality of service under the influx of new customers or some sort of DOS- attacks. As you, Alexey, ask, today we will confine ourselves only to the main causes of problems with sales of SaaS solutions.

Buckets with popcorn to "funny pictures"

(A.P.) So, take a bucket of popcorn and go in order. We will talk about SaaS in the B2B segment.

(A.K.) From the point of view of technology, the novation of the product, its suggestions to the user.

(A.P.) Obviously, the answer to the question “why SaaS is not for sale” is not simple. Otherwise, we would see a sea of successful projects and all potential customers would have moved to the cloud a long time ago. However, this is not the case - we observe fakapy. A lot of fakapov.

(AK) Yes, a lot, for example - Vasily Shabbat with a travel accounting service, collapsed market place of several opsocks (similar to the SaaS app store), merging several video conferencing services, SolverMate mail service and others ...

(A.P.) We continue. I will have a bit of a bit of fun to put the right accents. Because not least the clouds are not sold for one simple reason: many owners of fakap projects do not quite understand what they are dealing with.

About popcorn not forgotten?

Popcorn # 1

We swallow the first portion - it will be tough! It is often said that one of the most important reasons for poor sales is the lack of demand. It seems to many nonsense and makes the brain, especially given the fact that each of us in one degree or another successfully uses the clouds - facebook, google, vk, yandex, dropbox and many others - this is all SaaS, isn't it? Of course, this is SaaS. So what's up? The fact is that these projects formed their own demand, or occupied niches where it was already formed. Thus, the statement “bad sales due to lack of demand” is true, because successful projects either formed it themselves, or slyly took advantage of the labor of others.

Now the question for SaaS startups is: you started the project, well done, and you understand that you need to generate demand for your services for several years before it may appear? Or did you feel the existing source of demand and want to appropriate it, squeezing a competitor in a tough fight? Do you understand this? Great, and you did not forget to include the costs of these long and expensive events in your business plan? Do not forget? This is cool, but are you really sure that the investment will be enough to survive these skinny few years, actively conducting combat operations with competitors?

(AK) A great classic problem “why?”. In 2013, I spoke with dozens of startups belonging specifically to the B2B SaaS and when asked why you spent most of the founders for this time, nodded their heads and sparkled in their eyes, but we don’t know how to program anything else. Reason number 2 of the creation of a “startup” - the client came, asked, did, started up in production, called a startup and became fashionable guys. Although, you know how the outcome of such an approach is hitting solutions in the “purple ocean” (a difficult busy market in which you can find your niche. So, for example, we created a postal banking solution to alert customers about operations.

Popcorn # 2

(A.P.) Remember popcorn! The second portion went and we go on. An attentive, but not tempted in the SaaS-business reader will certainly have doubts that it takes several years to generate demand. OK, this is a good line of thought, let's deal with this issue in more detail.

The first thing to understand: SaaS is a business of building a pipeline that produces very inexpensive and similar services. The low price deprives you of two important opportunities for successful sales. First, you do not have the money to adapt the service for each client. Second, you do not have the opportunity to mess with the client, personally teaching him how to work with your decision. As a result, all that you can offer to the client is to build a unified service with a trendy user interface design, a sales department that works on patterns and is not the highest paid technical support service.

(AK) I do not agree with you, Alexander, if you look in the product catalog of the profile portal SaaS.ru, then the whole mass of solutions automates what is already automated in 5 ways, i.e. I still hold the position that SaaS is an innovation to a greater degree than the subject area of automation - after all, it is impossible to invent special accounting and automate it.

(A.P.) OK, Alexey, your right. But you mean the SaaS automation solution. My thesis is that SaaS is not a solution, but a solution-based service. The solution may be less functional, such as, for example, CRM SalesForce, but a service based on it is much more popular than, for example, the Siebel CRM solution.

We go further. The second thing to understand is: the elasticity of demand in B2C is fundamentally different from the elasticity of demand in B2B. If it is not difficult for a person to change his habits a little to use the SaaS service, then for the company, even for the smallest, such a change is a difficult task. Therefore, as soon as you launch a mega-cool B2B service, if in order to take advantage of it, business process changes from your customers are required, you will inevitably be disappointed. Companies will either endure the brains of your salesmen, but never reach the deal, or go into an outflow after 1-2-3 months, as soon as they understand what your company is forcing the service to do. And only in the case when the owner of the company realizes that by changing the company, he will earn more money, he will find the strength and time to change the established order of things to match the one that imposes your service.

(AK) And what about this? If we know the degree of elasticity, then maybe we can start selling solutions to employees or departments? So, by the way, many ISV SaaS - amoCRM, Megaplan do.

(A.P.) Alexey, let's understand. These companies work for B2B. Business is changing slowly. These companies are trying to enter the company through individual employees. It's right. However, after the sale, if the business is not ready to use the solutions, changing under them, then these customers will go to the outflow.

Moving on. The third thing you need to understand is that the micro business, the main consumers of SaaS services, is changing pretty quickly; therefore, you should constantly be aware of how the needs of your target audience change. In other words, if you groped and digitized the need, but it took you 9-10 months to implement the service - it’s not at all the fact that when you offer it, it will be in demand - people will live on completely different problems. According to this, you need to prepare for this state of affairs: quickly make a prototype of the service and test it on your potential customers. It may be necessary to conduct a series of “development / testing” iterations to find real needs. It is expensive, yes, but it is a little that will help you to make the service really demanded by your customers.

(AK) In general, in the 10-ku. All ISVs hang the SMB label on their decisions and few have seen this SMB, and most of them live with the certainty that the SMB is Goskomstat statistics. From the controversial - the price of the issue can vary from $ 3 to $ 100 per month, and this affects the elasticity even more and will ultimately lead to a "conspiracy in the industry" of developers. Those. is there an answer how much should a relatively massive SaaS service cost? I will add to the price reduction that even the micro-businesses do not really need all the functionality. I already wrote about this in my first part of the SaaS saga - for example, why a team of 10 people has access rights - they know each other and the degree of trust in such super-high teams.

(A.P.) Alexey, the question of the price of the service is a delicate question. The price that the client is willing to pay is derived from his expectations of the real benefits he will receive. The better you have realized the needs of clients in your decision and can influence their expectations, the higher the price of your service, which you can afford without reducing demand.

Popcorn # 3

But we go further. We take popcorn and swallow the third batch. After we talked about such non-obvious things as “SaaS-business is a low-margin conveyor”, “inelastic demand takes place in SaaS / B2B” and “business is rapidly changing in terms of its needs”, It is time to talk about the phenomenon of "the abyss of demand."

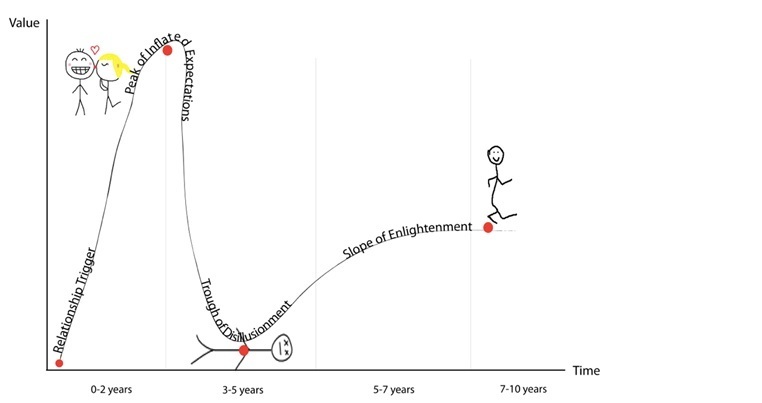

Quite a well-known analytical company Garnter every quarter produces a bunch of all kinds of waste paper literature. Often, this literature is replete with the so-called Garnter Hype Cycle on various types of innovative products. My free translation of the name of these diagrams is the “trajectory of the“ sobering up ”of expectations.” Garnter Hype Cycle diagrams are based on the well-known regularity of the stages of surges and drops in demand for any innovative products. To make it clear what I mean, I found in the Hype Cycle Network dedicated to family relationships. It is based on the same pattern as the Garnter Hype Cycle, i.e. it has the same stages and form, for this reason it can even be clear to you, Alexey ...

(A.K.) excellent comparison!

"Love lives three years"

(A.P.) So, what stages of development do we see on this trajectory?

1. At the beginning there is a stage of rapid growth of interest under the influence of bloated and unreasonable expectations. Let's call this stage "stage 1". At this stage, people buy solutions like pies, guided by fashion and the herd instinct lying somewhere near it.

2. Then comes the sobering stage (“Stage 2”). This is when people start to realize in droves that they have not quite correctly associated their needs and possibilities of solutions. At this point, people refuse to use the solution or do not buy it, if it was not necessary to make a purchase in order to try it.

3. Then comes the stage of finding real customers and finished the correct functionality for them (“Stage 3”). Many may not live up to this stage simply by losing faith in their own product or in their consumer.

4. After this comes the most delicious stage - when a consumer willingly buys a convenient product, because it meets its expectations and does not cause problems during operation (“stage 4”).

5. Then comes the last - terminal stage (not shown in the figure), when the owner of the decision must either throw it away or transfer it to other economic or technological principles (“step 5”).

Debriefing (demand) at each stage.

Now let's break down the volume of demand at each stage.

How big is the demand at stage 1?

To answer this question, you need to find the cause of demand by answering another question - who is the target audience at this stage? Obviously, at stage 1, the demand is made up of technological pioneers and geeks - they are chasing fashionable novelties and are ready to test them for themselves, not paying attention to the consequences. Are there many such pioneers and geeks? According to statistics - not very. According to the study of demand in the SaaS / B2B segment, which we conducted in April last year ( http://www.slideshare.net/AlexandreProzoroff/saasb2b-17042013 ), such companies are no more than 5-7% of the total population. What does it mean? This means that your volume of demand, above which there is no way to jump, is only 5-7% of the total population of the target audience. And only if you are ready to have such a sales volume and fight further - keep up the good work.

(A..) From insiders - one of the SaaS developers has a client base of 700K registrations, for example. This is me to that beautiful, a) that there is still a demand, and b) SaaS is clearly among the favorites of the SMB sergment.

(A.P.) Alexey, according to our data, which we cited in the study, in the Russian Federation at least 2M SMB clients. If your friend, whom you do not want to advertise, has 700K test registrations, it only means that his target audience has matured to stage 4. That is, your example confirms my arguments. Do you understand?

We go further. How big is the demand in the second stage?

Stage 2 is sobering. On the one hand, not all technological pioneers and geeks went into the outflow - many remained. But on the other - the majority of clients, skeptics, have not yet matured to pay for a solution that is not quite suitable for their needs. Therefore, real demand at this stage can grow, but not many times and requires very delicate and meticulous work on creating new functionality, setting up the sales department and technical support service. For example, Megaplan began to approach the exit from this stage, having entered it about a year and a half or two ago. To keep financials above zero, a year ago the marketing department was completely reduced and the sales service was reconfigured, because it became clear: the required minimum of operational marketing measures works well and is already quite automated, and the rest of the activities have virtually no effect on the flow of leads. Why pay people who do not bring new customers? Nothing personal - just SaaS.

Further. How big is the demand in the third stage?

If the company found strength and retained faith in its decision, it also gained a new understanding of its client’s needs and, besides, the investor didn’t run out of money and patience to incur losses for several years, plus a lot was done to improve the product - In this case, the company will certainly have a bright future, if the management does not get sick with star fever and does not go crazy. The third stage - the best period for the company - the period of scaling up the business. At this stage, the skeptics turn to face the solution and begin experiments with it. At first, the most courageous, and then the rest of the skeptics, begin to buy. Demand begins a multiple growth. The main task of the leadership is to correctly scale the business. It is not simple. At this stage, we need excellent managerial skills for business leaders. Not all startups have them. It's time to think about how to attract and motivate a person with necessary business skills for long-term work, if you don’t have one in your company.

We go further. How big is the demand in the fourth stage?

This is a stage of stability. At this stage, management is not so much interested in demand as in searching for alternative solutions in order to replace in time what brings the main income today. The main task of management at this stage is low transaction costs and the search for real alternatives to existing products - the main sources of revenue.

Now about the last, terminal stage. It is characterized by the fact that if the management did not find an alternative to the dying solution that generated the main revenue, the company goes under the ice with a drop in demand for its services.

(A.K.) That's really “love lives for three years” and in the SaaS / B2B segment, 2 companies won - Megaplan and MoySklad - neither the first nor the second were pioneers in automation of the business field, and they proposed the principle SaaS. Ie, it seems to me that your drawing reflected the undercooked popcorn, the one that is at the bottom of the bucket, and all the most roasted and with a hypnotic smell - this is the SaaS in the story with these two references.

(A.P.) Yes, these two companies managed to find a formula to overcome the “gulf of demand.” Learn from them.

But we go further. A little more popcorn.

Alexey, you asked how the above superimposes the relationship between “ISV-User” and “ISV-Partner-User”?

(AK) Yes, it excites everyone and always, and you would perfectly complement my discourse on the usefulness of the channel in SaaS. I add that we in Quickme made bets on partners and so far everything is working out with our affiliate program Sfera 2014!

(A.P.) It’s very simple - the client doesn’t care who renders a service to him - the benefits and quality of service are important. Therefore, the above is equally true for both options for the formation of the service.

From whom to buy - from ISV or from a partner?

(A.P.) It would be another matter if you asked what options there are for building relationships in the “ISV-Partner-User” relationship. Here, too, everything is quite simple. These relationships need to be looked at from the point of view of the benefits that the customer receives and the degree of automation of operational marketing activities at the ISV.

Let us analyze possible scenarios.

1. "The partner has nothing to offer the client, except for his ardent desire to sell the ISV service." If the operational marketing activities of the ISV work well, and the partner really has nothing to offer, except for his ardent desire - this is not a working scheme at all. A partner can beautifully place product logos on his / her display - it’s all the same, the flow of customers will go directly to the ISV.

2. "The partner has nothing to offer the client, except for his ardent desire to sell the ISV service, and the ISV does not have established operational marketing and sales processes." This case is a high-risk startup for a partner. In this case, to achieve success, it is necessary to clearly separate the functions and responsibilities of the ISV. Suppose an ISV is only engaged in the development of a service and its technical support, while sales and marketing are assumed by a partner. This or other sharing of responsibility and, as a result, of expenses, can end in success. If this does not happen, the solution will hang on the partner’s window without attracting new customers.

3. "The partner has its own customer base." This is a good cooperation option for ISV. In this case, the task is to convert the existing client base of the partner into warm leads, which are driven through the sales department with personal managers. This can be done in different ways. By partner or ISV sales force. It is important for a partner to warm up the customer base on behalf of the partner. After warming up, you need to start conducting activities that involve leads in working with the solution. After the start of their implementation, it is necessary to focus on how to lead as much as possible involved in the work with the solution, not limited to just words - this is an extremely strong influence on the conversion and, as a result, revenue.

4. "The partner makes its service based on the ISV service." This is also a working version for ISV. The likelihood of success with a partner is the higher, the more benefit customers receive from its services. At the same time, it is necessary to understand that a beautiful showcase with several sets of pictograms for different types of clients, without close integration of solutions among themselves, has very doubtful benefits for clients. In this option, the division of responsibilities is based on the configuration of the partner services.

(AK) Excellent addition and agree with almost everything that you wrote. I will share with you my success in building a partner channel.

(A.P.) Thank you.

(AK) My reasoning on building a partner channel and working with it.

A startup is not a search for a business model, but an identity and a high degree of uncertainty.

(AK) And now you would not like to somehow analyze the Moore curve and the Garnter Hype Cycle and try to reduce the degree of uncertainty in which the startup always has to be? Or we better talk about reducing separately. The reasons for my concern are disbelief in the startup postulates of Steve Blanc. Maybe so we will be able to reduce a large number of failures in the environment of cloud startups (well, not only SaaS).

(AP) I did not understand about Moore’s curve and the Garnter Hype Cycle. Moore's Law - I know. But he has nothing to do with the Garnter Hype Cycle. Explain the question.

(AK) We drove, okay. They Mury as we Ivanov -

(AK) Although I may be mistaken and I don’t need a comparison - if we superimpose curves on each other, we will get a strong coincidence and it’s better to say a few words again how to overcome this very “valley of death” and get to the “early majority” .

(A. P.) In my subjective opinion, in the 15 years that I have been involved in startups, nothing has changed in terms of the process of overcoming the “valley of death”. As before, certain personal qualities from start-up leaders are required. A large number of fakapov says that people do not possess these qualities and, moreover, do not quite understand what they are dealing with. But this is all surmountable, if there is will and time: the necessary qualities can be developed in oneself and a product in demand can be built. The problem is that there is no will and, at times, time. What is going on?

1. Young people go to a startup, guided by fashion and thinking that this is such an adult and cool life, where you are your own boss. But nothing is further from the real state of things than this delusion. If you are led only by selfish motives - your project is inevitably waiting for a pack. At least, simply because you will be engaged in self-deception, thinking that you know better what your potential client needs.

2. , , . , – . , , , , -.

3. , , . , . , , , - . – , « ». , . – . , , .

, , , , .

, :

1. , ,

2. , – ,

3. ,

4. .

- , . , – SaaS- .

(..) , 2013 6-7 . - http://comfway.com/ , quickme.ru . , — .

http://www.bootstrap24.ru/

« SaaS»

Source: https://habr.com/ru/post/222401/

All Articles