Stock Market Toolkit: What are Futures and How Do They Work?

Earlier in our blog the topic of derivatives (derivatives) was raised and some of their classes were described. Very often, it is about buying or selling such exchange instruments that are referred to as “selling air” and obviously harmful speculation. In fact, the importance of the same options and futures for the stock market and, more broadly, for the country's economy, it is difficult to overestimate. Today we will talk about futures contracts and the logic of working with them.

Futures history

The first futures exchange appeared in Osaka, the ancient capital of Japan, as early as the Middle Ages, it was used to trade in the future rice crop. However, modern futures trading originated in Chicago in the middle of the nineteenth century. In the 1840s, Chicago became the commercial center of the Midwest. This was facilitated by a convenient geographical position, as well as an established infrastructure (railway and telegraph). At about the same time, inventor Cyrus McCormick , having completed his father’s project, presented a threshing machine for grain processing, thanks to which the productivity of farms increased.

')

Farmers from the Midwest came to Chicago to sell their grain to dealers, while at that time there were no established procedures for evaluating a product or determining its exact weight. Very often, all this remained at the discretion of the dealer. In addition, farmers who brought goods (grain or livestock) could find that there were already too many people like them in Chicago and the supply far exceeded demand, which affected the price of the goods. Buyers, in turn, faced the problem of transporting grain, especially in winter.

Because of such difficult conditions, farmers and traders began to enter into contracts with a deferred supply of goods. The scheme could be the following: a farmer sells grain to a merchant at the end of autumn or in early winter, which he must keep until he can be transported, for example, by river. In this case, no one has canceled the risk of falling prices over the winter. To protect themselves from this, traders who bought grain, went to Chicago and concluded contracts with processors for the supply of grain there in the spring. Thus, they guaranteed themselves and buyers, and a reasonable price for grain.

In 1848, the first of the Chicago-based commodity exchanges, called the Chicago Board of Trade of the City of Chicago (CBOT), was created. And on March 13, 1851, the first futures contract for 3,000 bushels (approximately 75 tons) of corn for delivery in June at a price of 1 bushel, which was one cent lower than the price that day, was concluded on this exchange platform.

Futures contracts gradually became widespread due to the benefits associated with their use. The buyer of a futures contract could change his mind to buy grain on it and resell this right to an interested party. Or, a farmer who, for whatever reason, could not or did not want to deliver the agreed amount of grain in due time, could sell this obligation (for the delivery, after all, relied money) to another farmer. In case of bad weather, buyers of futures contracts benefited greatly because they had the right to buy grain at a much lower price than it cost after crop failure. However, if, on the contrary, overproduction was observed and the price fell, then a futures contract could turn out to be not so profitable.

Quite quickly, futures became interested in speculators, who actually did not need any grain. Such players pursued only one goal - to buy cheaper and sell more expensive.

Initially, only grain crops (corn, wheat, oats, etc.) were traded on the exchange, but later futures for assets not related to this area appeared - in 1960, futures began trading on the Chicago Commodity Exchange (CME) competing with CBOT live cattle and frozen pork. In 1982, fully electronic gold and silver futures contracts were introduced at CBOT. Then in 1982, futures for the most famous American stock index, the S & P 500, appeared. In 1999, CME first introduced weather futures. Despite some unusualness of this tool, they are very important for the US economy, because they allow reducing price risks in agriculture and energy of the country.

What is modern futures

As we found out above, futures (from English futures) is an obligation to buy or sell a certain asset (it is called basic) at a certain price on a certain date in the future. In addition, each futures contract is characterized by the number of the underlying asset (eg shares), the date of execution of the contract (expiration date) and, in fact, the price (strike price), according to which the buyer agrees to buy the underlying asset and the owner to sell.

Thus, the seller undertakes to sell a certain amount of the underlying asset in the future at a certain price, and the buyer, at that time, buy it at the agreed price. The guarantor of the transaction is the stock exchange, which takes insurance deposits from both parties to the transaction.

The underlying asset may be:

- A certain number of shares (stock futures);

- Stock indices (index futures);

- Currency (currency futures);

- Commodities traded on exchanges, such as oil (commodity futures).

- Interest rates (interest futures).

All futures contracts are traded on special trading platforms - urgent sections of stock commodity or currency exchanges. In Russia, for example, there is an derivatives market on the Moscow Stock Exchange, where futures and options are traded.

Futures chart for RTS-3.14 index from SmartX terminal

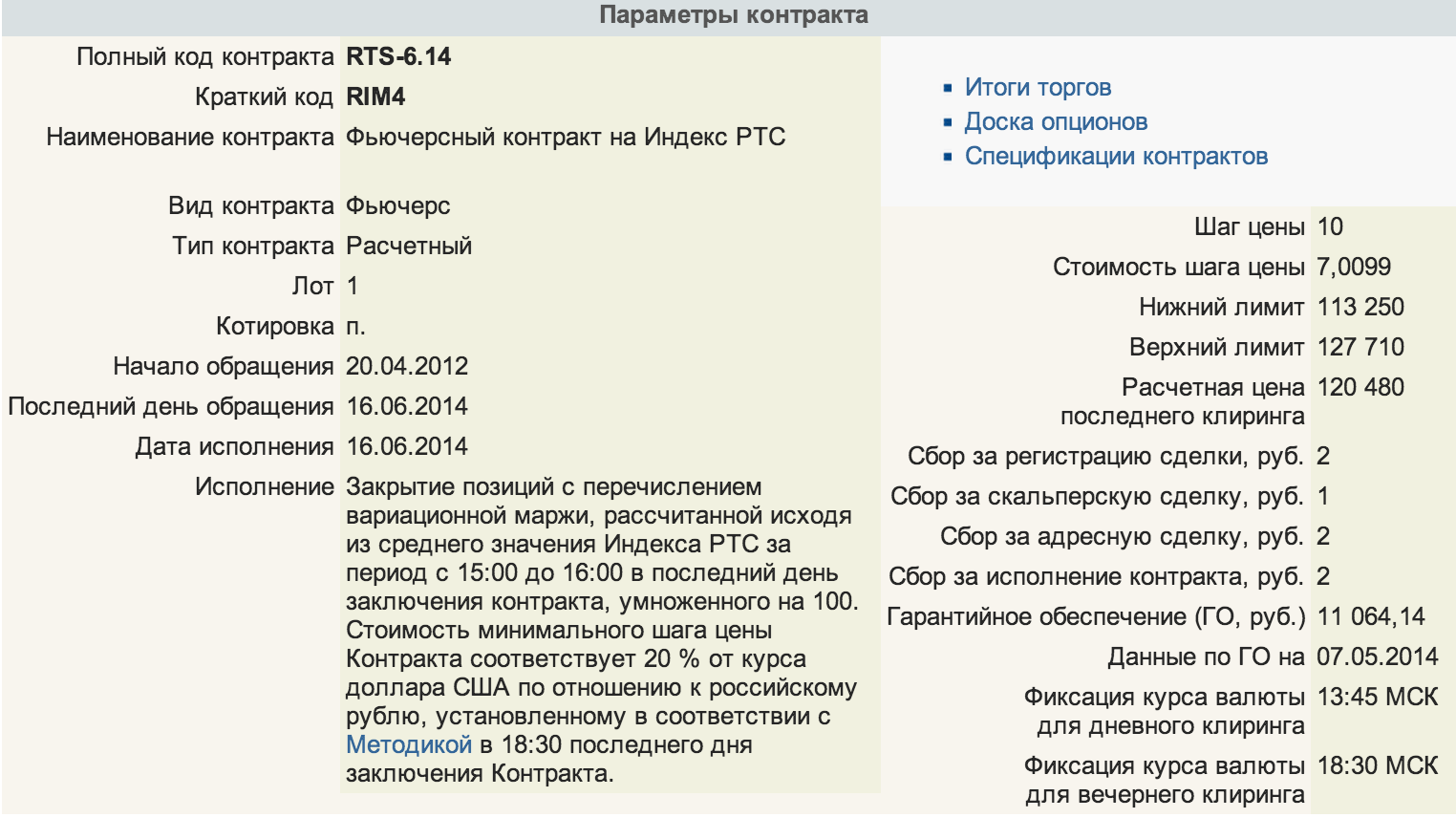

Before a futures contract is put into circulation, the exchange determines the terms of trade for them, which are called “specification”. This document contains information about the underlying asset, the number of units of this asset, the expiration date (performance) of the futures, the cost of the minimum price increment, etc. An example of such a specification is the description of the RTS Index futures .

Futures are of two types - settlement and delivery. In the case of the latter, the physical supply of the underlying asset is permitted - for example, oil or currency. It happens that such a delivery is not implied and futures are settlement. Then, at the time of its expiration, the parties to the transaction obtain the difference between the contract price and the estimated price on the expiration day, multiplied by the number of existing contracts. Index futures refer to the calculated ones, since they can not be put.

When trading in futures contracts, the position value is recalculated on a daily basis relative to the previous day, with write-off / crediting of money to the investor’s account. That is, the difference between the price of buying or selling a futures and the estimated price of its expiration is paid daily to the merchant's account - this is the concept of variation margin.

Futures have an expiration date, which is encoded in their name. For example, in the case of the RTS index, the name is formed as follows: RTS - <settlement month>. <Settlement year> (for example, RTS-6.14 futures will be executed in June 2014).

How it works

As is clear from the history of futures contracts, one of their main missions is insurance against financial risks (so-called hedging) - for this purpose, this tool is used by real suppliers or consumers of a commodity that is the underlying asset. Experienced traders and investors use futures (often settlement) for speculation and profit.

Futures are a fairly liquid instrument, which, however, is unstable and, accordingly, carries considerable risks for the investor.

When the time comes for the execution of a futures contract that one trader has sold to another, in general, several outcomes are possible. The financial balance of the parties may not change, or a merchant may make a profit.

If the price of a financial instrument has increased, then the buyer is the winner, if the price falls, then the seller, who most likely expected it, is celebrating success. If the price of the instrument does not change, then the amounts in the accounts of the participants in the transaction should not change.

Unlike an option, futures are not a right, but an obligation on the part of the seller to sell a certain amount of the underlying asset in the future at a certain price, but for the buyer to buy it. The guarantor of the execution of the transaction is the stock exchange, which takes insurance deposits from both participants (collateral) - that is, you do not need to pay the entire futures price at once, only the collateral is frozen on the account. This procedure is done both with the buyer’s account and with the seller’s account in the transaction.

The value of the guarantee provision (CS) for each contract is considered by the exchange. At the same time, if at some point the investor’s account becomes less than the minimum acceptable level of GO, then the broker sends him a demand to replenish the balance, but if this does not happen, then some of the positions will be closed forcibly (margin call). To avoid such a situation, the trader must hold money in the account in a quantity that is quite significantly larger than the amount of collateral - because if the futures price changes a lot, then its funds may not be enough to cover the position. The guarantee security is frozen on the merchant account until the transaction is redeemed.

At the time of this writing, the actual value of the collateral charged to customers wishing to trade futures on the RTS index is 11,064.14 (more here ). Accordingly, if the trader has 50,000 rubles on his account. That is, the merchant will be able to buy only 4 such contracts. In this case, an amount of 44,256.56 rubles will be reserved. This means that only 5,743.44 rubles of free funds will remain on the account. And if the market goes against a certain number of points, the estimated loss will exceed available funds, and a margin call will occur.

As you can see, a lot depends on the price of the futures, which may change under the influence of various factors. Therefore, this stock exchange instrument is classified as risky.

Why do we need speculation and futures

Very often, people who are not very familiar with the specifics of the stock market confuse it with Forex (although this is not particularly true ) and are branded as some sort of “scam”, where speculators rob to the thread of gullible newbies. In fact, this is not the case, and stock market speculations play an important role in the economy. Speculators buy cheap and sell expensive, but in addition to the desire for enrichment, they have an impact on the price. When the price of a stock or another stock instrument is undervalued, a successful speculator buys - which contributes to the price increase. Similarly, if an asset is overestimated, then an experienced player can make a short sale (sale of securities borrowed from a broker) - such actions, on the contrary, help lower prices.

When a lot of stock market professionals who view the stock market from different angles and use a large amount of data to analyze both the situation in the country and a particular company, their decisions affect the entire market as a whole.

In the same way, in order to imagine the role of futures, it is worth imagining what would have happened if this financial instrument were not available as such. Imagine that a company producing oil is trying to predict the necessary volumes of production. Like any business, the company wants to maximize profits with minimal risk. In this situation, you can not just extract as much oil as possible and sell it all. It is necessary to analyze not only the current price, but also at what level it may be in the future.

At the same time, those who produce, transport and store oil are not necessarily analysts and have access to the most complete predictions about the possible price of oil. Therefore, the mining company cannot know exactly how much a barrel of oil will cost in a year - $ 50, $ 60 or $ 120 and produce its corresponding volume. To get a guaranteed price, the company simply sells futures to minimize risk.

On the other hand, the exchange speculator from the example above may consider that the price of a specific futures is too high or too low, and take appropriate actions, leveling it to a fair

At first glance, the importance of establishing a fair price on the market does not seem to be such a necessary thing, however, in fact it is extremely important for the fair use of the resources of society. It is on the exchange that capital is redistributed between countries, sectors of the economy and enterprises on the one hand, and various groups of investors on the other. Without the stock market and the tools with which it functions (including derivatives), it is impossible to effectively develop the economy and meet the needs of each specific member of society.

Articles and related links:

Source: https://habr.com/ru/post/222257/

All Articles