Everything will be mobile: an overview of the mobile advertising market of the Internet

According to various studies , mobile advertising costs worldwide will reach $ 18 billion in 2014 (by comparison, in 2013 all spending did not exceed $ 13 billion). By 2017, some experts predict growth to $ 41.9 billion. The United States is still the largest market, but mobile advertising will also develop in other countries. In our today's topic, we decided to study the landscape of mobile advertising segment in RuNet in more detail.

Mobile Russia

The Runet has always lagged behind the Western markets, but nevertheless, the domestic segment of the world wide web is developing quite actively. Therefore, there is nothing surprising in the fact that it is of great interest to Western companies. Apple, Nokia (we will miss it!) And Samsung dominate the market for mobile devices, iOS occupied 34.7% of the market in 2012.

')

According to TNS Russia, in 2013 the monthly audience of the mobile Internet grew by 27% (three times faster than the Internet audience) and amounted to more than 21 million people. Already in 2014, there will be as many Russians who access the Internet not only from computers, but also from mobile devices, as many computer users. In general, one can even say that the mobile advertising market in Runet does not keep up with the penetration of the mobile Internet.

Image Slon.ru

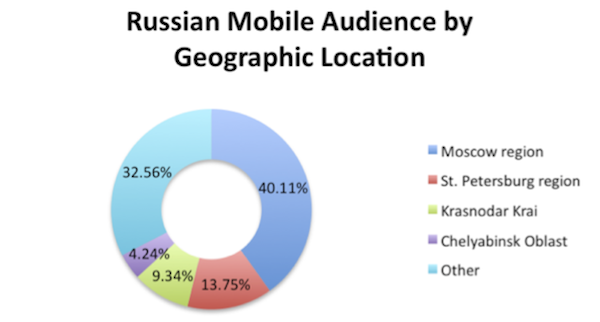

According to various sources , Moscow occupies about 40% of the total use of mobile Internet - almost half of the market, so the capital remains the most interesting region in terms of mobile advertising campaigns.

CTR (click-through rates) of mobile advertising in Russia on average fluctuate between 0.2653% and 0.2808%, but on Apple devices it is much higher and reaches the level of 0.46%.

To achieve a good CTR in the domestic mobile advertising market, you need to spend quite a lot of money. In terms of advertising targeting, the most expensive device is the Apple iPad - the average cost per click is 5.44 rubles, the iPhone is in second place — 3.47 rubles, on average, per click.

The Russian market is one of the leading in central and eastern Europe. The eMarketer publication estimates its growth in 2013 at 38.3% of the European. As for the volume of the market in money, the cost of mobile advertising in Russia in 2013 amounted to more than $ 62 million (central and eastern Europe - $ 162.4), this year this figure will increase to $ 104 million, and by 2017 it will be almost half a billion dollars.

There are more conservative estimates, a compromise option can be considered the amount of about $ 53.5 million at the end of 2013.

How things are arranged

The ecosystem of the mobile advertising market is well described in this article . In short, it includes the "classic" players in the advertising market - platforms, networks, agencies, etc. You can place ads on a variety of outreach sites that have relevant applications or mobile versions of sites that support advertising in different formats - this can be both media sites and, for example, game applications.

The placement itself takes place with the help of the so-called advertising networks that unite Internet sites. Russian traffic can be bought not only in Russian networks, but also from foreign players, as many advertisers do.

There are not so many such ad networks (working with both platforms and mobile applications) around the world (a few dozen):

- AdMob is a Google project with a good integration system (SDK) that allows developers to work with different platforms and operating systems.

- Milennial Media - the company entered the IPO, which already indicates the seriousness of this business.

- Adfonic - the network works directly with international advertising agencies and brands like Samsung, ESPN, BBC and Amazon Kindle.

- Chartboost is an advertising platform for game developers that provides various integration and analytics technologies.

- Tapjoy - the platform allows users to earn virtual money units for making purchases in applications, by downloading other applications.

- Avazu Mobile is an international network that is particularly well represented in the Asia-Pacific region. Customers are offered various targeting options for advertising campaigns.

- LeadBold is a network that offers application developers a variety of ad formats, so you can always achieve acceptable CPM.

- WapStart is one of the largest advertising networks in Russia.

- SlickJump is a new project of one of the founders of Acronis, Maxim Tsyplyaev, SlickJump service helps owners of Internet resources to monetize traffic, including mobile.

- OTM is another project that allows advertisers to place targeted ads on mobile devices.

This is a short list, there are other networks, including Russian (Madnet, Begun Mobile, iVengo, AdMoment, MobiAds, etc.). However, according to experts, the performance of mobile networks at the moment is not very high, so many customers continue to buy mobile traffic through "desktop" systems that have been operating for more than one year and are optimized for various devices, providing the ability to display ads to mobile device owners . (Here it is taken into account that when entering the "desktop" version of the site from a mobile device, it is necessary to adapt the displayed advertisement to different parameters.)

At the same time, advertising in applications is far from the only way to attract the attention of the audience. Moreover, familiar to all SMS-mailings are the most popular advertising tool in the mobile segment. The Slon.ru publication provides such a chart based on data from J'son & Partners Consulting:

But this segment, unlike media and contextual advertising, does not grow, but falls, so the future growth of the industry is not connected with it at all. The most dynamic is the development of advertising in applications. In addition, a large amount of advertising is placed on social networks (Facebook, VKontakte, Odnoklassniki) and contextual advertising (Google, Yandex).

findings

The development of technologies is likely to continue in two directions, firstly, the development of ad formats (unfolding and interstitial rich media banners, mobile video advertising, etc.) and technologies for collecting information about users. In particular, it is on this that the platforms of some domestic players working on the RTB auction technology (for example, RuTarget) are based - by buying data from various suppliers (for example, from AddThis ) they can build user profiles and display banners on advertising sites of just the right audience ( , people who in the recent past were looking for information about a car of a certain brand or picked up tickets to warm countries).

Experts agree on one thing - in the coming years, the mobile advertising market in RuNet is waiting for explosive growth. However, even a simple glance at the figures in the USA and Russia gives an understanding that growth in itself does not mean a large market volume. And such a relatively small amount of it allows it to develop more freely and remain a field for experimentation, where you can constantly invent and test new advertising formats. It is obvious that those players who in the next year or two will be able to develop their expertise in mobile advertising most of all will be able to count on far greater revenues by 2017-2018 than they do now.

Source: https://habr.com/ru/post/221439/

All Articles