10 banking marketing tricks, tricks and deceptions

While the development of a completely new version of our product is going on, which will not leave anyone indifferent, we are continuing a series of posts about bank frauds and tricks. Our previous post was quite successful, so we decided to write another one.

The desire to make the business even more profitable and as risk-free as possible pushes the lender on such ingenious financial delights, which by their nature are designed to empty wallets of gullible and inattentive borrowers. What tricks most often go banks, and how not to get caught in the insidious network - read about it below.

For mortgage lending, life insurance and the ability to work of the borrower is a must. But often banks, in order to reduce their risks and make good money, impose insurance on the client in the case of ordinary consumer lending.

')

Example:

Alfa-Bank's real loan individual offer for an individual.

The proposed loan amount is 508500 rubles (you pay interest on it), 447800 rubles (you actually get it on your hands)

Bold highlights what the customer sees as a sentence:

A client who has applied to the bank on an individual offer will find out about the availability of insurance at the very last moment before signing the contract. All this time, the bank will convince you that you take the amount N at a percentage of X, in fact, the loan amount will be different, and you need to consider the rate based on how much you get on your hands.

Thus, in addition to the already considerable interest of the bank, resulting in a substantial overpayment for three years, the client will have to just give another plus 59800 rubles (271300-211500 rubles). By simple calculation, the real interest rate turns from 23.90% into quite a “risky” 33.70%.

How to get around:

How to get around:

The reasons why the debt is formed can be many. For example, you repaid the loan before the day when the commission for using the loan was accrued. At the initial stage, these are pennies, which over time will grow into a decent amount. Moreover, guided by the provision of a 3-year statute of limitations, unscrupulous banks remind you of the debt only after 1.5-2.5 years ... in order to have time to accumulate more penalty money.

Example:

How to get around:

How to get around:

In fact, it is an opportunity to withdraw more funds from the card than is available on it. Very often the bank connects this option in the appendage to the services provided to you and moreover, without your knowledge. The proposal, of course, is tempting, if you do not pay attention to the mercilessly high interest on the very "excess" that you removed. It is very easy to go into the minus - it is enough just to withdraw a total of only 50 rubles from the debit card at a large limit.

Example:

How to get around:

How to get around:

The card is no longer needed and you just threw it out? But for the bank, it is still active, which means that various commissions are charged to it, which, again, accumulate in decent amounts ...

How to get around:

How to get around:

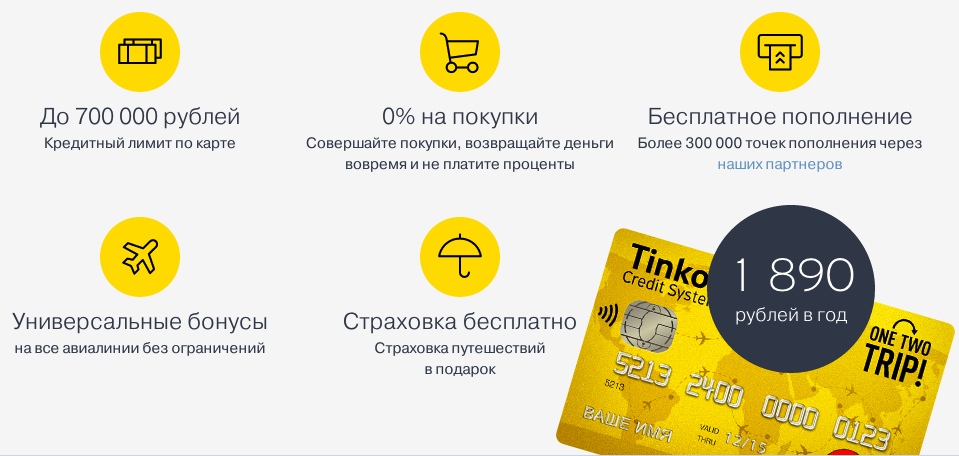

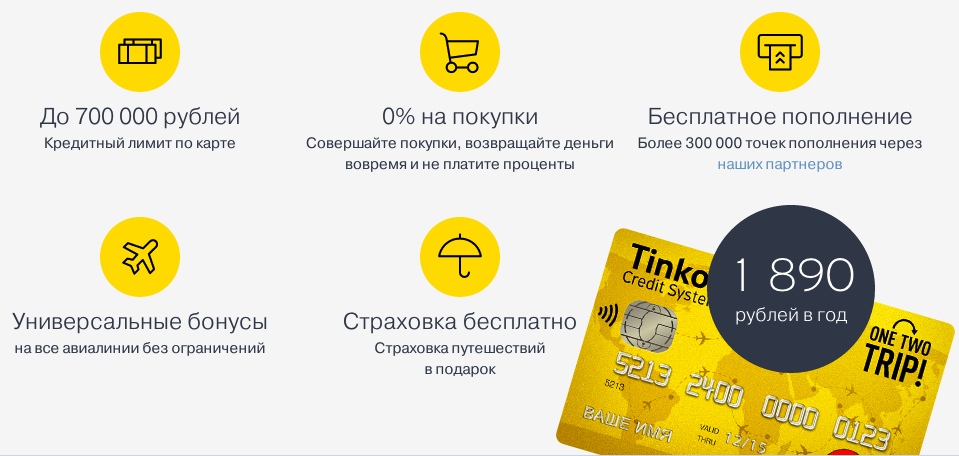

Image from tcsbank.ru

In describing the advantages of cooperation, the bank, as a rule, indicates the smallest of theoretically possible interest rates and the highest (again, theoretically) loan amount. At the same time, it is extremely difficult to receive even ten times less money at interest at times large. To do this, you will have to offer an ideal credit history, an extract from work with impressive salaries, to enlist the support of solid guarantors and so on. And even all of this will not be enough a priori - simply because the bank is not interested in working with little profit for itself.

Example:

How to get around:

How to get around:

Many banks are merciless in relation to customers who have lost their credit card. For its blocking and reissue you will have to pay a fine, and sometimes very, very considerable.

Example:

How to get around:

How to get around:

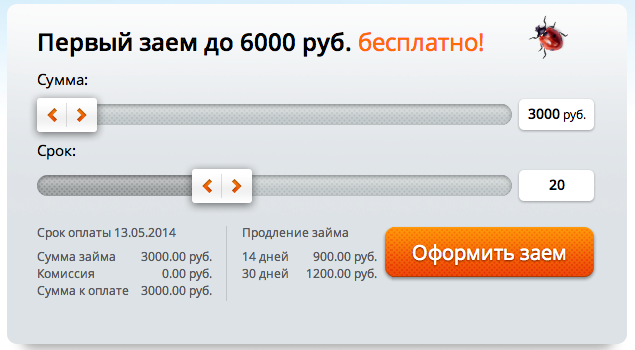

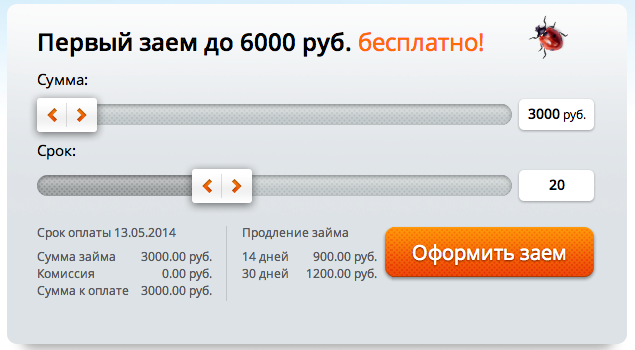

image of ezaem.ru website

The loan offered at “zero percent” seems even more remarkable and necessary. However, interest in him can quickly disappear if the client finds out that he will still have to pay interest.

Example:

How to get around:

How to get around:

According to the legislation of the Russian Federation, banks do not have the right to limit the consumer who takes a loan for personal needs, in the desire to return funds before the contractual period. But for this, the client is obliged to notify the bank of his intention, at least 30 days in advance.

Knowing this, banks seek to present the situation from a different angle and change the wording “fine” to something like “bank reward”. But the change of the concepts of the essence of the matter does not change, and therefore the borrower has the full right to seek help from the court. Just do not forget to save all checks and receipts by this time.

If we are talking about an entrepreneur who plans to develop his business with the money of a bank, then all such nuances are determined by the agreement.

Example:

How to get around:

How to get around:

Image from the site mvideo.ru: right now on the main page of the site

Today, many shopping centers offer to take goods on credit, but without overpayments. The essence of such offers is that the store gives the customer a discount on the product, which reduces to no interest accrued later on the loan by the partner bank. That is, you actually purchase the goods by installments. But do not forget about all the same insurance. Plus, the range of products that can be purchased under these conditions is usually limited.

Example:

In fact: a loan is issued with insurance at 30-35% per annum, in case you want a loan without insurance - 99% waiver.

Similar options exist in the networks of M.Video, Tekhnosila, Yulmart and others. In some cases, the interest rate on such loans is formed by the manager himself, their premium depends on it. A bank manager in a store performs the role of a sales person who, judging by his subjective perceptions, offers you a loan on certain conditions. The more unprofitable a loan is for you, the more the manager will earn. In retail networks there are no profitable loans.

How to get around:

How to get around:

If you enter into an agreement for a loan at a fixed interest rate, then the interest for you will have to remain unchanged throughout the loan repayment period. And if even under the contract such a change is possible, then another law will come to the rescue - "On Consumer Protection". It negates agreements that directly or indirectly violate the rights of the buyer of goods or services.

How to get around:

How to get around:

Do not forget to read more about loans:

PS The calculations given in the post are not accurate to the penny and are aimed at explaining the general logic of the marketing work and the tricks of the banks. If you managed to calculate better and more correctly - please report this to the PM.

The desire to make the business even more profitable and as risk-free as possible pushes the lender on such ingenious financial delights, which by their nature are designed to empty wallets of gullible and inattentive borrowers. What tricks most often go banks, and how not to get caught in the insidious network - read about it below.

1. Voluntary compulsory insurance

For mortgage lending, life insurance and the ability to work of the borrower is a must. But often banks, in order to reduce their risks and make good money, impose insurance on the client in the case of ordinary consumer lending.

')

Example:

Alfa-Bank's real loan individual offer for an individual.

The proposed loan amount is 508500 rubles (you pay interest on it), 447800 rubles (you actually get it on your hands)

Bold highlights what the customer sees as a sentence:

| Credit amount | 508500 rub. | 448700 rub. |

| Loan terms | 36 months | 36 months |

| Monthly payment | 20 thousand rubles | 20 thousand rubles |

| Annual rate | 23.90% | 33.70% |

| Overpayment for 36 months | 41.59% | 60.46% |

| Total overpayment | 211500 rub | 271300 rub |

A client who has applied to the bank on an individual offer will find out about the availability of insurance at the very last moment before signing the contract. All this time, the bank will convince you that you take the amount N at a percentage of X, in fact, the loan amount will be different, and you need to consider the rate based on how much you get on your hands.

Thus, in addition to the already considerable interest of the bank, resulting in a substantial overpayment for three years, the client will have to just give another plus 59800 rubles (271300-211500 rubles). By simple calculation, the real interest rate turns from 23.90% into quite a “risky” 33.70%.

How to get around:

How to get around:- In accordance with applicable laws of the Russian Federation, banking institutions are required to offer credit programs, both with and without a clause on compulsory insurance. Insist on the option without insurance.

2. Not fully repaid loan

The reasons why the debt is formed can be many. For example, you repaid the loan before the day when the commission for using the loan was accrued. At the initial stage, these are pennies, which over time will grow into a decent amount. Moreover, guided by the provision of a 3-year statute of limitations, unscrupulous banks remind you of the debt only after 1.5-2.5 years ... in order to have time to accumulate more penalty money.

Example:

- In Alfa-Bank, for CLASSIC, STANDARD and GREEN cards, the penalties for the minimum payment delay amount to one percent of the amount of the overdue debt (calculated for each day of delay). Plus, a one-time fine of 700 rubles is paid - for the formation of the debt itself.

- And in Home Credit Bank the situation is different - here the penalty is charged depending on the duration of the delay. So, for 10 days you will need to make a one-time payment in the amount of 500 rubles, for 2 months - 800 rubles, for 3 months - 1000 rubles, for 4-5 months - 2,000 rubles, and then 500 rubles each month.

How to get around:

How to get around:- After closing a loan or card, call the bank and make sure everything is closed.

3. Overdraft

In fact, it is an opportunity to withdraw more funds from the card than is available on it. Very often the bank connects this option in the appendage to the services provided to you and moreover, without your knowledge. The proposal, of course, is tempting, if you do not pay attention to the mercilessly high interest on the very "excess" that you removed. It is very easy to go into the minus - it is enough just to withdraw a total of only 50 rubles from the debit card at a large limit.

Example:

- In Promsvyazbank, overdraft is automatically connected after the first card transaction requiring authorization, if the client has not refused it within 5 days. And until the consumer visits the bank branch and writes a disclaimer, the loan will work. In the case of care, you will need to pay 0.3% of the amount of the excess limit daily.

- In VTB24, the penalty for each day of unpaid debt to exceed the overdraft limit will be 0.6% of the amount of this debt.

How to get around:

How to get around:- Ask your bank manager if there is an overdraft on your card and how to disable it.

- Activate SMS or Internet banking service to keep track of your account balance. Just keep in mind that this option is also paid.

- The balance in the account will most likely be calculated on the basis of the amount of your funds and the credit limit (in Promsvyazbank, Siab Bank, for example). That is, to determine the amount that you can use without fear of going into a minus, you will have to take away the size of the overdraft limit from the data shown to you.

4. Maintenance of an old waste card

The card is no longer needed and you just threw it out? But for the bank, it is still active, which means that various commissions are charged to it, which, again, accumulate in decent amounts ...

How to get around:

How to get around:- Officially cancel an unnecessary card in the bank. The manager will have to cut it right in front of you.

5. Too profitable offers

Image from tcsbank.ru

In describing the advantages of cooperation, the bank, as a rule, indicates the smallest of theoretically possible interest rates and the highest (again, theoretically) loan amount. At the same time, it is extremely difficult to receive even ten times less money at interest at times large. To do this, you will have to offer an ideal credit history, an extract from work with impressive salaries, to enlist the support of solid guarantors and so on. And even all of this will not be enough a priori - simply because the bank is not interested in working with little profit for itself.

Example:

- The credit program "Partner" for individual entrepreneurs and small businesses from Alfa-Bank offers: "up to 6 million rubles without collateral for 3 years." The site talks about a preliminary decision on the issuance of a loan in half an hour and a simplified package of documents. In fact, bank analysts carefully study your credit history, assess whether you own real estate, etc. Before checking business competitiveness and accounting integrity, the matter often simply does not reach, because it is important for the bank that you have something to ask about the loan today.

- In Promsvyazbank, managers actually impose insurance on consumers, arguing that it will be easier to get a loan. For example (http://arb.ru/bank/promsvyazbank/claims/9707186/), a person received only 372,000 rubles from the loan amount of 425,000 rubles, and 53,000 rubles is taken into account for insurance. At the same time, interest is paid on the first amount. Under the terms of insurance, the bank promises to return the money spent on insurance, but only after the expiration of the initial term of the contract. If you repay the loan early, the contract will continue until the date specified in it. In our case, the loan was taken for 7 years ...

How to get around:

How to get around:- Do not believe the beautiful booklets, believe the numbers. Carefully read the contract.

6. Fees for card loss

Many banks are merciless in relation to customers who have lost their credit card. For its blocking and reissue you will have to pay a fine, and sometimes very, very considerable.

Example:

- The reissue of the card in case of its loss in Alfa-Bank is 270 rubles. An emergency reissue (within 72 hours) of the card in the event of its loss abroad amounts to 6,750 rubles (with the exception of the “Gold” and “Platinum” lines)

- Reissuing a credit card in Sberbank will cost 150 rubles. An urgent withdrawal of money from the card outside the Russian Federation, including, in case of its loss, will amount to 6 thousand rubles for one operation.

How to get around:

How to get around:- Check with the manager what is the penalty in your bank for reissuing a card for its loss.

7. Interest-free loan at high interest.

image of ezaem.ru website

The loan offered at “zero percent” seems even more remarkable and necessary. However, interest in him can quickly disappear if the client finds out that he will still have to pay interest.

Example:

- LLC "E loan" offers to take up to 6 thousand rubles for free. The advertisement on the site clearly indicates the loan amount, the interest rate (0 percent) and the final payable, equal to the one that you plan to take. Very tempting. However, after reading the terms of the contract, we meet point number 4, which is called the "Procedure for calculating interest." At the same time, you will not find specific numbers in it, since “the amount of interest for using the Microloan amount is calculated by the Company with respect to each specific Microloan”.

How to get around:

How to get around:- Do not believe zero loans - they do not exist, because the meaning of the loan is to make the bank earn on it.

8. The ban on early repayment

According to the legislation of the Russian Federation, banks do not have the right to limit the consumer who takes a loan for personal needs, in the desire to return funds before the contractual period. But for this, the client is obliged to notify the bank of his intention, at least 30 days in advance.

Knowing this, banks seek to present the situation from a different angle and change the wording “fine” to something like “bank reward”. But the change of the concepts of the essence of the matter does not change, and therefore the borrower has the full right to seek help from the court. Just do not forget to save all checks and receipts by this time.

If we are talking about an entrepreneur who plans to develop his business with the money of a bank, then all such nuances are determined by the agreement.

Example:

- In one of the legal blogs we find a message that the Arbitration Court decision was satisfied with the claim of a certain LLC in relation to the Sverdlovsk branch of “Rosselkhozbank” to recover from the respondent the amount paid as an early repayment fee. But in the spring of the same year, between the same parties there was a new trial, in the course of which Rosselkhozbank demanded that the company indemnify the losses incurred as a result of the loan being paid by the borrower before the deadline. The amount of damage was estimated at the rate of interest due to the bank for the month. And in this formulation, the Supreme Arbitration Court decided to satisfy the claim. If the borrower had notified the bank in 30 days (as is the case with individuals) about his intention to pay the debt ahead of time, the bank would have no single opportunity to receive at least some form of its “fines” money.

How to get around:

How to get around:- When applying for a loan, ask the bank manager what the terms of early repayment for your loan are.

- For 30 days, notify the bank of your intention to repay the debt ahead of schedule.

9. Advertising and nothing personal

Image from the site mvideo.ru: right now on the main page of the site

Today, many shopping centers offer to take goods on credit, but without overpayments. The essence of such offers is that the store gives the customer a discount on the product, which reduces to no interest accrued later on the loan by the partner bank. That is, you actually purchase the goods by installments. But do not forget about all the same insurance. Plus, the range of products that can be purchased under these conditions is usually limited.

Example:

- In Eldorado under the program "0 * 0 * 24 Option" you can take up to three loans in the bank "Home Credit" for goods of the same name. All product groups are available, but mobile phones and laptops are sold for this promotion only in a limited range.

In fact: a loan is issued with insurance at 30-35% per annum, in case you want a loan without insurance - 99% waiver.

Similar options exist in the networks of M.Video, Tekhnosila, Yulmart and others. In some cases, the interest rate on such loans is formed by the manager himself, their premium depends on it. A bank manager in a store performs the role of a sales person who, judging by his subjective perceptions, offers you a loan on certain conditions. The more unprofitable a loan is for you, the more the manager will earn. In retail networks there are no profitable loans.

How to get around:

How to get around:- Be careful to the offers of banks, do not take consumer loans in stores.

10. Changes in interest rates and credit conditions

If you enter into an agreement for a loan at a fixed interest rate, then the interest for you will have to remain unchanged throughout the loan repayment period. And if even under the contract such a change is possible, then another law will come to the rescue - "On Consumer Protection". It negates agreements that directly or indirectly violate the rights of the buyer of goods or services.

How to get around:

How to get around:- If you are not confident in your knowledge, first show the loan agreement to a lawyer or an economist, and after that sign it.

- Official financial institutions rarely overstep the line of the law, however, there are quite a few fraudsters in the credit market today. Check the presence of a credit institution in the state register (if you work with an MFI) or in the list of Banks of Russia (if we are talking about a bank).

Do not forget to read more about loans:

PS The calculations given in the post are not accurate to the penny and are aimed at explaining the general logic of the marketing work and the tricks of the banks. If you managed to calculate better and more correctly - please report this to the PM.

Source: https://habr.com/ru/post/219971/

All Articles