Saving Russian electronics - entering foreign markets

The other day we received another news about US sanctions in the field of electronics: the supply of components for Russian space exploration projects was stopped. Such topics have recently been actively discussed on the websites of leading media about high technologies. For example, just yesterday , an article appeared on the CNews portal about how a large plan for the transition to domestic developments in products for the military-industrial complex will be developed on behalf of the Government of the Russian Federation. Readers were shown a photo of the Russian Elbrus microprocessor (see above), and also quoted the Minister of Communications, Nikolai Nikiforov, who believes that in Russia “in about 5 years it is possible to develop a number of platform solutions - including an operating system for mobile devices. " In the conclusion of the article, the minister calls on domestic developers of electronics and software to focus on the global market instead of creating products of a local scale, since Russia has potential markets to export its technology.

This publication turned out to be very consonant with the theses of the speech that we, the Promwad team, prepared for the Live Electronics of Russia forum back in 2010. Today, four years later, our ideas turned out to be very relevant. We offer Habr readers to get acquainted with the text under the cut and comment in the comments.

This is how our manifesto in defense of national electronics (text and slides) sounded:

')

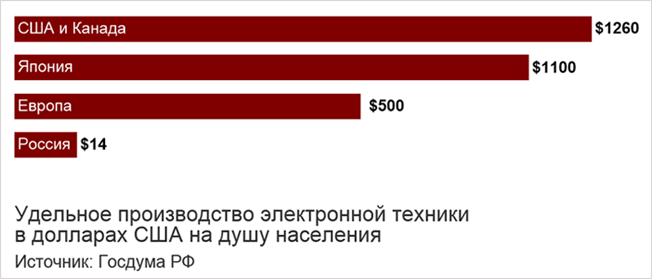

The Russian electronic industry does not use potential opportunities for more efficient development. Our developments are generally uncompetitive both in the global market and in the domestic one. This fact was repeatedly voiced by the participants of the largest industry forums and conferences, which is confirmed by the results of market research.

Only 5% of electronics labeled “produced in Russia” is exported (as we know, this indicator is one of the indicators of competitiveness, it reflects the depth of integration into the world market). The share of Russian electronic products in the international market reaches only 0.05% (a scanty figure, considering that our domestic market alone is 3% of the consumption of electronics worldwide). National companies are not owners even in their own territory, being content with only a fifth of the domestic market.

At this time, new centers of economic development are emerging on the world stage, which are having an increasing influence on the alignment of forces in the industry. China, India and Brazil produce more than 30% of electronics for the global market, ahead of the United States, EU countries and Japan.

Of course, national problems in the electronic industry did not go unnoticed. The development of the radio electronics business is closely monitored by the state, commercial companies and venture capital investors. Industry experts regularly publish their editions of a list of recommendations for solving the pressing problems of the electronics industry. Industry associations, ministries and the Government of the Russian Federation also readily offer a whole range of programs. The latest document of this kind was the project “Strategies for the Development of the Electronic Sector of Russia until 2025”, developed by AEAP on behalf of the Ministry of Industry and Trade.

The developers of this document assume that if the program is successfully implemented, the share of domestic developments in the domestic electronics market will be equal to import and will reach 50%, while in the world this indicator will be equal to 5% (ie, it will grow 100 times!). But the achievement of Russia's leadership in priority areas in foreign markets is planned only in the long term. And in the coming years, according to the strategy developers, enterprises should form the foundation for achieving this goal, i.e. To begin with, work out the scenario “grocery company - infrastructure equipment - Russian market” (see figure below, top row).

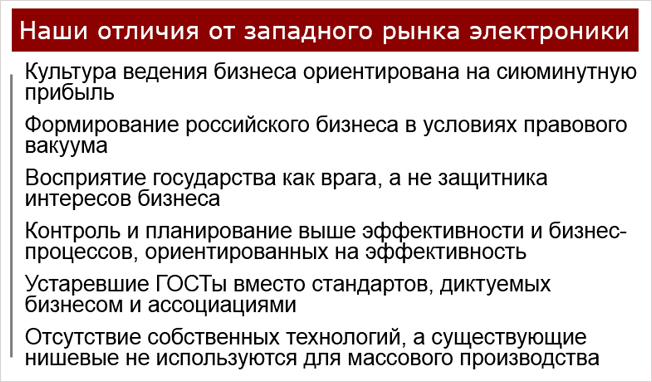

Options for the development of Russian manufacturing companies and electronics developers

However, without an export orientation, companies will not be able to offer more intellectually rich electronics and thus stand out against the background of mass production of Southeast Asia. Only by working in a highly competitive environment of Western markets in a service model with a focus on exporting consumer electronics (see figure, bottom row), one can absorb a new business culture - focus on quick results, searching for a fine line between production costs and engineering solutions. This is the only opportunity to introduce more efficient business processes. It is only from personal experience that one can understand what a business is in the field of mass consumer products, what actually includes the concept of “quality production” and how to work with it. While in Russia it is not. And such an experience just like that, without a real immersion, is impossible to obtain, even the best experts and consultants will not help.

Such countries as China, Korea, Taiwan, Vietnam, India, and Japan were able to achieve visible success in the electronics industry due to the fact that they did not isolate themselves in the domestic markets, but rather absorbed foreign investment and / or foreign experience. They did not go their way alone.

Only by creating Russian intellectual capital in the field of electronics, following the formula “Russian intelligence + Russian capital = Russian intellectual capital” can we achieve success and catch up with the global industry by becoming a real partner and competitor in the global market. It is necessary to use generally accepted world business models, which are characterized by the absorption of knowledge of Western experts. They need to learn how to manage, organize business processes, use technology, and integrate into the global infrastructure. Only by increasing the national intellectual capital, Russian electronics will be able to integrate into the global industry.

In this case, as a working model, it is necessary to consider such options as:

- Russian fabless company + western factory;

- Western chip vendor + Russian factory;

- Western consumer electronics manufacturer + Russian EMS company.

It should be recognized that the option “Russian fabless + Russian factory” is an uncompetitive model in the electronics market.

But what if you look at the development of the industry not in general, but to figure out what exactly small and medium enterprises should do to ensure growth? The answer to the question “to be or not to be” is connected with the solution of the following major problems:

- Lack of corporate strategy.

- Raw business processes and organizational structures.

- Lack of integration with world leaders.

- Work in markets with artificially limited competition.

- Lack of cooperation in the industry.

- Lack of specialists and weak engineering culture.

Government strategies and programs are not a panacea. If industry players put the burden of responsibility for their fate on the shoulders of ministries and industry associations, the current situation in the electronic market will not change. Until every manager is aware of the fact that he can (and should!) Himself, without external assistance, take concrete steps to enter foreign markets, the plans for future development will remain unfulfilled.

* Sad statistics from the first paragraph of our theses were obtained from the “Strategy for the development of the electronic industry in Russia until 2025” (the full text in the DOC format is available on the website of the Ministry of Industry and Trade, which should develop an import substitution program for the defense industry by the end of 2014).

PS If you are interested in meeting other analytical articles of our team, welcome to Promwad Electronics Design Center Library .

Source: https://habr.com/ru/post/219585/

All Articles