Income cards 2014 - how do they earn?

You are transferred a salary to a card or to a current account in a bank, and, possibly, given in an envelope. After that, the money is lying and waiting for them to spend.

There are always times when money is idle. There is a lot of such periods of time, and the sums of free means are different. You will not deposit them on deposit, suddenly you will need it tomorrow, but on a card on which interest is charged ...

How much can you get if all the free money worked every day?

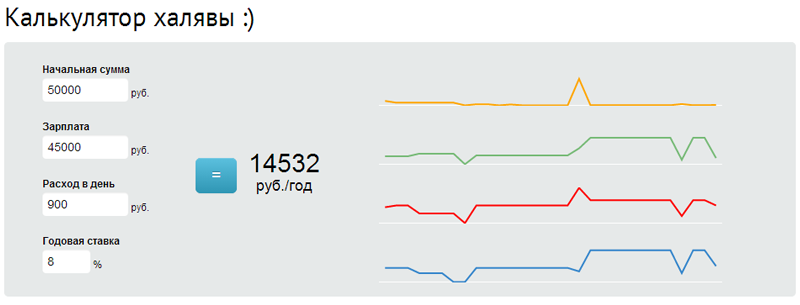

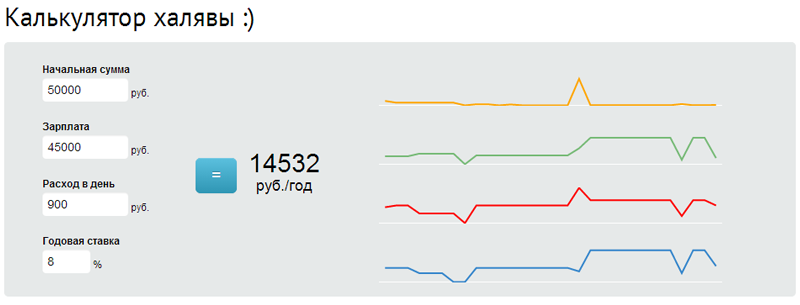

Our programmer specifically for readers Habra made a calculator , you can play around.

')

Cards with a yield of 5% or less, I do not consider. This includes Binbank cards (3-5%), Home Credit 5-7%, but 7% is charged only on a gold card, whose issue value is 2500 rubles, and we want to earn. Here, Promsvyazbank, on income cards, it pays 4-5% on the balance in the account.

Meet:

svyaznoybank.ru/retail/cards/universal

Today there are few universal cards that combine credit with additional income on the balance of own funds. The messenger is quite interesting in this regard. Interest is calculated if there is more than 10,000 rubles on the account.

We put 100,000 rubles a year - we get% in the amount of 7,000 rubles - 900 rubles = 6,100 rubles.

europlan.ru/credit-cards

There is no accrual on the balance on the Europlan card. But the savings account is automatically opened on the card at 10% per annum. In the Internet bank, you can transfer extra money to the savings account and back for a couple of clicks (no commission). The main thing is not to withdraw the minimum amount of the savings account in the amount of 1000 rubles.

In this case, not all available funds work: the more often and more you transfer to a savings account, the more you get.

We put 100,000 rubles a year - we get% in the amount of 10,000 rubles.

rocketbank.ru/tariffs/all-inclusive

Interkommerts Bank issues a card under the Rocketbank brand. The card here is just a tool, and most importantly, it is a mobile bank, around which everything revolves. But today it is not about him.

So, in the amount of 30,000 rubles. 9% is charged - this is good, but the use fee every month is bad. If you spend more than 30,000 rubles a month on the card, then the service will be free.

We put 100,000 rubles a year - we get% in the amount of 9,000 rubles - 900 rubles (75 * 12) = 8100 rubles.

www.tcsbank.ru/debit/#money

A lot has already been written on the TCS card, I’d just note that the service will be free if the deposit is open, or there is at least 30,000 rubles in the account.

We put 100,000 rubles a year - we get% in the amount of 8,000 rubles.

www.rsb.ru/bvk/standart/terms

See the card "Bank in the pocket Standard." With deposits there are possible options: either to consistently receive 4% for a cumulative account, or for a balance - 2-10% (depending on the balance and sums on expenditure transactions).

In addition, it is possible to draw up deposits at rates of up to 10.25% per annum online at the Internet Bank.

About buns: a lot of card design options, you can choose your own. Additionally, you can get an NFC card - for free!

We put 100,000 rubles a year (if spending a month from 15,000 rubles to 30,000 rubles, then the rate is 6%) - we get% in the amount of 6,000 rubles - 300 rubles = 5,700 rubles. If you spend more than 30,000 rubles a month on a card, then the rate will be 10% and 9700 rubles will be released .

Tip: do not keep large amounts on the card. It will be more profitable from time to time to transfer the excess funds to a full deposit (preferably in the same bank and without fees for transfers between your accounts). The deposit rates are higher and safer.

Subscribe, and then miss something interesting.

There are always times when money is idle. There is a lot of such periods of time, and the sums of free means are different. You will not deposit them on deposit, suddenly you will need it tomorrow, but on a card on which interest is charged ...

How much can you get if all the free money worked every day?

Our programmer specifically for readers Habra made a calculator , you can play around.

')

Cards with a yield of 5% or less, I do not consider. This includes Binbank cards (3-5%), Home Credit 5-7%, but 7% is charged only on a gold card, whose issue value is 2500 rubles, and we want to earn. Here, Promsvyazbank, on income cards, it pays 4-5% on the balance in the account.

Meet:

Svyaznoy

svyaznoybank.ru/retail/cards/universal

Today there are few universal cards that combine credit with additional income on the balance of own funds. The messenger is quite interesting in this regard. Interest is calculated if there is more than 10,000 rubles on the account.

We put 100,000 rubles a year - we get% in the amount of 7,000 rubles - 900 rubles = 6,100 rubles.

Europlan

europlan.ru/credit-cards

There is no accrual on the balance on the Europlan card. But the savings account is automatically opened on the card at 10% per annum. In the Internet bank, you can transfer extra money to the savings account and back for a couple of clicks (no commission). The main thing is not to withdraw the minimum amount of the savings account in the amount of 1000 rubles.

In this case, not all available funds work: the more often and more you transfer to a savings account, the more you get.

We put 100,000 rubles a year - we get% in the amount of 10,000 rubles.

Roketbank

rocketbank.ru/tariffs/all-inclusive

Interkommerts Bank issues a card under the Rocketbank brand. The card here is just a tool, and most importantly, it is a mobile bank, around which everything revolves. But today it is not about him.

So, in the amount of 30,000 rubles. 9% is charged - this is good, but the use fee every month is bad. If you spend more than 30,000 rubles a month on the card, then the service will be free.

We put 100,000 rubles a year - we get% in the amount of 9,000 rubles - 900 rubles (75 * 12) = 8100 rubles.

Tinkoff

www.tcsbank.ru/debit/#money

A lot has already been written on the TCS card, I’d just note that the service will be free if the deposit is open, or there is at least 30,000 rubles in the account.

We put 100,000 rubles a year - we get% in the amount of 8,000 rubles.

Russian standard

www.rsb.ru/bvk/standart/terms

See the card "Bank in the pocket Standard." With deposits there are possible options: either to consistently receive 4% for a cumulative account, or for a balance - 2-10% (depending on the balance and sums on expenditure transactions).

In addition, it is possible to draw up deposits at rates of up to 10.25% per annum online at the Internet Bank.

About buns: a lot of card design options, you can choose your own. Additionally, you can get an NFC card - for free!

We put 100,000 rubles a year (if spending a month from 15,000 rubles to 30,000 rubles, then the rate is 6%) - we get% in the amount of 6,000 rubles - 300 rubles = 5,700 rubles. If you spend more than 30,000 rubles a month on a card, then the rate will be 10% and 9700 rubles will be released .

Tip: do not keep large amounts on the card. It will be more profitable from time to time to transfer the excess funds to a full deposit (preferably in the same bank and without fees for transfers between your accounts). The deposit rates are higher and safer.

Subscribe, and then miss something interesting.

Source: https://habr.com/ru/post/218927/

All Articles