Overview of the Russian market of VMware-hosting. Comparison of the leading providers of corporate IaaS in Russia

The cloud market in Russia is forming quite dynamically and now we can single out a separate segment in the niche of renting virtual infrastructure - the so-called “corporate” IaaS. It is distinguished, first of all, by the use of commercial hypervisors and control software, high demands on the hardware component, at a relatively higher cost of cloud resources. At the same time, overpaying for the licenses of the hypervisor and for the use of high-end equipment, the corporate customer receives the necessary functionality, such as HA (high availability) functionality, support for any guest OS, integration with its own virtual infrastructure, etc.

The undisputed leader of server virtualization resources for the corporate segment today is VMware. In this post, I will share information from a real project on the deployment of a virtual data center, during which all the officially existing VMware service providers in Russia were actually compared. Below is detailed information on the distinctive features of such companies and my thoughts on this matter.

')

Separately, it should be emphasized that everything that you learn below has nothing to do with the VPS / VDS hosting market and the needs of companies that manage one server and two IT specialists (Corporate refers to what belongs to a large company, corporation. - Dmitriev Russian Explanatory Dictionary. D.V. Dmitriev. 2003).

Short backstory. One large corporate startup chose a platform for organizing a virtual data center. There are only two starting criteria for selecting suppliers:

1. The main site should be in Russia.

2. The virtualization platform used must be VMware.

I’m not going to go deep into the details of choosing VMware as a hypervisor, I’d just note that the critical arguments in favor of this solution were: existing positive experience with the hypervisor, High Availability, vMotion functions, support for the required OS, ability to interface with your own virtual infrastructure, and, in the future, the ability to use the functionality of SRM. But this is not the case, therefore we will not give additional arguments and take these initial premises as a given.

The main platform is in Russia to ensure minimal delays and an affordable, dedicated connection to the cloud. For the future, the plus for the provider will be the presence of a second platform with a similar architecture, possibly foreign.

Go. Where to get the list of Russian VMware service providers? To cut off all kinds of agents and resellers such as 1cloud , go to http://partnerlocator.vmware.com/ , specify Country - Russian Federation, Partner Type - "Service Provider". We get a list of VMware partners who officially provide IaaS in Russia. In the list of 12 companies. For honesty, we sort them by the start date of the provision of services in the status of VMware Service Provider, since The order of issuance in the partner-locator is completely incomprehensible to me.

So, here is a list of heroes.

| IaaS provider | Site | From what year does IaaS provide in the status of VMware Service Provider | VSPP Affiliate Status | |

|---|---|---|---|---|

| one. | IT-GRAD | http://www.it-grad.ru/ | 2008 | Enterprise |

| 2 | Dataline | http://www.dtln.ru/ | 2009 | Premier |

| 3 | Cloudone | http://www.cloudone.ru/ | 2010 | Professional |

| four. | ONLANTA | http://www.onlanta.ru/ | 2011 | Enterprise |

| five. | Safedata | http://www.safedata.ru/ | 2011 | Enterprise |

| 6 | Cloud4Y | http://www.cloud4y.ru/ | 2011 | Professional |

| 7 | Croc | http://www.croc.ru/ | 2012 | Enterprise |

| eight. | I-teco | http://www.i-teco.ru/ | 2012 | Enterprise |

| 9. | Megafon | https://server.megafon.ru/ | 2012 | Enterprise |

| ten. | RTComm-Sibir | http://www.rtcomm-sibir.ru/ | 2012 | Professional |

| eleven. | Softline | http://www.softcloud.ru | 2014 | Enterprise |

| 12. | DEPO Electronics | http://www.depo.ru/ | 2014 | Professional |

Immediately medals receive IT GRAD for the most extensive experience and Datalayn for the highest partner status.

The next step is to understand the approximate prices of cloud resources. Most of the listed providers have calculators on their sites that calculate the total cost of a machine or pool by some non-linear formulas. For corporate level this, of course, is not suitable. We will need fixed prices for each of the resources specified in the contract. Moreover, even the prices we receive in the first commercial offer are only the starting point for pushing the real figure, for example, by holding a tender or auction. In this segment, already on volume from 100 000 r. a monthly payment can be negotiated a substantial discount without even scaring the provider with lower prices of competitors and without any competition.

In other words, the prices that we will see in the table on the basis of the first commercial offers received are not the prices that will end up in our contract, and are presented solely for understanding the order of values. At the current stage, we should be more interested in the model and pricing principles. In this regard, taking into account the homogeneity of the hypervisor and management software, we do not have such diversity as in the market of budget cloud hosting.

By requesting commercial offers, we get an understanding that there are two basic billing models in this niche:

- static (for the allocated amount of resources);

- dynamic (for the actual amount of resources consumed by the machines).

Static models differ in the size of the billing period. Also, they can be applied rigid tariff grids with a given ratio of CPU / RAM, which is an inconvenient limitation.

A dynamic model can include a hard disk resource; in this case, a gigabyte of occupied space will be somewhat more expensive than a gigabyte of allocated disk space. Or do not include, then the cost of HDD will be taken by analogy with the cost of a static model.

Not all providers support dynamic billing model. This is due to the fact that it is suitable, as a rule, mainly for test environments and development environments. For corporate production it turns out expensive. However, for those who develop their own software, the presence of a dynamic model is a significant plus to the opportunity to save money.

When requesting commercial offers in some companies, you will have to face the quest called “get exactly VMware”. For example, in Ayteko, by default, they will offer you a budget MakeCloud on the OpenStack platform, while on VMware they have a so-called “Enterprise Cloud” implemented separately. In CloudFoay, by default, a test will be given to you on Citrix Xen. And KROK will tell you that they use Red Hat KVM virtualization in their cloud, so we’ll have to separately clarify which hypervisor we need.

Having completed the first quest, in most cases you will have to face the second one - to get separate prices for CPU, RAM and HDD, and not just the cost of the entire pool you requested. Yes, and more, preferably in rubles. For many providers, prices are offered in dollars, euros, or cu, but since we are in the corporate segment, if you wish, we can easily convert everything into rubles and even enter these numbers into the contract. The conversion rate, however, may not please at all.

Anyway, after several postal iterations, we get separate prices in terms of resources, and with the help of a calculator we bring everything into the format of a monthly payment using a static and dynamic model. For disks, we take HDD SAS 15K as the standard of comparison or comparable in performance from the list of tariffs offered by the provider. The cost of the processor is reduced to the cost of 1 GHz (if necessary, divide the cost of renting the core by its clock frequency). Once again, these prices are interesting for our case only as indicative, for understanding the general situation on the market. Dollar exchange rate taken on 03/19/2014, and is 36.45 p.

* Minimum prices with respect to the ratio of the number of processor cores to the amount of GB of RAM 1: 8. If this attitude is not respected, the cost will be more expensive.

For the presence of billing on the actual consumption of resources, medals are awarded to Dataline, IT-GRAD and SafeData.

Leaders at the lowest / highest prices can not be allocated, the total cost will depend on the ratio of the volumes of individual resources (CPU / RAM / HDD), total consumption volumes and the results of the negotiations on price.

It turns out that in the IaaS VMware market the average starting price for a 1 GHz processor is about 500 p. per month, and for 1 GB of RAM - about 600 p. A hard disk with performance comparable to SAS 15K will cost an average of 14 rubles per GB.

If with the resource of processors and RAM (taking into account the use of a common virtualization technology), all providers are approximately the same, and there should not be any issues regarding the performance of both, then everything is much more complicated with the disk subsystem. Having received the position “Disk space HIGH”, “HDD FAST” or “HDD SAS 15K” in the command station, we do not get any understanding of what performance we will be guaranteed.

The only real means of estimating the performance requirements of the disk subsystem for a particular application is to conduct load testing with measuring the current load (in IOPs) and delay (Latency, in ms) in the operating system (eliminating previously the parasitic load of other applications). Practically for any applications, latency at 20 ms is enough; higher delays, as a rule, begin to affect application performance.

Therefore, we should clarify this point. Subject interests - the presence of the written down in the contract (SLA) or at least the declared guarantees on the number of I / O operations per second (IOPs) and guarantees on the maximum delay when accessing the disks (Latency, ms). As well as the ability to manage the performance of our disk subsystem, in the context of the pool or in the context of individual machines (which of course is more preferable).

A little fiddling with the documentation and vendors, we get the following table.

* The agreed numbers can be entered into the contract upon a separate request, depending on the volume of consumption.

This time, we give out medals to providers Cloud One (for the best starting performance indicators, for nothing, which is not reflected in the typical SLA) and IT GRAD (for manufacturability: the ability to set the required performance parameters within the standard SLA).

Sadly, more than half of the providers are not able to guarantee at least some figures on the performance of the disk subsystem. This means that during its degradation we will have to try very hard to prove to the provider that this is indeed an incident, while our application at this time may completely lose its functionality.

We now turn, in fact, to the guarantees of performance. Usually, organizations that provide any IT services, it is customary to issue an SLA, which records guaranteed availability, quality parameters of the service, level of service, etc. Surprisingly, not all VMware service providers have an SLA, or some providers understand the SLA only as a rule technical support services.

Since we are comparing here, we will pay attention to guaranteed availability and compensation in case of its violation - these clauses are, if not in the SLA, then at least in the contract. So, having analyzed the main compensation schemes, the following can be highlighted:

- Linear scale, directly proportional to downtime

- Progressive scale, with thresholds and limiting the amount of compensation,

- Lack of typical compensation scheme. Proved damage compensation, with limited compensation

How it looks in numbers is shown below.

* 1 incident is allowed with a resolution time of no more than 90 minutes

** Availability per year, 3.3% penalty for every 0.1% reduction in availability. The penalty from the amount of payments for the last quarter.

*** SLA is missing.

**** Losses are reimbursed within the amounts received and must be documented.

* Quarterly payment compensation with an average annual decline in availability, reduced to 1 month. Those. if during the year there was unavailability of 11 days, then the last quarterly payment will be fully compensated.

According to the results of the above analysis, without a doubt, we will hand over the Softline company medal for the toughest SLA in terms of compensation for violations of accessibility.

After availability, which almost everyone has, we will try to assess the saturation of the SLAs used in terms of parameters and quality indicators. We considered the parameters and performance indicators of the disk subsystem earlier, so we will focus on regulating the quality of the support service.

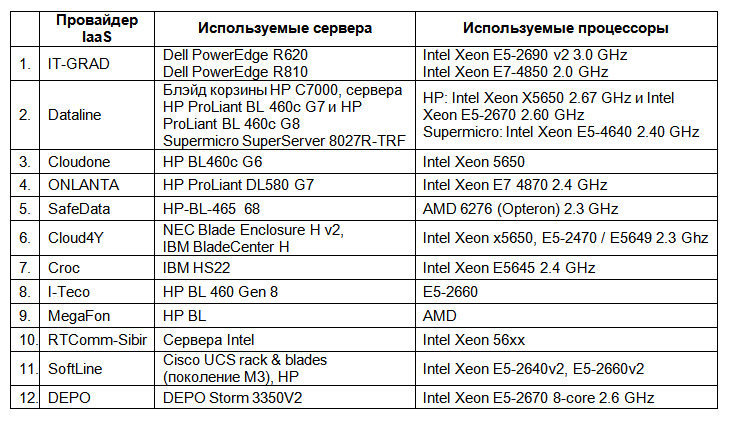

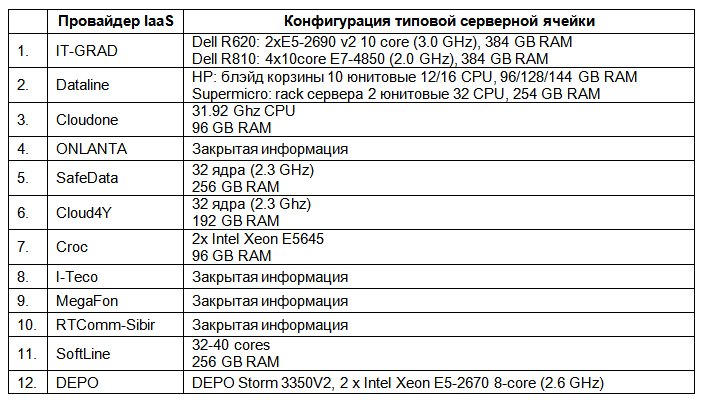

After analyzing the procedural moments, it is time to look at such tangible things as the cloud platform and its placement platform. Let's start with the traditional questions regarding iron, which is part of the platform.

The configuration of a typical server cell is, as it turned out, highly confidential information, which corporate IaaS providers share extremely reluctantly.

In the absence of the full amount of reliable information on this section, we will not hand over medals, but it is worth highlighting important points, such as the processor generations used, their frequency and the size of the server cell. Obviously, newer processors will provide greater performance at 1 GHz frequency, higher core clock speeds - the only way to accelerate the execution of applications that less efficiently parallelize their work, and the size of the server cell directly limits the size of virtual machines created, for example, powerful database servers. Hiding such information from a potential client is clearly a bad sign.

Among the storage systems used to build public clouds on VMware, NetApp is the leader in Russia.

For a number of issues, we will not be able to carry out the differences without in-depth research. For example, all VMware IaaS providers declare the presence of two independent channels on the Internet with automatic switching by means of network equipment (you can only check it in practice). For all, the default HA (High Availability) function is declared by default. All service providers formally declare a 100% guarantee of the allocation of the stated resources for the client.

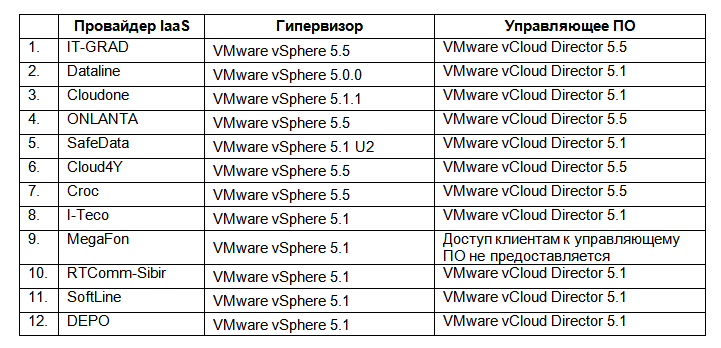

Below is the status of virtualization software for the first quarter of 2014. Megaphone is frustrating.

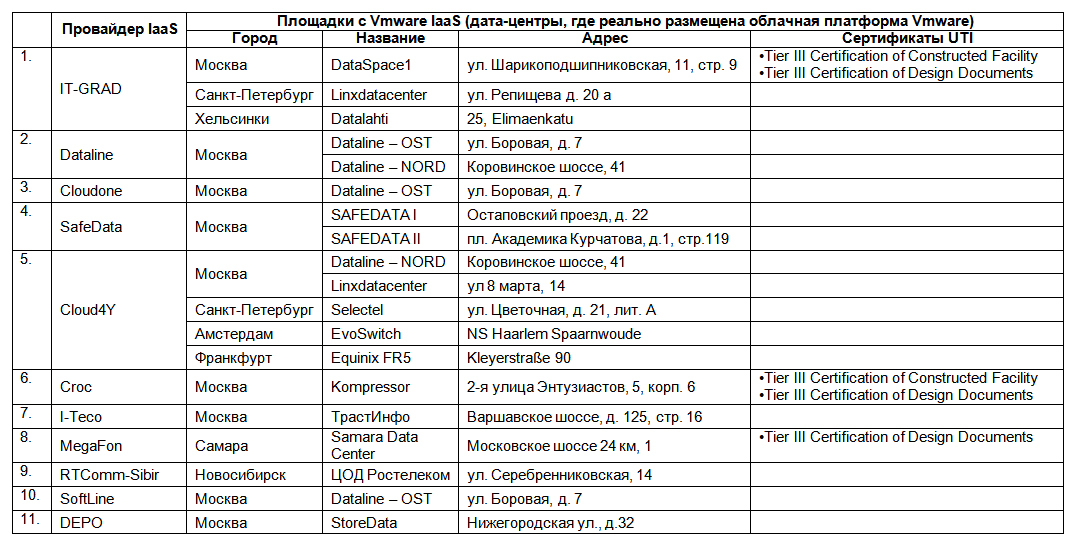

Having dealt with the hardware and virtualization software, let's move on to the overview of the sites where cloud platforms are located. Formally, all VMware-hosters claim that their data centers comply with the TIA-942 Tier 3 standard. Traveling around all data centers and checking if this really is not our option. Therefore, the easiest and most reliable way is to check the availability of certificates confirmed by the Uptime Institute:

- Tier III Certification of Constructed Facility

- Tier III Certification of Design Documents

Confirmed UTI certificates can be found here: http://uptimeinstitute.com/TierCertification/certMaps.php .

A list of confirmed VMware sites can be found here: http://vcloudproviders.vmware.com/vcloud_ecosystem .

Sites with a declared reliability category below Tier 3 will not be considered here as “unincorporated”. All of these data centers, of course, if you wish, you can visit by arranging a tour with the appropriate VMware cloud provider.

According to the survey results, the medals will be awarded to CROC and IT-GRAD for sites that are fully certified by Tier III Uptime Institute.

As a result, we considered the main “hard” parameters by which VMware service providers can compare a corporate client. All data are presented as of Q1 2014 and are based on data received by real customers during private closed tenders for the lease of VMware virtual infrastructure based on the analysis of typical offers from providers.

These data may not be accurate , but the good news is that, as mentioned earlier, in the corporate segment there is an opportunity to correct many things, roughly speaking, “on the go”, for example:

- agree on substantially more favorable pricing conditions than the prices presented here, issued by providers "by default";

- offer the provider and coordinate with its own editorial SLA;

- agree on the individual configuration of the hardware platform underlying the cloud data center;

- consider other individual Wishlist in project mode.

The ability to negotiate and adjust the conditions for themselves depends on the size of the project - on the part of the client, and the share of cloud business in the overall activity - on the part of the provider.

We will not single out the comparison leader in this review of VMware service providers, since for each client each criterion has its own weight. Therefore, we confine ourselves to a general impression of the current market.

If you look at the development of the Russian VMware hosting market in dynamics, you can clearly distinguish the pioneers: IT-GRAD, Datalayn, Cloud One and Safdat. And Datalayn and Sayfdata is initially a data-center business, frolicking in IaaS. These providers place their platforms exclusively on their own sites. IT GRAD and Cloud One are originally cloud companies that place their capacities in data centers of their choice.

They are pulled up by major integrators and telecom providers, such as KROK, Ayteko, Lanit, Megafon and Rostelecom.

Finally, in the first quarter of this year, integrators such as Softline and Depot entered the VMware hosting market.

Analysis of the presented data shows that the most developed services - both from the technical and organizational side - from companies that were the first to start in this market and currently have the largest number of customers using VMware IaaS, thanks to focused work on the corporate segment during last five years. By circumstantial evidence, these are IT-GRAD and Dataline (actually used sites, equipment level, partner status, etc.). In a completely rudimentary state, IaaS VMware is at Megaphone and Rostelecom, but for them this is apparently not critical, since they are aimed at regional government customers, which will obviously have no effect on the demand from them.

It will be easiest to agree on the correction of the service and the terms of its provision with companies for which corporate IaaS is the main activity (IT-GRAD, Dataline, Cloudone, SafeData, Cloud4Y). Integrator companies (Croc, I-Teco, SoftLine, DEPO, Lanit) are more focused on selling the service “as is”, while “as it is” lags significantly behind the IaaS specialized market in terms of degree of development. providers, or try to translate the client into their usual design approach with a charged price tag for a dedicated solution. Federal telecommunications providers (Megafon, Rostelecom) are not at all prepared for a dialogue with a potential corporate commercial client with minimal elaboration of their services.

I hope that the material in this article will help corporate customers to demand more from providers of virtual infrastructure, and providers of corporate IaaS on VMware to refine their proposals.

Source: https://habr.com/ru/post/218287/

All Articles