Tricky grace periods

Do you believe that a bank can give money for 200 days at 0%?

It is hard to believe that there is no trick here, but it sounds very tempting. Indeed, no credit organization distributes money without profit for itself in the long run. Therefore, banks create programs of a grace period that look attractive, and as a result bring profit to lenders.

Who is not familiar with the term " grace period ", can find a detailed description on our website. And we will begin the debriefing. How do they work, this money for free?

Misconception: "I can withdraw all the money from the account and use it for 200 days, then return it."

In fact:

1. You can not remove anything at all, because LP in Avangard does not apply to cash withdrawals. Only the purchase of goods.

2. Goods can be purchased for up to 50,000 rubles.

3. The tariffs indicate: Monthly minimum payment of overdraft debt - 10% of the debt amount and 100% of the amount of commissions, interest and penalties. Those. By the end of the 7th month, about 40% of the amount will remain in your hands.

4. It may be less than 200 days, because the contract states: “up to 204 calendar days from the date of granting the first overdraft for performing a preferential operation until the 20th day of the seventh month from the date of issue of the card”.

')

It is important to remember that 200 days is a one-time drug that is activated with the first purchase. Next LP is only for 50 days (until the 20th day of the next month). Those. in fact, it can last for 21 days, not 50, depending on the date of purchase.

It’s more interesting here: you can withdraw cash if you don’t feel sorry to pay a commission of 4.9% (at least 299 rubles). 145 days at 0% consist of a one-time drug in 92 days and the subsequent renewable drug in 55 days.

Features:

1. The first LP, the one that is 92 days, starts from the month in which the card was issued, and ends with the last day of the 3rd month. If you were given a card on the 20th, then 92 days turn into 72 days.

2. The second LP, 55 days, is calculated from the first day of the month to the 25th day of the next, i.e. in fact, it can be only 25 days.

3. You need to pay the minimum amount every month, but only 5% of the amount owed.

In Alpha, you can withdraw money already at 3.9%, and the calculation is more honest. The grace period starts from the day after the purchase and lasts 100 calendar days.

It is necessary to pay part of the debt each month in the amount of not less than 5% of the debt.

The most common, but not the easiest PL. Calculated from the date of purchase to the date of the report + 20 days. It turns out that the real period under 0% can vary from 20 to 50 days depending on the date of purchase.

By the way, never pay on the last day of the LP. Depending on the method of repayment, the money can be credited the next day, and after 2 days, and suddenly the weekend is ahead?

Bank customers often misunderstand the peculiarities of the grace period, which is why “bank threw me” scandals swell up. In punishment for violation of the maturity of the LP, the bank charges the loan rate from the date of purchase.

The grace period can and should be used because it is one of the real merits of a credit card. LP is ideal when the salary has not yet been issued, the money runs out, and the new smartphone really wants it now.

But first, take a good look at how it works on your card, and do not delay payments until the last day. A complete list of cards with a long grace period can be viewed in our rating: http://credit-card.ru/grace-period.php

It is hard to believe that there is no trick here, but it sounds very tempting. Indeed, no credit organization distributes money without profit for itself in the long run. Therefore, banks create programs of a grace period that look attractive, and as a result bring profit to lenders.

Who is not familiar with the term " grace period ", can find a detailed description on our website. And we will begin the debriefing. How do they work, this money for free?

Avangard - 200 days

Misconception: "I can withdraw all the money from the account and use it for 200 days, then return it."

In fact:

1. You can not remove anything at all, because LP in Avangard does not apply to cash withdrawals. Only the purchase of goods.

2. Goods can be purchased for up to 50,000 rubles.

3. The tariffs indicate: Monthly minimum payment of overdraft debt - 10% of the debt amount and 100% of the amount of commissions, interest and penalties. Those. By the end of the 7th month, about 40% of the amount will remain in your hands.

4. It may be less than 200 days, because the contract states: “up to 204 calendar days from the date of granting the first overdraft for performing a preferential operation until the 20th day of the seventh month from the date of issue of the card”.

')

It is important to remember that 200 days is a one-time drug that is activated with the first purchase. Next LP is only for 50 days (until the 20th day of the next month). Those. in fact, it can last for 21 days, not 50, depending on the date of purchase.

Promsvyazbank - 145 (92 and 55) days

It’s more interesting here: you can withdraw cash if you don’t feel sorry to pay a commission of 4.9% (at least 299 rubles). 145 days at 0% consist of a one-time drug in 92 days and the subsequent renewable drug in 55 days.

Features:

1. The first LP, the one that is 92 days, starts from the month in which the card was issued, and ends with the last day of the 3rd month. If you were given a card on the 20th, then 92 days turn into 72 days.

2. The second LP, 55 days, is calculated from the first day of the month to the 25th day of the next, i.e. in fact, it can be only 25 days.

3. You need to pay the minimum amount every month, but only 5% of the amount owed.

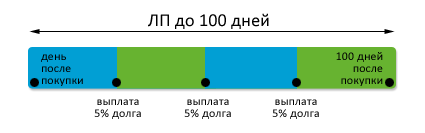

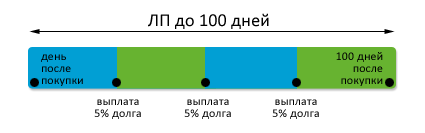

Alpha - 100 days

In Alpha, you can withdraw money already at 3.9%, and the calculation is more honest. The grace period starts from the day after the purchase and lasts 100 calendar days.

It is necessary to pay part of the debt each month in the amount of not less than 5% of the debt.

Sberbank - 50 days

The most common, but not the easiest PL. Calculated from the date of purchase to the date of the report + 20 days. It turns out that the real period under 0% can vary from 20 to 50 days depending on the date of purchase.

By the way, never pay on the last day of the LP. Depending on the method of repayment, the money can be credited the next day, and after 2 days, and suddenly the weekend is ahead?

What happens if you do not pay the debt before the end of the grace period?

Bank customers often misunderstand the peculiarities of the grace period, which is why “bank threw me” scandals swell up. In punishment for violation of the maturity of the LP, the bank charges the loan rate from the date of purchase.

findings

The grace period can and should be used because it is one of the real merits of a credit card. LP is ideal when the salary has not yet been issued, the money runs out, and the new smartphone really wants it now.

But first, take a good look at how it works on your card, and do not delay payments until the last day. A complete list of cards with a long grace period can be viewed in our rating: http://credit-card.ru/grace-period.php

Source: https://habr.com/ru/post/218279/

All Articles