The defeat of robots: the ups and downs of high-frequency trading (Part 1)

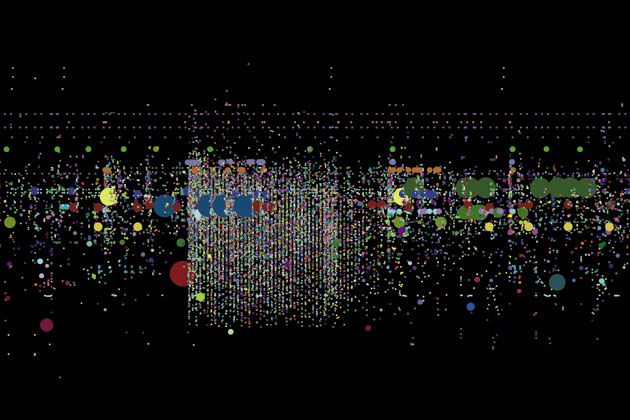

San Francisco Stamen has teamed up with Nasdaq to visualize the frantic pace of automated bidding. The figure illustrates purchase and sale requests sent by the algorithms within just one minute (the illustration shows trades dated March 8, 2011)

Steve Swanson was a typical 21 year old computer geek with very atypical work. It was in the summer of 1989, and he had just received a degree in mathematics from Charleston College. He was attracted by T-shirts and slippers, and on television, the Star Trek series. He spent most of his time in the garage of Jim Hawkes, a statistics teacher at the college where Steve was studying. There, he programmed algorithms for what would later become the first company in the world leading high-frequency trading, and will be called the Automated Trading Desk. Hawks was haunted by the obsession with making profit in stock markets using formulas to predict price behavior derived from his friend, David Whitcomb, who taught economics at Rutgers University. Swenson's task was to turn the Whitcomb formulas into machine code.

')

A satellite dish mounted on the roof of Hawks' garage, caught signals that carry information about quotes updates, and as a result, the system could predict prices in the markets within the next 30-60 seconds and automatically buy or sell stocks. The system was called BORG - short for Brokered Order Routing Gateway, the Brokerage Routing Gateway. The name carried in itself a reference to the Star Trek TV series - or rather, to a vicious alien race capable of absorbing whole species, turning them into parts of a single cybernetic mind.

One of the first victims of BORG was market makers from the exchange halls, which manually filled out cards with information on buying and selling stocks. ATD not only knew better who gave a more attractive price - the new system carried out the process of buying / selling shares in a second - by today's standards, this is turtle speed, but then nobody could surpass it. As soon as the price of the shares changed, ATD computers started trading on terms that other market participants did not have time to adjust, and a few seconds later, ATD sold or re-purchased shares at the “right” price. In those days, the largest market maker of the Nasdaq Stock Exchange (NDAQ) was Bernie Madoff’s company.

"Madoff hated us," says Whitcomb. "In those days we managed to leave him with a nose."

On average, ADT earned less pennies per share, but the company worked with hundreds of millions of shares a day. As a result, the company was able to move from Hawks garage to a modern business center worth $ 36 million in the swampy suburb of Charleston, South Carolina, which is about 650 miles from Wall Street.

By 2006, the company was selling approximately 700-800 million shares a day, which accounted for more than 9 percent of the total US stock market. And she had competitors. A dozen other large companies operating in the field of electronic trading appeared on the scene: Getco, Knight Capital Group, Citadel grew out of the trading floors of the commodity and futures exchanges in Chicago and the stock exchanges of New York. High-frequency trading (High Frequency Trading, HFT) began to gain momentum.

Depending on who you ask, you will be given different definitions of high-frequency trading. Essentially, this is the use of automated strategies to handle large volumes of stock buy / sell teams in a split second. Some firms can trade in securities in microseconds (as a rule, such companies trade for their own benefit and not for customers). However, high-frequency trading is not only good for stock trading: HFT traders have already conquered futures, fixed-income securities and foreign exchange markets. The options market is holding up.

Depending on who you ask, you will be given different definitions of high-frequency trading. Essentially, this is the use of automated strategies to handle large volumes of stock buy / sell teams in a split second. Some firms can trade in securities in microseconds (as a rule, such companies trade for their own benefit and not for customers). However, high-frequency trading is not only good for stock trading: HFT traders have already conquered futures, fixed-income securities and foreign exchange markets. The options market is holding up.Back in 2007: "traditional" trading companies are striving to automate their activities. Citigroup buys ATD this year for $ 680 million. Svenson, a forty-year-old man, is becoming the head of the entire Citi Securities Trading Division and is starting to integrate ATD systems into the Citi banking sector worldwide. By 2010, high-frequency trading works with more than 60% of the total volume of the US stock market and, apparently, is preparing to absorb the remaining 40%. Svenson, tired of bureaucrats at Citi, leaves the company and in the middle of 2011 opens his own HFT company. Technology Crossover Ventures, a privately held company, offers him tens of millions of dollars for opening a trading company, which he calls Eladian Partners. If everything goes well, already in 2012, TCV will close a new multi-million round of investments. But things did not go as planned.

For the first time since its inception, HFT companies, the living nightmare of all markets, have failed. According to Rosenblatt Securities, in the period from 2008 to 2011, about two-thirds of all trading operations in the US stock market were conducted by high-frequency traders - now this figure has dropped to 50%. In 2009, high-frequency traders worked every day with about 3.25 billion shares a day. In 2012, this number decreased to 1.6 billion. HFT traders not only began to work with a smaller number of shares, they began to receive less profit from each trading operation. The average income per sector fell from one-tenth to one-twentieth of the singing per share.

According to data from the company Rosenblatt, in 2009 the entire HFT trading industry earned $ 5 billion in stock trading. Last year, these figures reached only $ 1 billion. For comparison, JPMorgan Chase earned a little more than six times the first quarter of this year alone.

“Our revenues have rapidly gone down,” says Mark Gorton, founder of Tower Research Capital, one of the largest and fastest HFT firms.

“The time for easy money is over. Many things we are doing better than ever, and we get less for it than before. ”

“Trading margin does not cover our costs,” says Raj Fernando, executive director and founder of Chopper Trading, a large company in Chicago using high-frequency trading strategies.

"Now no one goes to the bank with a smile, that's for sure."

A considerable number of HFT companies closed last year. According to Fernando, before going out of business, many of these companies asked Chopper to purchase them. He did not accept any offers.

One of the objectives of high-frequency trading was to increase the efficiency of the markets. High-frequency traders have done so much work, reducing the number of unproductive operations when buying and selling stocks, that now it was not so easy for them to make money. In addition, the markets are currently experiencing a lack of two factors that HFT companies need the most - and this is an increase in the volume of stock markets and volatility. In comparison with the deep, volatile market trends of 2009-10, the modern stock market is more like a paddling pool. Trading volumes on the US stock markets today amount to about 6 billion shares a day - this figure is almost the same as in 2006. Volatility - an indicator of the volatility of the price of a share - has halved compared to last year. Looking for a price difference in stock markets, high-frequency traders thus serve as a guarantee that when the situation gets out of control, they themselves will quickly bring it back to normal. As a result, they “quench” volatility by not giving way to two of their most frequently used strategies: market-making and statistical arbitrage.

One of the objectives of high-frequency trading was to increase the efficiency of the markets. High-frequency traders have done so much work, reducing the number of unproductive operations when buying and selling stocks, that now it was not so easy for them to make money. In addition, the markets are currently experiencing a lack of two factors that HFT companies need the most - and this is an increase in the volume of stock markets and volatility. In comparison with the deep, volatile market trends of 2009-10, the modern stock market is more like a paddling pool. Trading volumes on the US stock markets today amount to about 6 billion shares a day - this figure is almost the same as in 2006. Volatility - an indicator of the volatility of the price of a share - has halved compared to last year. Looking for a price difference in stock markets, high-frequency traders thus serve as a guarantee that when the situation gets out of control, they themselves will quickly bring it back to normal. As a result, they “quench” volatility by not giving way to two of their most frequently used strategies: market-making and statistical arbitrage.Market makers companies “enliven” the bidding process, requesting quotes for both purchase and sale. They make a profit on the value of the spread, which is now hardly more than one penny per share, so these companies need to work with large volumes of shares in order to stay afloat. Companies that choose arbitrage strategies make money at the insignificant price difference between interconnected assets. If Apple (AAPL) shares trade at a different price on any of the 13 US stock exchanges, HFT companies will buy cheaper or sell more expensive shares. The more price changes, the more likely it is that the price difference will appear on the market. As soon as price fluctuations slowed down, arbitrage trading became less profitable.

To be continued…

Source: https://habr.com/ru/post/216233/

All Articles