Investing in games: the Asian threat

We are continuing a series of publications about the Asian games market, this time our article is devoted to mergers and acquisitions.

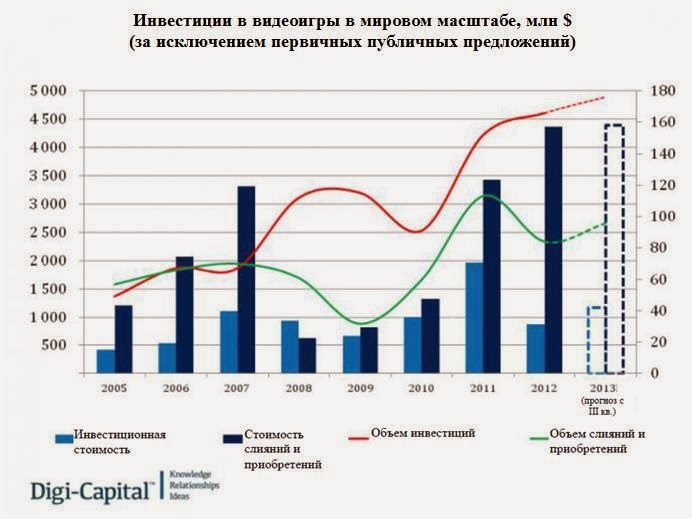

Investment Bank Digi-Capital has published a new edition of its Review of global investment in the gaming sector in the third quarter of 2013.

Commenting on the review, Digi-Capital founder Tim Merel said:

')

“It’s no secret that mobile Internet has blown up technology markets. Research and consulting company Gartner predicts a fivefold increase in revenue from sales of mobile applications - from 15 billion dollars in 2012 to more than 70 billion in 2016. Given that over 70% of the global revenue from sales of mobile applications in 2013 comes from games and that, according to forecasts, Asia will dominate in terms of revenues from mobile and online games (China - 32%, South Korea - 12% and Japan - 10% by 2016), thanks to the mobile sector and Asia, sales of games continue to grow.

In this context, the cost of mergers and acquisitions of gaming companies has also increased. In Q3 2013, it grew by 1% compared to the same period in 2012, reaching a level of $ 3.3 billion. At the same time, the average transaction value increased by 12% and amounted to $ 45.8 million. Mobile gaming companies dominated the market for mergers and acquisitions of gaming companies (47% of the total value of mergers and acquisitions and 29% of their total volume), as well as developers of technology and game licensing tools (27% of the total value of mergers and acquisitions and 15% of their total). If this trend continues in the fourth quarter, we will be able to talk about another record year for the market of mergers and acquisitions in the gaming industry.

The direction of development preserved in 2012: 8 out of 10 mergers and acquisitions in the games market in Q3 2013 were made by Chinese, Japanese or South Korean companies. Due to high revenue growth, as well as profitability and value in key national markets, both large and start-up companies from Asia continue to acquire solid local and foreign gaming companies at estimated ratios exceeding the corresponding figures of their Western counterparts. Now, more than ever, close relations with Asia are of particular interest to investors in the gaming industry.

Over the past 12 months, another Asian trend has emerged among Asian technology, media and telecommunications companies: to acquire companies that develop mobile games and technologies as part of a strategy to ensure protection and growth in a “mobile explosion”. Many Asian companies would like to invest in Western mobile game development companies — or purchase them. This would give them a trump card in local markets or would allow them to go international and publish mobile games from Asia in western markets. However, building relationships and market knowledge is still a problem area, especially for those Asian companies that are interested in constant high-quality sales in the West. As is the case with other leading trends from Asia, over the next 12-18 months we expect similar steps from Western companies.

The cost of investment in the gaming industry in Q3 2013 rose after a decline in 2012 by 35%, reaching, respectively, $ 876 million, but it continues to remain well below the record $ 2 billion in 2011. The volume of investments in the games market in Q3 2013 increased compared to 2012 by 6% (to 132 transactions), while the size of the average investment transaction grew by 26.9% compared to 2012 and amounted to $ 6.6 million. The main share of investments in the third quarter of 2013 fell on mobile games (42% of the total investment value and 38% of the total investment), as well as technology and gamification (36% of the total investment value and 33% of the total investment).

Since 2012, institutional and corporate investors have made great efforts to take advantage of high growth, profitability and profitability of mobile games, but at the same time a significant gap between the demand for investments and their number continues to exist. Digi-Capital marks approximately 1,000 transactions per year in America, Asia (China, Japan and South Korea) and Europe, so we are trying to help corporate and institutional investors find the key to the mobile industry. This is a serious task and should not be neglected. ”

Also interesting figures about the Chinese online gaming market can be found in Kanoba.

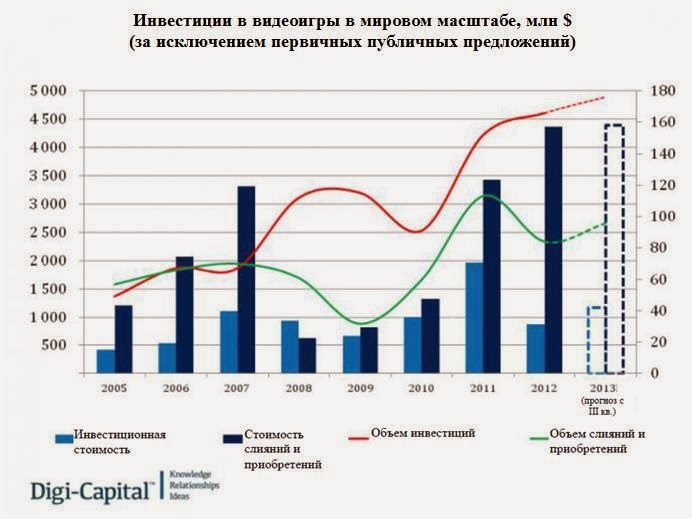

Investment Bank Digi-Capital has published a new edition of its Review of global investment in the gaming sector in the third quarter of 2013.

Commenting on the review, Digi-Capital founder Tim Merel said:

')

“It’s no secret that mobile Internet has blown up technology markets. Research and consulting company Gartner predicts a fivefold increase in revenue from sales of mobile applications - from 15 billion dollars in 2012 to more than 70 billion in 2016. Given that over 70% of the global revenue from sales of mobile applications in 2013 comes from games and that, according to forecasts, Asia will dominate in terms of revenues from mobile and online games (China - 32%, South Korea - 12% and Japan - 10% by 2016), thanks to the mobile sector and Asia, sales of games continue to grow.

In this context, the cost of mergers and acquisitions of gaming companies has also increased. In Q3 2013, it grew by 1% compared to the same period in 2012, reaching a level of $ 3.3 billion. At the same time, the average transaction value increased by 12% and amounted to $ 45.8 million. Mobile gaming companies dominated the market for mergers and acquisitions of gaming companies (47% of the total value of mergers and acquisitions and 29% of their total volume), as well as developers of technology and game licensing tools (27% of the total value of mergers and acquisitions and 15% of their total). If this trend continues in the fourth quarter, we will be able to talk about another record year for the market of mergers and acquisitions in the gaming industry.

The direction of development preserved in 2012: 8 out of 10 mergers and acquisitions in the games market in Q3 2013 were made by Chinese, Japanese or South Korean companies. Due to high revenue growth, as well as profitability and value in key national markets, both large and start-up companies from Asia continue to acquire solid local and foreign gaming companies at estimated ratios exceeding the corresponding figures of their Western counterparts. Now, more than ever, close relations with Asia are of particular interest to investors in the gaming industry.

Over the past 12 months, another Asian trend has emerged among Asian technology, media and telecommunications companies: to acquire companies that develop mobile games and technologies as part of a strategy to ensure protection and growth in a “mobile explosion”. Many Asian companies would like to invest in Western mobile game development companies — or purchase them. This would give them a trump card in local markets or would allow them to go international and publish mobile games from Asia in western markets. However, building relationships and market knowledge is still a problem area, especially for those Asian companies that are interested in constant high-quality sales in the West. As is the case with other leading trends from Asia, over the next 12-18 months we expect similar steps from Western companies.

The cost of investment in the gaming industry in Q3 2013 rose after a decline in 2012 by 35%, reaching, respectively, $ 876 million, but it continues to remain well below the record $ 2 billion in 2011. The volume of investments in the games market in Q3 2013 increased compared to 2012 by 6% (to 132 transactions), while the size of the average investment transaction grew by 26.9% compared to 2012 and amounted to $ 6.6 million. The main share of investments in the third quarter of 2013 fell on mobile games (42% of the total investment value and 38% of the total investment), as well as technology and gamification (36% of the total investment value and 33% of the total investment).

Since 2012, institutional and corporate investors have made great efforts to take advantage of high growth, profitability and profitability of mobile games, but at the same time a significant gap between the demand for investments and their number continues to exist. Digi-Capital marks approximately 1,000 transactions per year in America, Asia (China, Japan and South Korea) and Europe, so we are trying to help corporate and institutional investors find the key to the mobile industry. This is a serious task and should not be neglected. ”

Also interesting figures about the Chinese online gaming market can be found in Kanoba.

Source: https://habr.com/ru/post/213343/

All Articles