Quick start to the stock market: 10 steps

In the comments to the previous articles, we were asked to write a guide that would help beginners to get used to the stock market faster and not lose all their money. We have been blogging in Habré for several months already, so we have accumulated a certain amount of useful, and not just entertainment materials, which will help in the first stage to better understand the structure of the stock market.

Step 0

First of all, it is necessary to obtain theoretical knowledge about stock trading and understand whether you need it? Our bibliography will help you in this task.

')

Step 1

But why go to the stock market, and let's say, not on Forex? The answer to this question is contained in two articles by the Chairman of the Board of ITinvest Vladimir Tvardovsky ( one , two ).

Step 2

First of all, it is necessary to figure out how exactly the exchange trading is organized in our country. In addition to exchanges, brokers and traders, regulators, self-regulating organizations, registrars, depositories, clearing organizations and clearing centers, clearing houses and depositories are among the stock market players not only in Russia, but also in any country.

Details of the device of the Russian stock market are described in our two articles ( one , two ).

Step 3

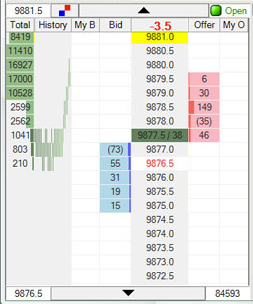

Next, you should familiarize yourself with such a phenomenon as a trading terminal .

Step 4

After a trader has entered a bid to buy or sell using the terminal, before entering the exchange, she enters the broker's trading system. Such systems are provided with authorization and limiting tools that allow them to route a request to the market, as well as provide the client with information on its status and the current status of its portfolio. At the same time, it is important to know that most of the applications on modern exchanges are generated by special robots, for connecting which brokerage systems have an API .

Trading robots can make hundreds and thousands of orders within seconds, so the most important thing for them is speed. That is why the work according to the “user (robot) - brokerage system - core of the exchange” scheme cannot satisfy all merchants - after all, it has an extra link in the form of a brokerage system. That is why there was a technology that allows to optimize this chain as much as possible - direct access to the exchange .

Step 5

Having gained theoretical skills and learning more about technology, many traders immediately start trading - and lose money. We must move gradually. It was for such a smooth “introduction” to the specifics of the stock market and getting used to the chosen means of trading that test or virtual exchange trading was invented.

Step 6

In addition to software, many traders pay attention to the “iron” component of work in the stock market. Therefore, before you seriously plunge into the world of stock market battles, it is worth exploring the range of trading gadgets - who knows, maybe some tool will help you make more money.

Step 7

Shares - this is not the only thing that can be bought or sold on the stock exchange. Surely you often heard the expression that stock speculators "make money out of thin air"? Surely, it was a question of derivatives . Without which, meanwhile, the normal functioning of the economy was much more difficult.

Step 8

In the modern stock market one cannot escape the topic of algorithmic trading. Therefore, it will be useful to learn about the prospects of this area in the conditions of our country.

Step 9

Having dealt with the theory and prospects of algorithmic trading, this is a good time to turn our attention to its practical component. From our topic you will learn with the help of what software you can create a real trading robot (with an example).

Step 10

Do you still think that the stock market is a hoax? Take a look at an example of a simple guy who, having gained some experience on the stock exchange, has managed to apply it and his IT skills in order to earn half a million dollars per year ( first part , second part ).

That's all for today. In the near future, we will have new interesting technical articles in our blog (for example, about developing our own trading terminal) and topics in which the stock market is viewed in more depth. Thanks for attention!

Source: https://habr.com/ru/post/212629/

All Articles