Exchange software: Tools for creating trading robots

We often write about algorithmic trading and related technologies, but we have never talked about software with which, in fact, you can create your own trading program. Under the cut - a review of common software to create mechanical trading systems, adapted to the Russian stock market.

Well-lab

Fidelity International's product is one of the most powerful tools for technical analysis, development and testing of trading strategies. The built-in programming language in it is WealthScript, which has a lot in common with Pascal, the latest versions use C # and other .NET languages.

')

In the Russian stock market, it is used in conjunction with brokerage terminals - at Wealth-Lab, the user describes his strategy, according to which the program generates requests for operations. With the help of special libraries for integration, these orders are then transmitted to the trading terminal, from which they are executed. Objectively, such a scheme imposes quite a lot of restrictions, so the Wealth-Lab, of course, cannot be called an ideal option for Russian exchanges.

MetaStock

Another foreign product. MetaStock contains a large library of various indicators and tools for creating your own formulas. Of the benefits - a fairly simple built-in programming language. With the help of additional modules you can generate buy / sell orders. Like the Wealth-Lab, in the Russian market it is used in conjunction with trading terminals with the help of additional libraries, which entails approximately the same problems. Also, the downside can be attributed to the fact that the simplicity of the built-in programming language does not allow describing complex trading strategies.

Omega research

A tool for technical analysis designed to create and test mechanical trading systems. You can write robots in the Easy Language built-in programming language (the syntax is similar to Pascal). As in the case of the two programs listed above, the Russian stock market is used with the help of "pads". Among the drawbacks, respectively, the stability of the work of such a design, as well as the complexity of setting Omega Research. In addition, the program only works with its data format and does not support conversion from text files or formats of other technical analysis programs.

In addition to foreign products, there are a number of software solutions from Russian developers on the domestic stock market. And here are just some of them.

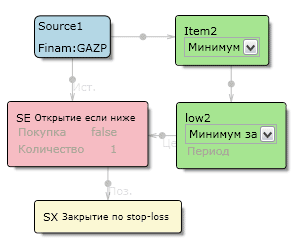

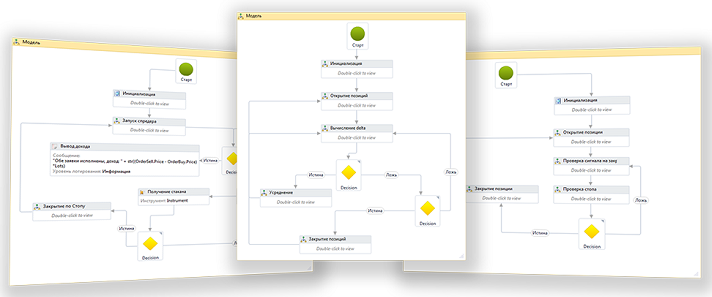

TSLab

Like the previous project, TSLab is developing - it is a platform for creating and launching mechanical trading systems, “sharpened” specifically for the Russian stock market. One of the essential for traders who do not have programming skills, is the ability to record the trading algorithm in the form of a flowchart.

StockSharp

Free (in the base version) StockSharp open source platform and products based on it (S #. Studio). As the name implies, you can program in C #. Of the benefits - the ability to connect to various trading terminals and brokerage systems.

LiveTrade

The line of products of the St. Petersburg company Cofite. Thanks to the API, LiveTrade Terminal allows you to launch robots implemented on the .NET platform. It is possible to connect several Russian brokers to trading terminals and systems (including the ITinvest system using the SmartCOM API). In addition, Cofite has a product Robotlab, which is entirely designed to create robots. As in the case of TSLab - trading algorithms can be implemented using a visual designer. The resulting block diagram of the robot can then be run in the terminal.

Smartx

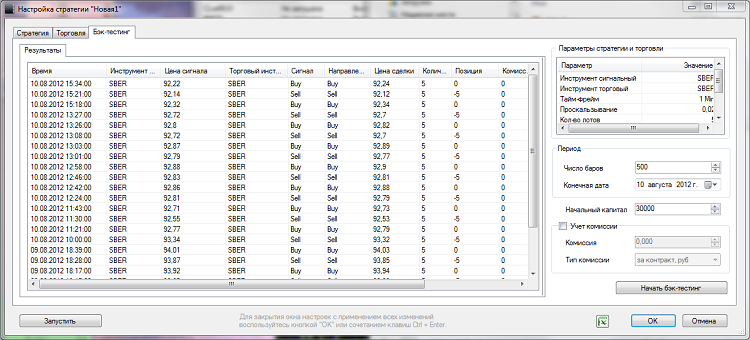

The SmartX trading terminal is not an ordinary terminal in the usual sense, but an integrated software product, which, among other things, includes the TradeScript script programming language , a vector language that was created by the American company Modulus Financial Engineering (USA) specifically to create trading robots.

From the interesting functions of the terminal can be identified:

- The possibility of back-testing of trading strategies - testing the robot on historical data. At the same time, these archived data do not need to be loaded from other (often paid) sources - they are loaded by the terminal automatically.

- Ability to build algorithms for tick data.

- Another interesting feature is the ability to test a trading strategy “on the fly” using current exchange data, but without taking an order to the exchange itself - the time of the virtual transaction, the price and the resulting yield will be displayed in a separate window.

The scripting language is quite simple to learn, and you can start programming simple robots within a couple of hours after you get acquainted with it. In addition, many algorithms are similar in writing with Metastock, so that if a user was previously familiar with this program, then he would practically not have to relearn.

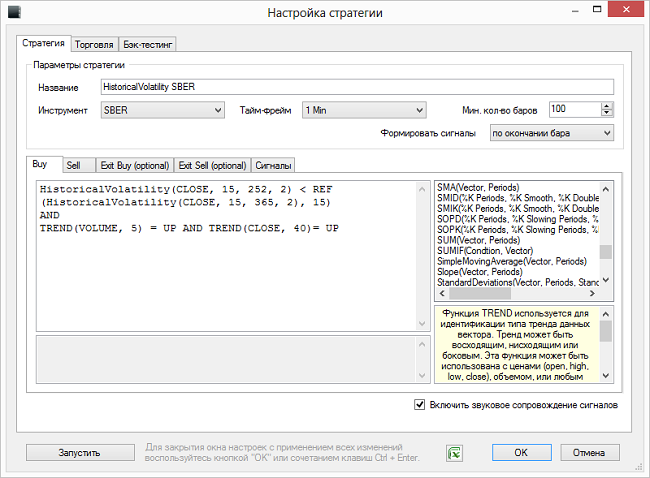

An example of a simple tradeScript robot:

Buy Signals # , , HistoricalVolatility(CLOSE, 15, 252, 2) < REF(HistoricalVolatility(CLOSE, 15, 365, 2), 15) AND TREND(VOLUME, 5) = UP AND TREND(CLOSE, 40) = UP Sell Signals # , , HistoricalVolatility(CLOSE, 15, 252, 2) < REF(HistoricalVolatility(CLOSE, 15, 365, 2), 15) AND TREND(VOLUME, 5) = UP AND TREND(CLOSE, 40) = DOWN The advantage of this method of creating robots is that, in contrast to the same Wealth-Lab and Metastock, there is no need to create complex structures and use “extra” libraries for sending orders to the terminal - everything is built in and immediately connected to the brokerage trading system.

In addition, the user can run as many simultaneous algorithms as the clock frequency of the processor and computer memory will allow. Given the large number of words and operands of the scripting language, this means the possibility of creating any complex trading strategies.

Smartcom

The API of our brokerage system (more details in this habratopic ), with which you can create trading robots of any complexity. There is an additional plugin for AmiBroker, which greatly facilitates data analysis.

That's all for today. In the following topics we will talk in more detail about the writing of trading robots and give examples of specific mechanical systems created using various tools. Thanks for attention!

Source: https://habr.com/ru/post/212335/

All Articles