Creating your own bank, or How to ensure a comfortable old age

Watching my retired parents, or rather, the size of their pensions, I think hard about how to secure something in a decent amount. It does not seem to count on a state within the CIS. So you have to do something yourself! And we must begin now, while I am 32 years old, there is some kind of income and strength to spin. There used to be thoughts that I would be forever young, forever healthy and do something all the time. Gradually, I begin to realize that about 20 ... 30 years old - and the forces will melt (or spray). Therefore, a couple of years ago, I began to do something in this direction. Got some experience that might be of interest to a respected community. Even if for the reader the issue of retirement now sounds crazy abstract, I still recommend at least a run. If I had read such material 5 years ago - I would have been much richer already! ..

Watching my retired parents, or rather, the size of their pensions, I think hard about how to secure something in a decent amount. It does not seem to count on a state within the CIS. So you have to do something yourself! And we must begin now, while I am 32 years old, there is some kind of income and strength to spin. There used to be thoughts that I would be forever young, forever healthy and do something all the time. Gradually, I begin to realize that about 20 ... 30 years old - and the forces will melt (or spray). Therefore, a couple of years ago, I began to do something in this direction. Got some experience that might be of interest to a respected community. Even if for the reader the issue of retirement now sounds crazy abstract, I still recommend at least a run. If I had read such material 5 years ago - I would have been much richer already! ..UPD : the article added about the meaning of diversification, and in the comments there were many questions ...

As usual, I immediately warn you - this is my personal experience, which is not subject to

Stage -1: non-financial assets

The history of our long-suffering homeland has clearly shown that financial savings 30 years ago have no value. In particular, my wife (then still a minor girl) was charged a sum comparable to a car. After this money initially evaporated, then returned, but in a very modest and fixed amount. There even a normal bike is not enough ... Where is the guarantee that this will not happen in the future?

No one will give guarantees. Therefore, the most reliable will always be eternal values. This is health - and this is an appropriate lifestyle, skills - and this is a continuous training and mastering new skills, attitudes - and this is the ability to correctly conflict, educating yourself and your children ... This applies not only to yourself, but also to your descendants (well, not the school will teach them all this!)

No one will give guarantees. Therefore, the most reliable will always be eternal values. This is health - and this is an appropriate lifestyle, skills - and this is a continuous training and mastering new skills, attitudes - and this is the ability to correctly conflict, educating yourself and your children ... This applies not only to yourself, but also to your descendants (well, not the school will teach them all this!)')

But it is best to combine wisely. After a couple of years of accumulating these most non-financial assets, I saw that no one bothers me to combine. Moreover, all of the above money almost does not require!

- health is not only gyms and fitness clubs, but also ... less driving and more walking, hiking and kayaking, finding a garden where much energy is spent and high-quality food is grown, less hamburgers and cheeseburgers;

- skills - Internet in the teeth and go! By landscaping my house with my own hands (money doesn’t really allow people to be hired), I learned how to glue wallpapers, repair and build plumbing, electrical too, I myself built a drain pit (and there was not only work with a shovel, but also laying, pouring above). I also learn to tinker with the car a bit;

- relations - it is not necessary to go to trainings for Kozlov and Norbekov, look around! Maybe you can somehow become softer at home, in your family? .. You can always help your child overcome fears and self-doubt, help his friend get out of his life's scrapes.

This is a very big topic, worthy of individual books, so we will focus on financial assets and those directly connected with them (and this is real estate, metals, antiques ...). For the sake of justice, I will note that I also do not forget the topic of eternal values.

Stage 0: Creating Your Bank

I am a modest IT front worker. I work not in a large company, but in a rather small one. For life, however, enough, free time too. Someone else collects bottles, someone works as a loader, someone as president, and someone else as someone else. This, however, is not about ways of making money, but about the fact that we have a cash inflow . And once it is, something can be put aside from it (this idea is very well expounded in the very popular book The Richest Man in Babylon).

How many? Personally, I decided to stay at 10%.

Why exactly 10%, not 7.35% or 11.82%?

Well ... first, consider it elementary. I earn, say, 2435 MNT per month. Of these, 243 put aside. It is so elementary that I taught this to my 7-year-old daughter, who hadn’t heard anything at all about multiplication and division.

Secondly, there is a simple math. For a month you, let's say, earn x MNT. Of these, you spend 0.9 x and set aside 0.1 x . By the end of the year, you will:

- earned 12 x ;

- spent (12 * 0.9) x = 10.8 x ;

- retained (12 * 0.1) x = 1.2 x .

Not bad, huh? Slightly tempering your appetites, you received almost 11 salaries in a year, and set aside one and a quarter salaries for the future. By saving money this way, in 10 years you will save up ... 12 wages! Salary for the whole year! A whole year you can not work! Beautiful !!!

And thirdly, yes, I have to squeeze myself a little. But, as it seems to me, with any income, it’s realistic to limit yourself to a tenth. Personally, I could.

“Secondly” looks beautiful, but we must make an amendment to inflation, to all kinds of emergency, and so on. Then I didn’t think about it yet ... Then I generally just set aside money “just in case.” By the end of the year it was necessary to buy something expensive, for which money was not enough. I thought then - “take a loan, or what? ..” And then he suddenly remembered - I postponed it! I'll take a loan from myself! Class !!!

As a result, as it turned out, I created my own bank. When I looked at my savings as a “bank,” all sorts of processes went through my head. And she poured into the next stage. But about him a little later.

What can be summed up? Begin to set aside a fixed percentage of earned money in a disciplined manner . Why from "earned"? Because there is a profit in the form of monetary gifts, from investment activity (deposits, interest on someone for debt, etc.). Why "fixed"? Because there is a temptation to not postpone any small profits at all (“there is so little money!”), And it becomes a pity for the big

Stage 0.5: consumer loans

A couple of times it got. Got out with a firm conviction - you need to interpose in them only when there is no other way!

A couple of times it got. Got out with a firm conviction - you need to interpose in them only when there is no other way!All sources devoted to the topic of finance give the same advice - first say goodbye to loans, then go in for savings and money saving. It is good if the loan is small, but what if it is a house or a car? It’s not so easy there ... However, if you manage to save 10% and pay the loan, then go ahead! Well, if not - wait with your bank and repay the loan as quickly as possible.

I cannot say anything more on this subject, since the experience is small.

Stage 1: financial reporting

The idea that it was worthwhile to keep such a otchetik ran in different places — earned so much, spent so much on it. The thought seemed to me all the time not very worthy and important. But once, when I had already earned my bank, I decided to take up this business. Fortunately, I know Excel quite well, it is easy to collect checks and receipts, it’s not a problem to add up all your expenses for today and transfer them to your computer in the evening. So I began to lead this.

What is the financial report for?

- to stand firm on the ground . I now clearly know (or I can quickly find out) how much and what my money goes to. And, say, if I decide to transfer to another job, I clearly know what salary I need. And I can confidently say how much money I spent on school, on a car, etc. The same is true of income;

- ordering finances . After reviewing the report for the first full month, you will immediately see the “black holes”. I did not have them, but the topic is relevant for many. If you smoke, get a "smoking" - for the year the amount will be hefty. If you like to lean on a drink, the result will also be stunning. If you like

bars, women, casinos,rambling, this also does not contribute to the formation of financial well-being in the distant future. By the way, entertainment is needed and it is impossible to forbid them for yourself! Without them, it will not be life, but hard labor. BUT! it's about streamlining them, limiting them to some justified and reasoned amount - say, no more than 5% of revenues. And then they will be completely “legal” for you, your conscience will not be tormented; - visible result of activity . You began to spend less on the smoke - but God knows, was it worth it? .. You looked at the statistics - yes, the money has increased! You said goodbye to the loan - the result is something here! You invested in some enterprise - in a year or two it paid for itself! For example, I used to be told: “the garden does not pay for itself! How much do you spend on it! ”I looked - but not so much! And how much he brings! Sometimes at the end of winter I buy potatoes / carrots / buryaks, I don’t take tomatoes at all. How much would I spend buying them on my 4 mouths all year ???

So I recommend!

What kind should he have? The question is very personal, because there are a lot of opinions. There are options for tables, there is ready software. Personally, I decided to keep the table in Excel and not to take ready-made programs. I am satisfied with the result, because I constantly expand the analysis and statistics for myself. I will not post it, but I will tell you the general principles (I can send it to anyone who wishes to - write to your personal email).

I have a story by months - the earliest month is the last page. On top of it comes a section “at the beginning of the period” (how much was at the beginning of the month), then “at the end of the period” (what is further summarized), then “history” (by sections). Vertically there are the columns of “total” (amount), “arrival” (how many have arrived), “expense” (how much was spent), “assets” (deposits, etc., which is not money), “debts” (loans - that requires money in the future). I have sections of the story - “work, income”, “maintenance” (house, car, ...), “children”, “miscellaneous” (gifts, entertainment, household deposits, ...), “investments” (profit and expenses). Funds go separately (about them later).

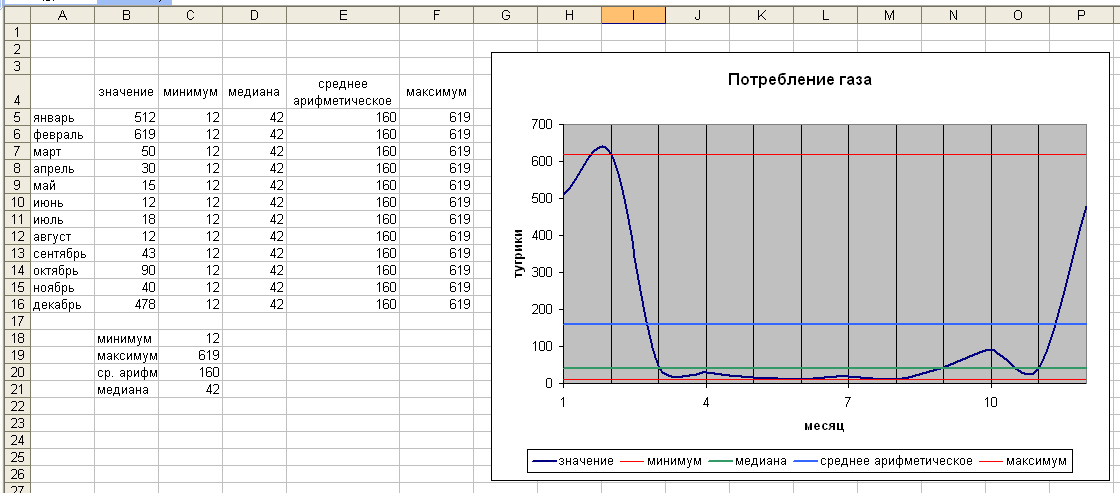

Then I began to keep the history of utility payments: "month, year", "amount", "gas" / "electricity" / "water" - the volume for the current month, the actual cost, the average volume for the current year, the average cost for the current year. It is interesting now to compare the average consumption per year. By the way, here my gas “eats” very uneven money - in the summer less than 10% of winter money. And I decided to pay all year arithmetic mean. If before, a strong winter was almost a ruin for me, but now I don’t feel the difference.

I also began to conduct all investment activities - separate pages are devoted to it.

Immediately, I introduced a “structure” - one page, where for all months (the last one is above) the ratio “earned / spent”, “assets / cash”, etc. is written. Right there is a breakdown in% of incomes and expenses under budget items ( on average, 12% eat me on average per year, children - only 2%, nutrition - 17%).

Mathematics of calculations is a separate and very interesting song. Suppose I have gas values paid for the year. I look at the minimum (MIN formula in Excel) / maximum values (MAX) and I see a corridor in which values go. The arithmetic average (AVERAGE formula) shows me the average value that I had to pay a whole year to get the right amount. For some intuitive understanding of the average, the median (MEDIAN formula) is more suitable — it is rare (albeit large) outliers that do not have a large effect in the sample of values.

It turned out a lot of pages. Therefore, I made the first page "table of contents". From there there are transitions to the desired page.

The plans - to start all sorts of beautiful graphics that will delight my eyes.

UPD: why am I a diversification supporter

Next, I will sign a lot of places and ways where I want to invest my 10%. There are many of them, and they are called the formidable word "funds." Someone will find it too complicated, and many will ask - “why such difficulties? Invest in stocks / gold and all! No need to invest there, here, somewhere else - invest in one thing! ”. Or, to put it correctly, many people do not understand the meaning of diversification.

Next, I will sign a lot of places and ways where I want to invest my 10%. There are many of them, and they are called the formidable word "funds." Someone will find it too complicated, and many will ask - “why such difficulties? Invest in stocks / gold and all! No need to invest there, here, somewhere else - invest in one thing! ”. Or, to put it correctly, many people do not understand the meaning of diversification.Actually, Kiyosaki calls for this. He is against dispersing his financial forces in different directions, he is sharply against diversification. He believes that you need to choose one thing, to prepare properly, and - r-time! millionaire. So he, in fact, did (we will not go into details - how much he had “r-time” and what his condition was).

However, he - Kiyosaki - does not take into account the fact that not all people have a “rich dad” who will teach and tell them everything. He does not take into account that not everyone wants to spend all his energy on making money. And he does not take into account the fact that people have children (he, by the way, does not have them) ... He also forgot that there are revolutions in different countries in the style of the fall of the USSR and the change of currencies.

In general, not everyone is an ideal approach to be a pro in the world of finance. Many (and me in particular) are much closer to a different approach - to live their own lives, and use money as a means to realize goals. That is, money is not the goal and meaning of life! I want to spend a little time on them in my life, and leave the rest to life.

I found a lot of useful information from Sergey Spirin . He has a good blog "Investor Notes" , where he introduces everyone to the idea of "Asset allocation" - a reasonable distribution of assets. And there the main idea is to divide our funds into weakly related (and better unrelated) asset classes. That is, diversify as widely as possible.

The picture in the section title (taken from here ) vividly shows the advantages of the St. Petersburg Stock Exchange over the one from New York before the 1917 revolution. Then it was necessary to vbuhivat all the funds in Russian stocks! Those who did so, eventually collapsed ... Only clairvoyants could imagine the collapse of the entire financial system that existed then.

We can not predict what will happen to America, Australia and other world market leaders. Well, that is, someone can, and all the rest is to invest their money in different, unrelated assets, - in gold, which can always be sold, in bonds of their country, neighboring and some overseas, in shares of companies as his country, and the other, in real estate both at home and in other places ...

That is why I consider different types of investments. I want to protect myself from uncertainty. The price is high, but peace is more expensive.

Stage 2: goal setting

This is a very important stage, which at first seems unimportant and abstract. I felt its importance when the deferred amount became tangible and it was time to decide what to do with it. At first, I thought just to keep this amount on the shelf (then on the card), but then I felt the teeth of inflation. I had to invent something to protect them.

This is a very important stage, which at first seems unimportant and abstract. I felt its importance when the deferred amount became tangible and it was time to decide what to do with it. At first, I thought just to keep this amount on the shelf (then on the card), but then I felt the teeth of inflation. I had to invent something to protect them.Now the most thing is to agree on the terms:

- salary is that which is earned by one’s direct labor. They can be multiplied only by changing jobs or, if you are a private entrepreneur, by increasing your turnover;

- consumption - all that directly leaks from the budget. This includes loan payments;

- an asset is something that can be sold - and then it will turn from an “asset” into a “income”. Real estate, stocks, deposits (with payment of% at the end of the term) are all examples of assets. Leased real estate is an asset that generates passive income . Sold property moves from "asset" to income (one-time, unfortunately);

- income - earnings, passive income and sold asset;

- debt is something to be paid for - and then it flows from “debt” to “expense”. Rental properties, car loans are all examples of debt.

Your debt (loan, for example) is always an asset for someone (for a bank). Your income and income is always someone's expense. Your asset generates income. Your debt sucks you money from the budget. Your income, which lies in the bank under the sofa, is a dying asset, because all the time it is chewed by inflation.

Obviously, I would like to ideally:

- get rid of all debts - so that the money would stop leaking into black holes;

- have reliable assets that periodically generate incomes that exceed expenses for the same period — for example, with your monthly expenses of 1000 tugriks, your rental property, cars, etc., bring in at least 1000 tugriks (or better, because all this needs to be repaired);

- also have reliable assets “for a rainy day”, which can cover all your current expenses for a certain period during the sale - with the same 1000 tugriks a month, have a supply of banking metals or real estate that can be sold for 6000 tugriks so that you can calmly to live;

- to have a stock of funds that will allow both types of assets to grow at the risk of losing them - say, to have another 100 tugriks a month for investing on the stock exchange, participation in businesses, etc .;

- if you have to create a debt (buy a car on credit, real estate or household appliances), then also have an asset that works to repay it.

Well ... I have such dreams. I work with them.

All authors urge to formulate these dreams in a clear form. Everywhere it is advised to decide for yourself - something like “in the next 30 years to create assets that generate 1000 tugriks monthly, have a pro-asset of assets for 10,000 tugriks, and risk 1000 tugriks monthly. As soon as I reach these numbers, I stop making money. ”

Therefore, the task is to create various funds . Each fund has its own minimum, which cannot be crossed, and the maximum to which it is necessary to strive. Once the minimum is reached, the following tasks can be accomplished in parallel. As soon as the maximum is exceeded, the exceeded values are transferred to the following funds that have not reached the goals and maxima.

It creates such a line of funds. The most "junior" - the most modest in size (and profitability), but the most priority. Filling them (or exceeding their minimum threshold), you can move on. “Farther” are older funds. With the growth of income and the emergence of free funds, you can either raise the standard of living or create new global goals (say, charity in its various manifestations).

UPD : A group of funds forms a "portfolio of investments." Say, the N1 portfolio serves for the purpose of a reserve and consists of the most reliable funds (I have a cash reserve, deposits in reliable banks, bank metals). Unfortunately, in the world of investment "the most reliable" = "minimally profitable." Therefore, we also need a portfolio of N2 riskier assets - and, therefore, more profitable assets. I prefer the division into 3 portfolios - the most reliable (it is often called the “airbag”), which creates passive income (funds that “make money” are rental property, regularly sold assets, etc. - “acceleration zone”) and serving great purposes (to satisfy children's hopes and adult dreams).

Personally, I am confused by references to specific values of MNT / euro / dollars / .... There is always inflation, a change in world currencies (in 30 years anything can happen!), A change in appetites. Therefore, I decided to go the other way. Every month in my financial report I have the figure “monthly expense”. Of course, from it, the “minimum monthly consumption”, “maximum ...”, “average arithmetic ...”, “median ...” are derived. I take one of them as a conditional unit (hence the Tugriki appearing in the text).

And then the following comes out - “cash reserve of at least 1 average arithmetic expenses for the current year, Goal - 1 maximum of expenses”. This means that I recalculate my expenses for the current year every month. Suppose that in this current year I have a minimum expenditure of 1000 tugriks, a median of 2000 tugriks, an average of 3000 tugriks, and a maximum of 7,000 tugriks (real ratio for the current year). If my cash accumulated less than 3000 MNT, then the problem is not solved. When I have them from 3000 to 7000, then I can solve larger tasks, but I continue to put money here (how many here and how many there is determined separately). When I have accumulated 7300 MNT this month and I plan to put 1000 MNT, then I derive 300 MNT from this fund and invest 1300 further, into the next funds-hungry funds. Every month I control the cash reserve and maintain it on the figure of 7,000 MNT.

Suppose I began to live beautifully and spend more. Now I have all the numbers to change - at least the same 1000 (I obviously will not spend less), the median 2010 (still spending more), cf.-arithme. 2200 (I began to buy a lot), a maximum of 7500 (exceeded the monthly spending for this year this month). Now, with my 7000 tugriks, I no longer reach my maximum, and I also planned to spend 2000 tugriks on funds. Then I spend 500 on the cash reserve fund, the remaining 1500 on the following funds.

And so on in floating mode. In some years, the appetites may decrease (children have grown up and now live separately) - then a lot of money is released (if I do not decide to create new funds). And maybe the other way around - money is becoming more and more, we are spending more (or I help families of children, now we divide funds into all). Then it is necessary to return from the most recent funds to the older ones (or lower their additional profit below the funds).

UPD : without such an approach, focusing on specific values in specific monetary units, I must take into account inflation for groups of goods that interest me. At the beginning, I thought about keeping my “consumer basket”. Then I realized that this should be my current expenses - a finished basket for groups of goods and services that interest me. As a result, my cart automatically takes into account both inflation, and a change of interests, and everything else. Therefore, it is very convenient.

All this along the way is written in the financial report, it is checked on it. Suppose I have costs 1000 MNT, cash 1200. Then 1.2 is calculated in the corresponding cell. Excel knows a lot, he calculates himself. Very comfortably! However, no one says that this is the only software capable of such - the same OpenOffice Calc, for example. Here is a catalog of spreadsheets.

Stage 3: my goals and their implementation

Consider my current view, my long-term goals:

- “Airbag” - creating a reserve for a rainy day. Until I solve these problems, I do not move on and continue to work as a hired worker or as a private entrepreneur in low-risk areas. I would like to solve the problem in 5 ... 10 years.

- cash reserve - not less than 1 Wed-arithm. expenses. Target - 1 max. expenses;

- the stock in deposits in reliable banks - at least 3 honey. expenses. Target - 3 max. expenses;

- stock in precious metals - at least 3 med. expenses. Target - 3 max. expenses.

- preparing for the overclocking zone - studying everything that I need in the overclocking zone. These are issues of work with stock exchanges and bonds, real estate.

- “Acceleration zone” - the creation of active income. At this stage, you can quit hired work, but you must remain a private entrepreneur. The overall goal is to have a monthly income of 1 max. expenses. I would like to solve the problem in 5 ... 10 years.

- deposits in risky banks - deposits in high-yield (and, as a rule, high-risk) banks for at least 2 minutes. expenses. The goal is an annual income of 2 max. expenses;

- domestic state bonds - an investment in the bonds of their country, a stock of at least 3 minutes. expenses. Purpose - annual income on coupon payments of 2 max. expenses;

- external state bonds - an investment in bonds of other (different!) countries, a stock not less than 6 min. expenses. Purpose - annual income on coupon payments of 2 max. expenses;

- long-term investment funds - an investment in low-risk highly liquid long-term funds, a stock of at least 6 minutes. expenses. Purpose - annual income on coupon payments of 2 max. expenses;

- reliable stocks - an investment in shares of low-risk highly liquid reliable enterprises, a stock of at least 6 minutes. expenses. Target - 6 max. expenses;

- venture funds - an investment in medium and high risk funds, the stock of at least 1 max. expenses. Target - 3 max. expenses;

- high-yield shares - the purchase of high-risk shares, a stock of at least 1 max. expenses. Target - 3 max. expenses;

- real estate - real estate transactions. The goal is an annual income of 4 max. expenses.

- “High targets zone” - everything, you can no longer work. There is a passive income, there are decent stocks. You can do high and grand ideas. Here the division into funds is no longer necessary. Or, rather, the funds here will correspond to the cherished dreams ... Say, visit all the mountains of the world, or build a free school for children, or engage in the development of environmentally friendly cars, or ... or ...

Such are the ambitious goals and dreams (I recall once again - my dreams, not necessarily yours!). This is, in essence, a long-term financial plan. While I am in the process of forming a "airbag".The cash stock I have is formed by half of the minimum expenses and all the time is wasted. But I try to reimburse him. The principle I have now is this - out of 10% of the income I save 1/3 on deposits and precious metals, 2/3 on cash reserves. As soon as the cash stock reaches a minimum, I will change the strategy - I will save 1/3 on it, 2/3 on deposits and precious metals. When all these points reach a minimum, I will start to master the funds of the next zone.

. , , , . , . , . — , , — . , . — , .

Thanks for attention!

PS .

Source: https://habr.com/ru/post/211628/

All Articles