Nanex: A Nightmare on Elm Street for High-Speed Trading, Part 4

[ The first part , the second part , the third part

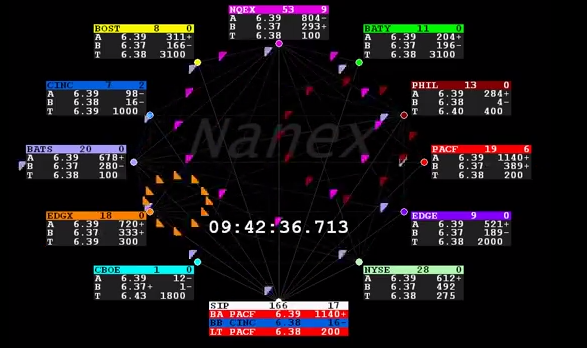

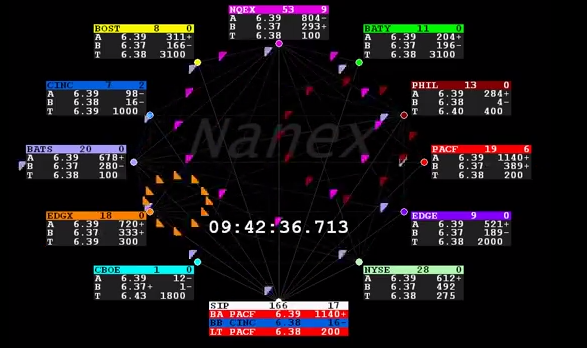

To illustrate the process of conducting computerized trades to an inexperienced public, Nanex began to transform trading information into animated videos with triangles and dots showing tens of thousands of teams moving rapidly between exchanges. One video published on YouTube showed a 50 millisecond interval, during which the price of Nokia Ovi quotes changed at a speed of 22,000 times per second. The video , published on October 9, has already been viewed more than 6,400 times [at the time of translation of the article, the number of views exceeded 10,300 - approx. translator ].

')

In Nanex, a computer was programmed to play one or another note on the piano when shares of one company known on the stock exchanges were bought and sold. As a result, the program produced a staccato composition that sounds pretty wild even if you play it at a slow pace. She was supposed to illustrate what Hunsader called the absurdity of modern "computer" trading.

“Everyone who went this way should behave a little theatrical, and Wall Street doesn’t like it,” says Haim Bodek, founder of Decimus Capital Markets LLC , a company developing computer programs to help organizations better trade with high-frequency firms and avoid “predatory” market behavior.

“The irony is that it points to really serious shortcomings,” said Bodek, who was previously the founder of Trading Machines LLC, a company specializing in high-frequency options trading, and headed the electronic volatile trading department at UBS AG.

One of the Nanex plots was spotted in the book by artist Trevor Paglen (Trevor Paglen), “The Last Pictures”, the disc with an electronic version of which was launched into space on board the satellite a year ago, as part of a project designed to leave “traces of human civilizations ”, which, according to the official website of the project, will continue to circulate around the Earth’s orbit many years after mankind disappears.

Hunsader began in the era of floppy disks, spending, according to him, "all the savings", so that in 1984 he could buy a computer, a machine, which he still keeps under his desk. He kept daily trading data from the Chicago Commodity Exchange and sold information to the holders of electronic bulletin boards, the forerunners of the modern Internet.

In 1987, he received a job offer from Tom Joseph (Tom Joseph), founder of Trading Techniques Inc. , who developed graphs for technical analysis and studying changes in the value of securities. While most traders were still shouting and waving in stock pits or hunched over in front of the first PCs, Hunsader and Joseph could get stock schedules without leaving Cadillac Joseph using a Compaq computer connected to a car phone.

Trading Techniques bought CQG , a trading software manufacturer, and Hunsader went there to work. He read a book on programming in Java, then wrote an application that allowed users to receive intraday charts of stock behavior on the recently popular Internet. The founder of the website Quote.com became interested in the application and hired Hunsader to work.

Internet portal Lycos Inc. acquired Quote.com in 1999, and Hunsader left the company. The following year, he focused on writing software for his own venture project, in which he invested thousands of hours of programming.

The result was Nanex, which receives quotes from consolidated market news feeds and distributes the data to users using software that allows the latter to analyze data, draw charts and write their own trading programs that complement the original one.

Flash Crash inspired Hunsadera to take a closer look at the data he sent to users. He decided to find out what was happening, together with Donovan, a surfer from Southern California and a programmer who, among other things, developed software using 3D graphics.

The more these two went deeper into the study of quotations, the more unexpected patterns appeared on the charts of stock behavior. They called it a crop circle, referring to a link to the mysterious ornaments that sometimes appear in the countryside, and published a report on the information found on the company's website.

YouTube

To illustrate the process of conducting computerized trades to an inexperienced public, Nanex began to transform trading information into animated videos with triangles and dots showing tens of thousands of teams moving rapidly between exchanges. One video published on YouTube showed a 50 millisecond interval, during which the price of Nokia Ovi quotes changed at a speed of 22,000 times per second. The video , published on October 9, has already been viewed more than 6,400 times [at the time of translation of the article, the number of views exceeded 10,300 - approx. translator ].

')

In Nanex, a computer was programmed to play one or another note on the piano when shares of one company known on the stock exchanges were bought and sold. As a result, the program produced a staccato composition that sounds pretty wild even if you play it at a slow pace. She was supposed to illustrate what Hunsader called the absurdity of modern "computer" trading.

“Everyone who went this way should behave a little theatrical, and Wall Street doesn’t like it,” says Haim Bodek, founder of Decimus Capital Markets LLC , a company developing computer programs to help organizations better trade with high-frequency firms and avoid “predatory” market behavior.

"Serious flaws"

“The irony is that it points to really serious shortcomings,” said Bodek, who was previously the founder of Trading Machines LLC, a company specializing in high-frequency options trading, and headed the electronic volatile trading department at UBS AG.

One of the Nanex plots was spotted in the book by artist Trevor Paglen (Trevor Paglen), “The Last Pictures”, the disc with an electronic version of which was launched into space on board the satellite a year ago, as part of a project designed to leave “traces of human civilizations ”, which, according to the official website of the project, will continue to circulate around the Earth’s orbit many years after mankind disappears.

Hunsader began in the era of floppy disks, spending, according to him, "all the savings", so that in 1984 he could buy a computer, a machine, which he still keeps under his desk. He kept daily trading data from the Chicago Commodity Exchange and sold information to the holders of electronic bulletin boards, the forerunners of the modern Internet.

Cadillac, Compaq

In 1987, he received a job offer from Tom Joseph (Tom Joseph), founder of Trading Techniques Inc. , who developed graphs for technical analysis and studying changes in the value of securities. While most traders were still shouting and waving in stock pits or hunched over in front of the first PCs, Hunsader and Joseph could get stock schedules without leaving Cadillac Joseph using a Compaq computer connected to a car phone.

Trading Techniques bought CQG , a trading software manufacturer, and Hunsader went there to work. He read a book on programming in Java, then wrote an application that allowed users to receive intraday charts of stock behavior on the recently popular Internet. The founder of the website Quote.com became interested in the application and hired Hunsader to work.

“We put this app on their website and grew from zero to 10,000 paid subscribers in about 18 months,” recalls Hunsader. “These guys paid about $ 100 a month for such a simple thing from the Web. The company had to hire temporary employees for the weekend in order to have time to process the data from credit cards. ”

Number five

Internet portal Lycos Inc. acquired Quote.com in 1999, and Hunsader left the company. The following year, he focused on writing software for his own venture project, in which he invested thousands of hours of programming.

The result was Nanex, which receives quotes from consolidated market news feeds and distributes the data to users using software that allows the latter to analyze data, draw charts and write their own trading programs that complement the original one.

Flash Crash inspired Hunsadera to take a closer look at the data he sent to users. He decided to find out what was happening, together with Donovan, a surfer from Southern California and a programmer who, among other things, developed software using 3D graphics.

“We saw that the Securities and Exchange Commission seemed to be slowed down with a reaction to what was happening,” Hunsader recalls. “I told him:“ You know, we have the data. We have to do it. Let's see what happens. ”

The more these two went deeper into the study of quotations, the more unexpected patterns appeared on the charts of stock behavior. They called it a crop circle, referring to a link to the mysterious ornaments that sometimes appear in the countryside, and published a report on the information found on the company's website.

“It was both a blessing and a curse,” says Hunsader. “A blessing - because the report attracted the attention of the Main Street publication, which subsequently became interested in the Atlantic, which ultimately led us to the New York Times. And it was a curse because the bosses of Wall Street, or the elite, used this data to set us apart from conspiracy theories. ”

Source: https://habr.com/ru/post/210828/

All Articles