Nanex: A Nightmare on Elm Street for High-Speed Trading, Part 3

[ First part ], [ second part ]

[ First part ], [ second part ]"Too difficult"

“The markets are actually too complex,” Tabb wrote in an email to me. “The problem is to simplify them. Maybe too many exchanges are open now? Or are there too many dark pools of liquidity? Too many algorithms? In order to simplify the structure of the markets, the Securities and Exchange Commission will have to take extremely unpopular measures that will undo the last 15 years of the history of market structures during which many investors have been making a profit. They are in a very difficult position. ”

The founder of Nanex believes that in order to simplify the market structures of the Securities and Exchange Commission, it is worth starting with using the Market Information Analysis System, known as Midas and developed by Tradeworx, in order to study what, according to Hunsader, is one of the most important issues concerning modern markets.

')

Streaming data directly from exchanges, which is used by high-frequency trading firms like Virtu, contains more timely information than the "consolidated" news feeds that are sent to other market participants. It is streaming “live” data from exchanges that, according to Hunsadera, changes the level of play on the exchange. By the way, the Hunsadera company itself uses classic news reports for work.

Boutiques and Nanex

John Nester, a representative of the Securities and Exchange Commission, declined to comment on Nanex’s statements. In addition, he declined to comment, Eric Ryan (Eric Ryan), a representative of the New York Stock Exchange, Rob Madden (Rob Madden) of the Nasdaq OMX Group Inc. and Randy Williams of Bats Global Markets Inc., which teamed up with Direct Edge Holdings LLC.

The Nanex office in the suburbs, dazzling with expensive cafes and boutiques, is a room: most of one of its walls is occupied by monitors, the other corner is reserved for the server, a mini-refrigerator filled with soda is squeezed into the space between them - that's all.

The door is opened by Nate Rock, a 34-year-old engineer with a bushy beard and the inclination to insert fragments from Dungeons and Dragons into conversation [ DnD / Dungeons and Dragons - an old-school board game in the fantasy genre - approx. translator ]. He became interested in the work of Hunsader after attempting to invest in securities a certain amount earned from his previous work at Infinite Campus Inc., a company that develops software for teachers and students.

Dogbert Barrefuter

Without shoes, in camouflage shorts and a black T-shirt with the words “Pff”, Rock proudly wears the professional title “Dogbert” by analogy with the character of the comic “Dilbert” [Dilbert is the comic strip of Scott Adams, who heroically overcomes heroism office life - approx. translator]. He read about Hunsader’s business on the Zero Hedge blog and got the job starting by emailing with Nanex programmer Jeff Donovan on the May 2012 holiday break between beer drinking and Facebook news on the IPO.

“I am a researcher by education, and in what Eric is doing, I saw a research approach,” says Rock. “Everything is calibrated to milliseconds. I have never seen such a thing. ”

Among other people who paid attention to the fruits of Hunsadere's research was Jim Angel, a professor of finance at Georgetown University, who studies questions of market structures. According to him, the research of Hunsadera is a valuable help for researchers, regardless of how much they share the findings of Nanex, since there is not enough available information to confirm the presented calculations.

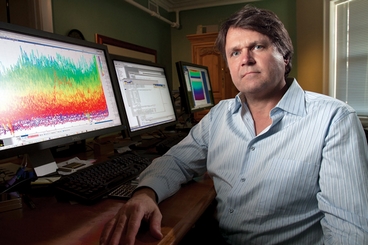

Eric Hunsader

Dark areas

"I do not think that his conclusions are always correct," says Angel. “He does not know who trades, who makes requests for various quotes. But operations in our financial markets are also not always completely “clean.” And even though the average state of our markets is much better than 10 or 20 years ago, in reality there are still dark areas on the financial map that we can and should bring to clean water. And he draws attention to them. ”

Hunsader sent out his materials criticizing the current state of the markets to everyone, starting with representatives of the Federal Reserve Bank of Chicago and ending with members of the British government, the regulars of Downing Street, 10 in London.

“He’s like a mosquito flying into a room that makes people pay attention to him,” said Van Hutcherson, a trader from JonesTrading Institutional Services LLC, based in Oak Brook, Illinois. “It sheds light on some very important situations, which, it seems to me, go unnoticed, because most, with the exception of very experienced traders, do not have access to technologies that make it possible to identify such dependencies.”

To be continued...

Source: https://habr.com/ru/post/210038/

All Articles