Stock Market Tools: Derivatives

Not so long ago, an interesting post was published on Habré “ How to an IT specialist to save his finances, ” to which, in particular, a not less interesting survey was attached. Its results are indicative - most users do not distinguish the stock market from the FOREX market (although there are actually differences ), and even the idea of investing your savings in startups is much more popular than becoming an investor on the exchange. The first place, with a huge margin, is occupied by banks, and this can also be understood - unfortunately, in our country, not so many people really have extensive financial knowledge, and in this case, a deposit in a bank is probably the best thing you can think of. save your money.

However, we believe that this is not the only way to maintain and increase our finances, so we continue our series of educational posts on the stock market. And today we will talk about, without which it is difficult to imagine the functioning of any exchange platform - derivatives.

')

In general, all types of derivative instruments, or as they are sometimes called - “secondary securities” - can be divided into the following classes:

- Depositary receipts;

- Securities warrants;

- Futures contracts;

- Forward contracts;

- Option contracts.

Depositary receipts

Inherently closest to ordinary shares. It often happens that some foreign company (conditional Rostelecom) wants to place its shares in the depositary of Bank of New York and concludes an agreement with it. The bank for these shares further releases for free circulation certificates of securities - American Depositary Receipts (ADRs). One ADR can correspond to one or several shares. ADRs are denominated in US dollars and are freely traded on US exchanges. What is important is that the market value of ADRs in terms of one share and the rate of national currency of the country of the company issuing the shares corresponds to the exchange (market) value of the shares underlying such ADRs.

Warrants to securities

The term "warrant" is derived from the English word warranty. Warrant is the right to redeem a certain number of shares of an enterprise in a rather distant future (from one to five years).

The owner of a warrant is guaranteed the right to redeem a certain number of shares at a certain price in the future, therefore the holder of the warrant is insured against dilution of his stake in the company (and, for example, from his withdrawal from her management). Warrants do not bargain on the stock exchange, but circulate, which is logical, on the over-the-counter market. Most often, they are used by shareholders who want to protect their stake in the company, in the event of additional share issues, during mergers and acquisitions of companies.

Futures contracts

Futures (from English futures) is an obligation to buy or sell a certain asset (it is called basic) at a certain price on a certain date in the future. In addition, each futures contract is characterized by the number of the underlying asset (eg shares), the date of execution of the contract (expiration date) and, in fact, the price (strike price), according to which the buyer agrees to buy the underlying asset and the owner to sell.

Thus, the seller undertakes to sell a certain amount of the underlying asset in the future at a certain price, and the buyer upon the occurrence of this time to buy it at the agreed price. The guarantor of the transaction is the stock exchange, which takes insurance deposits from both parties to the transaction.

The underlying asset may be:

- A certain number of shares (stock futures);

- Stock indices (index futures);

- Currency (currency futures);

- Commodities traded on exchanges, such as oil (commodity futures).

- Interest rates (interest futures).

All futures contracts are traded on special trading platforms - urgent sections of stock commodity or currency exchanges. In Russia, for example, there is an derivatives market on the Moscow Stock Exchange, where futures and options are traded.

Before a futures contract is launched into circulation, the exchange determines the terms of trade for them, which are called the specification:

- The underlying asset underlying the futures contract.

- The number of units of the underlying asset in one contract.

- Expiration date (performance).

- Minimum price increment.

- The cost of the minimum price increments.

- Guarantee (pledge) deposit required to open a position on one contract.

- The method for determining the estimated contract price for each trading day.

- Futures execution method is deliverable or settlement.

Example : futures contract on the RTS Index .

It is calculated, denoted as follows - RTS- <settlement month>. <Settlement year>, for example RTS-3.14 (futures is active for three months, that is, there are four futures in the year). The underlying asset of the contract is, in fact, the RTS index, calculated by the Moscow Exchange, and the cost of one point of the index is $ 2.

Futures chart for RTS-3.14 index from SmartX terminal

Futures chart for RTS-3.14 index from SmartX terminalFutures are divided into two types - settlement and delivery. In the case of deliveries, the physical supply of the underlying asset is allowed - from oil to currency. If such a supply is not allowed, the futures contract is calculated, and at the time of its expiration, the parties to the transaction receive the difference between the contract conclusion price and the settlement price on the expiration day, multiplied by the number of available contracts. These, of course, include index futures, which can not be put in any way.

When trading in futures contracts, the concept of variation margin arises, which involves recalculating the value of a position in relation to the previous day, followed by writing off / crediting money to the investor's account. The difference between the purchase / sale price of the futures and the estimated price of its expiration is daily received / debited from the account in the form of variation margin.

Forward contracts

“Forwards” is an obligation to buy or sell a certain product on a certain date in the future at a predetermined price. At first glance, everything is very similar to futures, but there is a significant difference.

- Forward contracts are concluded only on the over-the-counter market between two specific counterparties - they also bear the risk of non-compliance with the terms of the contract (in the case of futures, this risk lies on the exchange).

- Such a contract can be concluded on an arbitrary date in the future, unlike a futures contract that has a standard settlement date.

- As a underlying asset, a forward contract can be anything, and not just assets that allow exchange standardization.

- Such contracts, as a rule, do not require guaranteed deposits, and there is no variation margin charged on them.

Options

This is the right to buy or sell a certain underlying asset in the future at a certain price. Not an obligation, as in the case of futures, when, upon the occurrence of a specified date, the transaction will necessarily take place under certain conditions. In the case of an option, its exercise is the choice of the buyer, he may use his right, or he may not realize it.

Options are traded on the same stock exchanges and the same sections as futures contracts. They also have a specification, which includes the concept of the underlying asset. Interestingly, futures can also be used as the underlying asset. Options have expiration date. There are variations on when an option can be exercised. The so-called American options can be exercised at any time before the expiration date, European - only on this date.

Options are of two types - call options and put options.

- In the case of a call option, its buyer (option holder) acquires the right to buy the underlying asset in the future at a certain price (strike). The seller (option subscriber), in turn, sells this right for a price called a premium. If the buyer then decides to exercise his right, the seller will be obliged to sell him the underlying asset and receive the money.

- The put option holders buy the right to sell the underlying asset in the future at the strike price. Accordingly, the seller sells this right for a certain amount.

As in the case of futures, the exchange acts as an intermediary and guarantor of the execution of the transaction, which blocks the guarantee deposits on the sellers' accounts, ensuring that the players maintain their positions and fulfill their obligations (guarantee coverage). From buyers, the exchange deducts the premium and lists it to sellers.

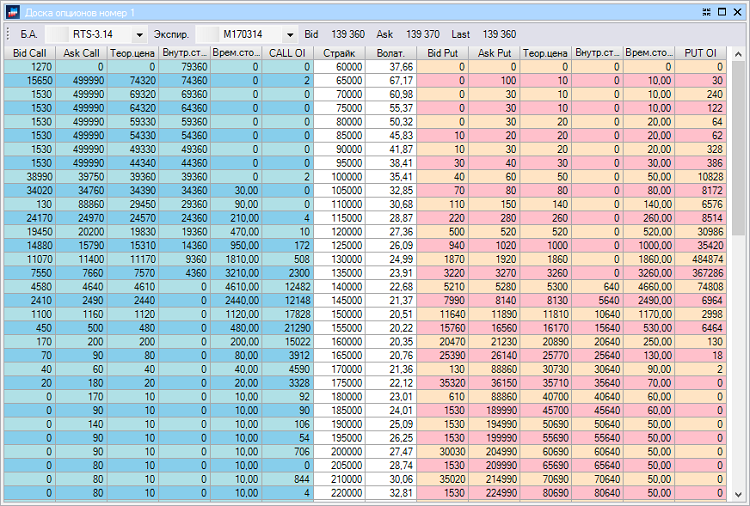

Options trading is so specific that, for convenience, most of the trading terminals have special “option boards” that collect information about options that the investor is interested in. Some go further and produce special terminals , “sharpened” solely under options trading (they often work on direct connection ).

SmartX Terminal Option Board

Today, thank you for your attention, we will be happy to answer questions in the comments. Next time we will talk about the significance of different groups of traders represented on the stock market - in particular, what is more from algorithmic traders, harm or benefit.

Source: https://habr.com/ru/post/209810/

All Articles