The programmer is preparing to receive investments: a step by step guide

Frankly, I myself am not a theorist, but rather a practitioner. Because I consider reading various textbooks on building my business and business trainings, although useful (and some of those I went to even seemed to be fascinating and interesting), but at times less effective than intensive work on the project. However, the need for some knowledge of the minimal “theory” in any matter cannot be denied. Over the past few years, I have formed a vision of the “dry residue” of the theory of all sorts of recommendations to startups, which fully correspond to the realities. At the same time, I tried to throw out everything that would take considerable time, but would not bring you closer to setting up your own business. Immediately clarify that this is completely my subjective vision, based on our personal experience.

Unfortunately, in my experience, all the questions below must be answered in the affirmative. Otherwise, a positive outcome of the search for investments is extremely unlikely. Having passed on these 10 questions you can come closer to the correct “packaging” of the project.

Thank you for your attention to all who mastered. I will be glad to answer your questions!

In the next article I will describe in detail directly the development of the project, its functionality, and much more, which has been happening since April 2013.

UPD Article, edited according to the views of readers, I return from the draft.

How, when and how much? Preparing a project to search for investment in 10 steps

Unfortunately, in my experience, all the questions below must be answered in the affirmative. Otherwise, a positive outcome of the search for investments is extremely unlikely. Having passed on these 10 questions you can come closer to the correct “packaging” of the project.

- Can you clearly describe your idea in 2-3 sentences in 30 seconds to a random person in the elevator?

Investors receive hundreds and thousands of applications. Most of them are junk and faceless, but it is very easy to get lost in this stream. If the essence does not turn out to be communicated quickly and clearly, the application will not be considered. Consideration of the project as a whole depends on the brief formulation of the main idea. - Do you know the competitors well?

')

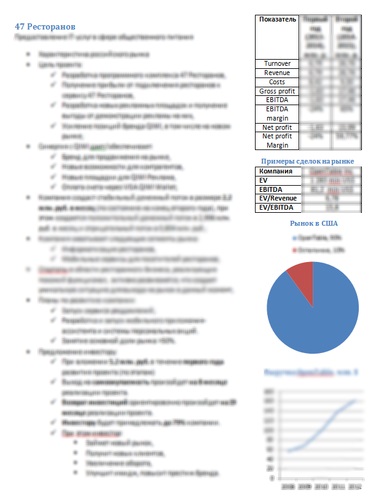

The truth of life is that there are always competitors, but they can be indirect rather than direct. For example, for social networks they could be dating sites, and for the electronic menu - paper. It is necessary to conduct an approximate assessment of the market (Companies, capacity, prospects and development history) based on open facts from the Internet, for example, from sites of public companies. It is also worth showing how your product is different and why. I would like to note that competitors in the young market are good, because collectively explain to consumers the benefits of new services, shaping the market. If you are sure that you do not have competitors, then all the prejudices of customers will have to be dispelled alone, which is far from such an easy task as it seems at first glance. - Have you made a prototype or an interactive layout?

Investors want to see what they are investing in. Without demonstration, the probability of success is significantly reduced. Most ideas can be tested either by creating an interactive design layout, or by making a minimal prototype. And the creator will solve many basic problems when he turns the idea into reality. Layout can be made very simplified, but must necessarily show the basic functionality of the service. - Do you understand why not do without investments at this stage?

There must be an understanding of why we cannot do without investments, and not just the desire to try the “why not?” Series. For example, the market has a limited time window of opportunities and you need to have time to enter it before someone else takes a highly competitive market, significantly increasing the cost of entering it. - Did you work out a business model?

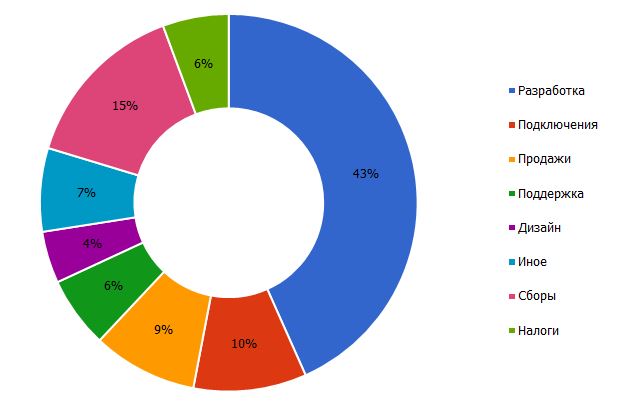

Unfortunately or fortunately, the approach of creating a service, recruiting a client base and resolving the issue of monetization at the last stage is possible in Russia when creating a service at your own expense or using a close circle of relatives and friends. The investor wants to see a calculated understanding of where the money comes from, how much will be spent and on what, and when there will be a return to self-sufficiency. At the initial stage, the risk of making a mistake in a model is large enough, but it must be calculated and thought out. In the course of work, it will immediately become clear what numbers you are ready to answer, where you need to focus in order to create an MVP (Minimum viable product) suitable for first sales. - Do you understand where the money will go?

As a rule, the forecast is made for two years, and there must necessarily be an exit point for self-sufficiency. Cost items must be justified, without bloated salaries. Much will have to do on their own. Moreover, it is often expected that the founder will receive the minimum necessary salary, at least before reaching the payback, if at all. - How much do you ask and how much are you willing to offer?

It is necessary to determine in advance the amount of investment, and what percentage of the company you are ready to give. The amount of investment should be reasonable and rely on the calculations for which you are ready to answer in case of failure. The first sowing investments, when the product has not yet entered the market, often revolve around a million or one and a half rubles, for a period sufficient to enter the market. Count on the three stages of investment, determining for yourself the maximum total share that you are ready to give up following the results of the three stages. - Do you have a team?

As practice shows, money is allocated primarily with faith in the team. One person will not be able to pull the implementation of the service, and the introduction and elaboration of the business model, not to mention the support and the multitude of arising needs to prepare some kind of “piece of paper”. Therefore, do not invest in singles. Well, if the team has a techie and a person versed in business and sales. Both should have some experience behind them, but the project leader should have one, and the shares should not be equal. In business it is necessary to bear responsibility and often make decisions on which the fate of the company depends. This responsibility to oneself, employees and the investor should be borne by one person. - Did you put everything in the presentation and executive summary?

If you have not already done so, then we take the answers to all the points above and form a bright, understandable even “grandmother on the bench”, not overloaded presentation in 10-15 slides, and also fit exactly A4 page, forming the executive summary. You are ready and you already have something to talk about with the investor if the project interests him. In most cases, a more detailed business plan is not required, because All calculations and forecasts should already be issued in the presentation and executive summary. - Have you chosen the funds?

Fan mailing to all addresses can only play in the negative, especially if they find out about it in the funds themselves. It is highly desirable to find information on the network about what funds exist that are engaged in projects at your level of development and investing in areas that are relevant for you. It is useless to apply at the initial stage to a fund that invests in a business with a turnover of millions of dollars. It is advisable to optimize letters for specific funds, which will significantly increase the chances of considering your application.

Thank you for your attention to all who mastered. I will be glad to answer your questions!

In the next article I will describe in detail directly the development of the project, its functionality, and much more, which has been happening since April 2013.

UPD Article, edited according to the views of readers, I return from the draft.

Source: https://habr.com/ru/post/208760/

All Articles