Trends and prospects of algorithmic trading in Russia

The main technological trend of the world stock market in recent years is the rapid development of the so-called algorithmic, or high-speed trading. Now it is not people who compete on the exchanges, but trading robots performing hundreds and thousands of operations in one trading session. As usual, having originated in the West, this trend has already reached Russia - there are a lot of algorithmic traders on the Moscow Stock Exchange. Today we will talk about the prospects for the development of this area in our country.

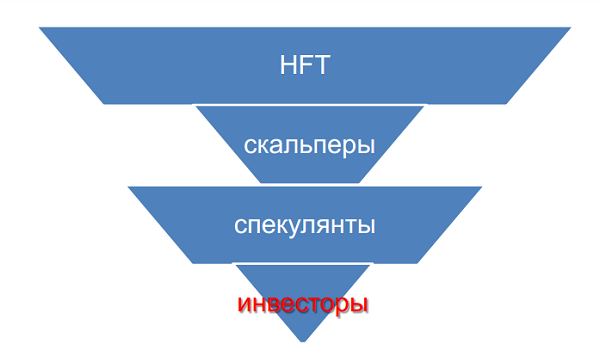

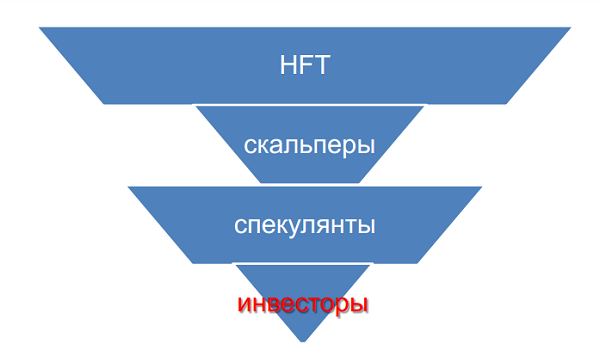

To begin with, we’ll define who are such high-speed merchants (HFT-traders from HightFrequenceyTrading) and what is their place in the stock market ecosystem . On any exchange there are several types of traders:

')

At the same time, speculators / dey-traders, scalpers and HFT-traders fall into the area of algorithmic trading, that is, these three categories of representatives of the stock market compete for profit among themselves.

In theory, this scheme is a "feed chain", i.e. for short-term investors, investors will be the source of money, short-term investors - for speculators and day traders, and so on. This is true if the market is arranged correctly and all listed groups of traders are present in it in the right proportions.

A stable, stable market is always fractal - there are always smaller ones along with larger participants who work with smaller amounts of funds and at smaller time intervals (timeframes) but make more transactions so that their turnover can even exceed turnovers of large investors. At the end of this chain are HFT traders.

This is the situation in the normal state of the market, however, at the moment on the domestic stock exchanges the situation is somewhat different and is characterized by the predominance of high-frequency traders, and a relatively small number of, in fact, long-term investors.

This scheme is confirmed by the figures for the algorithmic turnover on the Moscow Stock Exchange. In the stock market, the volume of algorithmic trading has been steadily increasing over the past four years: their share has doubled during this time.

* Data for each year correspond to October i. each year is presented in October

Even judging by our own data, the development of algorithmic trading is obvious. For three years (2010 - 2013) the share of algorithmic customer turnover increased by 15%, and the current algorithmic turnover in the derivatives market is about 60%.

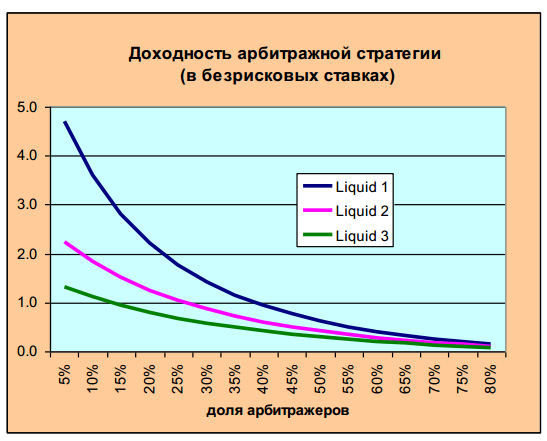

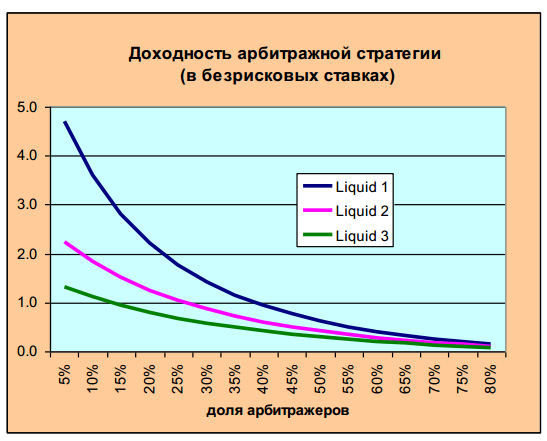

Such volumes of algorithmic trading lead to a decrease in the profitability of trading operations of traders who adhere to this style of work in the market. The more traders use robots making a large number of transactions, the higher the market liquidity (the so-called instant liquidity). And the more robots operating under similar strategies earns on current market inefficiencies, the sooner these weak points are leveled and the overall profitability of each particular strategy decreases.

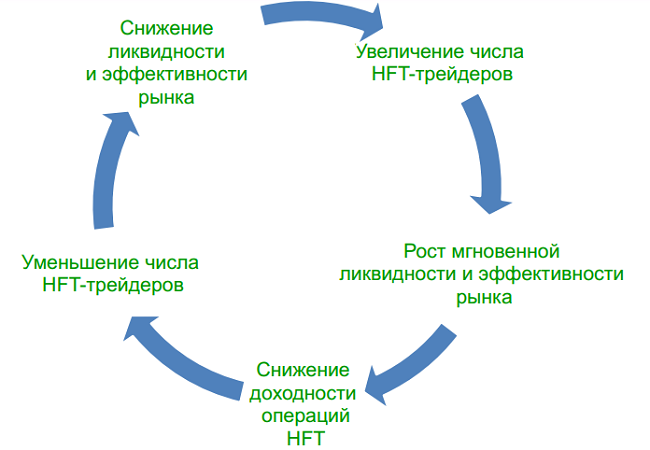

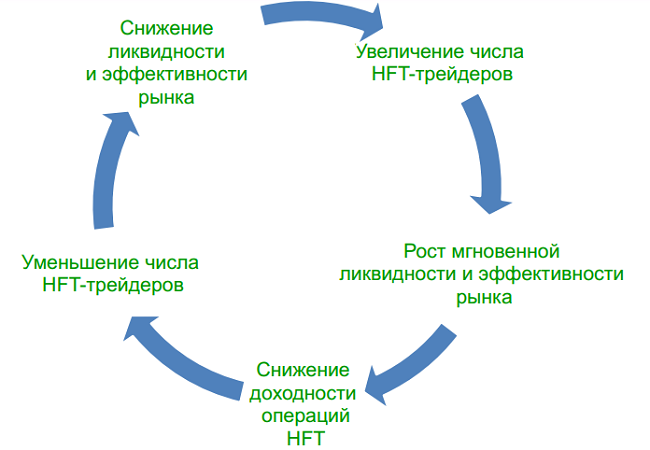

In general, the development cycle of HFT trade is characterized by the following scheme:

From all of the above, it follows that we can still see an increase in the number of HFT traders in the Russian stock market, but this growth will not be as significant as in previous years, and in the derivatives market, an increase in the number of HFT traders is generally unlikely.

Profitability is a complex function of the trader’s strategy itself, but also depends on several other basic indicators:

Yildness = F (R, Fees, Liquidity, Bid - Ask, Size, Hurst, Leverage) , where

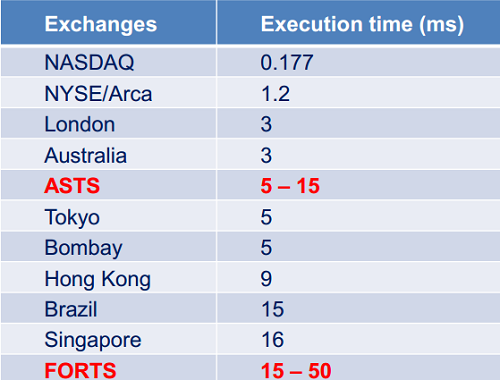

Even the most successful high-speed algorithmic strategy cannot be fully realized without a high transaction execution speed. That is, speed for HFT traders plays a key role.

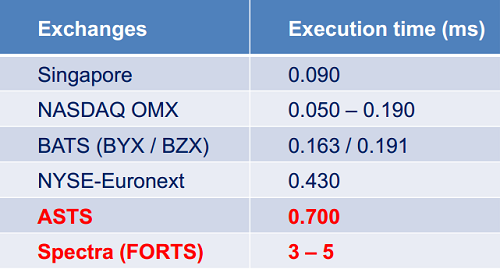

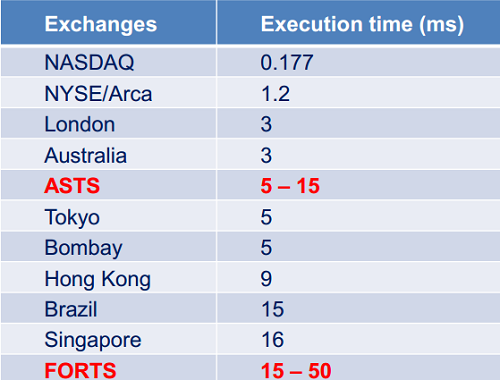

And here the dynamics emerges quite obvious. For a start, take a look at the time of order execution (latency), which existed on foreign and domestic stock exchanges in 2010.

* ASTS is the MICEX stock market, and FORTS – RTS, which later merged into the Moscow Stock Exchange.

As you can see, the speed champion was the American NASDAQ, to which everyone else lost significantly.

The exchanges all past years have invested heavily in infrastructure, which would reduce the processing time of customer requests. For example, the cost of updating the Singapore Exchange trading system in 2010-2011, which reduced the speed of order processing from 16 ms to 90 mks, amounted to $ 250 million.

Total exchanges, telecommunications companies, algorithmic hedge funds, corporate and private algorithmic traders in 2010 for technical re-equipment to increase the speed of trading throughout the world spent more than $ 2 billion.

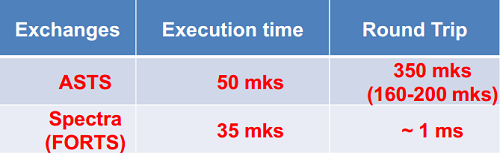

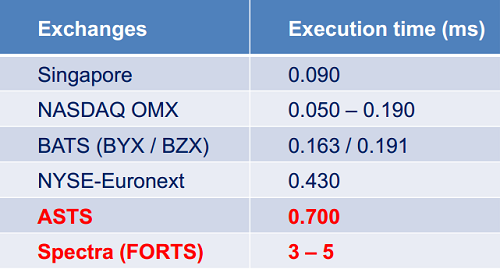

As a result, in 2013 (data for spring-summer), the situation changed quite significantly:

The NASDAQ ceded leadership to Singapore, while the Russian sites significantly improved their performance, but again fell behind their foreign counterparts.

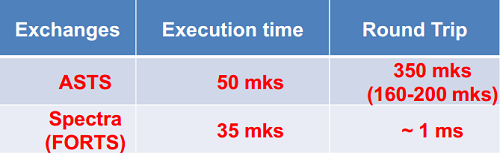

The development of the Moscow Exchange trading systems continues at a fairly rapid pace, and as early as December of this year, the time for the execution of orders was increased to 50 microseconds on ASTS and 35 in the Spectra (Forts) system.

As we see, the stock exchange pays a lot of attention to algorithmic traders and creates the best conditions for their work. But in order for them to win each other in the race, such traders, of course, also need to spend money on hardware, hosting, high-speed access to the stock exchange, buying information, constantly working on code optimization, and also looking for new markets and tools, strengthening control units risk, create and use models of future price changes. Well, of course, to develop new markets and tools, which still do not have a sufficient share of algorithmic trading.

PS The text was prepared on the recording of the report made by ITinvest Chairman Vladimir Tvardovsky at the II Russian conference on algorithmic trading on December 7, 2013.

High frequency trading

To begin with, we’ll define who are such high-speed merchants (HFT-traders from HightFrequenceyTrading) and what is their place in the stock market ecosystem . On any exchange there are several types of traders:

')

- First of all, these are investors who carry out long-term operations — they buy shares of certain enterprises, based on a deep analysis of their activities, and whose goal may not be to sell these securities. There is also a separate subspecies - the so-called short - term investors , whose "duration" of deals lies in the range from a week to a month.

- Speculators and dey-traders who carry out operations with securities precisely in order to earn on the price difference between buying / selling and short selling / buying. Their deals are medium term.

- Scalpers are a type of traders who make a lot of trades for a short time interval from a few seconds to a couple of minutes. The profit from each such operation, as a rule, is not very large, so the income consists of a multitude of transactions.

- Actually, HFT-traders who create trading robots operating according to certain algorithms.

At the same time, speculators / dey-traders, scalpers and HFT-traders fall into the area of algorithmic trading, that is, these three categories of representatives of the stock market compete for profit among themselves.

In theory, this scheme is a "feed chain", i.e. for short-term investors, investors will be the source of money, short-term investors - for speculators and day traders, and so on. This is true if the market is arranged correctly and all listed groups of traders are present in it in the right proportions.

A stable, stable market is always fractal - there are always smaller ones along with larger participants who work with smaller amounts of funds and at smaller time intervals (timeframes) but make more transactions so that their turnover can even exceed turnovers of large investors. At the end of this chain are HFT traders.

Current situation

This is the situation in the normal state of the market, however, at the moment on the domestic stock exchanges the situation is somewhat different and is characterized by the predominance of high-frequency traders, and a relatively small number of, in fact, long-term investors.

This scheme is confirmed by the figures for the algorithmic turnover on the Moscow Stock Exchange. In the stock market, the volume of algorithmic trading has been steadily increasing over the past four years: their share has doubled during this time.

* Data for each year correspond to October i. each year is presented in October

Even judging by our own data, the development of algorithmic trading is obvious. For three years (2010 - 2013) the share of algorithmic customer turnover increased by 15%, and the current algorithmic turnover in the derivatives market is about 60%.

What does this lead to?

Such volumes of algorithmic trading lead to a decrease in the profitability of trading operations of traders who adhere to this style of work in the market. The more traders use robots making a large number of transactions, the higher the market liquidity (the so-called instant liquidity). And the more robots operating under similar strategies earns on current market inefficiencies, the sooner these weak points are leveled and the overall profitability of each particular strategy decreases.

In general, the development cycle of HFT trade is characterized by the following scheme:

- The number of HFT traders has increased.

- This led to an increase in instant liquidity and market efficiency.

- Instant liquidity led to a decrease in the profitability of HFT merchants operations.

- As a result, their expenses have increased, which generally tend to only grow, and it is simply not affordable for many to become. As a result, some traders leave the market or reorient their strategies. And the total number of HFT traders is declining. Now we are just at this point.

- All this leads to a decrease in liquidity and market efficiency, which causes an increase in the number of HFT-traders, and everything starts anew.

From all of the above, it follows that we can still see an increase in the number of HFT traders in the Russian stock market, but this growth will not be as significant as in previous years, and in the derivatives market, an increase in the number of HFT traders is generally unlikely.

Yield

Profitability is a complex function of the trader’s strategy itself, but also depends on several other basic indicators:

Yildness = F (R, Fees, Liquidity, Bid - Ask, Size, Hurst, Leverage) , where

- R - risk-free rate acting on the market. The higher the rate, the higher the yield.

- Fees - the size of the broker and exchange commission. From this indicator, as well as from the risk-free rate, the yield depends in the opposite way ..

- Liquidity - liquidity. On the one hand, the higher it is, the lower the profitability. On the other hand, with low liquidity, it is not necessary to rely on high profitability either. This means that HFT traders need to find a middle ground and not rush into overly liquid, or vice versa, extremely unpopular papers and stock exchange instruments.

- Bid / Ask spred is the sale price of a financial instrument, and Ask is the sale price.

- Size - the size of the trading lot.

- Hurst is an indicator of the fractality of the Hurst market.

- Leverage - brokerage leverage that a trader can get to implement his strategy.

Speed performance

Even the most successful high-speed algorithmic strategy cannot be fully realized without a high transaction execution speed. That is, speed for HFT traders plays a key role.

And here the dynamics emerges quite obvious. For a start, take a look at the time of order execution (latency), which existed on foreign and domestic stock exchanges in 2010.

* ASTS is the MICEX stock market, and FORTS – RTS, which later merged into the Moscow Stock Exchange.

As you can see, the speed champion was the American NASDAQ, to which everyone else lost significantly.

The exchanges all past years have invested heavily in infrastructure, which would reduce the processing time of customer requests. For example, the cost of updating the Singapore Exchange trading system in 2010-2011, which reduced the speed of order processing from 16 ms to 90 mks, amounted to $ 250 million.

Total exchanges, telecommunications companies, algorithmic hedge funds, corporate and private algorithmic traders in 2010 for technical re-equipment to increase the speed of trading throughout the world spent more than $ 2 billion.

As a result, in 2013 (data for spring-summer), the situation changed quite significantly:

The NASDAQ ceded leadership to Singapore, while the Russian sites significantly improved their performance, but again fell behind their foreign counterparts.

The development of the Moscow Exchange trading systems continues at a fairly rapid pace, and as early as December of this year, the time for the execution of orders was increased to 50 microseconds on ASTS and 35 in the Spectra (Forts) system.

findings

As we see, the stock exchange pays a lot of attention to algorithmic traders and creates the best conditions for their work. But in order for them to win each other in the race, such traders, of course, also need to spend money on hardware, hosting, high-speed access to the stock exchange, buying information, constantly working on code optimization, and also looking for new markets and tools, strengthening control units risk, create and use models of future price changes. Well, of course, to develop new markets and tools, which still do not have a sufficient share of algorithmic trading.

PS The text was prepared on the recording of the report made by ITinvest Chairman Vladimir Tvardovsky at the II Russian conference on algorithmic trading on December 7, 2013.

Source: https://habr.com/ru/post/207000/

All Articles