Subtotals of a stock exchange startup

Exchange as a startup. It sounds rather unusual. Immediately a huge amount of legal issues, regulatory turbulence, etc. climbs into my head. It would seem, just do not start.

But, as many know, there are successful attempts to resist the bureaucracy of the financial world. The history of this confrontation is, of course, largely a virtual component - electronic payment systems. And as we well know, the world of software, albeit a virtual one, with proper skill and perseverance is quite real monetized.

The history of the development of such opposition / additions can be a long time to paint. But we will focus on one of the extreme events of this front: cryptocurrency. And even narrow the narrative: cryptocurrency exchange.

')

I’ll say right away that in order to fully understand the material, even if it was written diligently in a generally accessible language, you still have to work hard and become familiar with the educational program .

So, cryptocurrency. There is quite a lot of information on the net. The simplest thing to understand is the bitcoin that is so popular right now. For example, on the fingers is described in more or less detail here .

Roughly speaking, a stock exchange is an ECN-pricing exchanger. At this stage, the market of cryptocurrency exchanges is quite young. And, accordingly, is booming. Prospects are enormous, if you can figure out at least one step ahead. Therefore, we must pay tribute to the guys who created the exchange even a year ago - then it was necessary to think through more than one step ahead. And, of course, the creators of the cryptocurrency themselves cannot admire their own antisocial non-stereotypical thinking. As it is not paradoxical, very few people in the world understand what money and currency are ...

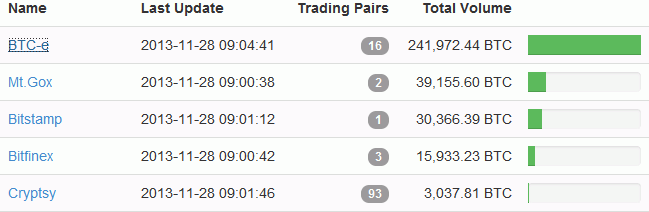

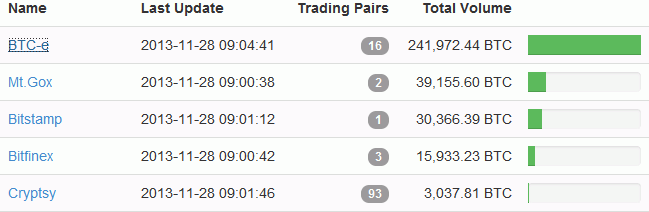

Let's look at the current state of the stock market:

This is a ranked table of daily turnover of cryptocurrency exchanges. Perhaps someone will be pleased to see in the first place with a significant margin exchange of Russian origin - BTC-E. Just a minute or two ago there was no such separation. Moreover, BTC-E was somewhere in the top five.

This table is missing a rather large Chinese exchange BTCChina. But believe me, its turnover is not as high as many Western resources show - they are not able to count correctly.

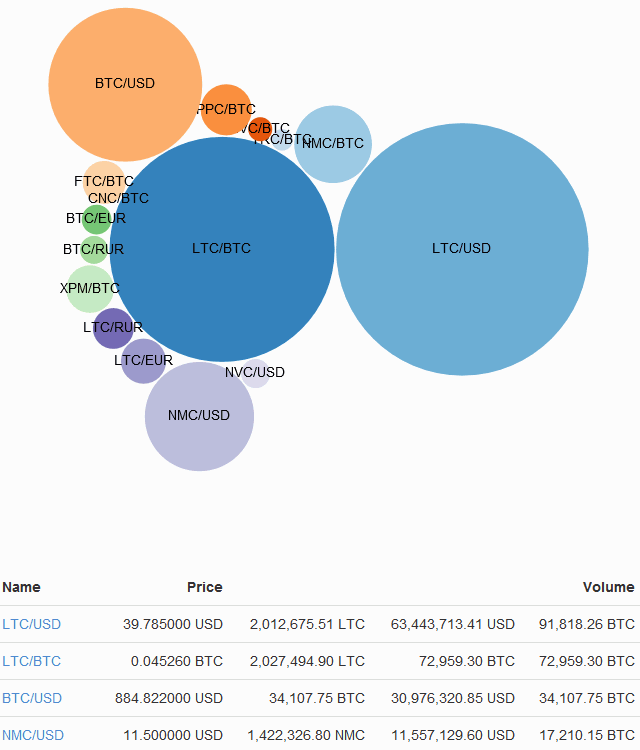

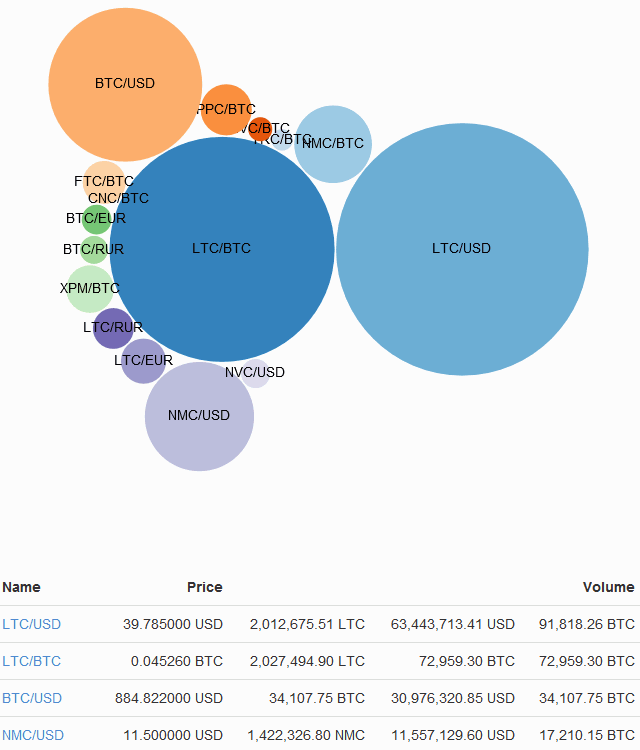

What was the reason for such a rapid take-off of BTC-E speed compared to its competitors? Let's see what their turnover consists of:

It can be seen that the BTC-E made a strategically correct move, giving the opportunity to trade many cryptocurrencies at once, and not just Bitcoin, like many others. Such foresight allowed to shoot just a month, because Bitcoin has become a lot to see slightly overheated.

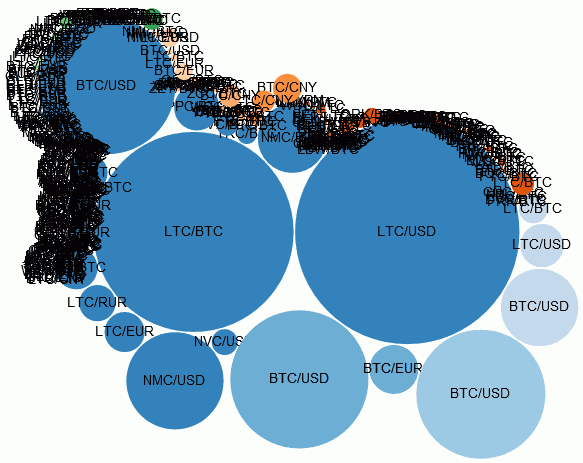

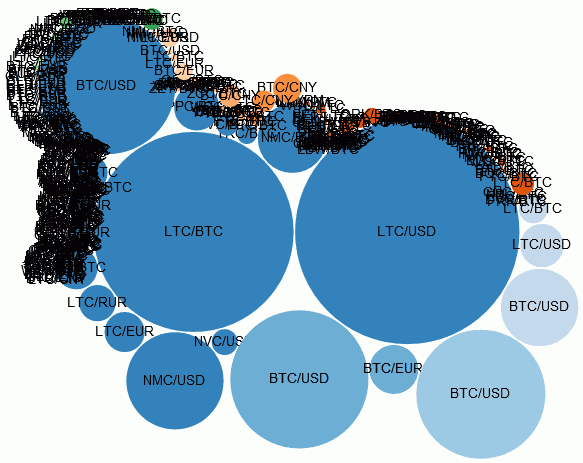

A rather serious cut of the decentralized world currency exchange market now looks like this :

I did not make videos from the updated screenshots of this visualization. I think it will be interesting for you to observe how the picture changes dynamically from day to day, sometimes going to this page.

There are many of them, I will describe only one, but also a real one: how to start trading on a cryptocurrency exchange?

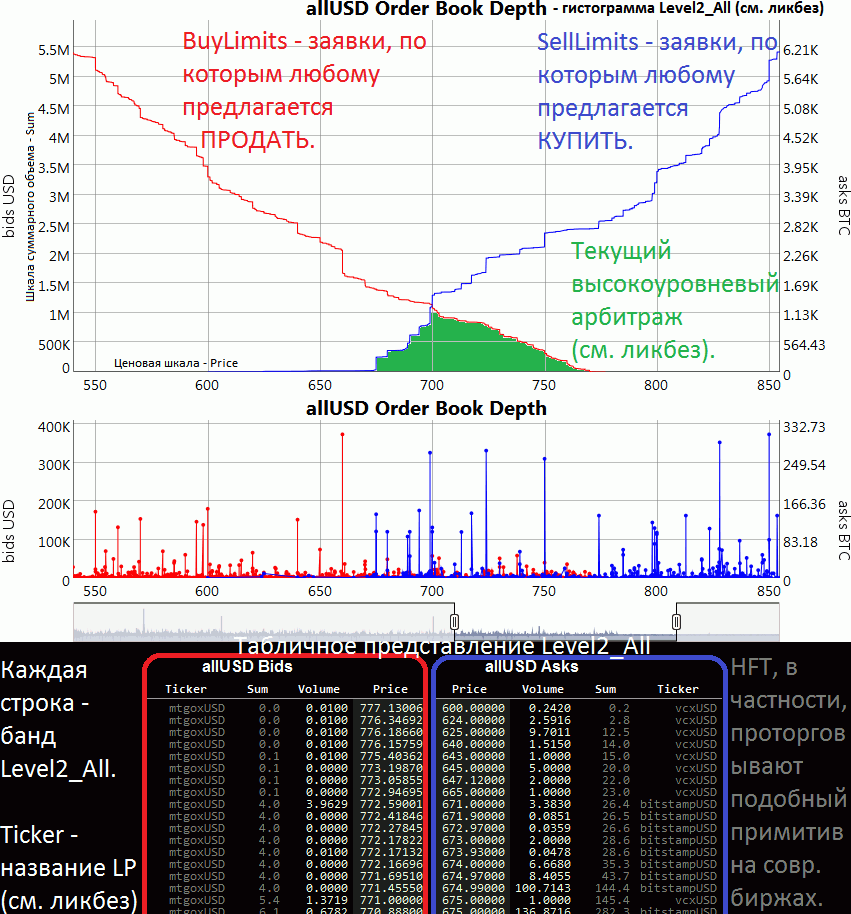

Everything is reduced to a minimum of bureaucracy. More precisely, it simply does not exist. You ANONYMOUSLY register, transfer money and trade. Everything. The very real process of trading in the laconic visualization, magnificent for the web, can be viewed here :

Has the stock-based startup paid off? Now you can see that the daily turnover of the same BTC-E is about 200,000 BTC. That at the current rate somewhere around $ 200 million. The commission at BTC-E is one of the smallest in the industry - 0.2%. We multiply one by the other, then we double it (the commission is taken on both sides of the transaction) and we get a daily output of $ 800,000. Whoever does not understand, the $ 800,000 exchange startup is already earning per day. Turnover is changing rapidly by tens of percent, so the actual exhaust must be looked at yourself (the data on the screen and the calculations lose accuracy, respectively).

It is necessary, of course, to compare this with someone. For example, with FOREX and the Russian currency exchange on FORTS.

On FOREX, for the same ECN / STP platform, in order to achieve such indicators, you need to have at least a daily turnover of $ 20 billion. Units in the world have something similar (especially on retail). And they built their business by far more than one year. Not to mention the difference in cost.

FORTS - the reader himself can calculate and, if desired, post the data in the comments. I can only say that FORTS looks faded, especially against the background of the prospects for the development of cryptocurrency trade and the fact that it, unlike the FORTS and FOREX, does not have a holiday. Those. cryptocurrency exchanges operate without any interruptions at all: 365/7/24.

They are huge. Accordingly, the competition is considerable. Almost every week there is an announcement of the next exchange startup. The most active are the Chinese. And this is explained not only by their number, but also by the understanding that they can jump out of the rigid framework of the regulation of the yuan. That only costs the transfer of large Chinese online stores for the possibility of payment in bitcoins. In general, well done.

It is clear that the momentum will grow. What was, is, and for some time there will be fraudulent cryptocurrency exchanges: they pretended that there was trade, while they themselves ran away with the money of investors / speculators. But how will things really evolve?

Almost all the exchanges are now functioning on the terribly inhibiting for the modern understanding of electronic market trading web technologies. While this narrow neck is not strongly felt. But with the increasing popularity, it will increasingly remind about itself.

Technologically trading engines will be improved. The FIX API and other more advanced trading protocols will appear. Who can count a few steps forward, is already making this transition. Since according to the laws of the genre, all current exchanges that are based on web technologies will be devoured by more technologically advanced. How this happens is described in the educational program . Briefly through the ECN / STP scheme. Those. there will be a serious centralization of the market. There will be several large trading platforms. The rest will die.

Now the miners are setting the big tone by droppingmined gold cryptocurrencies into exchanges. Algae traders minimum. Mostly clickers. To some extent, algorithmic traders are held back by a lack of confidence in the new industry and technologically weak trading engines.

Cutting meat that has never even seen predators is simple. Yes, this is a very distant reminder of HFT technologies , since it's not about the fight for microseconds and the physical length of the wire. And about many hundreds of milliseconds (costs of web engines). But from this those. insider in this context does not cease to be. You can live. Of course, the exchange commission is too big. But farsighted stock exchanges will lower it and even make it special. offers for market makers in the form of rebates (negative commission).

The current status of the inter-exchange arbitrage without pitfalls can be seen here :

A lot of pitfalls. But as the industry develops, there will be less and less of them. Be sure to show themselves the new generation of ECN / STP-aggregators, creating a kind of analogues darkkpulov, where several exchanges will run as LP at once. So the life of the arbitrators will be simplified. Their ranks will be replenished. And the exchange in their prices, finally, equalize.

Their sea. This is an emerging market, which always has similar inefficiencies. Yes, the liquidators are not very much so far in order to interest the largest algo-funds. But a million USD profit for a simple algo trader, which can explore the market in many respects even with simple classical methods, is a good add. income.

Logical development and near-stock service. These are, as a rule, resources for conveniently submitting material: delivery of real-time correct exchange feeds and their storage, visualization of various stock exchange indicators, etc.

The uniqueness of cryptocurrency exchanges is the ability to observe the stages of formation of the exchange from the very beginning of the new real commodity-money market. Those. A substantial part of the thousand-year financial development of mankind can be not only mathematically modeled, but corrected by observing the present experience of quickly playing the same story in a short period of time.

All this allows you to test existing economic theories for consistency. Build more adequate socio-economic causal relationships. Such opportunities for the rapid scrolling of one of the important processes in the history of mankind are reduced by an order of magnitude in the latency of information delivery, compared with what it was dozens to hundreds to thousands of years ago.

At the moment, data of such a development history almost from the inception of the cryptocurrency trade is available, thanks to one of the oldest cryptobirds - MtGox:

This is a lot of gigabytes of data on how transactions were performed on the mutual exchange of BTC <-> USD. The study of this almost Big Data layer can play a huge role in understanding us: sociology, economics, etc.

But, as many know, there are successful attempts to resist the bureaucracy of the financial world. The history of this confrontation is, of course, largely a virtual component - electronic payment systems. And as we well know, the world of software, albeit a virtual one, with proper skill and perseverance is quite real monetized.

The history of the development of such opposition / additions can be a long time to paint. But we will focus on one of the extreme events of this front: cryptocurrency. And even narrow the narrative: cryptocurrency exchange.

')

I’ll say right away that in order to fully understand the material, even if it was written diligently in a generally accessible language, you still have to work hard and become familiar with the educational program .

So, cryptocurrency. There is quite a lot of information on the net. The simplest thing to understand is the bitcoin that is so popular right now. For example, on the fingers is described in more or less detail here .

Exchange

Roughly speaking, a stock exchange is an ECN-pricing exchanger. At this stage, the market of cryptocurrency exchanges is quite young. And, accordingly, is booming. Prospects are enormous, if you can figure out at least one step ahead. Therefore, we must pay tribute to the guys who created the exchange even a year ago - then it was necessary to think through more than one step ahead. And, of course, the creators of the cryptocurrency themselves cannot admire their own antisocial non-stereotypical thinking. As it is not paradoxical, very few people in the world understand what money and currency are ...

Let's look at the current state of the stock market:

This is a ranked table of daily turnover of cryptocurrency exchanges. Perhaps someone will be pleased to see in the first place with a significant margin exchange of Russian origin - BTC-E. Just a minute or two ago there was no such separation. Moreover, BTC-E was somewhere in the top five.

This table is missing a rather large Chinese exchange BTCChina. But believe me, its turnover is not as high as many Western resources show - they are not able to count correctly.

What was the reason for such a rapid take-off of BTC-E speed compared to its competitors? Let's see what their turnover consists of:

It can be seen that the BTC-E made a strategically correct move, giving the opportunity to trade many cryptocurrencies at once, and not just Bitcoin, like many others. Such foresight allowed to shoot just a month, because Bitcoin has become a lot to see slightly overheated.

A rather serious cut of the decentralized world currency exchange market now looks like this :

I did not make videos from the updated screenshots of this visualization. I think it will be interesting for you to observe how the picture changes dynamically from day to day, sometimes going to this page.

Causes of development

There are many of them, I will describe only one, but also a real one: how to start trading on a cryptocurrency exchange?

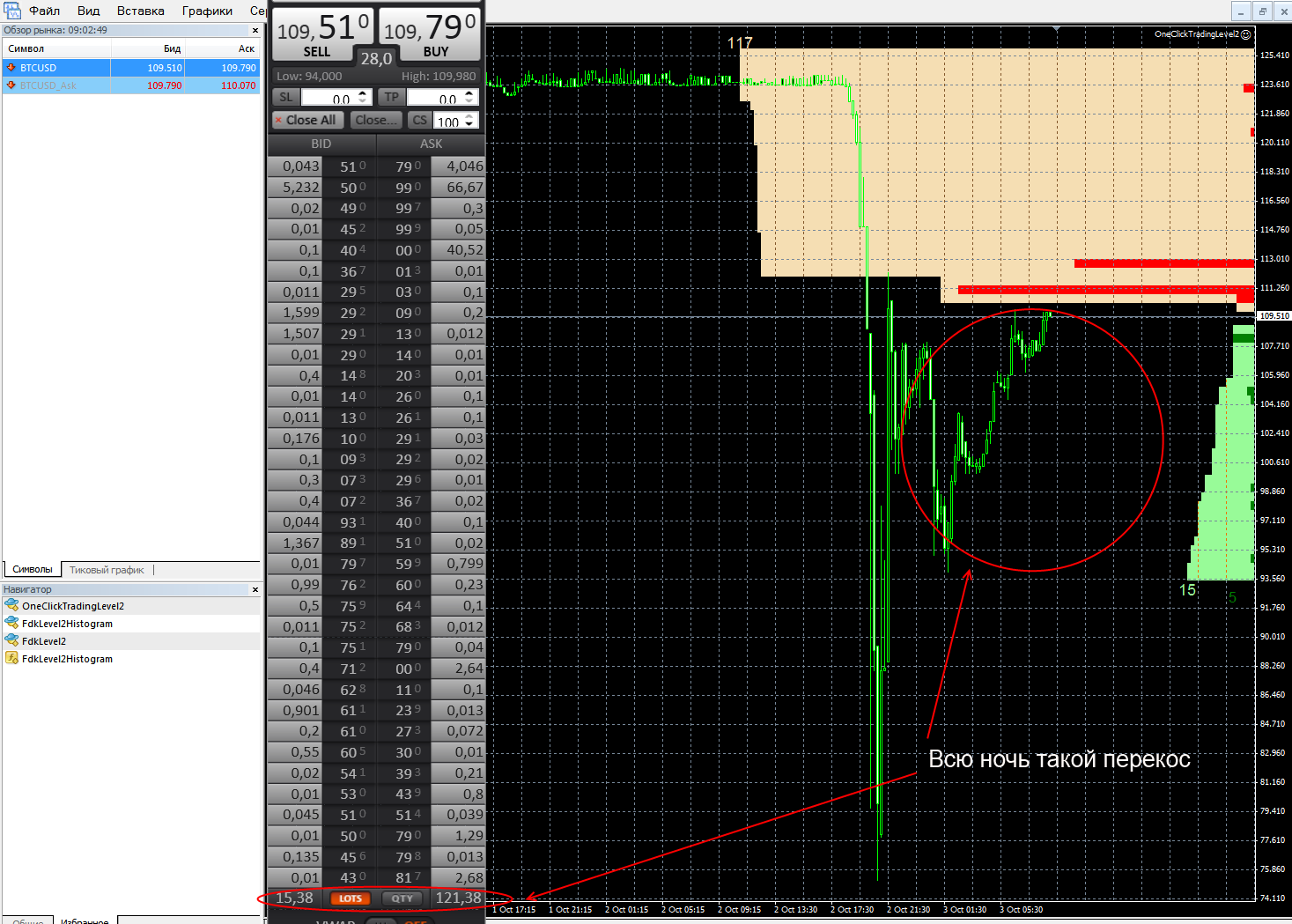

Everything is reduced to a minimum of bureaucracy. More precisely, it simply does not exist. You ANONYMOUSLY register, transfer money and trade. Everything. The very real process of trading in the laconic visualization, magnificent for the web, can be viewed here :

Monetization

Has the stock-based startup paid off? Now you can see that the daily turnover of the same BTC-E is about 200,000 BTC. That at the current rate somewhere around $ 200 million. The commission at BTC-E is one of the smallest in the industry - 0.2%. We multiply one by the other, then we double it (the commission is taken on both sides of the transaction) and we get a daily output of $ 800,000. Whoever does not understand, the $ 800,000 exchange startup is already earning per day. Turnover is changing rapidly by tens of percent, so the actual exhaust must be looked at yourself (the data on the screen and the calculations lose accuracy, respectively).

It is necessary, of course, to compare this with someone. For example, with FOREX and the Russian currency exchange on FORTS.

On FOREX, for the same ECN / STP platform, in order to achieve such indicators, you need to have at least a daily turnover of $ 20 billion. Units in the world have something similar (especially on retail). And they built their business by far more than one year. Not to mention the difference in cost.

FORTS - the reader himself can calculate and, if desired, post the data in the comments. I can only say that FORTS looks faded, especially against the background of the prospects for the development of cryptocurrency trade and the fact that it, unlike the FORTS and FOREX, does not have a holiday. Those. cryptocurrency exchanges operate without any interruptions at all: 365/7/24.

Development perspectives

They are huge. Accordingly, the competition is considerable. Almost every week there is an announcement of the next exchange startup. The most active are the Chinese. And this is explained not only by their number, but also by the understanding that they can jump out of the rigid framework of the regulation of the yuan. That only costs the transfer of large Chinese online stores for the possibility of payment in bitcoins. In general, well done.

Future of the industry

It is clear that the momentum will grow. What was, is, and for some time there will be fraudulent cryptocurrency exchanges: they pretended that there was trade, while they themselves ran away with the money of investors / speculators. But how will things really evolve?

What is now?

Almost all the exchanges are now functioning on the terribly inhibiting for the modern understanding of electronic market trading web technologies. While this narrow neck is not strongly felt. But with the increasing popularity, it will increasingly remind about itself.

New rails

Technologically trading engines will be improved. The FIX API and other more advanced trading protocols will appear. Who can count a few steps forward, is already making this transition. Since according to the laws of the genre, all current exchanges that are based on web technologies will be devoured by more technologically advanced. How this happens is described in the educational program . Briefly through the ECN / STP scheme. Those. there will be a serious centralization of the market. There will be several large trading platforms. The rest will die.

Traders

Now the miners are setting the big tone by dropping

Current Algorithmic Opportunities

Marketing

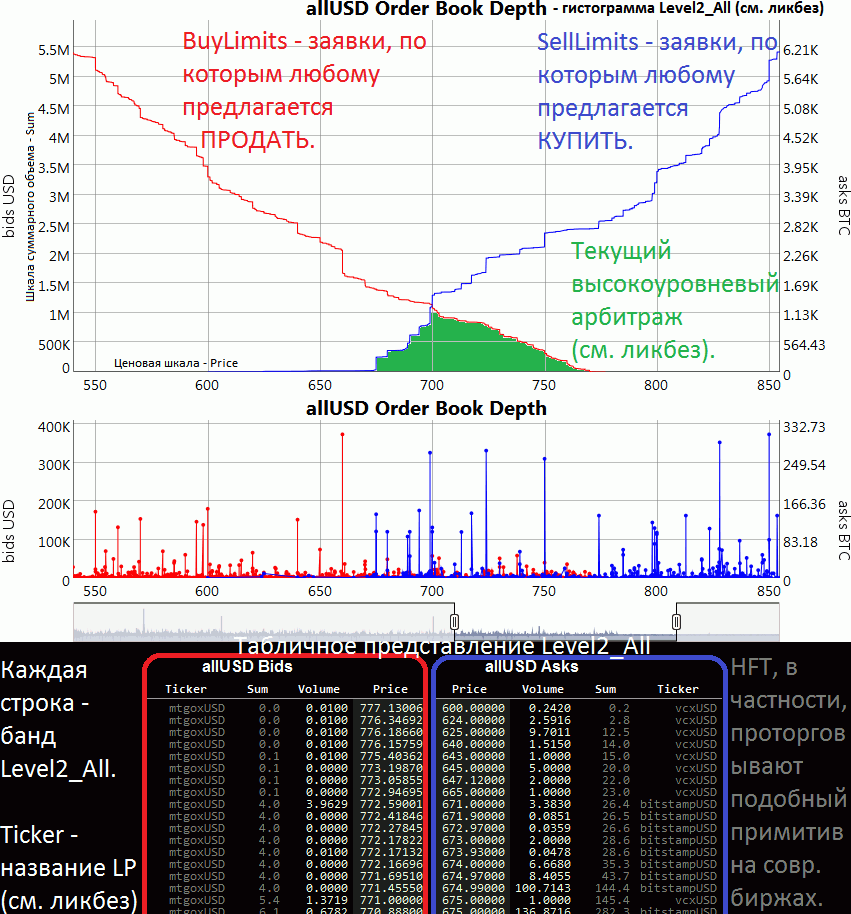

Cutting meat that has never even seen predators is simple. Yes, this is a very distant reminder of HFT technologies , since it's not about the fight for microseconds and the physical length of the wire. And about many hundreds of milliseconds (costs of web engines). But from this those. insider in this context does not cease to be. You can live. Of course, the exchange commission is too big. But farsighted stock exchanges will lower it and even make it special. offers for market makers in the form of rebates (negative commission).

Arbitration

The current status of the inter-exchange arbitrage without pitfalls can be seen here :

A lot of pitfalls. But as the industry develops, there will be less and less of them. Be sure to show themselves the new generation of ECN / STP-aggregators, creating a kind of analogues darkkpulov, where several exchanges will run as LP at once. So the life of the arbitrators will be simplified. Their ranks will be replenished. And the exchange in their prices, finally, equalize.

Market inefficiencies

Their sea. This is an emerging market, which always has similar inefficiencies. Yes, the liquidators are not very much so far in order to interest the largest algo-funds. But a million USD profit for a simple algo trader, which can explore the market in many respects even with simple classical methods, is a good add. income.

As a boltological example, one of the simplest models applied to bitcoin:

Green - BTC / USD. Red - a model built on a sample between the vertical lines. What is out of them - Out of Sample. While frighteningly close with reality (you can continue the green line on the current data). Of course, this is a coincidence.Or another boltologic exampleCrash when SilkRoad covered up:

Who is interested in exploring the nature of crashes on the market, which is almost virgin from the big manipulations, can use the Level2 history recorded during this period.

Industry satellites

Logical development and near-stock service. These are, as a rule, resources for conveniently submitting material: delivery of real-time correct exchange feeds and their storage, visualization of various stock exchange indicators, etc.

Historical significance

The uniqueness of cryptocurrency exchanges is the ability to observe the stages of formation of the exchange from the very beginning of the new real commodity-money market. Those. A substantial part of the thousand-year financial development of mankind can be not only mathematically modeled, but corrected by observing the present experience of quickly playing the same story in a short period of time.

All this allows you to test existing economic theories for consistency. Build more adequate socio-economic causal relationships. Such opportunities for the rapid scrolling of one of the important processes in the history of mankind are reduced by an order of magnitude in the latency of information delivery, compared with what it was dozens to hundreds to thousands of years ago.

At the moment, data of such a development history almost from the inception of the cryptocurrency trade is available, thanks to one of the oldest cryptobirds - MtGox:

https://data.mtgox.com/api/2/BTCUSD/money/trades/fetch?since=ID, ID - ( - ), . This is a lot of gigabytes of data on how transactions were performed on the mutual exchange of BTC <-> USD. The study of this almost Big Data layer can play a huge role in understanding us: sociology, economics, etc.

PS

It turned out messy, because written in one breath. Therefore, naturally, many moments are missed and not covered. If there is a desire - add / specify.Source: https://habr.com/ru/post/204010/

All Articles