Stock Market Tools: Trading Terminal

In previous articles we touched on a rather interesting side of the stock market, namely, algorithmic or high-frequency trading, but, of course, the most traditional way of online trading on the stock exchange is still the use of special trading terminals. We will talk about them today.

Terminal bloomberg

Many brokers provide clients with the ability to trade through web interfaces, but in today's reality, when many traders adhere to intraday trading style, and every second of trading is important for them, the web interface is significantly inferior to a specialized trading terminal, as in the general convenience of work, and in the speed of drawing graphs or updating stock data.

')

At the moment, dozens of brokers are working on the Russian stock market. These include both banks that offer their customers access to the stock exchange, and companies that deal exclusively with brokerage activities. The sizes of these companies are also very different, so not all of them can afford to develop their own software solutions for their clients.

Such brokers provide their clients with a popular trading program called QUIK. And those who can afford to develop their own software - go this way, because it provides greater flexibility and independence. Some brokers offer their customers QUIK and proprietary terminals.

QUIK terminal interface

As a result, of course, the most common terminal for trading on the Russian market is QUIK, but since our company is among those developing their own software solutions, the interface of the SmartX terminal we have created will be used to illustrate this and subsequent posts.

Consider the most important elements of the workspace in the trading terminal.

To work on the stock market, an investor needs to receive timely and accurate information on his account: the balance of funds on an account, open, closed positions, available and blocked as a guarantee security means - all this is critical for successful trading.

Account manager

Information on the current price and other parameters of the security is presented in the table of quotes, which each trader creates for himself and adds to it interesting papers for him.

Quotes table

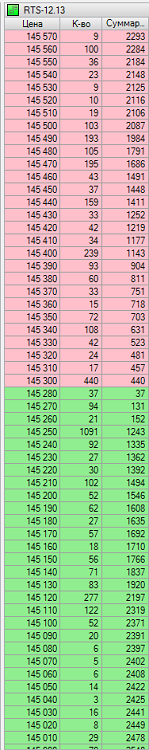

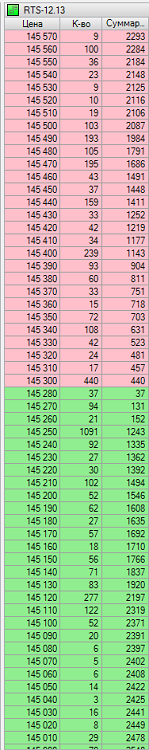

Another element necessary for trading is the stock exchange - i.e. table of applications for the purchase and sale of securities. The glass of the trading terminal is designed to assess the market supply and demand at a given point in time. Purchase orders with a specified price (limited orders) are placed in the bid queue, and limited sale orders are placed in the offer queue.

Stock glass in the terminal SmartX. Buyers 'requests (Bid) are marked green, and sellers' requests (red). An additional column shows the cumulative volume of bids.

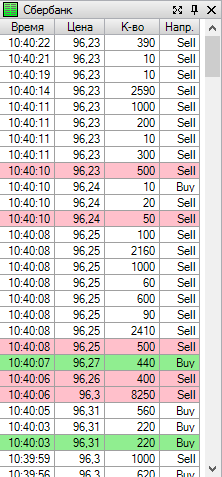

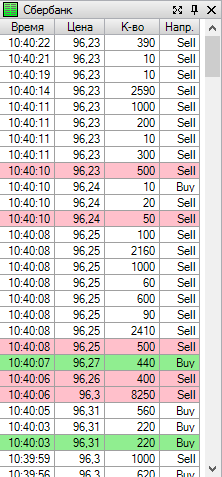

In addition to the table of quotes and stock exchange, the “All deals” window is often used. It is configured separately for each paper and structured in several columns: the time of the transaction, the price of the transaction, the volume of the transaction and its direction (Buy or Sell).

The window "All transactions. If the price after the transaction has not changed - the line is painted white, if it has grown - in green, and if it has fallen - in red.

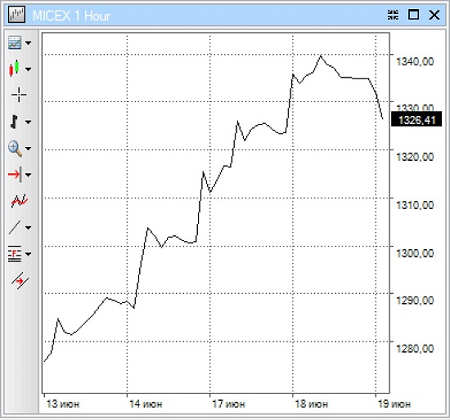

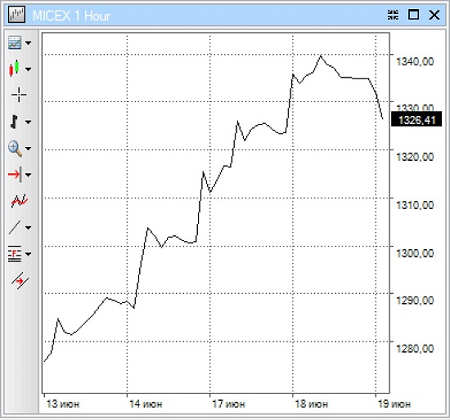

Many traders use price charts to analyze the situation on the stock market, its trends and forecasting price changes in the future (“technical analysis”). There are several types of charts.

Line graph is the simplest graph showing how paper prices have changed over time. This format is not very interesting, because it does not give a complete picture of the course of trading and, therefore, it is applied only when the sequence of all deals is displayed on the chart ( tick chart ) or to represent the price over a large time interval.

Next come two more popular types of charts - bar charts and candlesticks. Before considering them in more detail, you should understand the time discretization on the graphs. Each bar or candle represents a story for a specific interval or period of time. This story represents the four prices of this interval — the opening (Open), the maximum (High) and the minimum (Low) prices, and the end of the interval — the closing (Close). The interval itself can be almost anything - a week, a month, a quarter, or a day, an hour, half an hour, five minutes, one minute, and so on. Depending on the interval, the schedule is called “daily”, “hourly”, “weekly”, etc.

Representation of prices on charts using bars - in general, a separate bar consists of a vertical line and two “shelves” to the left and right of it. The vertical line connects the minimum and maximum prices. The shelf on the left corresponds to the opening price, on the right - the closing price. In the case when all four numbers Open, High, Low, Close are equal, the bar turns into a dash. This happens if during the time interval, which represents the bar, there was only one deal, it will also be the first and last, minimum and maximum.

Representing prices with the help of Japanese candles is a way that originated in Japan three hundred years ago. It is based on the same four price parameters and a specified time interval that are used in the bar charts. A candle is a rectangle with two dashes at the top and bottom. A white (green) candle means that the close is higher than the open. In this case, the lower boundary of the rectangle ("candlestick body") will mean the opening of the time interval, and the upper limit - closing. The dash below reflects the minimum price, and the top - the maximum. In the case of a black (red) candle, when the closing took place at prices lower than the opening prices, everything will be exactly the opposite.

The upper border of the candle body will be the opening, the lower - the closing, the dash at the top will reflect the maximum, and the lower - the minimum price.

Candlestick display is pleasing to the eye and easy to understand the current market situation. If the last candle is black (red), then the market falls, and if it is white, it grows.

Candles and bars can be formed not only by time (timeframe), but also by a fixed number of points in a candle / bar or by a given volume. We will talk more about these features and technical analysis in general in one of the following articles, but for now let's move on to the process of trading on the exchange.

Before you start trading on the stock exchange, you need to get acquainted with some terms.

First of all, trading in any organized market is based on the execution of buy / sell orders with a certain number of contracts (securities in the stock market or futures, options - derivatives market contracts). That is, in general, on the stock exchange you can not buy or sell an arbitrary amount of securities. Trade is carried out in lots, multiples of the smallest possible number, which is called a lot .

Those. a lot of securities is the smallest amount of securities that can be sold or bought during the exchange session. The lot is determined for each security in the stock specification and is usually equal to 1.10 or 100 securities. A lot of cheaper paper is larger, and expensive paper is traded in single lots. Over time, the price of paper can change significantly. Then the exchange can revise the specification and change the parameters of the lot, the size of its lot. Also, the issuing company can also split up its shares - such procedures are called split.

Another important concept is the security ticker (short name), which is assigned to any security when it starts trading on the exchange. For example, on the stock market of the Moscow Exchange, Sberbank shares have the SBER ticker, etc.

To buy, for example, stocks, the trader must notify the broker who gives him the opportunity to trade on a particular platform about his desire. This, of course, can be done with a written order, but since we are still talking about online trading, then, of course, orders are sent from the trading terminal.

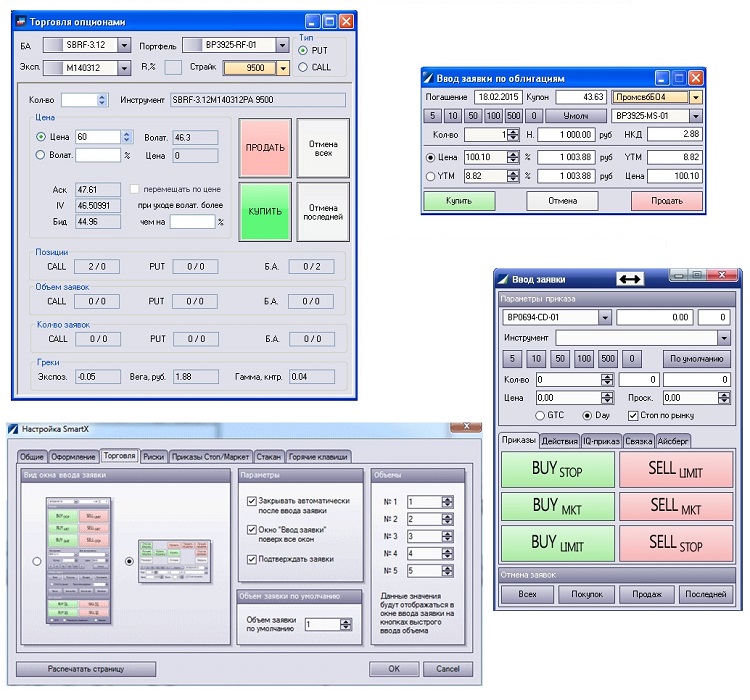

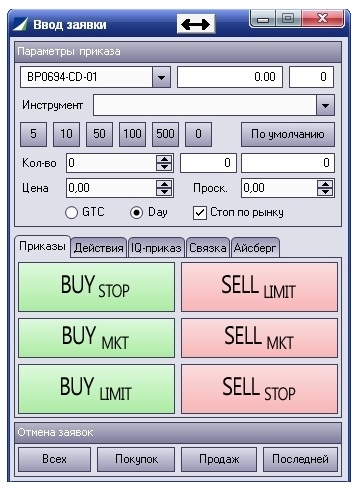

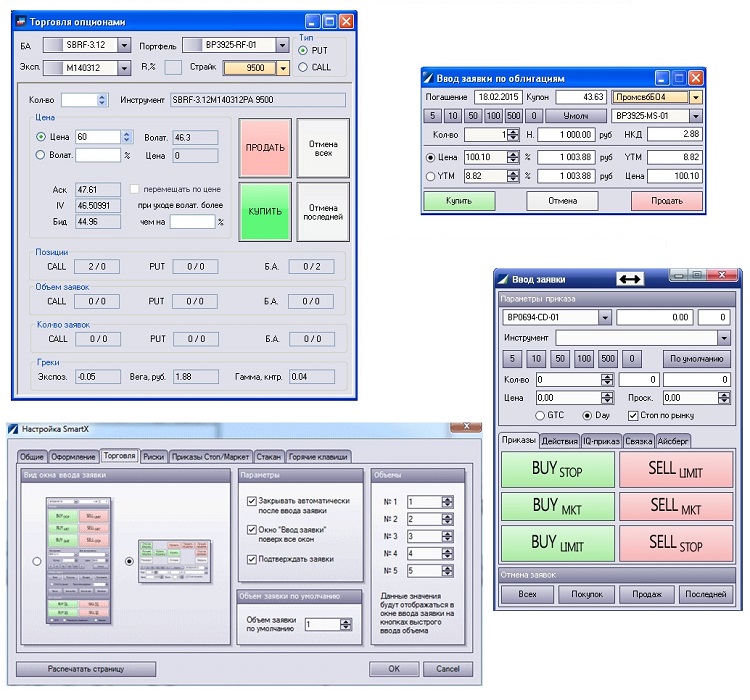

Windows for submitting different types of orders in the trading terminal

The information in the order must absolutely unambiguously determine the specific security with which the transaction must be made, the side of the transaction (purchase or sale) and the number of securities. If the information is not enough, the application will not be accepted by the broker.

In addition, all applications are divided.

As a result, the client can perform the following operations:

These are paired operations. The first pair is “buy-sell”, and the second is “sell short-buy-back”. Buying and selling without coverage - open the client's position on the selected paper, and selling and closing a short one, respectively, closes an existing position.

The short sale is used in falling markets, when the investor believes that the price of the paper will fall further. In this case, he, even if he doesn’t have this paper, takes it as a “loan” from a broker and sells it, and then buys it back when the price falls enough, and returns the paper to the broker. All these operations, of course, pass automatically, and the trader only needs to press the sell or buy button in the terminal.

Buying securities opens a long position, and selling short is a short position .

According to the validity period, orders are different for orders:

Finally, orders are classified by type of action and are divided into market, limited and conditional orders:

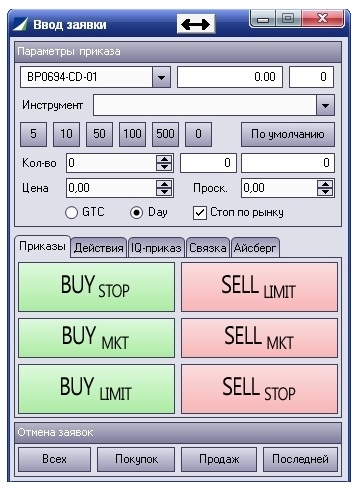

Application entry window in the SmartX terminal

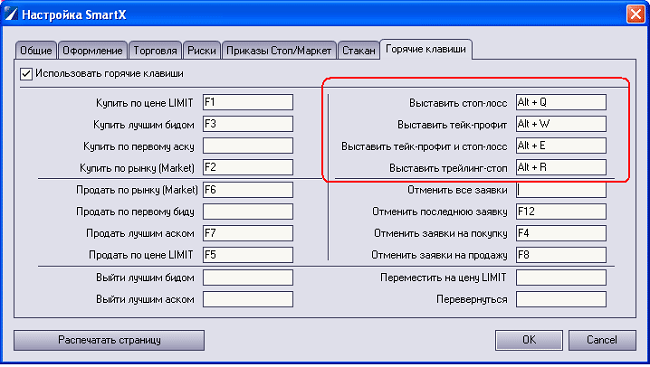

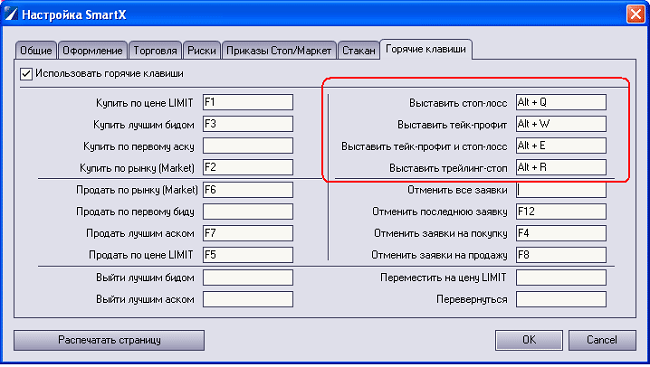

Typically, trading terminals have the ability to configure hotkeys that speed up order entry, as well as the function to confirm orders — sometimes, in order not to buy or sell by mistake what you didn’t want to buy or sell, the trader activates this feature and when sending a request for Exchange terminal requests confirmation.

Of course, this is not all types of orders, there are also conditional exchange orders (iq-orders), but we'll talk about them in one of the following articles.

Algorithmic trading is one of the main trends of the stock market in recent years. Therefore, it is not surprising that it is also reflected in trading terminals, which, it would seem, do not know any special points of contact with the exchange robots.

The developers of many trading terminals include automation capabilities of varying degrees of complexity. For example, in our SmartX terminal, TradeScript programming language with a lot of built-in functions is implemented, thanks to which you can create mechanical trading systems right in the terminal. Of course, this will not be a super-powerful trading robot, but it is quite possible to automate some tasks like opening a position upon reaching certain parameters.

In addition to writing scripts, they can be tested on historical data using the back-testing function. To test the script in real time, you can also use a special test circuit , where, instead of real trading, trading at prices close to reality, but with virtual money, is used.

We will discuss the creation of mechanical trading systems in more detail in one of the following posts.

That's all for today! Thank you all for your attention, we will be happy to answer questions in the comments.

PS The II All-Russian Conference on Algorithmic Trading will take place very soon. If you are interested in this topic - then here's an event on Habré , come, it will be interesting.

Terminal bloomberg

Many brokers provide clients with the ability to trade through web interfaces, but in today's reality, when many traders adhere to intraday trading style, and every second of trading is important for them, the web interface is significantly inferior to a specialized trading terminal, as in the general convenience of work, and in the speed of drawing graphs or updating stock data.

')

Trading terminals

At the moment, dozens of brokers are working on the Russian stock market. These include both banks that offer their customers access to the stock exchange, and companies that deal exclusively with brokerage activities. The sizes of these companies are also very different, so not all of them can afford to develop their own software solutions for their clients.

Such brokers provide their clients with a popular trading program called QUIK. And those who can afford to develop their own software - go this way, because it provides greater flexibility and independence. Some brokers offer their customers QUIK and proprietary terminals.

QUIK terminal interface

As a result, of course, the most common terminal for trading on the Russian market is QUIK, but since our company is among those developing their own software solutions, the interface of the SmartX terminal we have created will be used to illustrate this and subsequent posts.

Consider the most important elements of the workspace in the trading terminal.

Information about the auction and account

To work on the stock market, an investor needs to receive timely and accurate information on his account: the balance of funds on an account, open, closed positions, available and blocked as a guarantee security means - all this is critical for successful trading.

Account manager

Information on the current price and other parameters of the security is presented in the table of quotes, which each trader creates for himself and adds to it interesting papers for him.

Quotes table

Another element necessary for trading is the stock exchange - i.e. table of applications for the purchase and sale of securities. The glass of the trading terminal is designed to assess the market supply and demand at a given point in time. Purchase orders with a specified price (limited orders) are placed in the bid queue, and limited sale orders are placed in the offer queue.

Stock glass in the terminal SmartX. Buyers 'requests (Bid) are marked green, and sellers' requests (red). An additional column shows the cumulative volume of bids.

In addition to the table of quotes and stock exchange, the “All deals” window is often used. It is configured separately for each paper and structured in several columns: the time of the transaction, the price of the transaction, the volume of the transaction and its direction (Buy or Sell).

The window "All transactions. If the price after the transaction has not changed - the line is painted white, if it has grown - in green, and if it has fallen - in red.

Many traders use price charts to analyze the situation on the stock market, its trends and forecasting price changes in the future (“technical analysis”). There are several types of charts.

Line graph is the simplest graph showing how paper prices have changed over time. This format is not very interesting, because it does not give a complete picture of the course of trading and, therefore, it is applied only when the sequence of all deals is displayed on the chart ( tick chart ) or to represent the price over a large time interval.

Next come two more popular types of charts - bar charts and candlesticks. Before considering them in more detail, you should understand the time discretization on the graphs. Each bar or candle represents a story for a specific interval or period of time. This story represents the four prices of this interval — the opening (Open), the maximum (High) and the minimum (Low) prices, and the end of the interval — the closing (Close). The interval itself can be almost anything - a week, a month, a quarter, or a day, an hour, half an hour, five minutes, one minute, and so on. Depending on the interval, the schedule is called “daily”, “hourly”, “weekly”, etc.

Representation of prices on charts using bars - in general, a separate bar consists of a vertical line and two “shelves” to the left and right of it. The vertical line connects the minimum and maximum prices. The shelf on the left corresponds to the opening price, on the right - the closing price. In the case when all four numbers Open, High, Low, Close are equal, the bar turns into a dash. This happens if during the time interval, which represents the bar, there was only one deal, it will also be the first and last, minimum and maximum.

Representing prices with the help of Japanese candles is a way that originated in Japan three hundred years ago. It is based on the same four price parameters and a specified time interval that are used in the bar charts. A candle is a rectangle with two dashes at the top and bottom. A white (green) candle means that the close is higher than the open. In this case, the lower boundary of the rectangle ("candlestick body") will mean the opening of the time interval, and the upper limit - closing. The dash below reflects the minimum price, and the top - the maximum. In the case of a black (red) candle, when the closing took place at prices lower than the opening prices, everything will be exactly the opposite.

The upper border of the candle body will be the opening, the lower - the closing, the dash at the top will reflect the maximum, and the lower - the minimum price.

Candlestick display is pleasing to the eye and easy to understand the current market situation. If the last candle is black (red), then the market falls, and if it is white, it grows.

Candles and bars can be formed not only by time (timeframe), but also by a fixed number of points in a candle / bar or by a given volume. We will talk more about these features and technical analysis in general in one of the following articles, but for now let's move on to the process of trading on the exchange.

Trading operations

Before you start trading on the stock exchange, you need to get acquainted with some terms.

First of all, trading in any organized market is based on the execution of buy / sell orders with a certain number of contracts (securities in the stock market or futures, options - derivatives market contracts). That is, in general, on the stock exchange you can not buy or sell an arbitrary amount of securities. Trade is carried out in lots, multiples of the smallest possible number, which is called a lot .

Those. a lot of securities is the smallest amount of securities that can be sold or bought during the exchange session. The lot is determined for each security in the stock specification and is usually equal to 1.10 or 100 securities. A lot of cheaper paper is larger, and expensive paper is traded in single lots. Over time, the price of paper can change significantly. Then the exchange can revise the specification and change the parameters of the lot, the size of its lot. Also, the issuing company can also split up its shares - such procedures are called split.

Another important concept is the security ticker (short name), which is assigned to any security when it starts trading on the exchange. For example, on the stock market of the Moscow Exchange, Sberbank shares have the SBER ticker, etc.

Trading Orders

To buy, for example, stocks, the trader must notify the broker who gives him the opportunity to trade on a particular platform about his desire. This, of course, can be done with a written order, but since we are still talking about online trading, then, of course, orders are sent from the trading terminal.

Windows for submitting different types of orders in the trading terminal

The information in the order must absolutely unambiguously determine the specific security with which the transaction must be made, the side of the transaction (purchase or sale) and the number of securities. If the information is not enough, the application will not be accepted by the broker.

In addition, all applications are divided.

- By type of action: on the market, limited and conditional;

- By validity: 1 day (DAY) or until cancellation (GTC, Good Till Cancel);

- By type of operation: buying, selling, selling without covering and buying short sale.

As a result, the client can perform the following operations:

- Buy (Buy);

- Sell (Sell):

- Sell short or sell short (Sell Short / Open Short);

- Close short or buy back (CloseShort / BuyBack).

These are paired operations. The first pair is “buy-sell”, and the second is “sell short-buy-back”. Buying and selling without coverage - open the client's position on the selected paper, and selling and closing a short one, respectively, closes an existing position.

The short sale is used in falling markets, when the investor believes that the price of the paper will fall further. In this case, he, even if he doesn’t have this paper, takes it as a “loan” from a broker and sells it, and then buys it back when the price falls enough, and returns the paper to the broker. All these operations, of course, pass automatically, and the trader only needs to press the sell or buy button in the terminal.

Buying securities opens a long position, and selling short is a short position .

According to the validity period, orders are different for orders:

- Immediate execution , when the transaction must be completed immediately, if market conditions allow it, and cancel it or the balance, if there are no such conditions at the time the order enters the market (FOK, Fill Or Kill).

- With a validity day (Day, D). Such orders are valid during the current trading session. If the order is not executed for some reason during this session, then at the next session it will not be placed and canceled.

- Valid until execution or until cancellation by the investor (GTC) . GTC (Good Till Cancel) orders, unlike day sessions, are transferred to subsequent sessions and are active until they are fulfilled upon reaching the terms of the deal or until the investor cancels them himself.

Finally, orders are classified by type of action and are divided into market, limited and conditional orders:

- A market order (market order, market order, MKT) requires execution under current market conditions. Those. it sounds like “ buy / sell MMN lots of paper by market ”. This means that the transaction will take place at the current price of the paper or higher, if the number of securities in the order exceeds the first offer in the stock exchange. In this case, the broker will execute the transaction with the first offer, then with the second, third, etc. As a result, the price can get quite far from the current market quotes.

- The limited order (LimitOrder, LMT) is distinguished by the market presence of two additional attributes - the price of execution and the time of action. In addition to the security, the amount and side of the transaction? The client must specify a price, not worse than which this order should be executed ( Buy / sellNN lots of MMM paper at a price of 1000. Validity: day ). To buy or sell at a price of 1000 does not mean at all that the paper should be and will be bought for just 1000, it only means that the price will be no worse than 1000.

- Stop and stop limit orders (STOP, STOP-LIMIT) . These orders are most often used to close positions and protect your account from large losses. The stop order means that the order must be placed on the market if and only if the price reaches a predetermined value. The stop limit order is different in that when it is triggered, it is not a market order that is placed on the stock exchange, but a limited one.

Application entry window in the SmartX terminal

Typically, trading terminals have the ability to configure hotkeys that speed up order entry, as well as the function to confirm orders — sometimes, in order not to buy or sell by mistake what you didn’t want to buy or sell, the trader activates this feature and when sending a request for Exchange terminal requests confirmation.

Of course, this is not all types of orders, there are also conditional exchange orders (iq-orders), but we'll talk about them in one of the following articles.

Trade automation

Algorithmic trading is one of the main trends of the stock market in recent years. Therefore, it is not surprising that it is also reflected in trading terminals, which, it would seem, do not know any special points of contact with the exchange robots.

The developers of many trading terminals include automation capabilities of varying degrees of complexity. For example, in our SmartX terminal, TradeScript programming language with a lot of built-in functions is implemented, thanks to which you can create mechanical trading systems right in the terminal. Of course, this will not be a super-powerful trading robot, but it is quite possible to automate some tasks like opening a position upon reaching certain parameters.

In addition to writing scripts, they can be tested on historical data using the back-testing function. To test the script in real time, you can also use a special test circuit , where, instead of real trading, trading at prices close to reality, but with virtual money, is used.

We will discuss the creation of mechanical trading systems in more detail in one of the following posts.

That's all for today! Thank you all for your attention, we will be happy to answer questions in the comments.

PS The II All-Russian Conference on Algorithmic Trading will take place very soon. If you are interested in this topic - then here's an event on Habré , come, it will be interesting.

Source: https://habr.com/ru/post/203668/

All Articles