Bitcoin - an explanation for exponential growth

Disclaimer

I do not know why you can not publish translations of interesting articles, but I will try. The topic is very relevant and I think many will be interested here. Therefore, I hope that it will be moderated.

Also this publication is the answer to the question raised in a recent article “Bitcoin. What's next?"

So let's go ...

Introduction

Today I saw one interesting Bitcoin analysis, which I hasten to share with the community. Translation done by himself, not copy-paste. Sorry for the inaccuracies.

Source: bitcoinowl.com/exponential-growth-bitcoin-value-explained

Original author: Ivan Raszl

Original date: November 22, 2013 - 23:15

So why is it growing?

The price of Bitcoin is growing exponentially, and this will continue until 1BTC costs from $ 20,000 to $ 100,000. And this is why ...

')

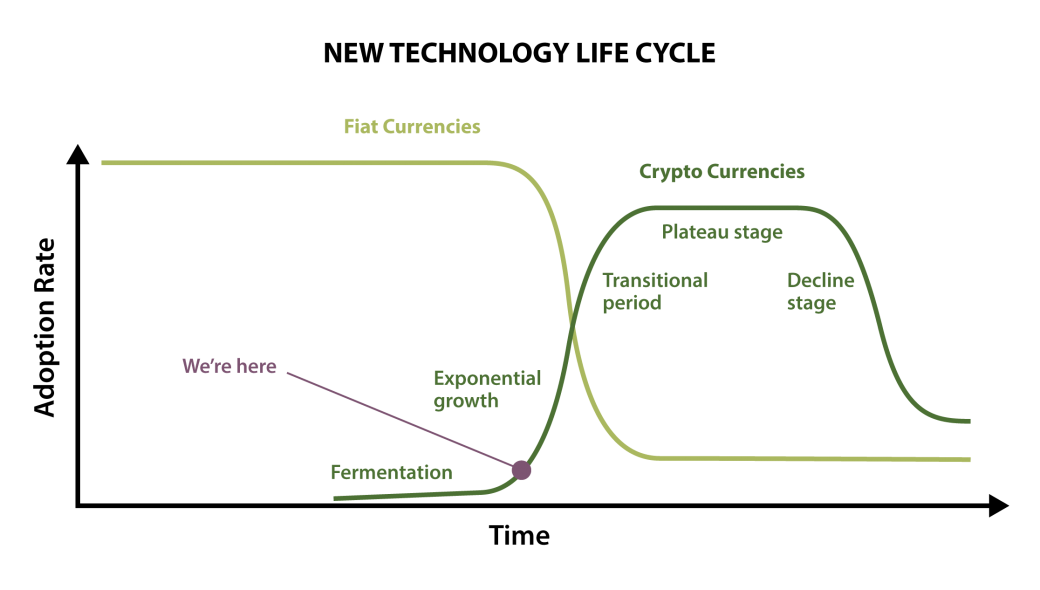

Today, many are skeptical about the growth rate of Bitcoin, thinking that this is a typical investment bubble, but I think we should not consider Bitcoin as another type of securities. Rather, it can be compared with Email, sites, MP3 or e-books. This is a technological innovation that will soon be able to replace the technology of the past ( “fiat money” - approx. Lane ). You can distinguish between 5 stages of its development:

- Fermentation : This is the stage when a new technology is known only in very narrow circles of specialists. At this stage, the technology is being tested, and if it survives, it can proceed to the next stage. These were the first 2 years of Bitcoin’s life, starting with the publication of the article in 2008 by Satoshi Nakamoto, the creator of this currency.

- Exponential growth : The more people begin to apply new technology, the more benefits it brings to all participants. This effect accelerates its development and recognition in society. As for cryptocurrency, now we are at the beginning of this stage. The advantages of cryptocurrency become apparent the faster, the more people begin to create their own wallets and more sellers begin to accept crypto-money for payment.

- Transitional stage : This is the stage when a new technology reaches a critical mass, and the number of newly affiliated participants is decreasing every day.

- Plateau : When the new technology has already absorbed most of the population and the rate of spread has stabilized. This can be any number of people - from 1% to 99% of the population, depending on how successful and innovative this technology is. Cryptocurrencies are likely to coexist along with fiat money for a long time. It is also likely that the speed of adoption will be quite high, comparable to the introduction of e-mail and e-books.

- Decline : All technologies eventually become obsolete. It is strange to talk about this, but cryptocurrencies at a certain point, in the not-so-distant future, will become obsolete and will be replaced by something new, something that can offer greater comfort and security than the current level of cryptography offers.

Today we can observe at what pace changes occur in all areas of public life, thanks to information technology. Cryptocurrencies are the next development step for money, and they spread exponentially, just like Email a few decades ago and e-books a few years ago.

Mail ➞ Email

Printed newspapers and magazines ➞ News sites and blogs

Vinyl and CD ➞ AAC and MP3

Books ➞ Electronic Books

Fiat Money ➞ Cryptocurrencies

None of these technologies has completely replaced the previous one. We still receive paper mail, but most communications are now e-mailed. On average, a person receives at least 100 times more emails than regular mail. We still print newspapers, but most people read at least 20 times more news articles on the Internet. We can still buy CDs, but over 90% of all music is currently sold online. We are still printing books, but Amazon now sells more e-books than paper ones.

The same will happen with cryptocurrencies. Many people will still have fiat money bank accounts, but most will start using their own cryptocurrency wallets because they don’t want to pay bank fees and costs, but they want to enjoy the security and speed of cryptocurrencies.

The growth rate of the adoption of cryptocurrency by society does not necessarily mean an increase in value, but Bitcoin is limited in quantity ( maximum - 21 million coins - approx. Lane ). If people want to transfer most of their savings into cryptocurrencies, there are two ways of developing events:

- The price of Bitcoin will rise, following the exponentially increasing number of investments in it. This is happening now.

- Even more other cryptocurrencies will be created and put into circulation in order to expand the range of virtual money. This also happens, and it will slow down the growth of Bitcoin to some extent. For example, Litecoins are much easier to mine, they will be four times more than Bitcoins ( 84 million coins - approx. Per ), they have four times faster transaction confirmation ( ~ 2.5 minutes versus ~ 10) minutes in Bitcoin-lane. ). Litecoins are already trading at around $ 10 per coin. There have been too many different other cryptocurrencies lately, but obviously few of them will succeed and will be accepted.

Already, the network has about 10 million active wallets that belong to approximately 7 million users. It can be estimated that at least 15% of the world's population will use cryptocurrencies in the future, which is reasonable, because already 22% of people own smartphones. This means that at least 1 billion people will ultimately use cryptocurrencies.

If we imagine that there will be 5 cryptographically reliable currencies (and this is currently only Bitcoin and Litecoin) competing for the same amount of money available to people, we are still left with a 20-fold increase in the value of Bitcoin before the course is stabilized from sharp fluctuations. But if the pace of implementation of competing currencies can not greatly affect the growth of Bitcoin, its price may increase by more than 100 times over the next two years.

From translator

Thanks for attention.

Source: https://habr.com/ru/post/203530/

All Articles