Bitcoin What's next?

The recent ups and downs of the bitcoin course have forced many people to wonder what this cryptocurrency is. Today I decided to briefly systematize my knowledge about it, as well as to present my own vision of the present and future of these virtual coins.

First of all, it is necessary once again to parry statements like “And how is this bitcoin provided?”. Currency is not the most accurate name for bitcoin, and here's why. Normal currency

To obtain them requires labor and time. Reserves are limited, and over time, mining becomes more difficult. To maintain the level of production, optimization / improvement of its technology is carried out, i.e. make great efforts to maintain the previous level of production. In the case of Bitcoin, all this is written in the open source and algorithms for the existence of currency, and we know how much they exist in circulation, what forces must be applied in order to get them, and, accordingly, how much we will get them. It is also possible to forecast an increase in complexity, but more on that later in the analysis of one of the graphs.

When will bitcoin collapse?

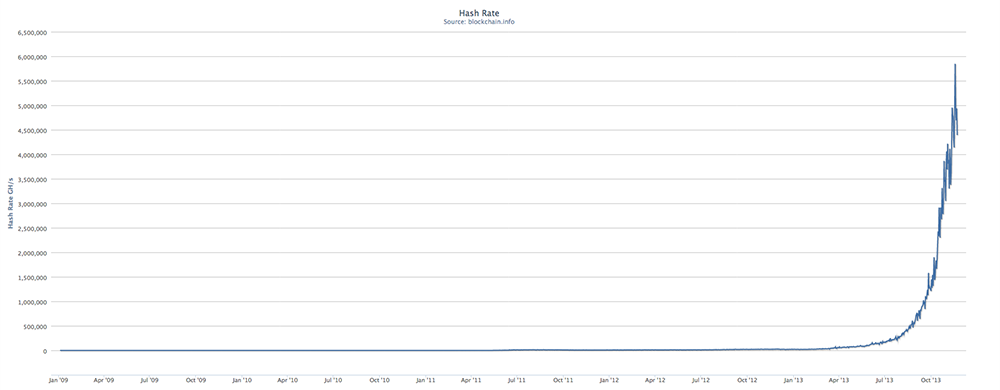

In one of the opinions, I read that crashing a bitcoin course can increase the complexity of mining, which in turn will lead to the unprofitability of generating new coins (creating new blocks) and a general loss of interest in the currency. Here it is necessary to study the cause. As we know, the complexity of mining rises automatically. To create a block (a specific number of bitcoins) it is necessary to perform complex calculations. The computing power is created by miners who want to get bitcoin. On the graph, we see that the growth of computing power is especially noticeable in recent times.

In order for bitcoin mining to take place evenly, every 2016 blocks (2 weeks) there is a change in the complexity of their mining. Next we see a graph of the growth of complexity, which turns out to be absolutely directly proportional to the past.

')

Here is the Bitcoin course chart:

Jumps that do not correspond to the past two charts (including the recent rise to 900 USD / BTC) are stock bubbles that are food for traders. Alas, I am not a trader.

What is mine?

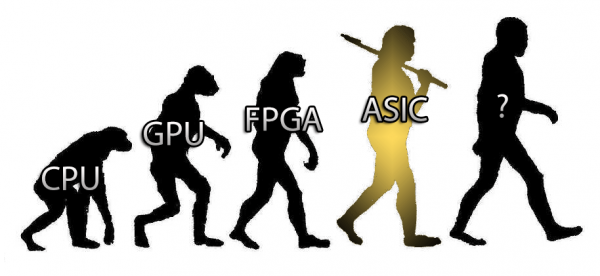

If the same devices were used for mining bitcoins for the entire time, that is, people would take quantity, not quality, the profitability of using these computing devices would sooner or later be gone. So, in fact, it happened with processors, video cards, and then FPGA (which were as powerful as video cards, but had less power consumption). Now at the peak of popularity ASIC'i with their inconceivable computing power. For those who think that this is really the last thing they’ll think up now , I have bad news .

We see and understand that whatever the computing power, the bitcoin production rate always remains at the same level. Now it is worth explaining why the computing power will only increase in the future.

Last Senate hearings, Bernanke’s positive feedback on bitcoin, an increase in the number of online and offline stores that host BTC, have a positive effect on the reputation of the currency. All this contributes not only to an increase in demand (after which all the same there is a partial correction), but also to an increase in new miners. Pula, as well as the possibility of buying virtual gigayshs, attract many people who want to do mining.

The capacity increase schedule can be compared with a black hole, no matter how scary it sounds. The greater the mass of a black hole, the greater the force of attraction it has, the more mass it attracts per unit of time, the greater its own mass becomes, the greater becomes the force of its attraction, the greater force ...

Well, or with a snowball.

I will not be the first to say that Bitcoin is by nature a diffusion currency. I agree with those who believe that at the moment, due to sharp jumps in the exchange rate, it is difficult for them to use as a monetary unit, but it continues to have an excellent investment potential. By the way, ask the owners of shops accepting Bitcoin - do they immediately withdraw currency at the appropriate rate or hoard?

The future of bitcoin.

How to maintain interest in supporting the system (mining) at such a low, as it seems to us now, level of income and a high level of complexity? What will happen when the number of bitcoins in the spawn begins to strive for their maximum number?

Yes, all the same. Imagine that the rate will rise in the same way as now, according to the level of complexity of mining. Despite a significant decrease in the reward for the found block, the block owner will receive a commission for transfers included in its block. With the increasing popularity of Bitcoin and the need to conduct faster transactions, the total amounts of commission payments to the wallets of people who have acquired the blocks will increase. Definitely, it is already becoming one of the important motivators for mining.

Bitcoin still has a lot of untapped opportunities, such as the ability to translate with the consent of several people, linking a public key to a real subject and many other unique features that will turn the world around.

Welcome to the comments.

Source: https://habr.com/ru/post/203182/

All Articles