Automation of accounting in the online store

Today, the life of a huge number of people is connected with the Internet: for someone it is a means of communication, for someone it is necessary for study or work, and for many it is a good way to make money. And here, first of all, the main question arises: the legalization of business and, as a consequence, the choice of tax regime.

Most often, online trading activities begin with the registration of the status of an individual entrepreneur (IP), since the process of obtaining this status is much simpler than registering a legal entity.

To conduct trading activities via the Internet, in accordance with Russian legislation, either the general regime or the simplified taxation system (STS) is applied. More often than not, individual entrepreneurs chose the simplified taxation system, which has indisputable advantages for small businesses over the ESS. According to the Federal Law No. 402- dated December 6, 2011 “On Accounting”, since January 1, 2013, the individual entrepreneur is also not assigned the sole responsibility for accounting (with all the ensuing consequences), leaving the choice to the conscience of the entrepreneur.

')

This means that minimally, in carrying out their activities, an entrepreneur acting independently (without hired employees) is obliged to keep records of income and expenses (KUDIR), pay fixed taxes and fees (to social funds, single tax). Thus, the average small business on the Internet site has the status of individual entrepreneurs and uses the simplified system.

The absence of requirements in accounting does not exempt the individual entrepreneur from drawing up primary documents, as well as from accounting for the movements of goods and funds accompanying online trading. Here the question arises in the automation of activities. What to choose: a finished program, of which the market is not small, or use spreadsheets?

As soon as we say "spreadsheets" - the first thing that comes to mind, of course, is Microsoft Excel. MS Excel is an excellent program, a powerful tool in capable hands, but how comfortable is it to organize accounting?

Here is the minimum required IP report set:

And, at the same time, there should be forms of primary documents for operational preparation and transfer to the buyer, as well as some set of reporting forms, for example, an act of reconciliation of settlements with counterparties.

In order to create everything you need in Excel, an entrepreneur must be well prepared and have enough time to implement automation processes.

If we consider the programs from 1C as an example (this is not advertising, objectively - 1C actually monopolized the Russian market of accounting systems) - the IE gets a full set of functionality, in addition to covering its need for accounting. If you do not take into account the cost of ownership of software products, then on the one hand there is Excel, which requires a creative approach from the entrepreneur, on the other - a boxed product, ready to work from the moment it is installed.

In our opinion, keeping records in Excel can be justified if the number of business transactions does not exceed 50 per month, and commodity items are not more than 100. Otherwise, our choice is a ready-made accounting system.

Every entrepreneur trading through an online store is faced with the need to exchange data between the accounting system and the online store. There are many options to “cross over” an accounting system with an online store: you can develop it yourself, order the development to external specialists, but it is better to choose a CMS system that has ready, regular exchange mechanisms .

Thus, the PHPShop online store engine has regular options for importing / exporting item positions, characteristics and images of goods, and updating warehouse status. For example, if you keep records in Excel, or you need to update data from supplier files, PHPShop has a special utility that will update prices and product descriptions in the online store, upload images.

You can import from virtually any data file, thanks to flexible settings, and sharing via ftp using the exchange schedule fully automates the process of updating data in the online store.

The PHPShop Enterprise Pro 1C version store script supports the exchange of information about products and issued orders with typical 1C solutions . This module has extensive capabilities for integrating data from an online store and 1C database.

If the exchange is configured automatically, then you can forget about the existence of this mechanism. Actually, the setting is performed in several steps:

Sharing with the site is a simple and convenient tool for any user who does not have knowledge of IT technologies. The initial setting is the most crucial stage on which the correctness of the exchange depends. Therefore, you can configure the exchange settings using the built-in Assistant, which will guide you through the configuration procedure, providing you with tips.

PHPShop does not require programming knowledge or help from an external specialist . The main thing is your idea of what data should be uploaded, and in accordance with this view, set up the exchange mechanism. All further exchange operations will occur as configured.

Most often, online trading activities begin with the registration of the status of an individual entrepreneur (IP), since the process of obtaining this status is much simpler than registering a legal entity.

To conduct trading activities via the Internet, in accordance with Russian legislation, either the general regime or the simplified taxation system (STS) is applied. More often than not, individual entrepreneurs chose the simplified taxation system, which has indisputable advantages for small businesses over the ESS. According to the Federal Law No. 402- dated December 6, 2011 “On Accounting”, since January 1, 2013, the individual entrepreneur is also not assigned the sole responsibility for accounting (with all the ensuing consequences), leaving the choice to the conscience of the entrepreneur.

')

This means that minimally, in carrying out their activities, an entrepreneur acting independently (without hired employees) is obliged to keep records of income and expenses (KUDIR), pay fixed taxes and fees (to social funds, single tax). Thus, the average small business on the Internet site has the status of individual entrepreneurs and uses the simplified system.

How to automate online store accounting?

The absence of requirements in accounting does not exempt the individual entrepreneur from drawing up primary documents, as well as from accounting for the movements of goods and funds accompanying online trading. Here the question arises in the automation of activities. What to choose: a finished program, of which the market is not small, or use spreadsheets?

As soon as we say "spreadsheets" - the first thing that comes to mind, of course, is Microsoft Excel. MS Excel is an excellent program, a powerful tool in capable hands, but how comfortable is it to organize accounting?

Here is the minimum required IP report set:

- movements on the current account in the context of buyers and suppliers

- movement on the cashier in the context of buyers

- accounting of movements of the nomenclature, for each position, in the context of suppliers / buyers

- book keeping of income and expenses

- formation of the amount of taxes on the USN

And, at the same time, there should be forms of primary documents for operational preparation and transfer to the buyer, as well as some set of reporting forms, for example, an act of reconciliation of settlements with counterparties.

In order to create everything you need in Excel, an entrepreneur must be well prepared and have enough time to implement automation processes.

Another way to keep records is to purchase the finished product or use rented (cloud) services.

If we consider the programs from 1C as an example (this is not advertising, objectively - 1C actually monopolized the Russian market of accounting systems) - the IE gets a full set of functionality, in addition to covering its need for accounting. If you do not take into account the cost of ownership of software products, then on the one hand there is Excel, which requires a creative approach from the entrepreneur, on the other - a boxed product, ready to work from the moment it is installed.

In our opinion, keeping records in Excel can be justified if the number of business transactions does not exceed 50 per month, and commodity items are not more than 100. Otherwise, our choice is a ready-made accounting system.

How to exchange data with an online store?

Every entrepreneur trading through an online store is faced with the need to exchange data between the accounting system and the online store. There are many options to “cross over” an accounting system with an online store: you can develop it yourself, order the development to external specialists, but it is better to choose a CMS system that has ready, regular exchange mechanisms .

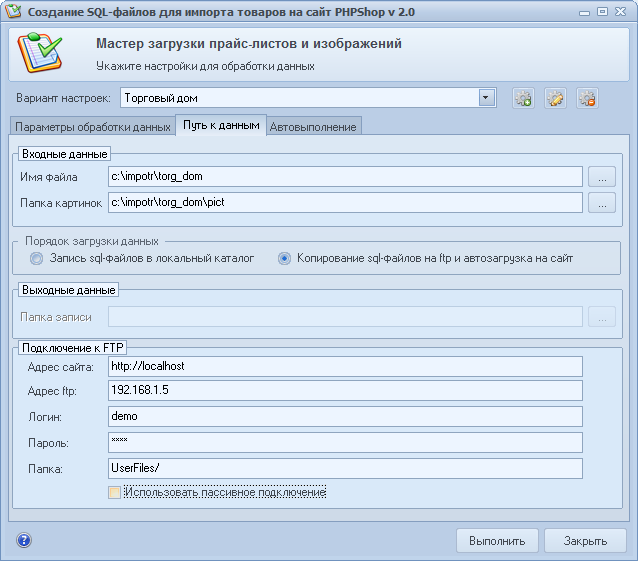

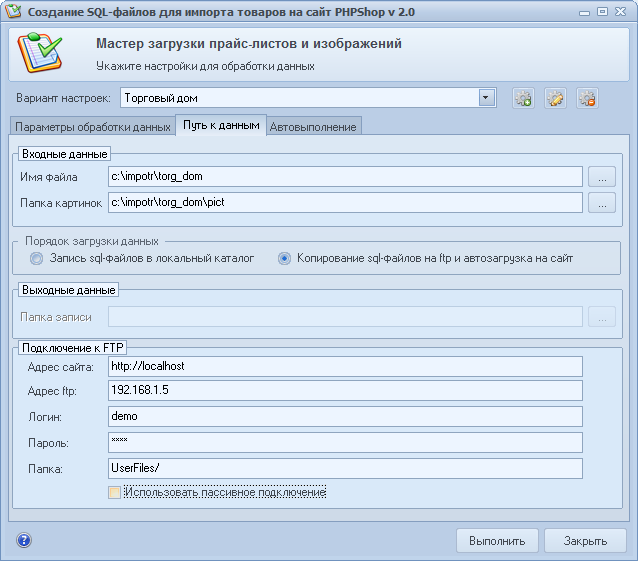

Thus, the PHPShop online store engine has regular options for importing / exporting item positions, characteristics and images of goods, and updating warehouse status. For example, if you keep records in Excel, or you need to update data from supplier files, PHPShop has a special utility that will update prices and product descriptions in the online store, upload images.

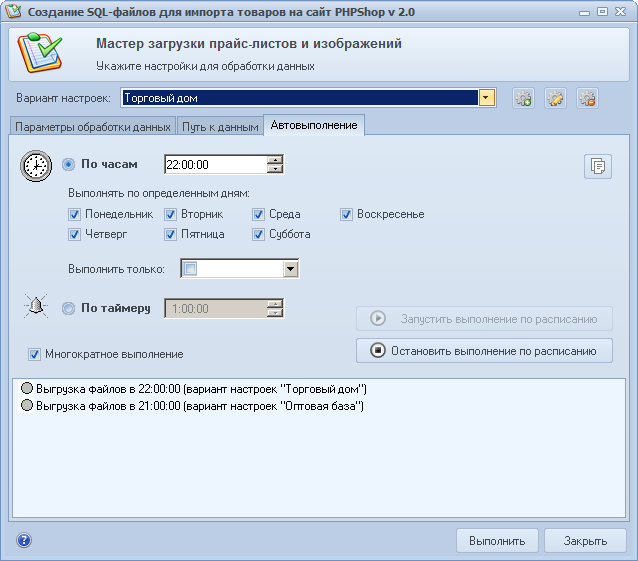

You can import from virtually any data file, thanks to flexible settings, and sharing via ftp using the exchange schedule fully automates the process of updating data in the online store.

The PHPShop Enterprise Pro 1C version store script supports the exchange of information about products and issued orders with typical 1C solutions . This module has extensive capabilities for integrating data from an online store and 1C database.

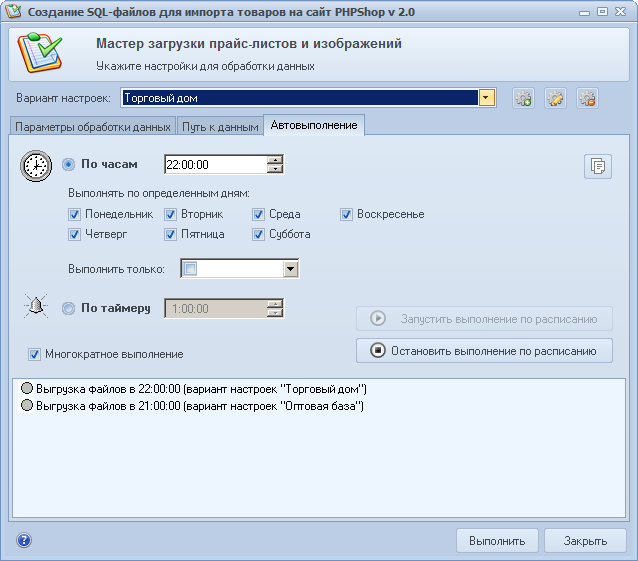

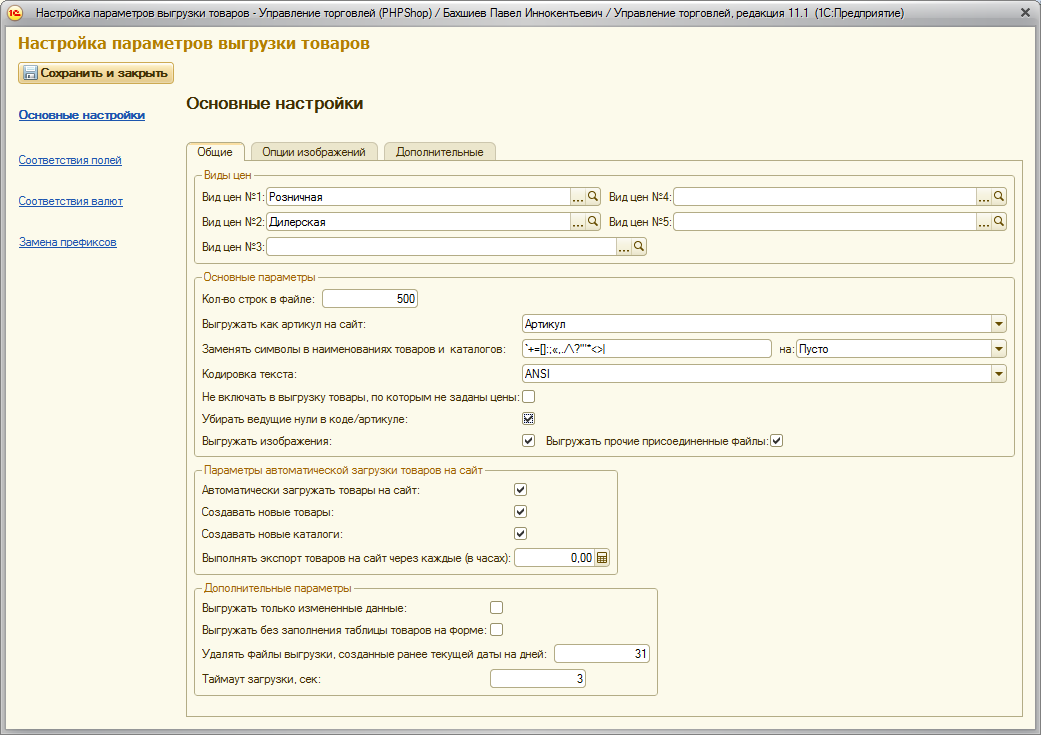

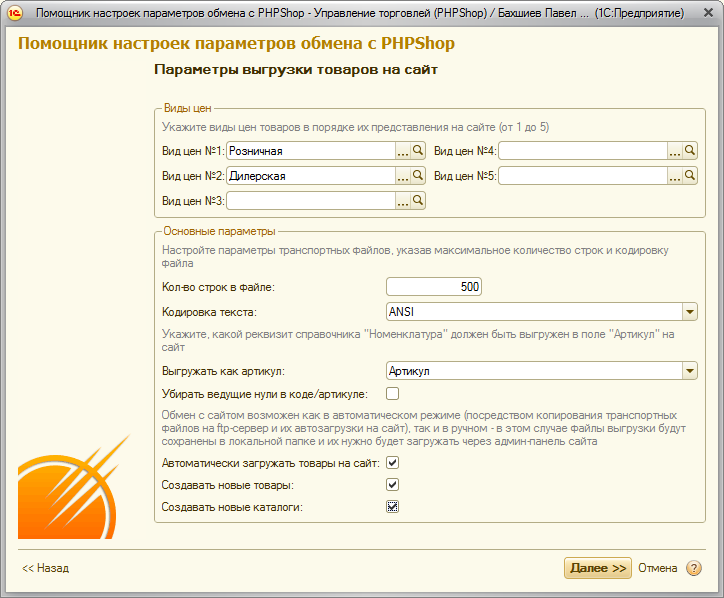

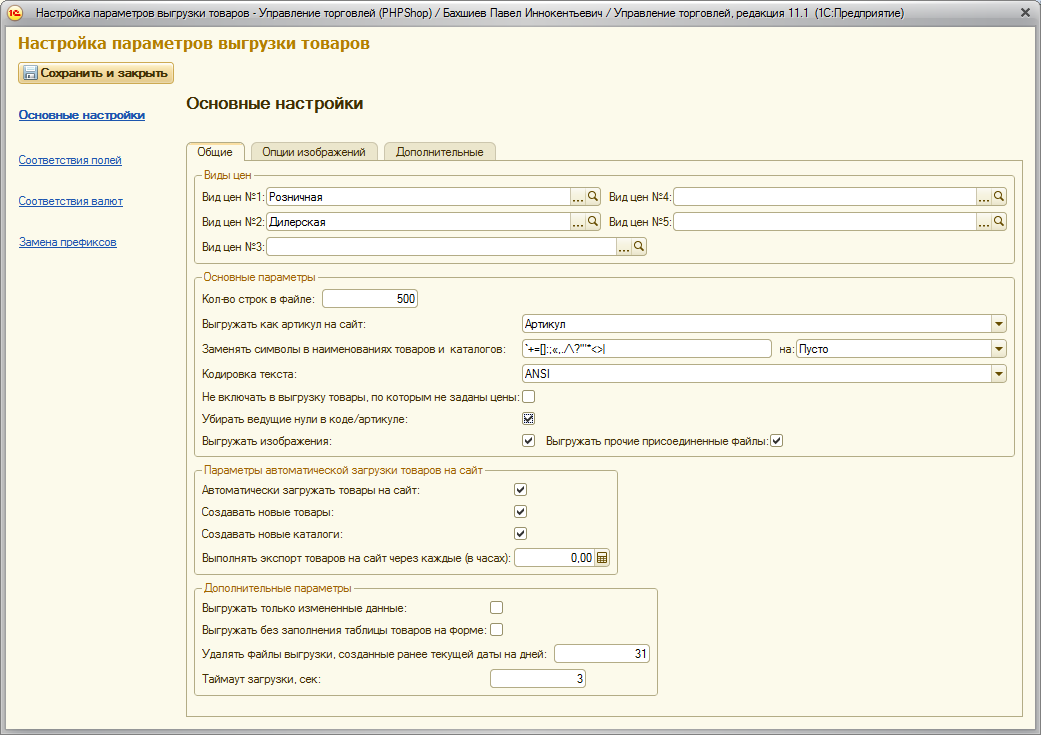

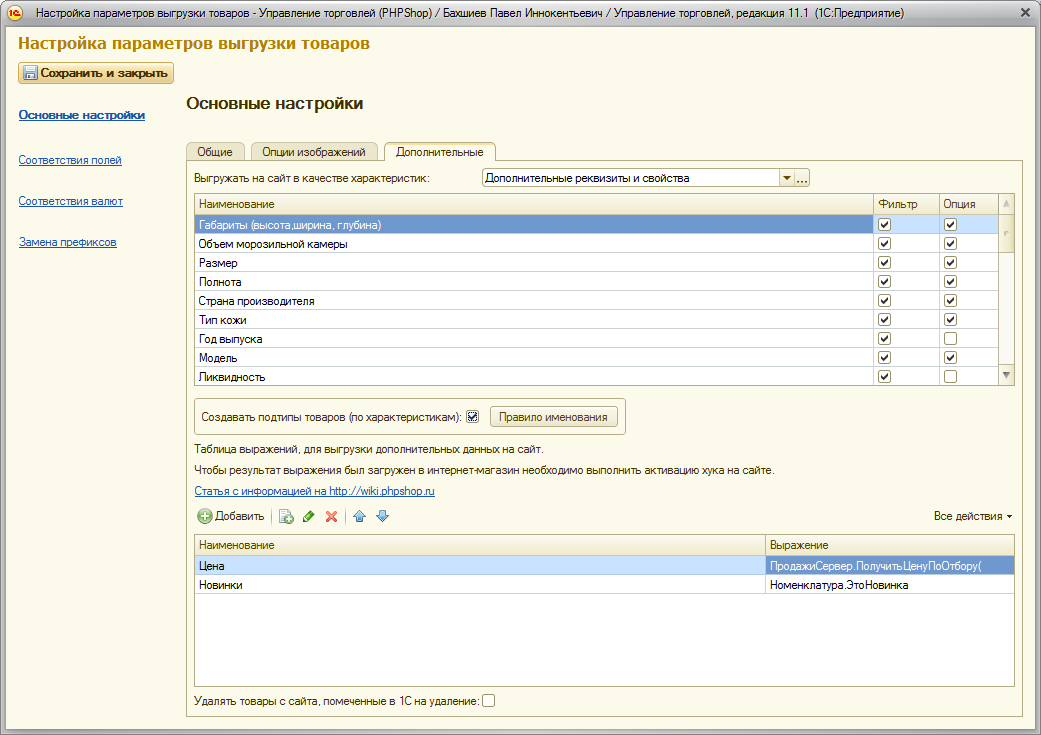

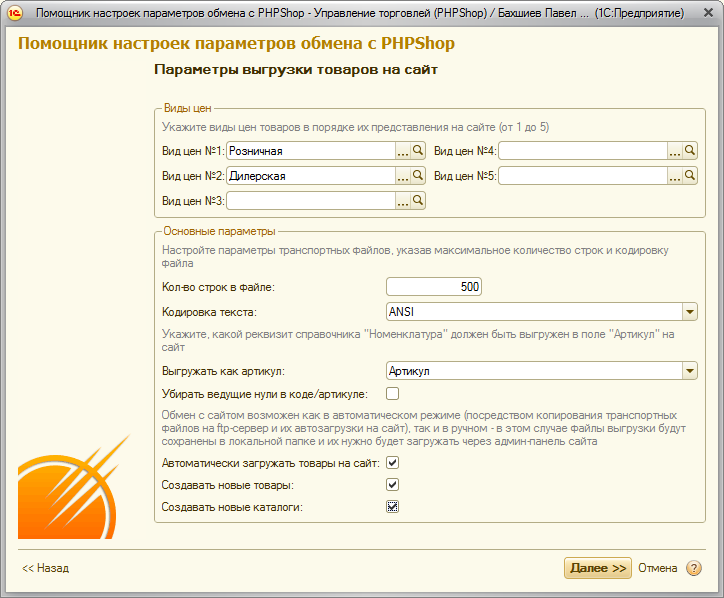

If the exchange is configured automatically, then you can forget about the existence of this mechanism. Actually, the setting is performed in several steps:

- Specifying parameters of access to the site and the direction of upload: via an ftp server or local resource for subsequent manual upload to the site

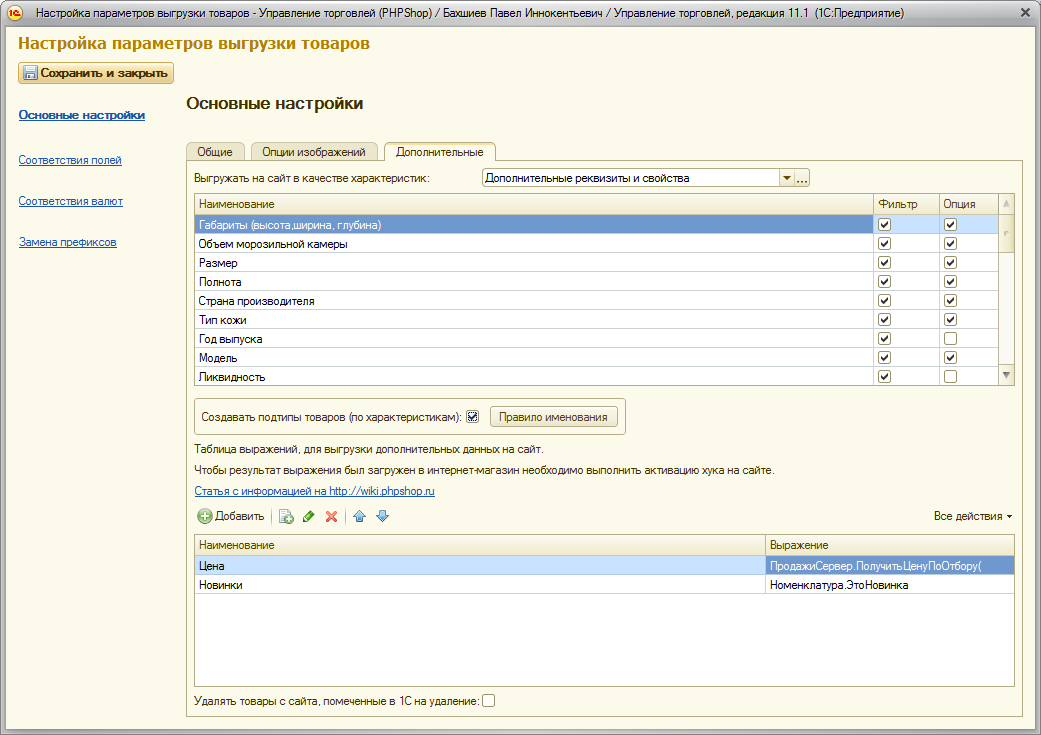

- Setting up the unloading of goods: currency, type of prices, descriptions, properties and characteristics, parameters of images and options for their transformation

- Setting the frequency of exchange

Sharing with the site is a simple and convenient tool for any user who does not have knowledge of IT technologies. The initial setting is the most crucial stage on which the correctness of the exchange depends. Therefore, you can configure the exchange settings using the built-in Assistant, which will guide you through the configuration procedure, providing you with tips.

PHPShop does not require programming knowledge or help from an external specialist . The main thing is your idea of what data should be uploaded, and in accordance with this view, set up the exchange mechanism. All further exchange operations will occur as configured.

Source: https://habr.com/ru/post/201988/

All Articles