Excel Template for Home Bookkeeping

When three years ago it became necessary to keep records of incomes and expenses of the family budget, I tried a lot of specialized programs. In each there were some flaws, flaws, and even design flaws. After a long and unsuccessful search for what I needed, it was decided to organize the required on the basis of the Excel template. Its functionality allows you to cover most of the basic requirements for housekeeping, and, if necessary, build visual charts and add your own analysis modules.

This template does not claim 100% coverage of the entire task, but can serve as a good base for those who decide to go this way.

The only thing you just want to warn you about is that you need a large desktop space to work with this template, so a monitor of 22 ”or more is desirable. Since the file was designed with the expectation of convenience and no scrolling. This allows you to fit the data for a whole year on one sheet.

')

Content is intuitive, but, nevertheless, a quick run through the main points.

When you open a file, the working field is divided into three large parts. The upper part is designed to manage all income. In other words, these are the financial volumes that we can dispose of. Bottom, the largest - for fixing all costs. They are divided into major subgroups for ease of analysis. On the right is a block of auto-summing up the totals, the more the table is full, the more informative its data is.

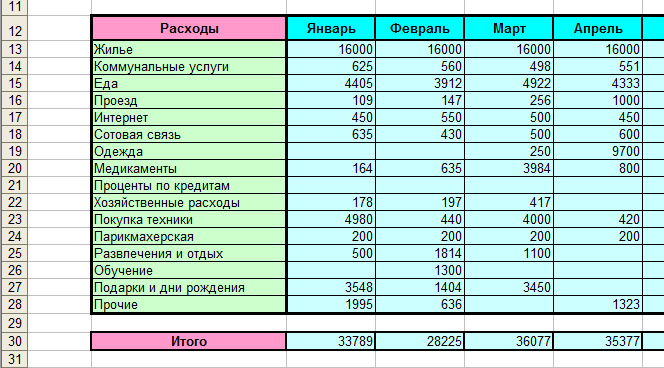

Each type of income or expense is in rows. Columns break input fields by months. For example, take a block of data with income.

What is really there to hide, many get "gray" or even "black" salary. Someone can boast of "white". For another, the main part of the income may be part-time work. Therefore, for a more objective analysis of their sources of income there are four main points. It doesn’t matter whether one cell will be filled in later or all at once - all the same, in the “total” field, the correct amount will be calculated.

I tried to split the expenses into groups that would be universal and suitable for most people who started using this file. As far as it was possible - to judge you. In any case, adding the required line with an individual item of expenditure does not take much time. For example, I myself do not smoke, but those who are hooked on this habit and want to get rid of it, and at the same time understand how much is spent on it, they can add a Cigarette consumption item. For this, basic knowledge of Excel is quite enough and now I will not touch them.

As above, all expenses are summed up by months in the final line - this is the total amount that goes to us every month where it is not clear. Due to the detailed division into groups, you can easily track your own trends. For example, in my winter months, food costs are reduced by about 30%, but the craving for buying any unnecessary nonsense is increasing.

Below this is a line called “remainder”. It is calculated as the difference between all monthly income and all expenses. It is for her to judge how much money you can save, for example, on deposit. Or how much is not enough, if the balance goes to minus.

Well, in principle, that's all. Yes, I forgot to explain the difference between the “average (month)” and “average (year)” fields in the right-hand final block. First, the “monthly average” considers the average values only for the months in which the expenditures were made. For example, you for the year three times (in January, in March and in September) bought educational courses. Then the formula will divide the total amount into three and place in the cell. This allows you to more accurately estimate your monthly expenses. But the second, “average for a year,” always divides the total value by 12, which more accurately reflects the annual dependence. The greater the difference between them, the more irregular these expenses are. And so on.

Download the file here . I would be glad if it will help you in mastering such a difficult task as home bookkeeping. Successes and income growth!

Source: https://habr.com/ru/post/199298/

All Articles